Demand Destruction

Key Takeaways

- This week, we review progress on the Merge, one of the few catalysts highlighted in our annual outlook that appears to have a strong probability of taking place.

- We also review derivatives market data that confirms the broad capitulation we highlighted last week.

- The Fed appears to have done its job in destroying demand and forcing us into a recession. We think that the bond market may be pricing in a Fed pivot earlier than expected.

- We address recent Tether FUD.

- As we enter another long holiday weekend, it is important that traders keep their heads on a swivel as liquidity is likely to be at an all-time low.

- Strategy – We maintain that it is wise to reduce exposure to altcoins and hedge long exposure in the immediate term. However, we are still constructive on cryptoasset prices in 2H. Importantly, we think this is the time for medium and long-term investors (1+ year) to consider allocating to bitcoin more aggressively.

Update on the Merge

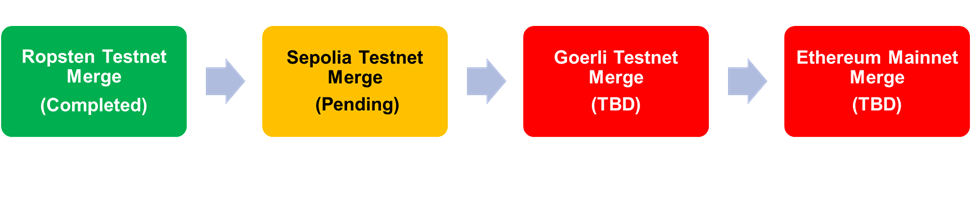

Despite one of our potential catalysts for the year being struck down this week (the GBTC conversion to spot ETF), the prospects for a 2022 Ethereum remain intact. This weekend, ETH developers will attempt the second of three testnet merges on the path to mainnet Merge.

Testnet merges are essentially dress rehearsals for the main event – the Merge of the Ethereum mainnet. The first testnet merge featured a few speed bumps but the endeavor was considered a success by developers. To read more of our thoughts on how things like inflation rate and Beacon Chain unlocks, we refer you to our note from June 9th on the matter.

In terms of timing, the Gray Glacier hard fork that was completed this week delayed the difficulty bomb by 100 days, extending the acceptable timeline for the Merge to the beginning of Q4. The Ethereum Foundation website lists Q3/Q4 of this year as the estimated time of completion.

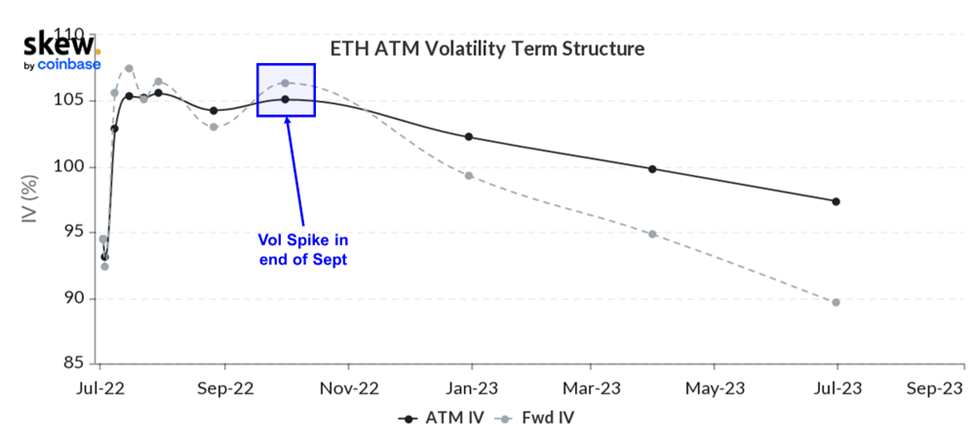

Below we can see that the options market is starting to speculate on the completion of the merge at the end of Q3, as signified in the spike in implied volatility for September options.

