Assessing the Damage

Key Takeaways

- A dramatic decrease in realized cap points to substantial capitulation in the crypto markets following the collapse of UST -0.24% .

- Most of last week's selling pressure appears to have resulted from organic spot market volume instead of cascading liquidations in the derivatives market.

- An LTH SOPR of less than 1 and an increasing LTH MVRV indicate that much of the selling was done by investors who purchased BTC 7.33% at or near the market top. We discuss the implications.

- Several factors, including a widening GBTC 7.32% discount to NAV, increasing stablecoin redemptions, and a 12-month high for bitcoin's put/call ratio, suggest an increasingly sour investor sentiment.

- Despite the evidence of capitulation and waning investor sentiment, the current macro backdrop still poses significant headwinds for cryptoasset prices.

- Strategy – Despite signs that we are approaching seller exhaustion, our near-term outlook remains cautious. It is reasonable to expect downside volatility around continued rate increases and QT. We think opportunistically purchasing near-term (1-3 months) put protection on long crypto positions, and reducing exposure to more speculative altcoins are valuable measures to mitigate this risk. Despite this, we remain constructive on cryptoasset prices for 2022 and expect tides to shift in early 2H.

The question remains – wen[1] bottom?

Since the November highs, most of the downward pressure on crypto prices has been the product of macroeconomic headwinds. Inflation has yet to conclusively rollover, and the Fed appears intent on stifling demand to bring down the costs of consumer goods. Last week, we had the first instance this year of an idiosyncratic event specific to the crypto markets shaking investors and sending prices lower.

The collapse of UST, combined with the macro backdrop, has had a chilling effect on the overall sentiment among crypto native investors and has sent many towards the exits. For more information on the events that unfolded last week, we direct you to our previous note and a market update video we put together late last week.

Below we will address several data points that will help us determine how close we are to the bottom of this bear market.

Capitulation

The bright side of last week’s carnage is that we finally started to see signs of capitulation. While never enjoyable, capitulatory selling – such as that seen in November 2018, March 2020, and May 2021 – is often the market rinse needed before asset prices can move higher. Capitulation is often the product of long-term holders, “top-buyers”, and crypto “tourists” liquidating their assets for cash to preserve liquidity in the case of a prolonged bear market. Below we examine a few metrics that provide convincing support for substantial investor capitulation. As is customary, we use bitcoin as our market barometer, given that the market generally ebbs and flows with bitcoin’s price action.

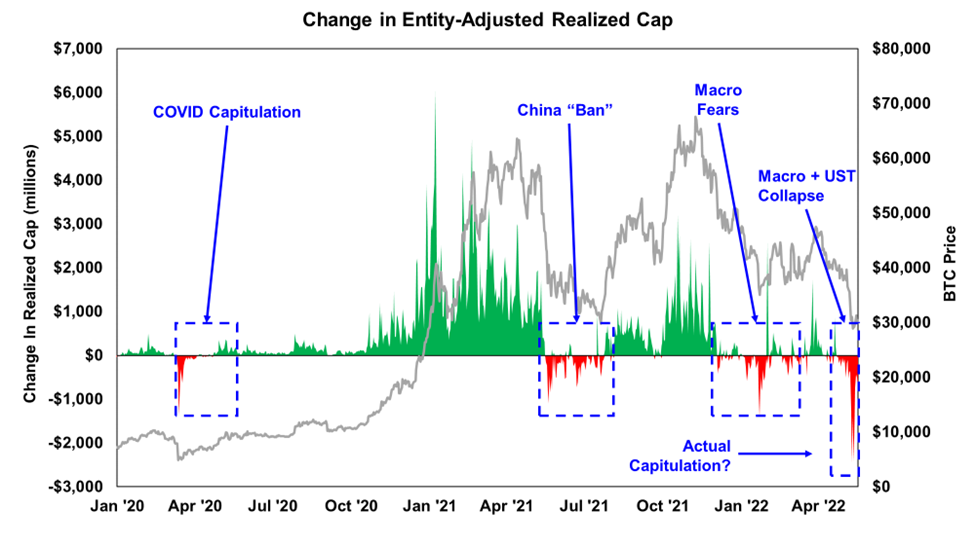

Below we examine the daily changes in bitcoin’s entity-adjusted realized cap or the daily changes in the overall cost basis of the bitcoin network. This metric serves as a close proxy for measuring capital inflows and outflows. We can see that since the start of 2020, there have been four distinct periods of capital outflows:

- In March 2020, at the start of COVID.

