Project development continues as token demand remains muted

Key Takeaways

- Completion of Ethereum’s Kiln Testnet appears to have catalyzed ETH staking demand. Monthly growth of new ETH staked is the highest since the launch of Beacon Chain.

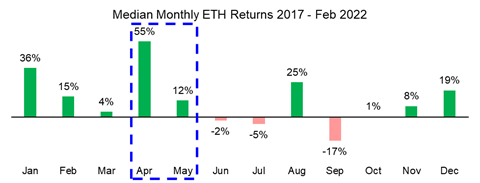

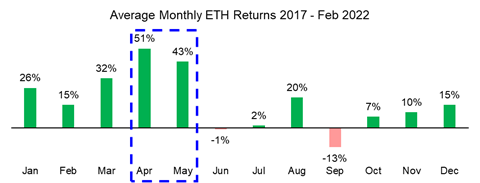

- We revisit BTC and ETH median and average monthly returns. Since 2017 April and May have been bullish for digital assets despite tax season.

- In reviewing BTC’s on-chain metrics, the demand-side remains muted. Realized cap has trended lower since February and new wallet growth has yet to break out.

- Last week, we attended the Solana Hackathon in NYC. DAO tooling was one of the most talked-about emerging themes, which we liken to B2B SaaS and discuss further below.

- Bottom Line – Despite relatively flat demand, digital asset prices have made a meaningful move higher over the past week. With a lack of new demand, eyes are focused on development efforts like Ethereum’s transition to proof-of-stake and innovative use-cases for layer 1s like DAOs – both of which should positively impact token prices on longer time frames.

Weekly Recap

Cryptoassets performed strongly for the second consecutive week, as prices have seemingly become less responsive to negative headlines surrounding the war in Ukraine and the risk of excess hawkishness from the Fed.

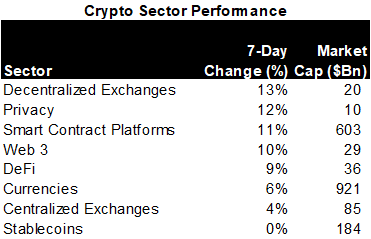

It was another “risk-on” week within crypto as smart contract platforms performed the best on a size-adjusted basis out of any other sector.

Much of this outperformance stems from the recent optimism surrounding Ethereum’s merge and the consequent increase in staked ETH. However, alternative layer 1 platforms such as LUNA, DOT, SOL, and AVAX, have had similarly bullish weeks.

Source: Messari

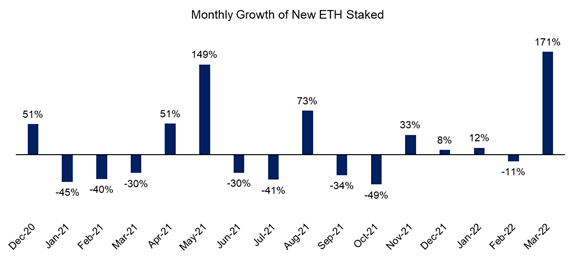

Last week, we discussed the implications of the latest testnet merge for Ethereum. We think that many ETH holders were waiting for more conclusive evidence suggesting that the merge was imminent. The completion of the Kiln Testnet merge was a likely catalyst for many to start to stake their ETH, thus reducing the liquidity of the ETH supply on exchanges.

Thus far, we have seen the highest monthly growth in new ETH staked since the launch of the Beacon Chain. Should the network maintain this level of momentum, we could see an intense squeeze on ETH supply at some point in 2022 as investors rush to stake their ETH.

Source: Fundstrat, Glassnode

As a reminder, we would also expect the merge itself to have accretive effects on ETH price. This is due to two main reasons:

- The merge would essentially reduce new ETH emissions to 0% once completed due to all issuance being redirected from proof-of-work miners to stakers. These stakers cannot liquidate their ETH due to the current locking mechanism which prevents existing stakers from achieving liquidity on day one post-merge. Thus, any earnings that they collect will not enter the market until the protocol is updated to allow for this.

- We expect an inevitable speculative bounce in price leading up to and following the merge, which should be an effective tailwind for price.

Seasonal Trends

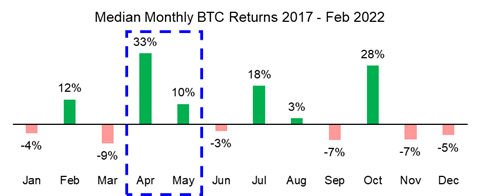

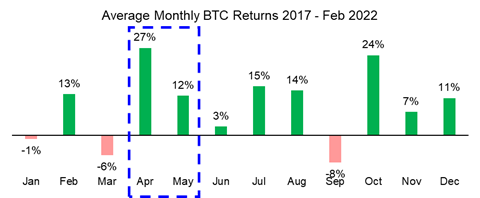

We have previously highlighted persistent seasonal trends for bitcoin in our analyses, and in 2021, they held up relatively well. We noted that September was a tumultuous month historically for BTC, and October and November were historically positive months for BTC price. Despite running into unforeseen macro headwinds in November, this played out according to the script as bitcoin reached successive all-time highs in October and November.