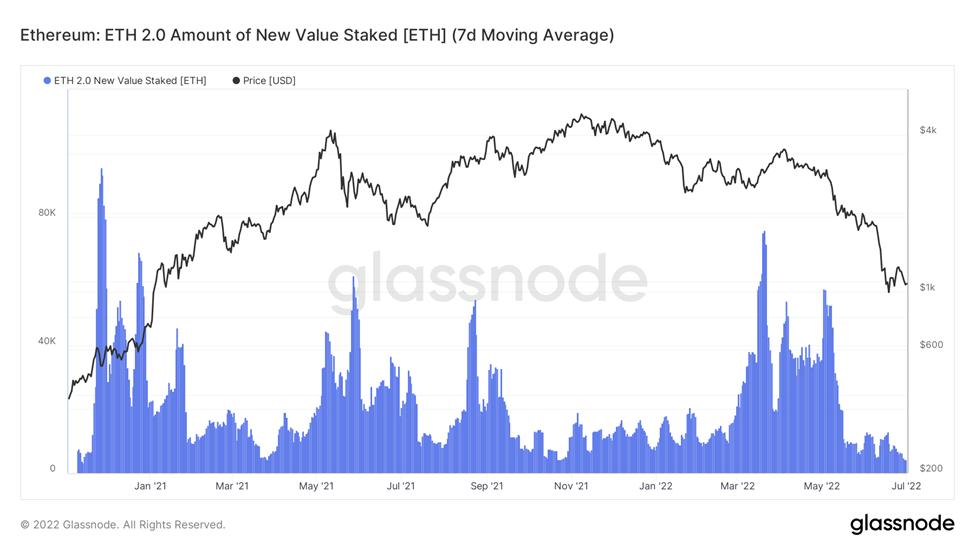

Despite this seemingly bullish news, we do not think that there is enough of a tailwind behind this narrative in the mainstream consciousness to buck any macro trends at the moment. As demonstrated below, there is a hesitance to stake additional ETH to the beacon chain, likely due to both (1) liquidity needs across the entire crypto market, coupled with (2) the fact that relying on stETH, a derivative asset representing the right to receive 1 ETH upon the unlock of Beacon Chain ETH, is less of a desirable endeavor following the spat of liquidations caused by deviations of both stETH and GBTC from their respective underlying assets.

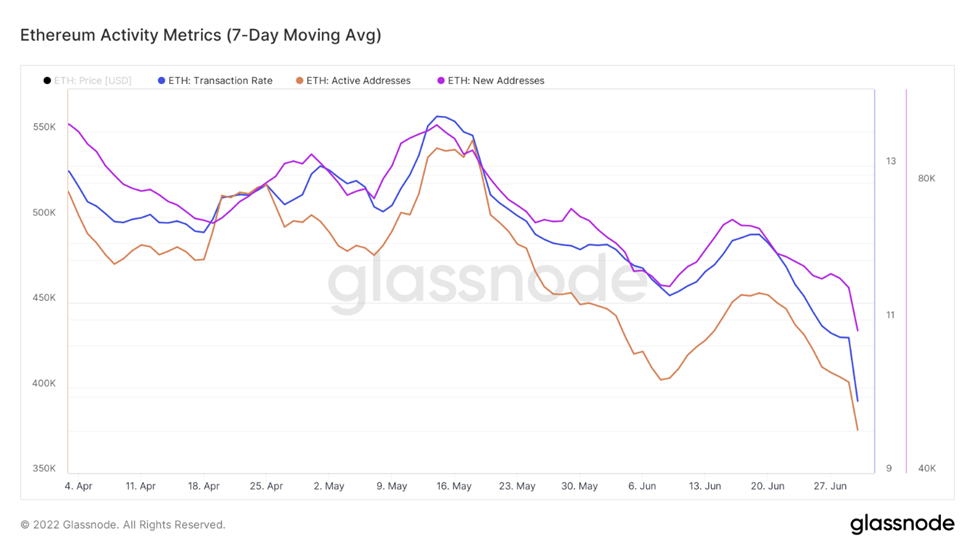

Additionally, it appears that there is generally less of an appetite to participate in the Ethereum economy, as demonstrated by key wallet and transaction-related activity metrics. Transaction rate, active addresses, and new addresses have been down-only since the start of this year, save for a pair of short-lived spikes around the UST unwind and the 3AC meltdown.

