Uptober: BTC, ETFs, and ATHs

Key Takeaways

- Bitcoin eclipses prior all-time high and tests $67,000, completing the comeback from a 55% drawdown April through July.

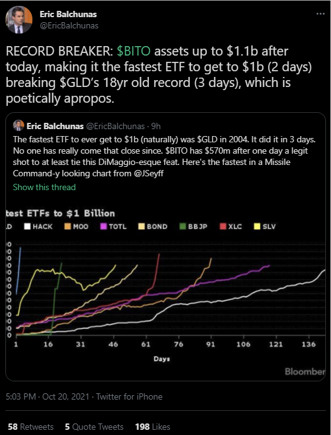

- ProShare’s Bitcoin Strategy ETF (BITO -0.45% ) was a huge success, garnering $570 million in asset inflows in its debut, and breaking the record for the fastest ETF to achieve $1 billion in assets on just its second day of trading.

- Open interest and funding rates increase, but the current Bitcoin leverage ratio and put/call ratio point toward a more sustainable market structure when compared with the last bull run.

- Positive long-term holder trends continue to support the rally, while lack of short-term investor participation suggests it is still early innings.

- Bitcoin continues to dominate, but we expect capital rotations into Ethereum and other altcoins as the bull market progresses.

- Bottom Line: Given the current momentum and market structure, we remain buyers of Bitcoin and Ethereum into any near-term volatility.

Bitcoin Completes the Comeback

In crypto, fortune favors the patient and the data-driven. Despite weathering a 55% mid-cycle drawdown from April through July of this year, Bitcoin maintained overwhelmingly bullish underlying trends that we have repeatedly highlighted throughout our analyses. We have watched as the “smart money” on-chain continued to accumulate BTC and now we are starting to see the seeds of these on-chain dynamics bear fruit.

Today, we completed the “comeback,” as Bitcoin eclipsed its prior all-time high of around $64,800 on the back of significant buying pressure brought about by the launch of first SEC-approved Bitcoin ETF.

Bitcoin’s price neared $67,000 in early morning trading hours on Wednesday as ProShare’s Bitcoin Strategy ETF entered its second full day of trading. The futures-based ETF was a huge success, garnering $570 million in asset

inflows in its debut, and breaking the record for the fastest ETF to achieve $1

billion in assets on just its second day of trading.

A Foot in the Door

Yesterday was a historic day for both crypto and traditional financial markets as it marked the arrival of the first SEC-approved Bitcoin ETF. ProShares’ Bitcoin Strategy ETF (BITO -0.45% ) was approved by the SEC on Friday and began trading Tuesday morning on NYSE. Trading volumes shattered all expectations (outside of our own Tom Lee’s) as the fund garnered $1.1 billion in asset inflows in its first two days of trading, making it the fastest ETF to reach the $1 billion milestone. Below is Bloomberg ETF Analyst Eric Balchunas, with the breakdown.

We have prognosticated in prior notes that this event would be a positive catalyst for Bitcoin’s price, and it appears that this was the case as increased futures volume on the CME has led to additional buying pressure for the leading cryptoasset. That said, we would like to caution our clients on gaining exposure to Bitcoin via a futures-based ETF due to the management fees and rollover costs incurred by holders. A futures-based ETF must buy futures contracts on the CME to track Bitcoin’s price. Every month, the fund exits its existing futures positions and purchase the next month’s contracts (it “rolls over”). When the market is in “contango” (futures prices are greater than spot), this process can get rather expensive, leading to deviations in value between the fund and the underlying asset. Therefore, if available, we recommend spot exposure to Bitcoin via the direct purchase of the asset.

It is a small sample size, but we note that the fund has tracked the underlying NAV fairly well in its first two days of trading.

Deficiencies aside, the introduction of this product is a net positive for the industry. Since ETFs are traded in all traditional brokerage accounts, BITO -0.45% creates a frictionless avenue for thousands of professional financial advisors and planners to achieve liquid exposure to Bitcoin without needing to endure a learning process. While there are clearly drawbacks to a futures-based ETF, one could just as easily view the rollover costs and management fees as a simple “cost of convenience” for those unwilling to integrate crypto rails into their financial advisory infrastructure.

