Wen Bottom?

Key Takeaways

- The Fed announced a 50-bps rate increase and solidified plans to commence with the balance sheet runoff less than a month from today.

- Risk assets performed one of the more pronounced “head-fakes” in recent history, as cryptoassets followed their strong Wednesday performance with a massive drawdown on Thursday.

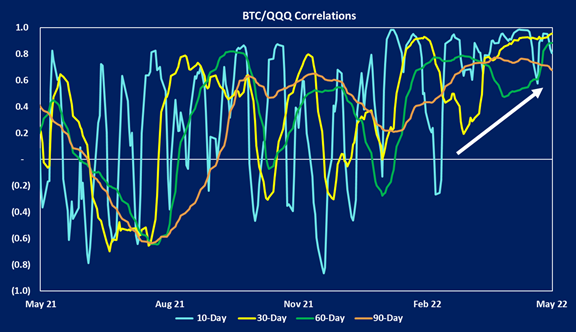

- The US 10-year now sits firmly above 3%, and correlations between QQQ and BTC remain at or near 1 across most timeframes.

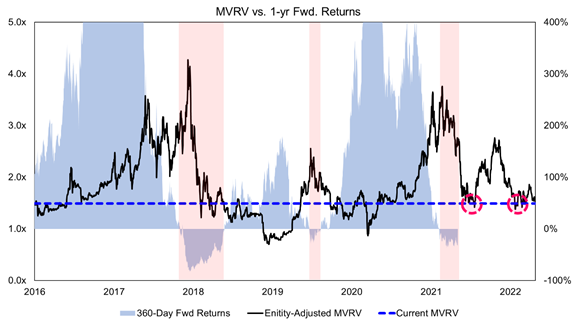

- Bitcoin’s current MVRV multiple is at a level with historically favorable 1-year forward returns.

- Using historical data, we attempt to estimate a price range at which bitcoin might bottom over the next few months.

- Strategy (Unchanged) - It is reasonable to expect downside volatility around continued rate increases and QT. We think opportunistically purchasing near-term (1-3 months) put protection on long crypto positions and reducing exposure to more speculative altcoins are valuable measures to mitigate this risk. Despite this, we remain constructive on cryptoasset prices for 2022 and expect tides to shift in early 2H.

FOMC Recap

This week, investors were provided with one of the bigger “head-fakes” in recent history. The May FOMC meeting took place on Tuesday and Wednesday, after which Jerome Powell announced a 50-bps rate increase to the target Fed Funds rate and plans to commence with the balance sheet runoff less than a month from today. While these measures were largely priced in, his statements did take the risk of a 75-bps rate hike at the next meeting off the table. As a result, equities, and other risk assets, including crypto, pumped into the market close on Wednesday. Unfortunately, the bounce was short-lived, as the Dow went on to have its worst day since 2020 on Thursday. Consequently, most risk assets plummeted, including bitcoin, which sank over 8% intraday.

Source: TradingView (As of 6pm 5/5/22).

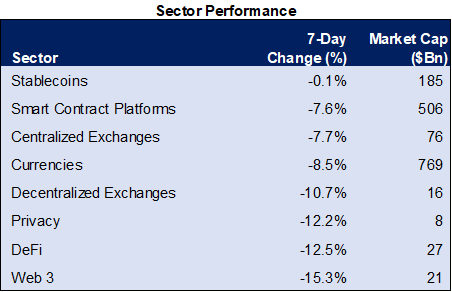

The weekly charts across all crypto sectors are red, with the more speculative areas bleeding more than currencies and smart contract platforms. We have noted over the past several weeks that we think the near term will continue to be tough sledding for names farther out on the risk curve.

Interesting to note – currencies performed worse than smart contract platforms and centralized exchange tokens. Upon reviewing liquidations data, the underperformance of currencies was primarily due to bitcoin positions comprising a relatively greater percentage of all long liquidations on Thursday.

Source: Messari (As of 6pm 5/5/22)

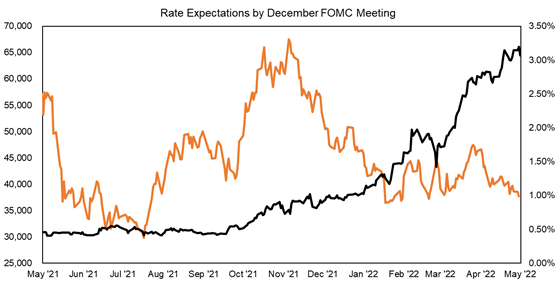

As demonstrated by the chart below, the parabolic rise of the projected Fed Funds rate by the December meeting has continued its upward trend and now holds a firm position above 3%.