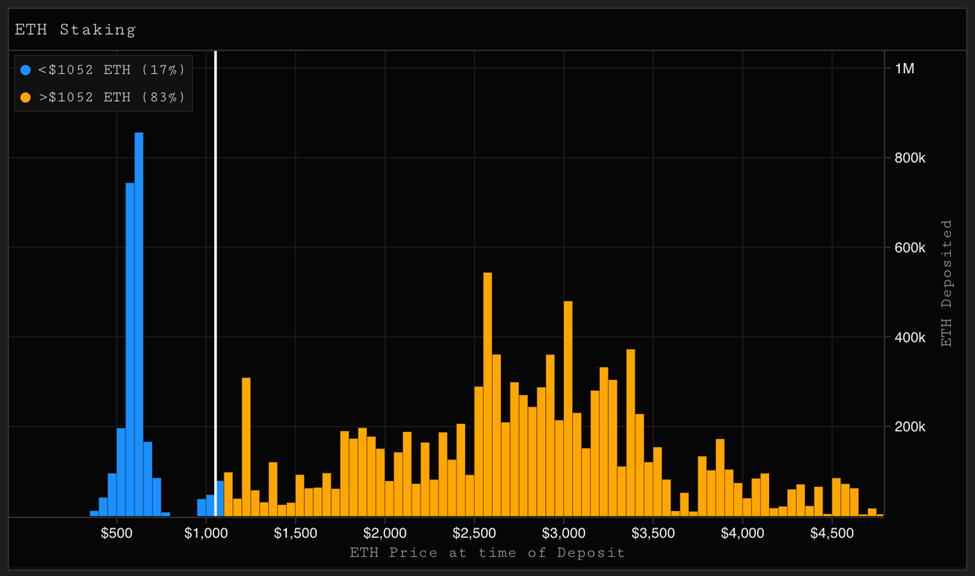

As an aside, one interesting piece of information that has been making the rounds on social media is the risk of mainnet merge resulting in an instant flood of liquidity, as those who have had their assets locked up for over a year are allowed to redeem their ETH and either sell their staked gains or simply participate in web3 dApps with their assets. Below is a chart that was compiled by @wilburforce_ on Twitter, which displays the relative volume of ETH staked based on their entry price.

Many people have been sharing this chart under the assumption that there will be an immense amount of sell pressure upon the transition from proof-of-work (PoW) to proof-of-stake (PoS), since those who are underwater will rush to the exits. However, based on how the process is currently laid out, stakers will be unable to sell any of their staked ETH for at least 6-12 months following the Merge. This was a logical element decided on by developers to prevent a disorderly removal of staked ETH.

Late-Stage Capitulation

Last week we wrote about clear capitulation, as SOPR plummeted to deep, negative levels, and realized losses spiked.