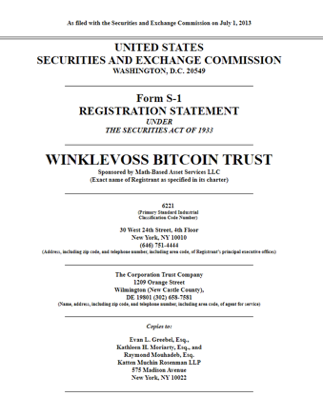

Many people are just entering the crypto market and might not truly grasp how long overdue this approval from the SEC was, but we think the screenshot below speaks volumes. This is the front page of an S-1 filed with the SEC by the Winklevoss twins back in 2013 in an effort to launch a Bitcoin ETF. This was the first of many applications and pleadings with the SEC to give a whole class of investors craving exposure to the emerging asset class an opportunity to do so. Finally, 8+ years later, we have an SEC-approved solution that is not quite what the crypto industry was yearning for but is hopefully a positive step in the right direction.

Also, for anyone wondering, the price of Bitcoin at the time of this S-1 filing was $90. This means that the would-be investors in this ETF missed out on a total return (excluding fees) of approximately 73,000%.

What Can We Expect from Here?

As we discussed in last week’s note, we will start paying closer attention to any potential signs of an overheated market.

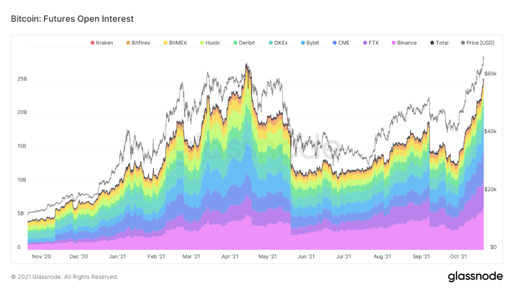

Below we see that open interest is climbing at a slightly higher pace than price, indicating that there may be more leverage chasing the latest price movement.

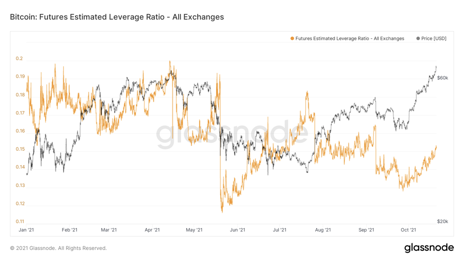

However, if we contrast the chart above with the one below, the market begins to look less frothy. The BTC leverage ratio (total futures open interest divided by the number of BTC on exchanges) appears to be increasing at a flatter slope than total open interest. The leverage ratio for BTC currently hovers around 0.15, which is a monthly high for this figure but is still a considerable distance from the leverage levels that BTC exchanges reached earlier this year.

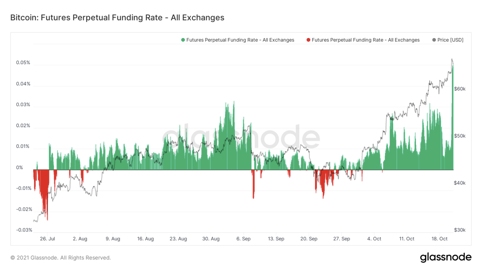

Perpetual futures fundings rates, another indication of how much risk traders are taking on, points toward a uniformly bullish view on the market, with a relatively drastic uptick in rates just within the last few hours. “Perps” have historically been able to maintain elevated funding rates for extended periods of time, but a continuation of these funding rates could still be a sign that the market is getting over its skis. For now, we think this is a healthy reaction to a monumental event (the ETF), and not something to be overly concerned about. We will continue to monitor throughout the next week.

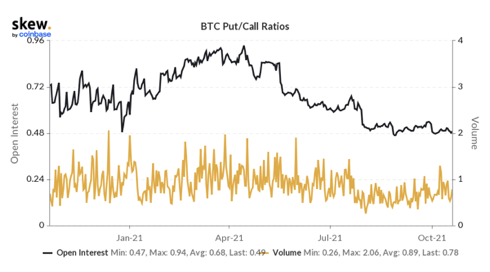

Consistent with funding rates, we also note that the options market is quite bullish, as the put/call ratio across Bitcoin options markets last registered a 0.49, just a few points shy of the 12-month low of 0.47. When Bitcoin last achieved all-time highs in April 2021, this same metric hovered around 0.92, indicating much more active speculation on the other side of this trade.

MVRV and Security Spend Update

We continue to look at Bitcoin’s Market-Value-to-Realized-Value (MVRV) ratio to gain a sense of on-chain profitability and potential selling pressure. Realized value, or “realized cap”, measures the value of the network based on the price at which each coin was last transacted. This metric can be more simply viewed as the network’s cost basis. MVRV is the Bitcoin market cap over the total realized cap of BTC. Naturally, as MVRV increases, coins in profit are more likely to sell given their extended levels of profit. The chart below clearly indicates that despite the ongoing run towards a new all-time high, the current MVRV ratio is much lower as compared to the ratio experienced during the winter months, when we were running hot. We think that there is more room to run for this metric before selling pressure outpaces buyer demand.