On that note, we would like to highlight another apparent seasonal trend in price action. Instead of looking at data from back in 2011 as we did several months ago, we reviewed monthly returns data from the previous five years, the time during which there was a significant increase in market participants and access to liquidity across the digital assets space.

From that data, we can see that April and May have been a period of outperformance for BTC.

Source: Fundstrat, Coinglass

Similarly, ether has performed well in the spring months as well. April is ether’s best performing month historically.

Source: Fundstrat, Coinglass

The obvious question here is, “why?”

Potential reasons are abundant – markets are complex systems that are a function of an endless number of variables. However, we think one contributing factor might be increased fund inflows following the resolution of tax liabilities and returns.

Many anticipate that investors will be hit with unsuspecting tax bills for capital gains realized in 2022. But from our experience, those who have remarkable capital gains typically have the foresight to have the liquidity to pay taxes on them. We think the resolution of tax season may give retail investors better clarity over how much capital they can deploy and possibly leads to favorable price action.

Regardless of the underlying reasons, these seasonal trends could help this current relief rally persist over the next month, and we will keep a close eye on technical trends or catalysts that might confirm this pattern.

Demand-Side Data Remains Unconvincing

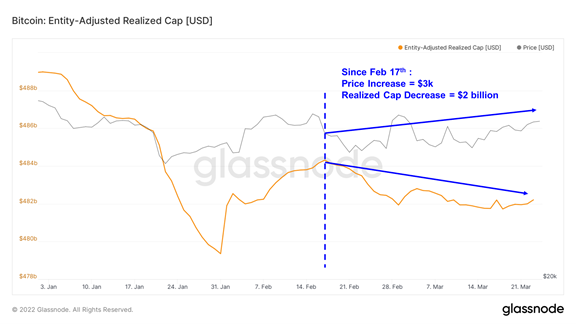

The lack of convincing demand-side data is a drum that we have been beating for a while now. In short, the dearth of on-chain activity prevents us from declaring this relief rally a product of a sustainable bull market. Realized cap is one relevant demand-side metric that we often review to see if flows into the bitcoin network are increasing. Realized cap represents the total cost basis of all coins held. If realized cap increases, this serves as a reasonable proxy for fund inflows. Conversely, if realized cap decreases, it means that coins with a higher cost basis are being sold to new investors at a loss, thus signifying the exodus of capital from the network.

As demonstrated below, we can see that despite the price of BTC increasing over the preceding month, we have not seen new capital inflows as realized cap has decreased by approximately $2 billion.

The good news is that short-term and “paper-hand” investors that held their coins at a higher cost basis likely sold to existing “diamond-hand” investors, lowering the overall cost basis of the network.

The bad news is that we have yet to see conclusive evidence of new buyers entering the fold as prices climb higher.

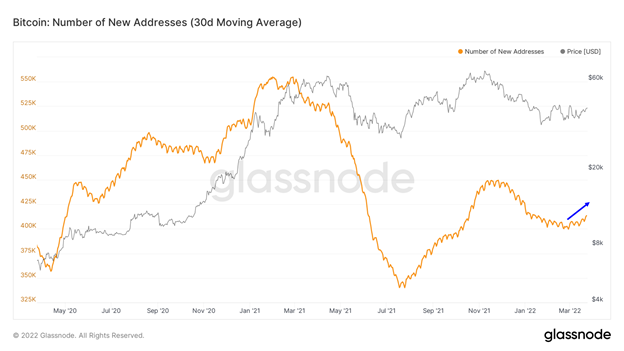

Additionally, we are still waiting to see a conclusive bullish reversal of new wallets, another metric whose ascent often precedes sustained bull runs. The 30-day trend looks promising, but another week or two of data might be helpful before we can attribute any signal to this pattern.

While the seasonal trends highlighted above could help the current relief rally persist in the immediate term, we likely continue to experience persistent volatility through the next few months or until more definitive signs of increased demand appear.

DAO Tooling @ Solana Hackathon NYC

Last week, members of the Fundstrat Digital Assets Team attended the Solana Hackathon in New York City – a six-day in-person event hosted by Solana Labs and ecosystem partners Jump Crypto and Multicoin Capital.

Having already made stops in Los Angeles, Seattle, Singapore, Dubai, Moscow, and Prague this year – the Hackathon provides Solana developers the opportunity to collaborate IRL and even earn funding for their ideas. Some of the most exciting Solana-based projects over the past year have come out of similar hackathons – including the move-to-earn app STEPN and decentralized social media platform GRAPE – making hackathons a great place to meet talented developers and get a glimpse of what they’re working on.