- In May 2021, when China enacted its quasi-ban of bitcoin mining.

- Late 2021 through early 2022, when the latest Fed tightening cycle commenced in earnest.

- From 4/22 to today, during which over $15 billion in capital exited the network.

There is a clear difference between the severity of the most recent decline and the preceding two. Even if we were to consider the Luna Foundation Guard’s bitcoin sales, the chart below would still reflect a dramatic drawdown in realized cap. These outsized flows lead us to believe that we witnessed significant capitulation last week.

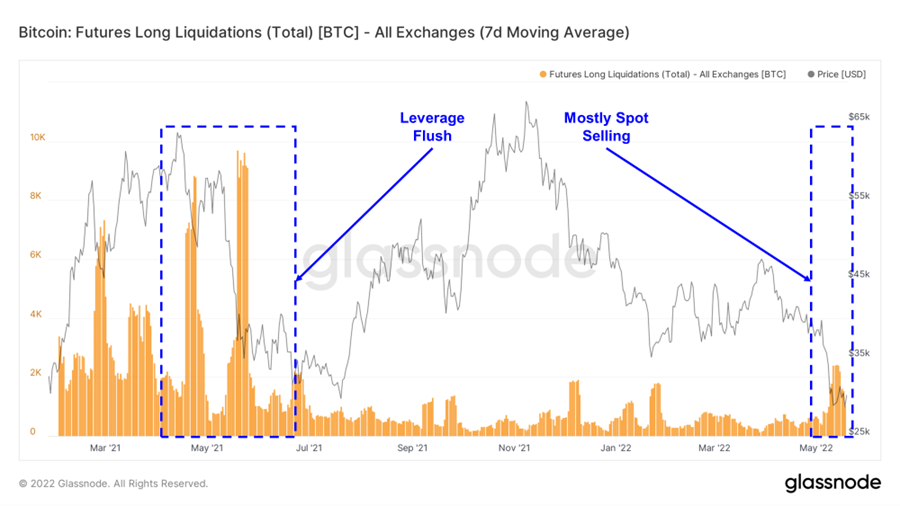

Further, most of the selling pressure appears to be the result of organic spot market volume instead of cascading liquidations in the derivatives market. Last summer, when China enacted a ban on crypto mining, bitcoin’s price fell precipitously. Still, much of this momentum was driven by overleveraged market participants forced to liquidate. As demonstrated below, the recent downturn lacks the same demonstrable leverage flush.

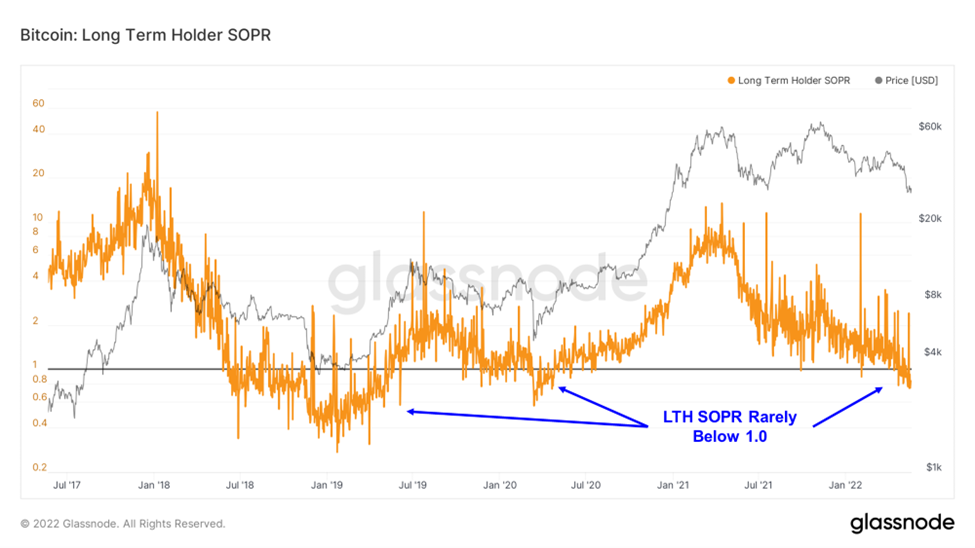

Long-term holders (investors with spent outputs with a lifespan of at least 155 days) were big sellers in the recent bout of volatility. This contingent of investors is generally known for accumulating during market downtrends and selling into speculative bull markets. However, now and then, when sentiment breaks and the market plummets at an abnormal pace, many “top-buyers” will rush to cash with the rest of the “paper-handed” short-term investors.

