Fed Minutes Aftermath

Key Takeaways

- Risk-on assets, including Bitcoin, drop upon the release of the latest Fed minutes, which signals the potential to reduce the balance sheet in Q1 2022. The 10-year has increased over 12% YTD and seems on its way to 2.0% for the first time since 2019.

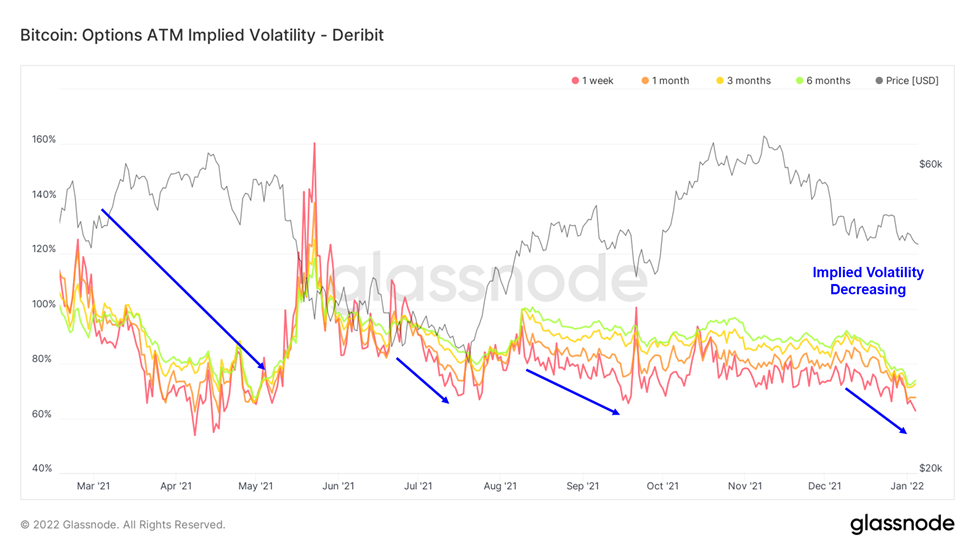

- Contrary to apparent market trepidation, the implied volatilities of Bitcoin options have been trending downwards over the prior month.

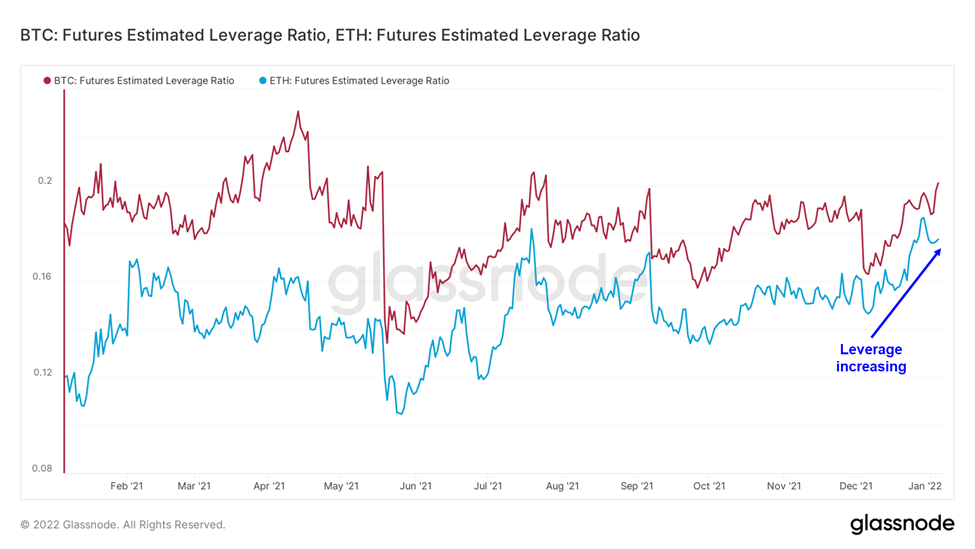

- The leverage ratio has surpassed the levels witnessed during the last major drawdown in early December, meaning if prices continue to grind down, we could see the market incur significant liquidations.

