FOMC Aftermath

Key Takeaways

- On Wednesday, the Fed reiterated intentions to further reduce bond purchases in February and ultimately cease bond-buying in March, with rate increases to follow sometime thereafter.

- Bitcoin’s correlation with tech stocks during this drawdown is characteristically different from 2018 and suggests that we are not headed for a similar crypto winter.

- GBTC discount to NAV reaches an ATH as it approaches 30% for the first time, presenting a potential opportunity for the patient investor.

- Increased crypto adoption in emerging markets might serve as a tailwind for Bitcoin this year.

- MVRV is at a level last seen in April 2020, when BTC was under $10,000.

- Bottom Line: Bitcoin and the broader crypto market continue to trade in lockstep with macro trends. It is possible that we could see short-term rallies over the next several weeks but overall maintain that monetary tightening will continue to present choppy waters for crypto through Q1 and into Q2. We continue to think there is a convincing macro thesis for Bitcoin and crypto to thrive in 2022, despite near-term risks. We plan to expand on these thoughts in our Annual Outlook call next week.

Fed Remains Unchanged

On Wednesday, the Fed reiterated intentions to further reduce bond purchases in February and ultimately cease bond-buying in March. The FOMC also issued their clearest signal of a March rate increase to date, saying that “it will soon be appropriate to raise the target range for the federal funds rate.”

These remarks appear to be what market participants had priced in as BTC, ETH, and the rest of the crypto market exhibited some volatility, but ultimately finished the trading day where they started. The major takeaway from Wednesday’s events is that there were no real surprises on the Fed policy front.

Same But Different

In last week’s note, we mentioned the potential for choppy waters in Q1 and Q2, given crypto’s outsized correlation with macro factors and impending monetary tightening. Since that time, we have seen a substantial decline in the global crypto market – moving from $2 trillion down to $1.6 trillion at the time of writing.

We see crypto’s volatility as a feature and not a bug (otherwise, we would probably be doing something else with our time) and is primarily a function of an early-stage technology coming to market in a completely liquid and globally accessible way. It is akin to watching early-stage tech valuations wax and wane in real-time. That said, many crypto investors are inclined to be cautious during periods of significant price drawdowns due to the fear that we could be entering a prolonged crypto “winter,” similar to the one experienced during 2018 and part of 2019.