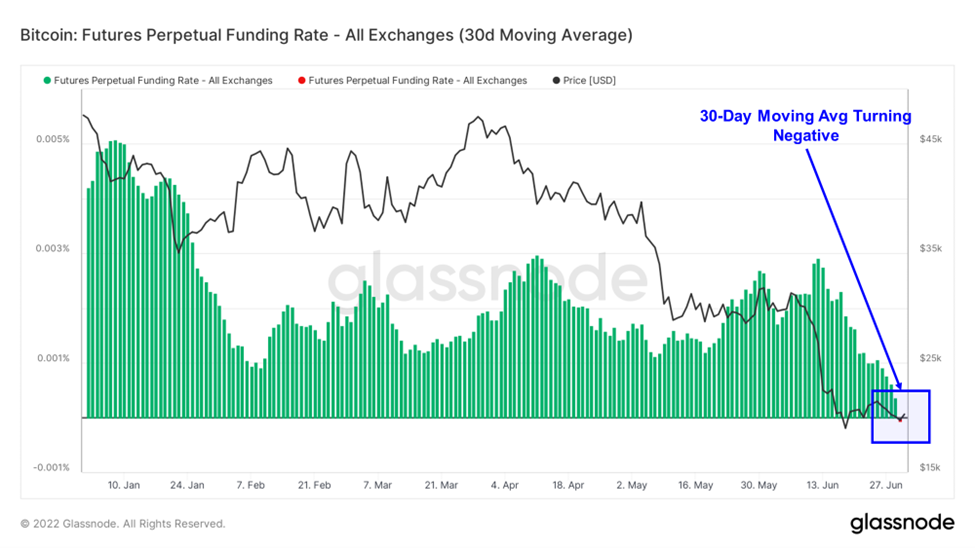

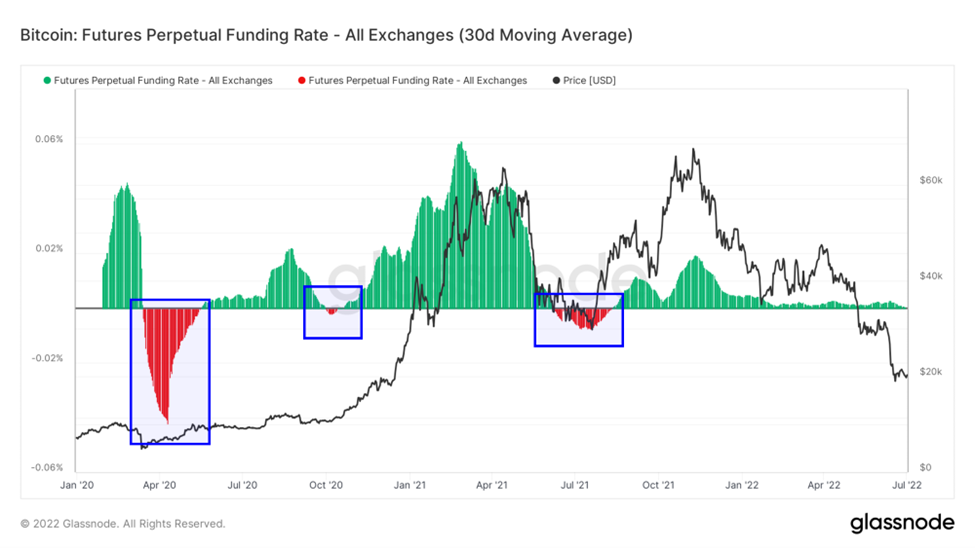

Below we examine the funding rates for bitcoin perpetual futures. These rates have been somewhat muted but conclusively skewed to the upside, indicating a larger appetite for the long side of the bitcoin trade. However, we see that the 30-day moving average for funding rates across all major exchanges has finally started to trend lower, peeking into negative territory on Friday afternoon. This is a sign that the market is ridding itself of any bullish fervor.

While there is a limited historical precedent for trading around funding rates, we can see below that each time over the past 24 months that the 30-day moving average has turned conclusively negative, it has signaled a near-term buying opportunity.