Source: Fundstrat, CME Group

Despite a late March/early April rally, not much has changed in terms of market drivers since the start of this year. We can see that the correlation between BTC and QQQ is still at or near 1 across most timeframes. We will need to see significant changes to this chart for those clamoring for a “decoupling” between bitcoin and equities.

Source: Fundstrat, TradingView

Our strategy remains the same as last week and in line with our expectations at the outset of this year. Bitcoin and the broader crypto market will continue to present choppiness in the face of Fed tightening. Thus, we recommend that clients consider downside protection, which is wildly cheap due to structurally lower implied volatilities in the options market. We still maintain that the market will turn in the second half of this year, and when it does, there will be ample opportunities on which to capitalize, beyond just BTC 5.22% and ETH 7.34% .

Searching for An Entry Point

Many clients have asked us with an impatient fervor – “wen bottom?[1]” Regardless of the macro environment, we will always recommend a non-zero percent allocation to bitcoin. The current macro landscape is riddled with potential tailwinds for bitcoin such that the asymmetry is conclusive to the upside over any timeframe beyond a few months. That said, many investors desire to pinpoint areas in which the market might find some support so that they can invest in greater size at these levels or (most often) avoid any near-term liquidity crises upon a massive drawdown.

In short, we think we could find strong support to the downside in the $29k – $33k range. Below we present a few frameworks that we are using to orient ourselves around this range.

[1] The word “when” is colloquially spelled as “wen” by many market participants in the crypto industry.

Cost Bases & Historical Multiples

Market-value-to-realized-value (MVRV) measures the profitability of coins presently held across the entire network. Naturally, the higher this metric rises, the “frothier” the market price for bitcoin is, and the more selling pressure there will be from holders. We can see that bitcoin, comparatively speaking, is trading at a very reasonable MVRV multiple (about 1.5x at the time of writing). BTC has traded north of this level for the lion’s share of the past six years. Further, we note that 1-year forward returns are generally favorable when MVRV is at or below this level.

Source: Fundstrat, Glassnode

Not only can we use MVRV to ascertain how inflated the bitcoin price is relative to the network’s cost basis, but we can also use this metric to calculate the current cost bases of different cohorts of investors and gauge where we might find support for any additional downside volatility.

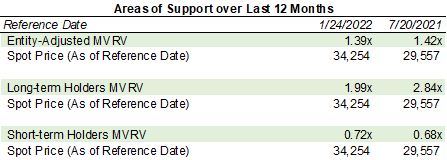

Above, there are two red circles, each centered around an area where we found critical price support over the past year. One point was in July of 2021, and the other was in January 2022.

Below we map out the MVRV metrics for long-term holders, short-term holders, and the overall market as of both dates.

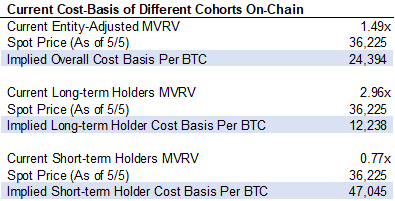

Once we establish the multiples at which the network found support, we can go ahead and determine the cost bases for each of the previously mentioned cohorts.

Based on the calculations below, we can see that long-term holders are still incredibly profitable while newer entrants are well underwater.

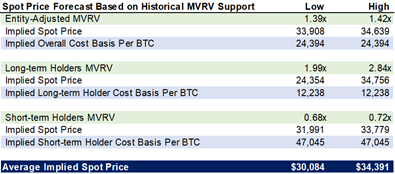

Once we complete this part of the exercise, we can put all the pieces together to create a crude estimate for where we might see downside support. After taking the MVRV multiples observed during historical market troughs and applying them to the current on-chain cost bases, we see that $30k – $34k is a reasonable range to expect bitcoin to find support.