The LTH SOPR (Spent Profit Output Ratio) chart measures the profitability of all coins sold by long-term investors. We use this metric to understand on-chain profitability and the relative appetites of long-term holders to sell out of their positions during periods of volatility. When SOPR is below 1, investors are selling coins below their initial cost basis.

As demonstrated by the chart below, there has been a considerable amount of selling of older coins at a loss over the previous few weeks. This is generally rare for long-term holders and occurs typically during capitulatory situations.

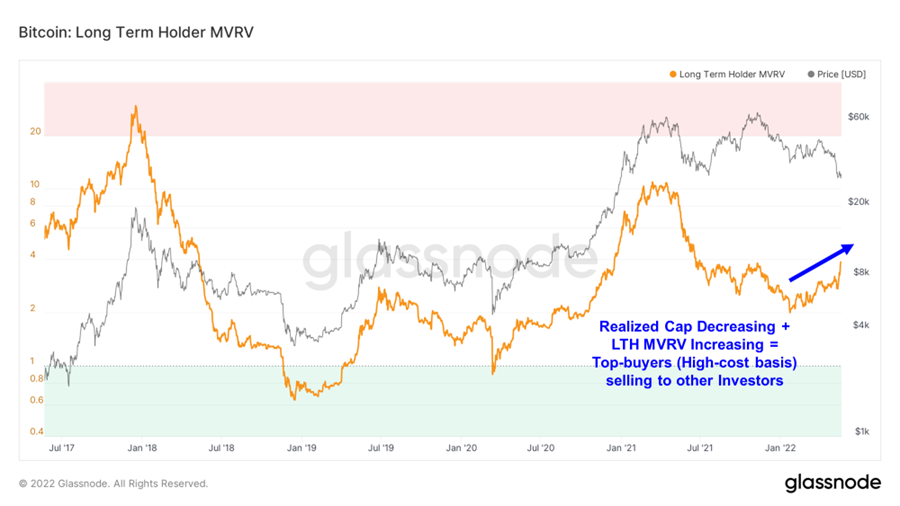

Interestingly, we can also conclude that many of the long-term holders that are selling are the ones who purchased their BTC at or near all-time highs.

The chart below maps out the MVRV of long-term holders, or the total market value of BTC held by long-term holders divided by the cost basis of those same long-term holders. An interesting pattern has emerged where LTH MVRV is increasing despite BTC price decreasing. This is counterintuitive and rarely observed, as a decreasing market value of bitcoin should lead to a decreasing MVRV multiple. However, if investors who purchased their bitcoin at the top start to exit their positions, then investors’ cost basis will decrease faster than market value and thus lead to an increase in MVRV.

In short – top buyers are selling on this latest dip, thus removing considerable potential selling pressure from the market.

Assessing Sentiment

In addition to capitulation from investors, we also want to see sentiment bottom and remain low to ensure that investors are not trying to “ape” back into a structurally weak market.

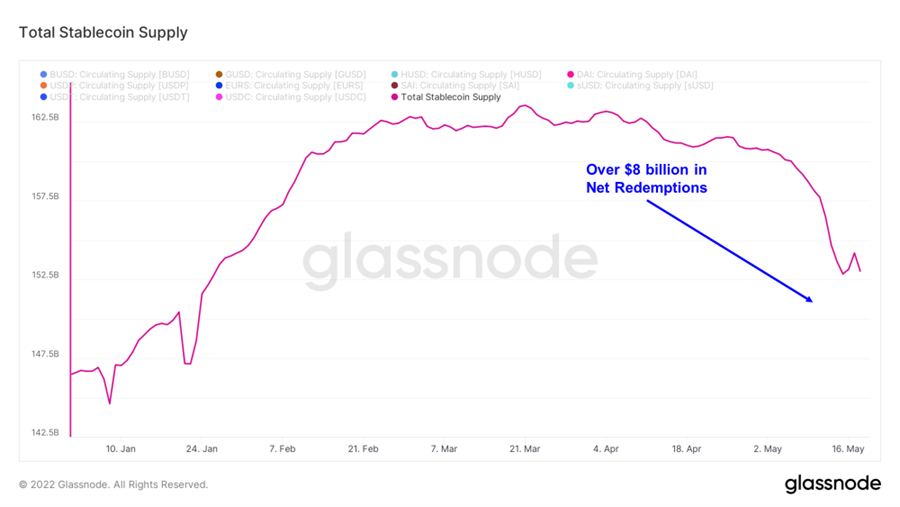

An interesting metric to help us gauge investor sentiment is the stablecoin market cap. Obviously, some extenuating circumstances put a sizeable dent in this metric last week. But, if we adjust this metric to exclude UST, we observe that there have been over $8 billion in stablecoin net redemptions since late April.