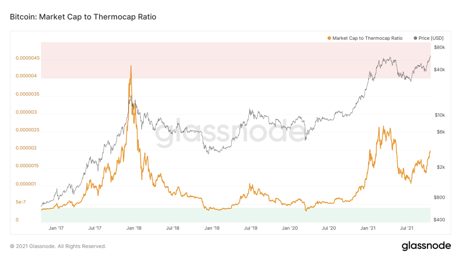

Market cap to Thermocap (MCTC) is used to measure the value of the Bitcoin network relative to the total cost invested by miners to secure the network. You can think of this metric as a multiple of book value for Bitcoin. As demonstrated by the chart below, this multiple has inched higher since BTC’s trough in July and currently sits at a similar level last seen in April. To reiterate our stance from last week, we think that based on Bitcoin’s price history relative to miner spend, this multiple can still experience significant expansion before we become cautionary.

On-chain Data Supports the Rally

Long-term holders continue to accumulate Bitcoins. Bitcoins held by long-term holders are firmly above October’s ATH of 12.6 million BTC – now sitting at 13.3 million BTC or 71% of Bitcoin’s circulating supply.

Historically, long-term holders accumulate during periods of depressed valuations while selling into the strength of speculative run-ups in price. Long-term holder accumulation previously peaked in October, at which point, long-term holders began selling into strength, taking profits. The metric later bottomed out in March, which was then followed by Bitcoin’s price peaking around $65k and correcting. Since the May correction, long-long term holders have been rapidly accumulating bitcoin.

If there is one caveat, however, it is that the rate at which long-term holders are accumulating has been slowing. The rate peaked in July near the short-term price lows of $30k and has continued to slow at an accelerating pace as Bitcoin reaches new all-time highs. While still positive, the net change in long-term holder accumulation will be important to watch.

Counter to long-term holders are short-term holders – which historically have done the opposite of their more patient counterparts – buying at the top and selling on the way down. While a decrease in STH supply is mostly driven by STH selling, a lesser factor is the transition from short-term to long-term which occurs when a bitcoin has not been spent in 155 days. In the below chart we can observe that supply held by short-term holders peaked in tandem with Bitcoin’s price earlier this year and has since dropped to the lower quartile of its historical range. This indicates that retail investors who contributed to the 1H21 run-up have mostly left the market. If STH supply has in fact bottomed, a reversal would indicate that retail is jumping back in to fuel another leg up.

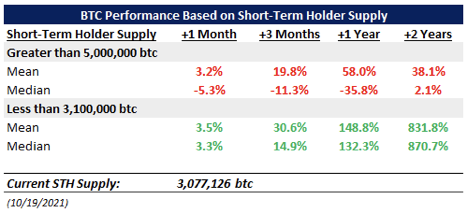

Intuitively we would expect that purchasing Bitcoin during periods of low STH supply – as we are in today – should outperform bitcoin purchased during periods of high STH supply. However, the discrepancy is quite staggering. Since 2012, purchasing Bitcoin when STH supply was low (defined as less than 3.1 million BTC) has resulted in an average 1-year return of 149% and 2-year return of 832%. This is in stark contrast to the 58% and 38% average 1- and 2-year returns following periods of high STH supply (defined as greater than 5.0M BTC).

Rotation Incoming?

While we have spent the lion’s share of this week’s report covering Bitcoin, we do think that at some point, capital will start to rotate into Ethereum and other altcoins, as has transpired in prior bull runs.

Below is a chart that reflects this pattern. We can see the blue line (BTC dominance) start to increase in concert with the orange line (BTC) beginning in October and continuing through the end of 2021. The blue line peaks and starts to decline while the orange line begins to increase at a slighter angle. The black line (total crypto market cap excluding bitcoin) begins to increase at a much faster rate than BTC as dominance falls and capital rotates.

Towards the right side of the chart, we see that dominance has been increasing recently, and as expected Bitcoin has outperformed the rest of the market considerably. Over the next few weeks, we will look for signals pointing toward any changes in this pattern that might indicate capital rotations into ETH and other alts.

Conclusion

If you have followed our research through this extended “dip” we appreciate your trust and your adherence to data-driven analysis. That said, given the current momentum and market structure, barring any change in sentiment, we think that both BTC and ETH continue to demonstrate strength and have room to run through the end of this year.