The Merge Approaches

Key Takeaways

- For the first time since December 2018, the Fed announced a benchmark interest rate hike of 25 bps and signaled six more hikes this year. The market took this announcement in stride, reacting positively in the absence of any increased hawkishness.

- Despite its reputation, Bitcoin has outperformed multiple tech indices YTD. While many believe this is a sign of a “decoupling,” it is far more likely that BTC was oversold relative to equities.

- We examine the recent decrease in activity on the Ethereum network. The decline in interest in NFTs and decreasing stablecoin velocity explain why fees are trending lower.

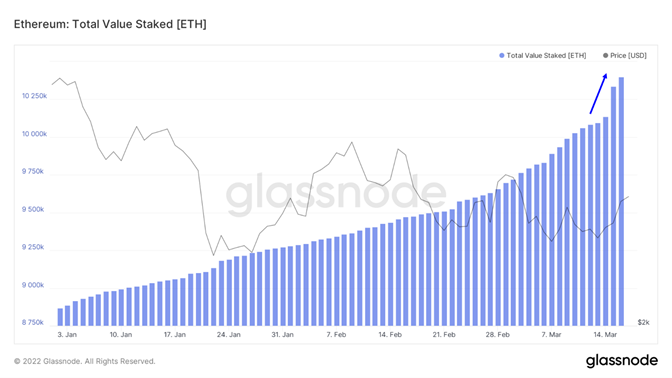

- Earlier this week, Ethereum merged on the Kiln testnet, the last merge testnet expected before the ultimate conversion of the network to PoS. On the news of a successful Kiln testnet merge, we saw a sharp spike in the amount of ETH staked, climbing from 10.1 million ETH to 10.4 million ETH staked in just a matter of days.

- Bottom Line – Despite the “risk-on” week for cryptoassets, we will likely encounter additional volatility in the near term. We remain optimistic that any dips for ETH and BTC are buying opportunities, and we think the probability of Ethereum transitioning to PoS in 2022 is increasing – one of our significant catalysts for this year.

Weekly Recap

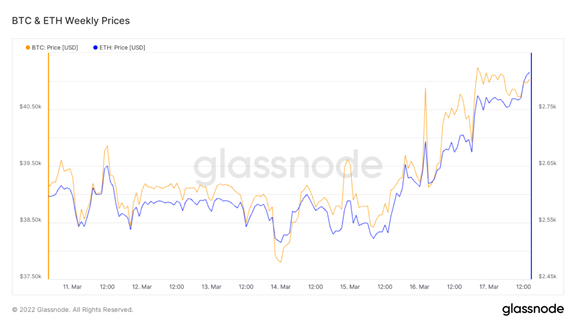

For the first time since December 2018, the Fed announced a benchmark interest rate hike of 25 bps and signaled for six more hikes this year. It is apparent that the market had priced this in (discussed further below) and is content with the lack of increased hawkishness despite rampant inflation.

Bitcoin and ether increased in lockstep with equities but remain largely range-bound, currently straddling $40k and $2.6k, respectively.

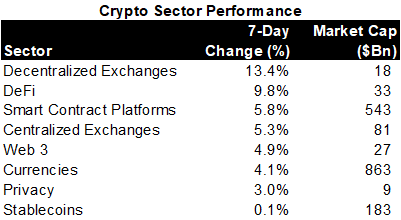

This week produced a relatively risk-on environment for crypto, as we saw web3, smart contract platforms, and DeFi all outperform currencies.

Source: Messari

Expectations for Year-End Interest Rates are Increasing

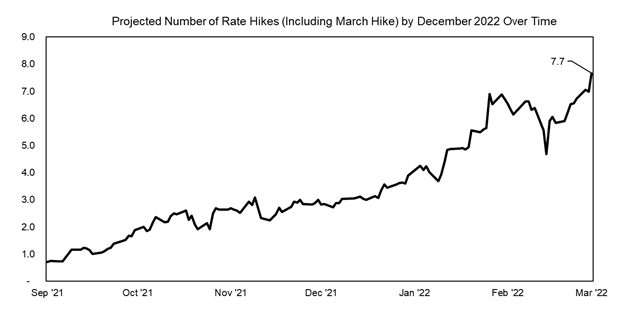

Below we chart the probability-weighted projected number of rate hikes for 2022. Clearly, things changed drastically towards the end of 2021. The number of expected rate hikes has risen from one in September 2021 to nearly eight following yesterday’s FOMC meeting. Please note that the line below includes the March rate hike.