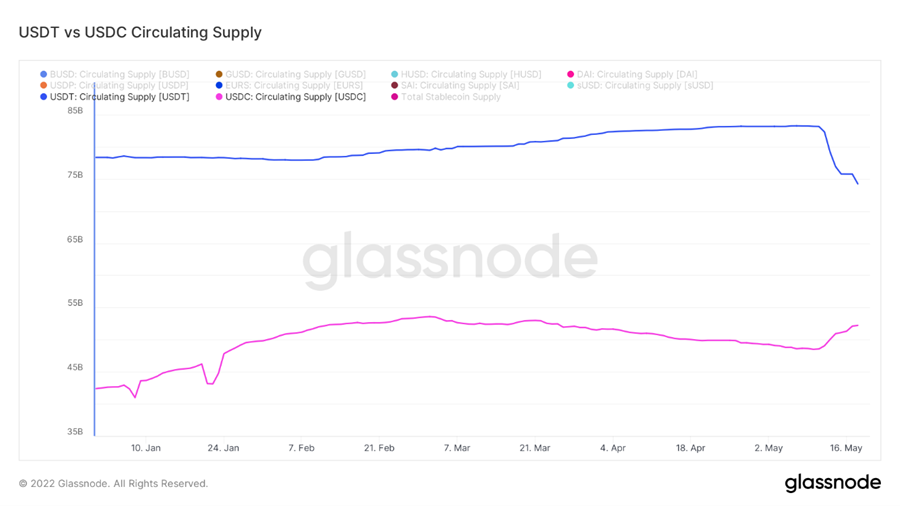

Suppose we unpack this metric a little further. In that case, we see that the lion’s share of redemptions was for Tether (which, save for a short-lived trip to $0.93 several days ago, has maintained its peg to $1.00 magnificently throughout the whole UST ordeal). At the same time, some capital actually made its way to USDC.

We think this is the product of a couple of things.

- First, there are institutions and retail traders that use USDT, that were concerned about knock-on effects from the UST unwind and wanted to move their stablecoin position to USDC before anything happened to the USDT peg.

- Beyond this cohort, there are many investors who simply wanted to “checkout” of the crypto ecosystem by redeeming their USDT for US dollars. These investors account for the $8 billion in net redemptions, and serve as a positive sign that many of the crypto “tourists” are leaving the market.

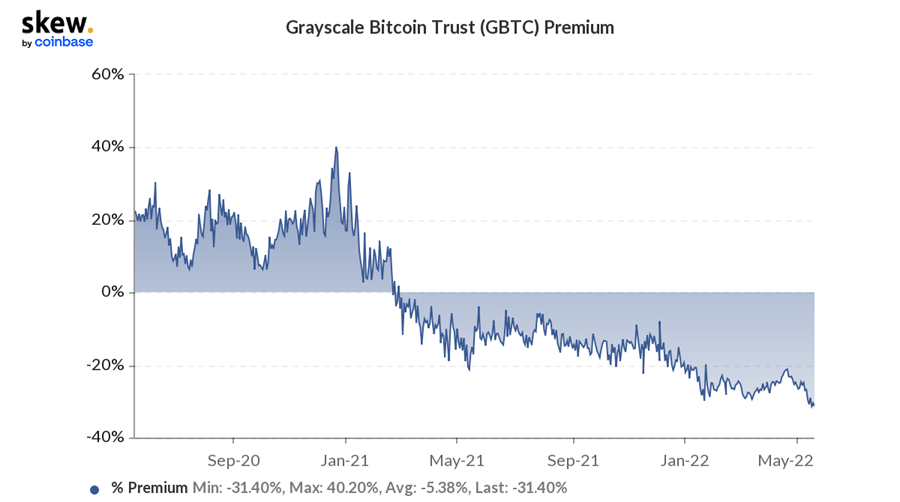

We can also look to Grayscale’s GBTC 7.32% to assess how those with the leading bitcoin trust in their brokerage accounts feel about holding this asset for the long term.