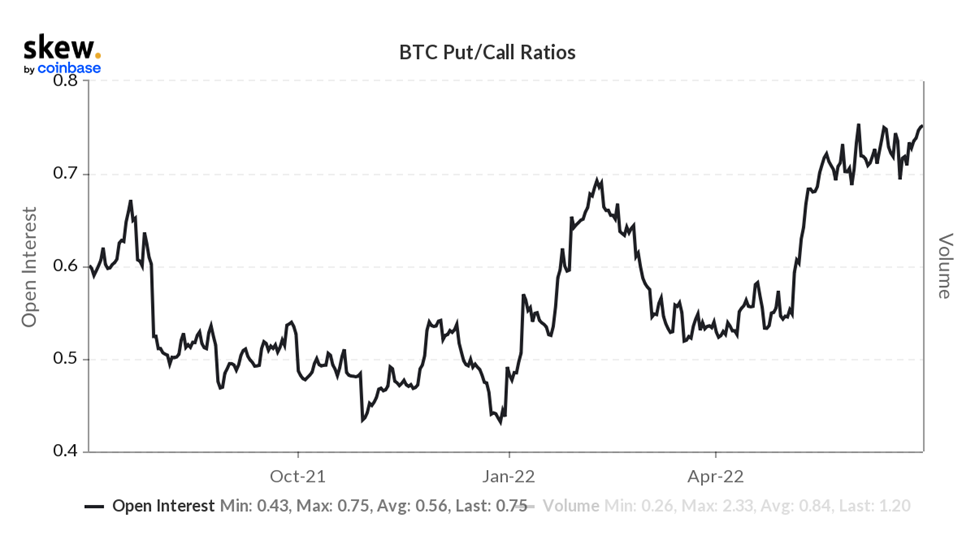

Like the negative funding, we see that the options market is similarly bearish on the prospects for second half returns. The put/call ratio is now the highest it has been in well over a year.

Demand Destruction is Working

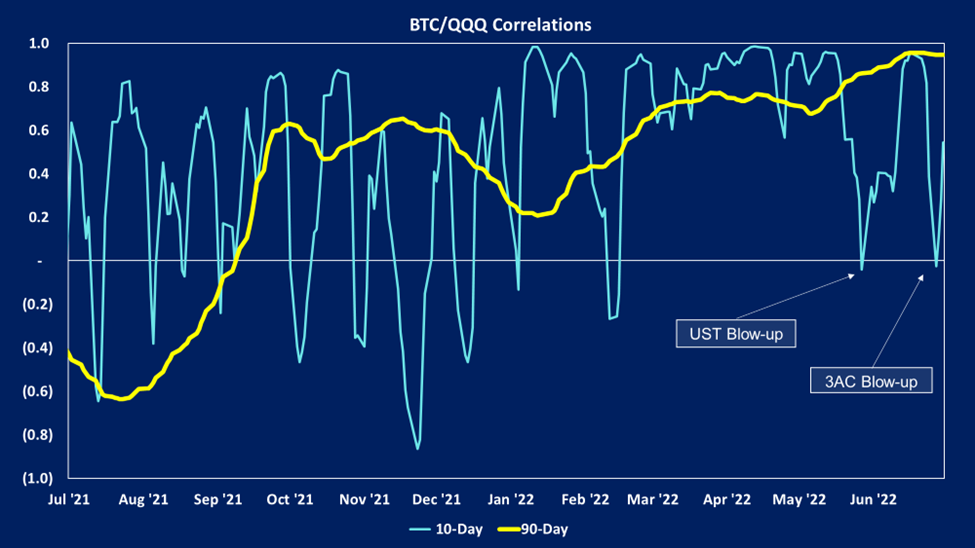

Despite the idiosyncratic carnage felt by bitcoin and the rest of the crypto market the previous few weeks, BTC remains strongly correlated with the Nasdaq. The brief stints of decoupling are displayed on the chart below and point to both the UST and 3AC fiascos that have troubled the industry.