One of the most talked-about web3 themes at last week’s event was DAO tooling – infrastructure applications that help DAOs run and manage their operations. As a refresher, DAOs, or decentralized autonomous organizations are crypto-native communities that leverage public blockchains to achieve a common goal.

DAOs prioritize openness, allowing contributions from mostly anyone – which vastly expands the pool of available human capital available to traditional businesses operating in a specific geographical location. We think this is an essential characteristic today, considering the over 11 million job openings in the US and “The Great Resignation” becoming a topic of spirited dinner conversation.

In 2011 Marc Andreessen said, “software is eating the world.” This statement is even more valid today than over a decade ago. We believe that in the same way Google Maps ate physical maps, DAOs are an early instance of software disrupting the traditional corporate structure.

To date, DAOs have launched to build crypto products and services (SushiSwap, Index Coop), manage investments (MetaCartel), and collect NFTs (Whale). There is even a DAO with the distinct goal of purchasing and operating a golf course (LinksDAO).

But what’s running these crypto-native communities under the hood, and what applications do DAOs use to manage internal operations? The answer is a bit complicated. Though for traditional corporations and small businesses, the answer is straightforward. B2B SaaS companies develop and sell apps that streamline operational tasks for businesses. SaaS platforms that fill just about every corporate operating need from accounting and payroll to customer relationship management (CRM) and billing. B2B SaaS is a massive market. This year on the enterprise side alone, IT spend on SaaS is expected to be approximately $672 billion. For DAOs, the market for similar software is wildly nascent and highly fragmented.

Enter DAO Tooling.

DAO tooling is B2B SaaS for crypto – providing digital organizations the tools and applications they need to operate successfully. This positioning alone makes DAO tooling appealing from an investment risk perspective. For the most part, DAO tooling projects aren’t developing novel technologies like scaling solutions or interoperability protocols with a high risk of technical failure. DAO tools can be more aptly described as picks-and-shovels for the next generation of digital corporations.

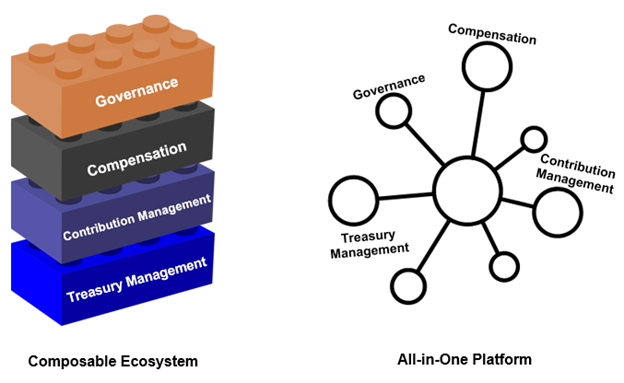

So far, developers have taken one of two approaches to DAO tooling: build an all-in-one platform addressing the gamut of DAO needs or build a specialized platform for specific operational tasks. With millions in funding flowing into the space, investors are taking bets as to which strategy will most effectively meet the needs of future organizations, thus capturing the most value.

From our perspective, all-in-one platforms risk disregarding one of the most potent technical tailwinds afforded by blockchains: composability. Composability is the concept of applications – not only communicating with each other (which was popularized by APIs in web2) – but building atop one another, leveraging, and integrating previously made products and services to create new ones. Composability has led many to refer to decentralized applications as Legos or building blocks. For example, in DeFi, applications are dubbed “money Legos.” DAO tooling applications could be thought of as “organization Legos.”

Composability is crucial because it drastically reduces development time and cost. What’s the point of building something from scratch if someone else has already done the work? Blockchain and composability allow developers to focus entirely on building newer and better products and features instead of spending time recreating what has already been made.

All-in-one DAO tooling platforms that build a wide range of products and features from the ground up would face several disadvantages when competing against an entire ecosystem of developers building specialized tools composing and integrating with one another. The ecosystem of developers will not only be able to out-build all-in-ones in terms of speed given the sheer number of developers, but they will likely be more effective at listening to and addressing the needs of DAO customers given their individual specializations.

What do DAOs need?

The composability of tooling apps matters little if they don’t address the fundamental needs of DAOs, to begin with.

A few standouts are:

Treasury Management tools that secure, invest, and disperse the organization’s funds as needed. (Gnosis Safe, Coinshift)

Governance tools that allow for effective decentralized decision-making at scale. (Snapshot, Boardroom)

Contribution Management tools that track the value added by DAO participants. (RabbitHole, Gitcoin)

Compensation tools that reward participants in intuitive and motivating ways. (Coordinape, Disperse)

As a final thought, if the future of organizations and human capital formation is digitally native, DAOs will likely challenge the traditional expectations of what is possible through human collaboration – just as software has done in other examples countless times before. If true, DAO tooling applications stand to be a fundamental catalyst for this trend.