As discussed before, we think there is considerable evidence that the approval of a Grayscale spot BTC ETF is closer than the market is pricing in. We also think that buying GBTC at a discount could be a good way to achieve a quasi-leveraged position on bitcoin over the long term and would pay off significantly if GBTC were allowed to convert to an ETF and the dislocation from NAV disappeared.

We have seen the GBTC discount compress slightly during short-term rallies as investors purchase secondary GBTC shares, increasing demand and bringing the market price closer to NAV. However, GBTC just hit a new record for its discount to NAV, reaching 31.4%.

To us, this signals that many investors are completely writing off the chance of a spot ETF approval. This also points to a complete lack of willingness for people to hold this asset in their brokerage accounts, at least partially due to souring sentiment.

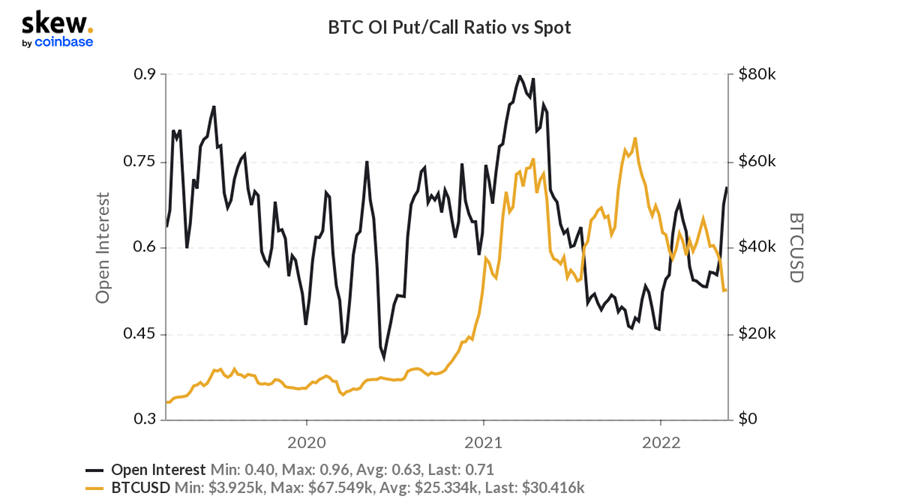

The derivatives market is also smelling doom and gloom, as the put/call ratio for all open interest has risen parabolically since late April and is at the highest level since the last capitulatory drawdown in May.

While a rising put/call ratio does not provide a strong directional signal, a confluence of defensive positioning by investors and intense selling pressure leads us to believe that investor sentiment is quite low.

The ”But”

We have established that (1) we have seen strong capitulation in the market, (2) a considerable portion of the selling pressure has been from “top-buyers,” meaning that there is less potential sell pressure embedded in the market, and (3) sentiment is low and optimism is waning.

While it seems as though we are approaching seller exhaustion, there remains a very large elephant in the room and it is growing larger by the day. April’s CPI print was 8.3%. This week, both Walmart and Target missed earnings projections due to higher production costs. Retailers across the country are trying to raise prices to keep up with supplier costs. Compounded by a structural energy shortage and supply chain bottlenecks, inflation is still rampant and has yet to show signs of rolling over.