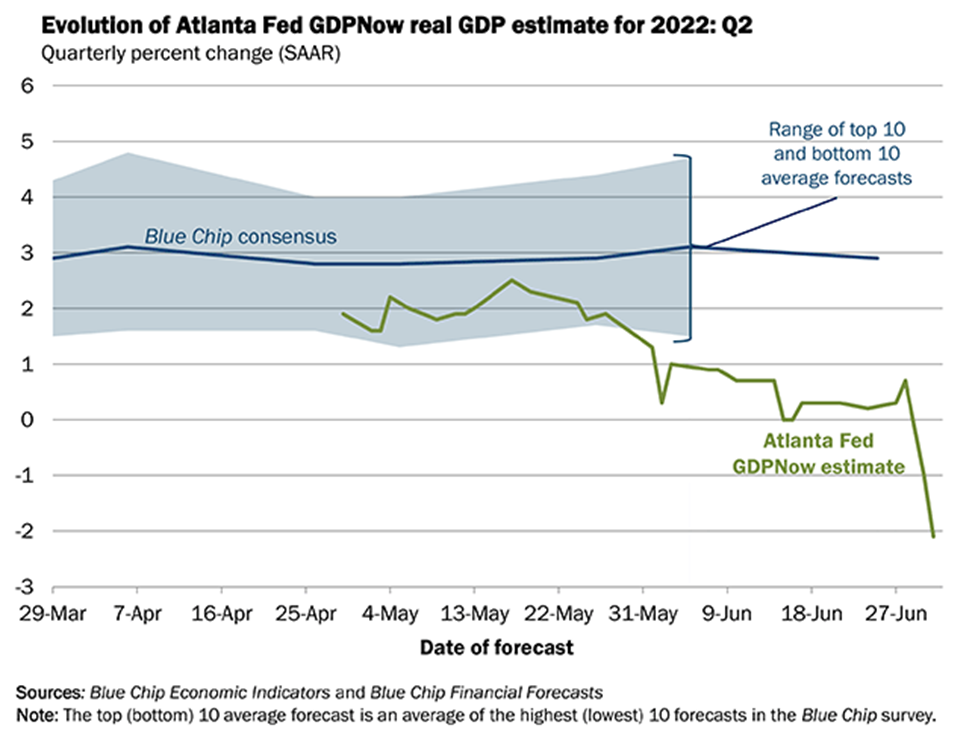

While it was sacrilegious at the start of the year to mention the “R” word, it has not seemingly become consensus that we are in a recession, as demand has fallen off a cliff. The Atlanta Fed live GDP forecast shows the latest Q2 estimate to be -2%.

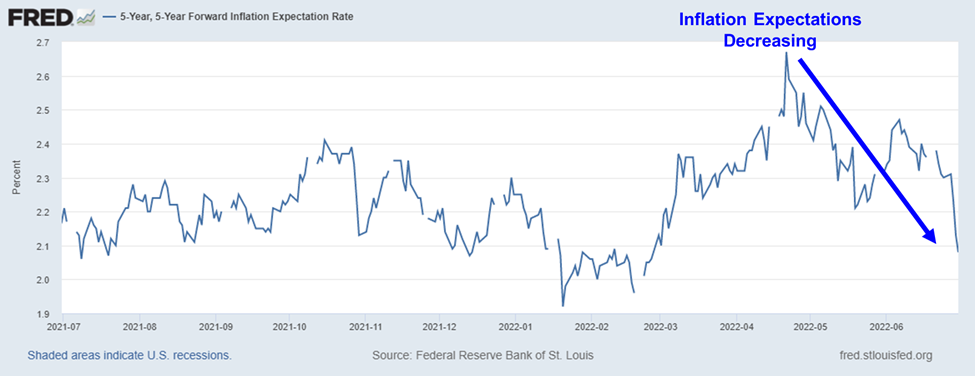

Below, we see that 5-year inflation expectations have been knocked back down to March levels. This likely points to the fact that the market thinks that the Fed’s actions thus far this year have done an ample job of stifling demand to the point that we see a pullback in inflationary pressures.