Source: Fundstrat, Glassnode

Recent Volume Data

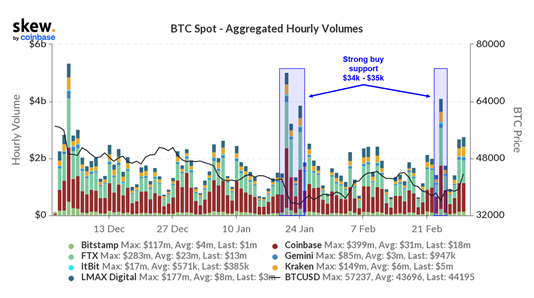

This “back-of-the-envelope” methodology is consistent with our prior observations earlier this year. We witnessed pronounced volume increases during the market tumult in January and February around the $34k – $35k range.

Twice since the market’s all-time high in November and subsequent drawdown, we have seen firm buying support in this area. The first instance was at the market low around January 24th, and the second was around the market dip following the issuance of sanctions on Russia.

This recent precedent gives us some confidence that there will be buyers who might step up in this area.

Source: Skew

Macro Outlook + Correlations to Tech Stocks

We can also leverage our macro team’s predictions for equities to estimate the magnitude of any potential drawdown. Below is an excerpt from Portfolio Strategist Brian Rauscher, who recently provided a revised, net-bearish outlook on the near-term macro situation.

“I believe that the equity market has not fully priced and fully appreciates the Fed’s hawkish bent and desire to subdue inflation at all costs. As I previously laid out, the diminishing odds of a peace deal between Ukraine and Russia means that my second scenario of a drop to the neighborhood of 3,500-3,600 for the S&P 500 is becoming more likely according to my work. Two of the primary legs of my bullish thesis going back to March 2020 have been an accommodative Fed and rising earnings revisions and expectations. Earnings expectations and guidance are now diminishing, and I believe it is inevitable that the analyst community will begin downgrading cyclical stocks. Analysts may be sitting on their hands a bit given the difficulty of projecting demand in certain industries affected by COVID, but I would say this is the next shoe to drop in markets. This, coupled with an aggressive Fed, could make it a rough go for the short to medium term.”

At the time of writing, the S&P 500 is trading around $4,100, meaning a drop to $3,600 would be a decline of approximately 12-15%. As we have established, there are strong correlations between equities (particularly tech stocks) and bitcoin. Nasdaq’s relationship with S&P returns would imply an approximate drawdown for QQQ of 15-18%.

Thus, it is reasonable to expect bitcoin to suffer from a decrease similar in magnitude, should equity prices decline to the levels noted by Brian Rauscher. This would imply a “bottom” for bitcoin of $29k-$30k.

Long-term Price Support

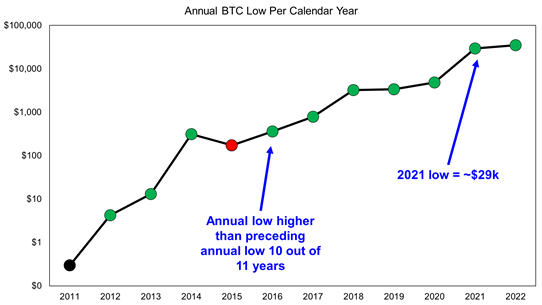

Thus far, we have used three different measures to estimate where investors might be willing to jump back into the market: (1) existing cost bases of bitcoin investors and historical MVRV multiple support, (2) downside estimates from our macro team coupled with recent correlation data, and (3) volume data from recent market drawdowns. The final leg of this prognostication is the chart below, which displays an interesting trend that many casual market observers may not be aware of.

Since 2010, bitcoin has recorded a higher low in each calendar year except for 2015. While we acknowledge that this trend could very well become a relic of the past, as bitcoin matures and moves toward a post-cycle world, if this trend maintains, we should see market participants backing up the truck at $29k.

Source: Fundstrat, TradingView

In summary, based on recent data and long historical trends, we think that $29k-$33k is a reasonable range to expect BTC to find a bottom.

Conclusion

One of our major pieces of advice to most crypto investors is to not try to time the market perfectly. So, to be clear, this analysis is not meant to serve as an exercise in precision.

As noted previously, on a relative basis, bitcoin is trading at a low multiple of capital stored in the network (MVRV). Further, we are surrounded by geopolitical (war, sanctions) and economic (negative real rates, high inflation, commodity crisis) calamities that could push more people to bitcoin and lead to overnight parabolic growth in adoption.

The best bet for most retail and institutional investors is to opportunistically average in during market downturns like the one we are experiencing now. However, we understand in times of uncertainty, liquidity is paramount. Thus, it is helpful to perform exercises like these to find any historical data to orient oneself and provide confidence in making large buys or weathering any potential forthcoming drawdowns.