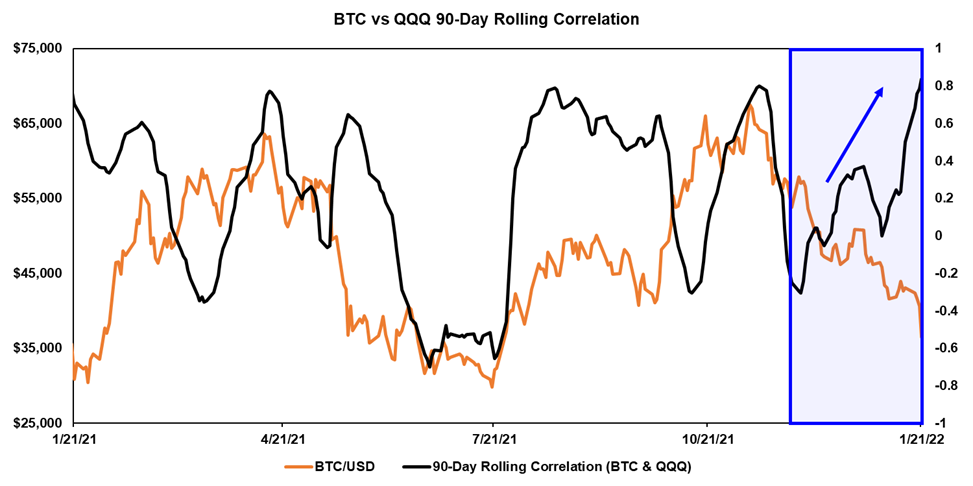

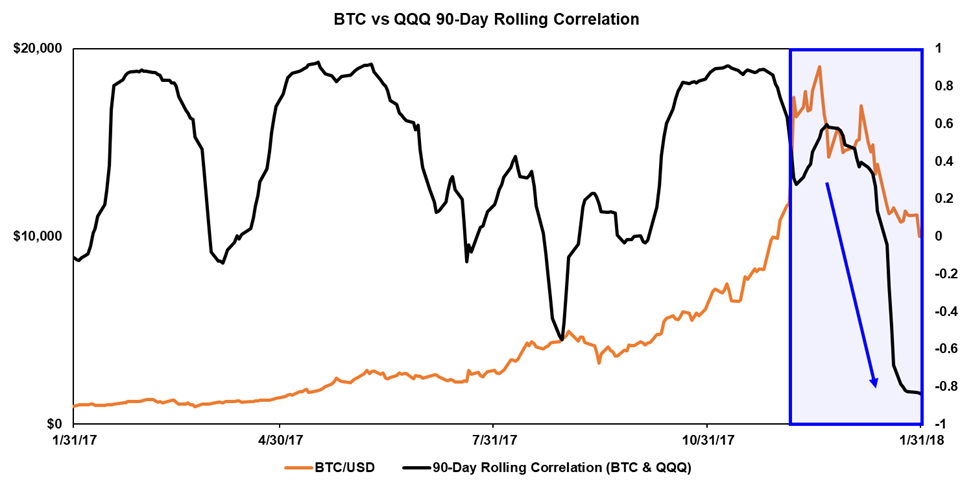

In 2017, traditional hedge funds, banks, and wealth managers did not have capital tied up in crypto. Therefore, the drawdown was mainly due to decreased sentiment among crypto-natives and, quite frankly, a general lack of good projects to trust with your capital. An excellent way to visualize this dynamic is with the two charts below. The first is the recent correlation between BTC and the Nasdaq-100, a tech-heavy large-cap growth fund. We can see that recently they have moved in lockstep as the rolling 90-day correlation is nearing 1, similar to April 2021 when BTC and QQQ both sold off.

In contrast, this is much different from the major drawdown in 2018 as BTC and the wider crypto market were diverging from tech stocks. This was more of a “take my ball and go home” situation among disgruntled crypto traders than an actual macro shift away from risk assets.

The difference in correlations to tech makes this drawdown characteristically different than the one in 2018 and suggests that the “bottom” is not necessarily where the marginal crypto-native seller capitulates, but rather where the marginal legacy macro seller becomes exhausted. This difference is a major reason why we are much less likely to experience a prolonged crypto winter this time around – if crypto-natives were the primary driver of the price decreases, we would be much more concerned.