Source: CME Group

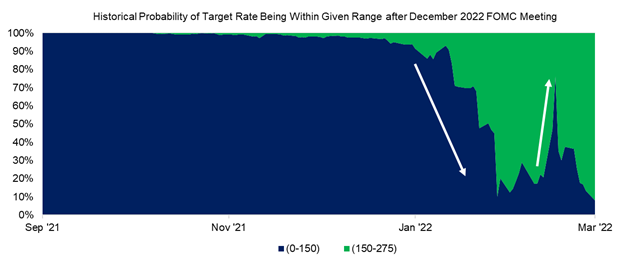

The only constant in the market recently has been uncertainty. We think the chart below speaks to how quickly expectations around inflation, rates, and consequently, asset prices, can change. The probability of the target fed funds rate being above 150 bps by the end of 2022 was nearly 0% at the start of the year, now it is approaching 100%, a near “certainty.”

Source: CME Group

If asset price performance is all about what happens relative to expectations, we must ask ourselves whether the final number of rate hikes for 2022 is more or less than 7.7.

Given how dramatically risk assets have sold off in the face of inflationary pressures, the ongoing risk of inflation, and recent talks of recession, we think the probability of undershooting this number is much higher than overshooting it (a good thing for asset prices).

In either case, we still expect bonds to struggle and for bitcoin to garner some of the fund flows that would have otherwise been parked in fixed income.

Decoupling?

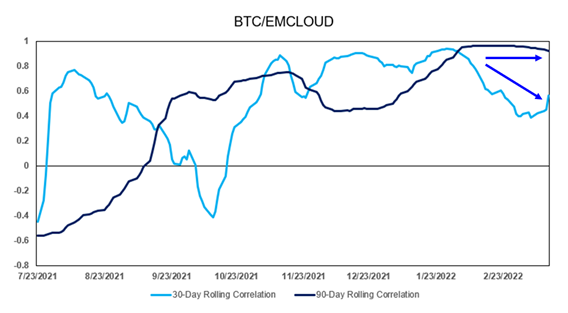

Earlier this year, we talked extensively about how BTC -4.54% was correlated strongly with risk assets, particularly cloud stocks.

We can see below that despite carrying the reputation of being an extremely risky asset, BTC has outperformed both the Nasdaq 100 and the BVP Emerging Cloud Index since the start of this year.

Source: TradingView

The magic word in bitcoin circles is “decoupling.” It signifies a breakout of bitcoin relative to tech stocks and is one of the significant events that investors think will precede bitcoin’s transition from a risk-on to a risk-off asset. While BTC remains correlated with cloud stocks on longer timeframes, it has pulled away and has been significantly less correlated in recent weeks.

Source: TradingView

While this performance is an encouraging sign, we think the likely explanation for this price action is that bitcoin was oversold relative to tech stocks, and it is not undergoing a complete decoupling from tech.

Reduced Activity on Ethereum Network

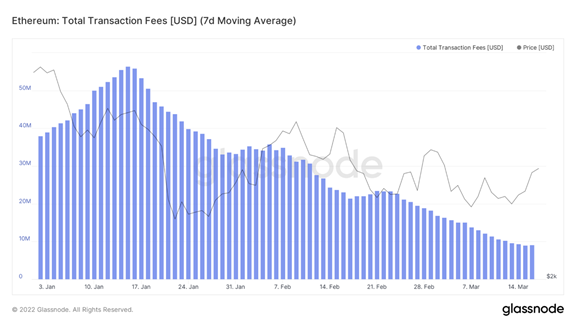

Switching our attention to the Ethereum network, we have witnessed an apparent decrease in activity, demonstrated by a steep decline in fees paid. The chart below suggests that demand to transact on the network is significantly lower than at the start of this year.