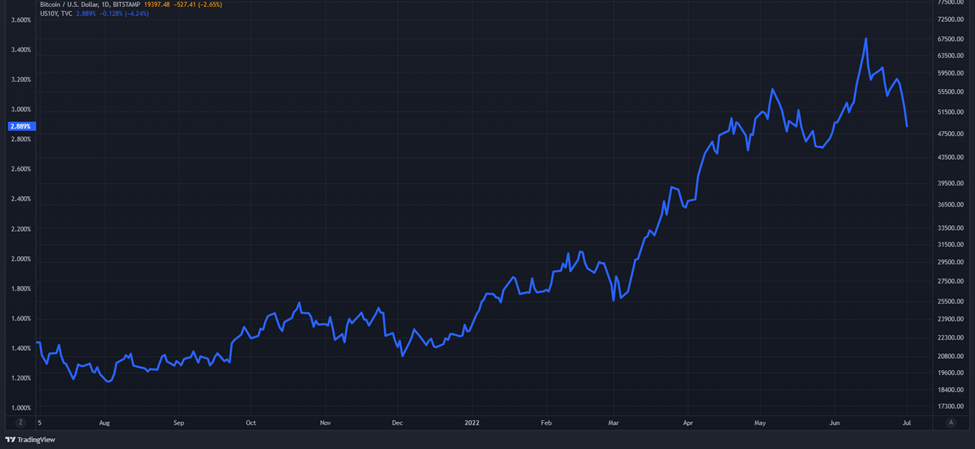

The US 10Y also pulled back sharply this week, from over 3.2% to 2.9% at the time of writing. While we could use some sustained price action below 3.0% to confirm, this (coupled with the chart above) tells us that the bond market might be calling for a Fed pivot earlier than expected with a recession looming.

A Quick Note on Tether

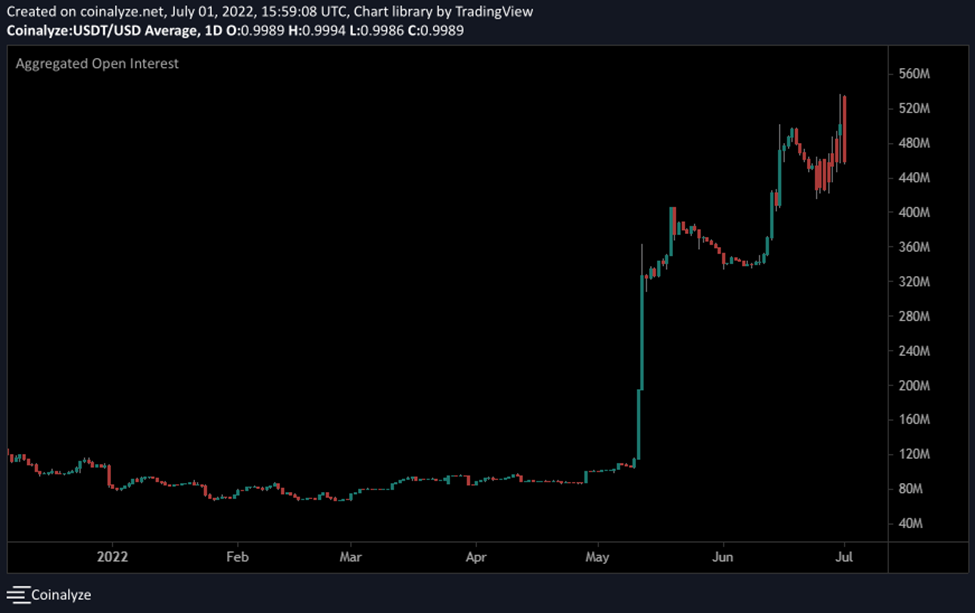

As is seemingly a quarterly tradition in crypto, we have encountered yet another bout of Tether FUD. We wrote about this last week, but there have been several traditional hedge funds that have placed short positions on the failure of USDT (see image below for futures OI on Tether).

Figure: Tether Futures Open Interest (Source: Coinalyze)

Many of these traders are incorrectly equating Tether, which is a fully collateralized stablecoin, to UST 0.37% , which was an algo-backed stablecoin. While UST featured a software-based mechanism that is inherently fragile, Tether is a simple fiat-backed USD stablecoin that can be minted and redeemed by liaising with a centralized authority. As is custom, Tether released its latest quarterly attestation report back in May, but this morning elaborated further on its progress toward reducing its commercial paper exposure. The company reduced its CP balance from over $20 billion in March to $8.4 billion of CP today (a 58% decrease), $5 billion of which are set to mature at the end of July. You can read the latest attestation report here.