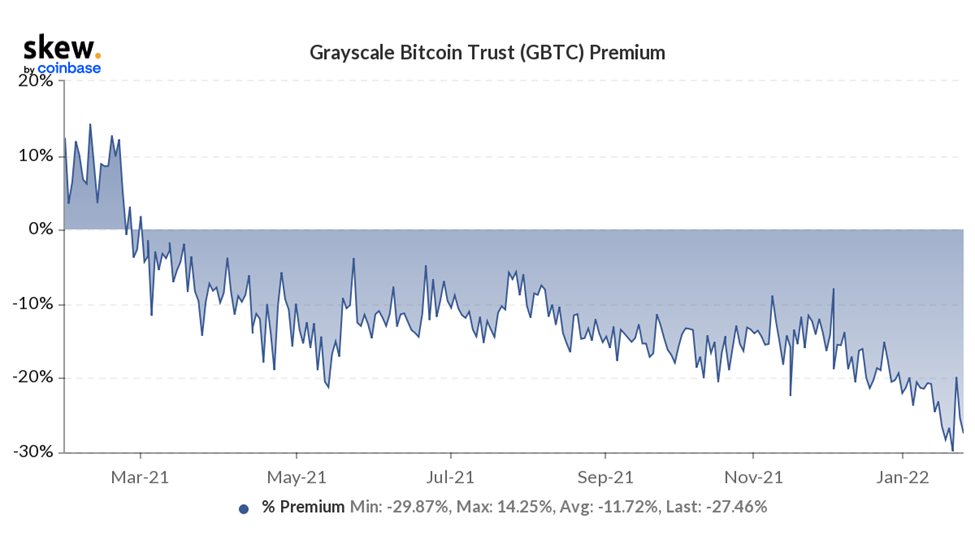

GBTC Discount at ATH

To piggyback on the view that the vast majority of selling pressure has come from legacy financial institutions we have the chart below, which displays the discount to NAV of the Grayscale Bitcoin Trust (GBTC -2.38% ). A product that once served as a lucrative onramp into BTC for institutions is now trading nearly 30% below the value of the assets held in its trust as selling pressure has significantly outpaced demand.

We think there is a potential opportunity cost in buying secondary shares of GBTC at these levels but given the extent to which these shares have declined below NAV, this may be a good way to open a “leveraged” position on Bitcoin without using actual margin or using derivatives. Below is a theoretical example using arbitrary prices to demonstrate how this could potentially boost returns (This excludes any management fees).

Currently, there is no redemption feature for GBTC, which is why it trades at such an extensive discount. However, Grayscale has applied to convert to an ETF, which would close the gap immediately. While approval of a spot BTC ETF does not appear to be imminent, there is an opportunity for the long-term investor to essentially acquire spot Bitcoin at a 30% discount. We should note that this trade might require patience and the discount is liable to expand but could be something worth considering.

Stablecoin Usage Suggests Increased Global Adoption

There is so much debate over how to label Bitcoin in terms of asset type, and viewpoints will generally vary depending on one’s goals or understanding of digital assets. Currently, Bitcoin is trading like a cloud stock, but as highlighted in our last weekly, we do not expect it to trade that way forever. In the same way that Facebook stock was highly volatile and lacked a business model before it achieved its ultimate level of network effects, in the developed world Bitcoin is an early-stage investment in a better store of value that is still in its go-to-market phase. That said, we already see some places in the world where bitcoin could be treated as a more traditional “store of value,” particularly in nations with highly volatile currencies, outsized inflation (we are talking 50%, not our 7%), and less robust capital markets.

For instance, Turkey has seen its Lira decline precipitously in the face of rapid inflation and there are signs that point to increased bitcoin adoption among Turkish citizens. Presently, the third-largest currency trading pair with Tether (USDT) is the Lira, indicating that many citizens are likely using USD stablecoins as an offramp from their domestic fiat system into crypto (source: CryptoCompare). It is not unlikely that a portion of this USDT is being used to purchase BTC on either regulated or decentralized exchanges. We think this is probably an easy sell for many Turkish citizens given that over the past 12 months BTC is up about 7% in USD terms, but still up nearly 100% when denominated in Lira.