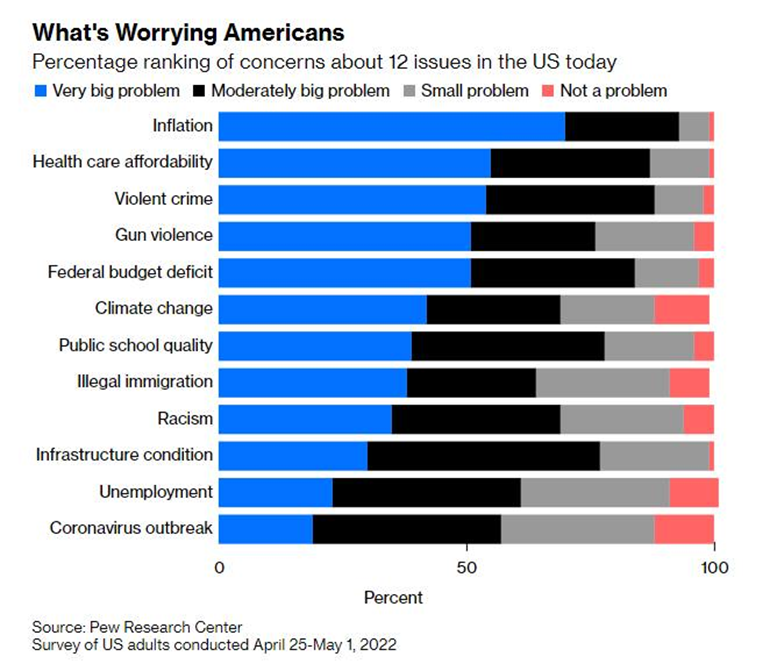

The inflation issue has also clearly permeated the American consciousness, moving beyond a topic discussed mainly by macro analysts over the past couple of years.

Below is a recent ranking of top concerns among Americans, and inflation is blowing away the competition.

The Fed’s language has also become increasingly hawkish, as Chairman Jay Powell has committed to performing all the rate hikes necessary to bring inflation back into orbit. The Fed has signaled at least two subsequent 50 bps rate hikes over the next couple of meetings.

Thus far this year, we have seen 75 bps of hikes, and risk assets have, in a word, stumbled. What will happen once markets need to adjust to an additional 100 bps in a matter of two months while the consumer price index remains at historically elevated levels?

We also must factor in the reduced market liquidity that will ensue in a couple of weeks. For the first time since the post-COVID stimulus began over two years ago, the Fed will start to unwind its balance sheet on June 1st. This will occur as liquidity in the bond and stock markets is approaching levels last witnessed in March 2020.

As Avisha Thakkar, a rates strategist at Goldman Sachs noted in a Bloomberg piece highlighting the ongoing liquidity issue, “Market depth and price impact metrics are closer to levels last seen amid the Covid shock, suggesting a fairly high risk of disorderly price action. One side effect of the Fed’s absence as a backstop buyer is that there is greater risk of market fragility when shocks do arise.”

It seems like there is less concern/speculation around the impact of QT compared to rate increases. This is likely because it is nearly impossible to forecast what liquidity crunches will do to asset prices. Rate hikes can be factored into most discounted cash flow models and will be adapted to over a long enough time horizon. However, the outsized moves in asset prices that we could see once QT commences are much tougher to forecast.

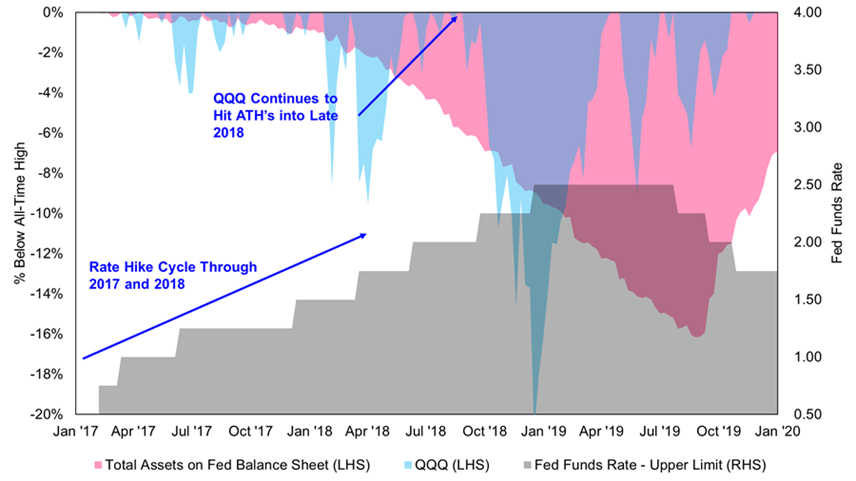

That is why we recommend using the last tightening cycle as a proxy for how to position your crypto portfolio over the next month or so. For a more comprehensive recap of this concept, we invite you to revisit our piece on how to position in the face of quantitative tightening.

Conclusion

Despite signs that we are approaching seller exhaustion, our near-term outlook remains cautious. It is reasonable to expect downside volatility around continued rate increases and QT. We think opportunistically purchasing near-term (1-3 months) put protection on long crypto positions and reducing exposure to more speculative altcoins are valuable measures to mitigate this risk. Despite this, we remain constructive on cryptoasset prices for 2022 and expect tides to shift in early 2H.

[1] The word “when” is colloquially spelled as “wen” by many market participants in the crypto industry.