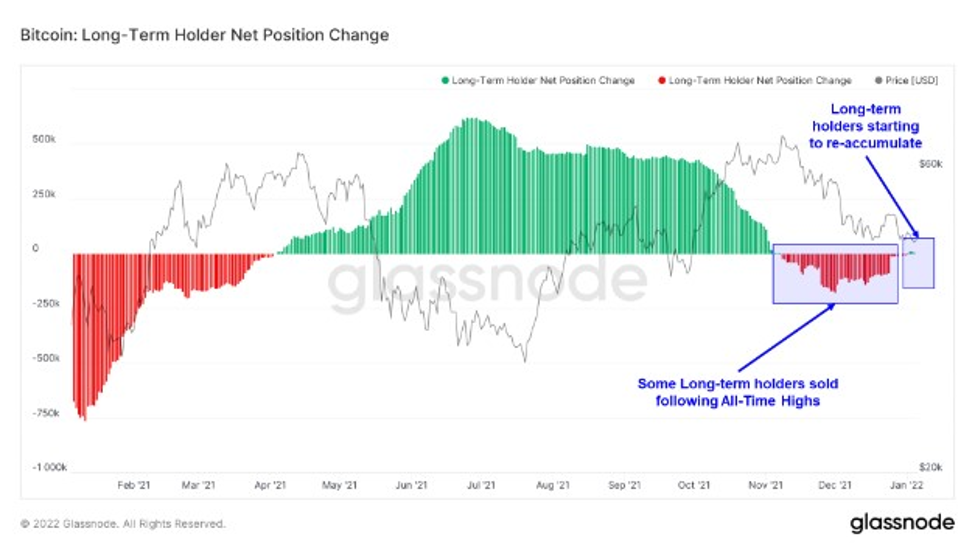

- Long-term holders have flipped from net-sellers to net-buyers over the past week as Bitcoin trades below its 200-day moving average for the first time since September.

- Bottom Line: Given the current macro backdrop, leverage within the Bitcoin market, and recent robustness seen in the altcoin market, we think it’s appropriate to be overweight Ethereum and other leading smart contract platforms. We probably would not bet the farm near-term on BTC but believe there is an opportunity in going long volatility via derivatives strategies.

Bitcoin is a Macro Asset that trades like a Cloud Stock

Markets are ringing in the new year with hawkish expectations as the 10-year rate has increased over 12% YTD and seems well on its way to 2.0% for the first time since 2019. Such action potentially signals a robust underlying economy coupled with ongoing inflationary concerns. Regardless of supporting rationale, risk-on assets, including Bitcoin, have dropped in an inversely proportionate fashion.

Rates were already ticking before Wednesday afternoon but were exacerbated by the release of the Federal Reserve’s minutes from its December meeting. It was previously thought that there might be a clear delineation between rate increases and balance sheet reduction. However, the group seemingly committed to reducing its balance sheet holdings sometime after the central bank commences with rate increases in Q1 2022. As an excerpt from the minutes reads, “Almost all participants agreed that it would likely be appropriate to initiate balance sheet runoff at some point after the first increase in the target range for the federal funds rate.”

While this may be the Fed testing the waters to see how the market responds to expedited monetary tightening, this is undoubtedly something worth our attention. Below we will look at how Bitcoin has been trading relative to rates, tech, and the broader crypto market.

BTC vs. US 10Y

As demonstrated by the chart below, BTC has wavered in the face of monetary tightening (at least in the last week). It is interesting to note that the digital gold had been trading in lockstep with the 10-year for the better part of 2 years. This trend might be counterintuitive to some, considering we have touted Bitcoin as a risk-on asset that trades similar to an unprofitable cloud stock, which should trade inverse to higher rates. However, as shown below, all risk assets have traded in this fashion over the same period as the market has benefitted from overly dovish conditions. Before this year, increases in the 10-year merely signaled that the market was getting overheated, not so much that the Fed would take action on it.

Now that we have more certainty surrounding the timing and degree of a hawkish shift in policy, we see Bitcoin behave closer to a small-cap tech stock.

BTC vs Cloud Stocks

When placed against emerging cloud stocks, it is evident that Bitcoin carries the same risk profile as margin-challenged tech companies. The blue line below represents Bessemer Venture Partner’s Emerging Cloud Index, designed to track the performance of emerging public companies that are involved in providing cloud software services.

To reiterate our stance on how Bitcoin can be considered a “store of value” and react to market drawdowns like highly volatile tech stocks – Bitcoin is an investment in a better store of value that is still in its go-to-market phase. We think that once Bitcoin starts to receive inflows from investors seeking near-term protection of purchasing power instead of high-growth, this will be a strong signal of product-market fit.

BTC vs FANG+

Something interesting to note that has become apparent during recent increases in rate expectations, is that often investors refer to “tech stocks” as though they are risk-on assets that trade like the rest of the technology sector. However, this is demonstrably false as demonstrated by the relative strength of the FANG+ index in the chart below. This is just something to keep in mind as we navigate markets in the new year.