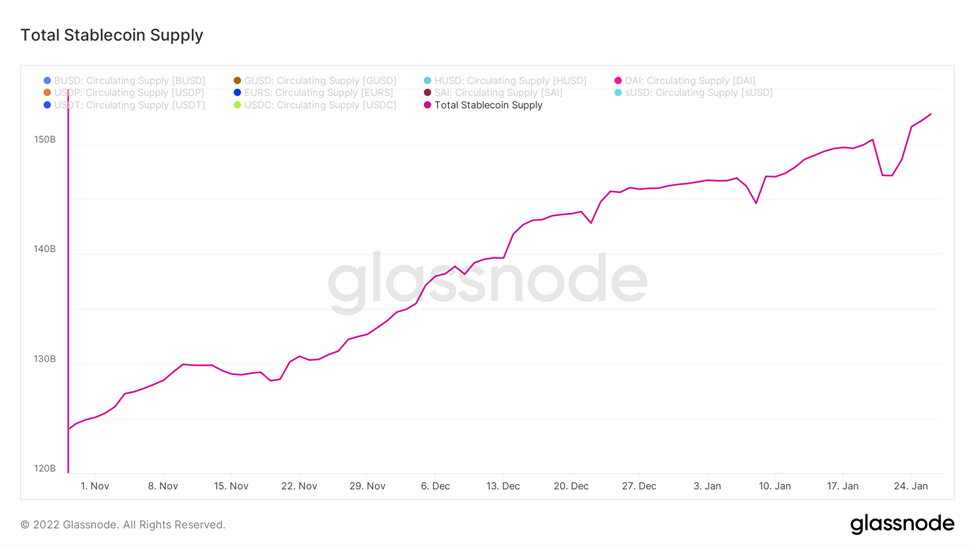

Interestingly, this increased level of emerging market adoption could be one of the major driving forces behind the persistent increase in the global USD stablecoin market cap. As demonstrated by the chart below, the adoption of USD stablecoins has continued to climb, despite the recent market volatility. We think that this type of ground-level crypto adoption could be a potential catalyst for the industry.

To be clear, stablecoin usage is not the same as Bitcoin adoption, but we think it is probable that where there is USDT adoption, there is likely to be increased Bitcoin adoption. Where there is smoke, there is fire.

Quick Note on Valuation

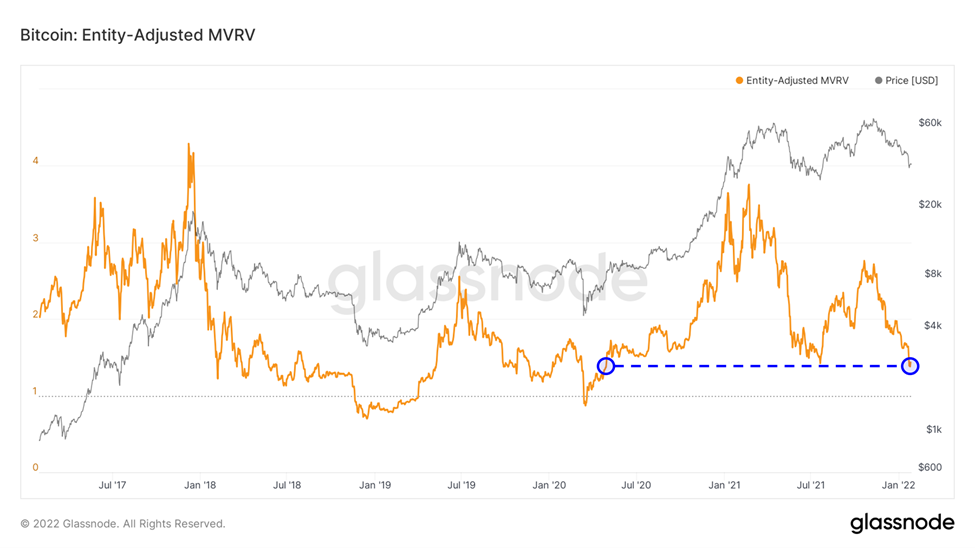

Market-value-to-realized-value (MVRV) measures the profitability of coins presently held across the entire network. Naturally, the higher that this metric rises, the “frothier” the market price for bitcoin is, and the more selling pressure there will be from holders.

Notably, this metric is now at a level last witnessed in April 2020, when the price was still well below $10,000. This speaks to the amount of capital invested into the network since that time as the cost-basis has increased significantly.

Bottom Line

As Bitcoin’s price rebounds and funding turns negative, the crypto market is in a better position for a rally in the latter half of January. Given the current amount of leverage in the system, it is smart to continue to be positioned for volatility. Looking beyond 1H 2022, we think investors may be discounting the potential for outperformance in digital assets.