Our view on Tether is the following – most critics are fear-mongering newcomers. While Tether is guilty of falling short on the transparency front, they are viewed by insiders as responsible actors that have worked towards greater transparency and provide a valuable resource to the industry. While acknowledging that anything is possible (especially in this market), there is no reason to think that their reserves are not fully backed at this time. Should our view on this change, our clients will be the first to know.

Holiday Weekend Reminder

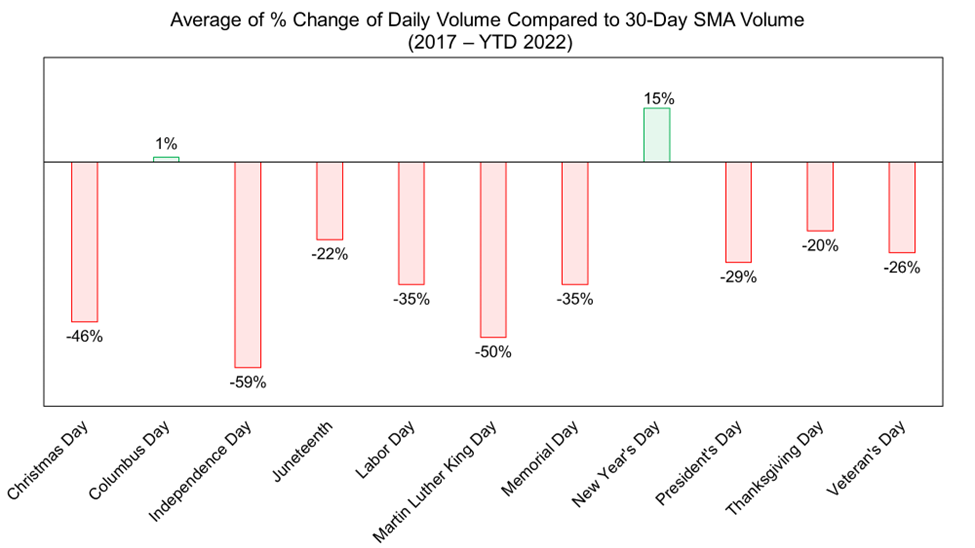

As a quick reminder, as we head into the holiday weekend, the crypto market is slated to be especially illiquid.

We highlighted the potential for significant volatility on Memorial Day, and this was realized to the upside. Given recent events, there is no telling in which direction the chips will fall, however, if you are placing short-term trades, it is worth noting that there is a high probability of volatility over the next few days.

Strategy

Below is a meme that we used to summarize our view on how 2022 would go, with bitcoin being threatened by Fed tightening in the first half of the year. Tightening, coupled with unprecedented levels of inflation, made it a challenging first half for most assets. Bitcoin, crypto, risk assets, bonds, and the 60/40 portfolio were all smacked across their proverbial faces in 1H.

We plan to provide more guidance on where we see the best opportunities in the market in 2H, but for now we are focused on finding signs that we are transitioning from the top frame in the meme to the bottom frame.

In summary, we continue to think that it is wise to reduce exposure to altcoins and hedge long exposure in the immediate term (1-month). However, we are still constructive on cryptoasset prices in 2H. Importantly, we think this is the time for medium and long-term investors (1+ year) to consider allocating to bitcoin more aggressively.

Articles Read 1/2

Enjoyed the read? Subscribe now for unlimited access!

Get invaluable analysis of the market and stocks. Cancel at any time.

Already have an account? Sign In 9af84c-1db4af-6ec536-502be0-94cb9f

Already have an account? Sign In 9af84c-1db4af-6ec536-502be0-94cb9f