BTC vs Altcoins

We think the chart below is very important and speaks to a couple of themes that we have addressed in prior notes – (1) that Bitcoin is an institutionalized asset, and (2) there is a separate decentralized economy being built that does not share as strong of a correlation with legacy markets as it once did.

In prior notes, we have mentioned how private investments in the crypto industry over the past two years have created a more robust climate for investing in altcoins than in previous cycles. This has manifested in an altcoin market that has rebounded from market drawdowns faster than bitcoin, and in general outperformance since the start of this year.

Meanwhile, institutions have arrived for Bitcoin, meaning that a risk-off move from legacy investors and funds that have exposure to Bitcoin will sell their BTC in conjunction with the rest of the risk-on market.

Opportunity in Going Long Volatility

In contrast to the apparent fear in the market, implied volatility across all timeframes has been trending downwards over the prior month. This is normally a good barometer for market risk. While the derivatives markets have evolved quite a bit over the past 12 months, there are often still dislocations between the spot and options markets.

We think that this apparent mispricing in the derivatives market could present an opportunity for investors to employ a strategy that is long volatility in both BTC.

Volatility Incoming?

We think there is further evidence of potential near-term volatility found in the current leverage ratio for BTC and ETH across all major exchanges. As a reminder this metric measures the level of open interest over the amount of BTC and ETH on exchanges.

We have surpassed the leverage ratio witnessed during the major drawdown in early December, meaning if prices continue to grind down, we could see the market incur significant liquidations.

Listen to the Long-Term Holders

Given that recent price movement has been largely macro-driven, we aren’t diving too deeply into on-chain performance. However, we would like to highlight the chart below, which shows that long-term holders have flipped from net-sellers to net-buyers over the past week.

As a reminder, we view long-term holders as “smart money” and their behavior is a strong signal of the health of the Bitcoin market.

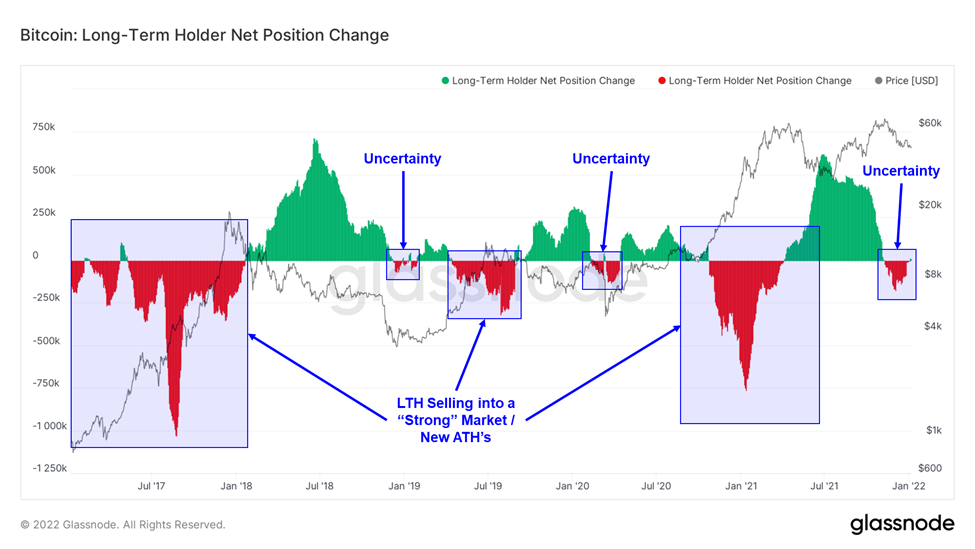

We can see that historically, they have accumulated BTC (green bars) during times of market consolidation or bear markets and have reduced their positions during times of perceived market strength. To us, this sudden shift in behavior signals near-term uncertainty.

Bitcoin Below the 200-Day

Finally, we would like to highlight to our clients that Bitcoin is trading below its 200-day moving average. As a rule of thumb, investors have faired well entering a position in BTC while it is trading above its 200-day and exiting once it crosses this threshold.

Obviously, there are higher returns to be had if one had added BTC to their portfolio the last several times that we have dipped below this level, but this requires some patience as there is always the risk of prolonged drawdowns/consolidation.

Bottom Line: Given the current macro backdrop, leverage within the Bitcoin market, and recent robustness seen in the altcoin market, we think it’s appropriate to be overweight Ethereum and other smart contract platforms. We probably would not bet the farm near-term on BTC but think there is an opportunity in going long volatility via derivatives strategies.