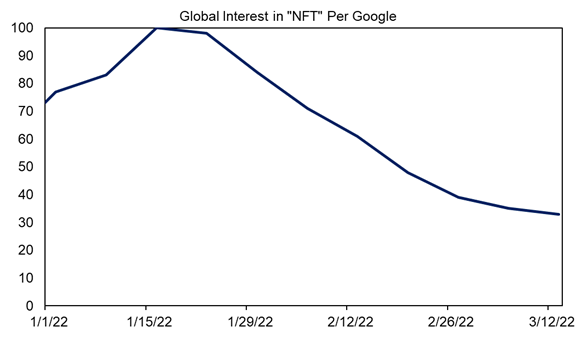

We think there are a few reasons for this, one being a reduction in demand for expensive NFTs, which are predominantly minted and traded on the Ethereum network. In fact, the highest burning smart contract on Ethereum since the implementation of EIP 1559 is the OpenSea smart contract.

Below we can see that consumer interest NFTs peaked around the same time as fees remitted on the network. This interest has waned in recent weeks, commensurate with the decrease in fees paid.

Source: Google Trends

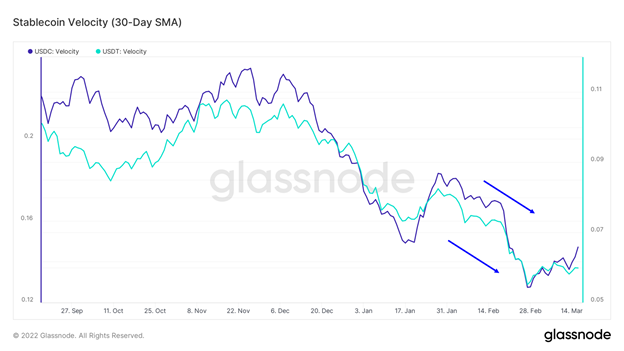

However, there are likely multiple factors contributing to the decline in usage of the Ethereum network. Leading stablecoins, USDT and USDC are among the top 10 burning smart contracts on Ethereum The more they are transacted with, the more fees are paid to the network.

The sharp decrease in stablecoin velocity likely speaks to a reduction in the amount of trading occurring in both CeFi and DeFi applications. Despite stablecoin market caps continuing to steadily increase, it appears that a lesser proportion of these stablecoins are moving as frequently.

It is likely that the majority of stablecoins are being used to liquidity mine or are simply being used as a store of value as traders wait for the market to achieve more directional clarity before entering new trades.

As a result of this decrease in activity, miners are being paid less in fees, and the multiple at which ETH -5.26% trades continues to climb further into frothy territory.

Its price-to-sales multiple is currently north of 50x, a dramatic increase from 17x a couple of months prior.

Source: TokenTerminal

But Network Usage Stops Mattering if Merge Occurs in Q2 or Q3

Despite this lull in network activity, there is good reason to be optimistic about price action over the next 6-12 months as it appears that the probability of a conversion to a proof-of-stake network in 2022 is increasing.

Earlier this week, Ethereum merged on the Kiln testnet, the last merge testnet expected before the ultimate conversion of the network to PoS. We are not going to wade into the technical details of what transpired, but according to Ethereum developers, the testnet merge was largely successful.

If you recall, one of our major projected catalysts for ETH, beyond a broader market lift from bitcoin performance, was the merge.

We continue to believe that investors are underpricing this event largely due to:

- An increase in the number of alternative layer 1 platforms that are garnering investor attention.

- This event has been on the developer roadmap for a very long time, and as a result many are skeptical that it can ever actually happen.

The skepticism surrounding the merge seems to be dwindling. On the news of a successful Kiln testnet merge, we saw a sharp spike in the amount of ETH staked, climbing from 10.1 million ETH to 10.4 million ETH staked in just a matter of days.

As we have repeatedly discussed, we think that as more consensus around a final merge date is achieved, we will see ETH holders start to pile into the ETH 2.0 staking contract.

This behavior is likely to constrain supply and will likely be concurrent with a speculative run-up in price, as the merge will start to be universally viewed as a price catalyst despite what the underlying fundamentals are signaling.

Therefore, despite macro conditions, we think it is possible that ETH can perform remarkably well through the rest of this year, irrespective of the rest of the market, if the transition to PoS is completed in Q2 or Q3.