Bitcoin Dominates

Key Takeaways

- Bitcoin experiences healthy consolidation following a red-hot start to October but continues to exhibit strong underlying fundamentals.

- BTC open interest has increased dramatically in recent weeks, but data shows that the majority of futures are cash-margined, which may point to a more robust derivatives market as compared to prior bull runs.

- Historical trends in Market Value to Realized Value ratio and Market Cap to Thermocap multiples suggest that despite the leasing asset’s recent impressive performance, there is still room for price to run.

- Historically, decisive decreases in Bitcoin dominance indicate an increased appetite for risk amongst market participants, thus making it a helpful metric for managing crypto allocations.

- Bottom Line – We continue to lean into our thesis that Bitcoin will make a run at all-time highs in Q4 and ultimately reach our $100,000 price target by year-end. Therefore, we are buying into any near-term weakness. We also reiterate our bullish view on Ethereum as we still expect the leading smart contract platform to benefit from favorable tailwinds and reach our price target of $10,000.

Bitcoin consolidates

After battling through a volatile September plagued by regulatory concerns and macro uncertainty, Bitcoin investors were greeted with a pleasant start to October (as we suggested might happen), as price increased 35% over the first week of the month. Since last Wednesday, Bitcoin has experienced a bit of healthy consolidation between $53,000 and $56,000, but at the time of writing trades around $57,000 and continues to exhibit fundamental strength.

Things are starting to heat up

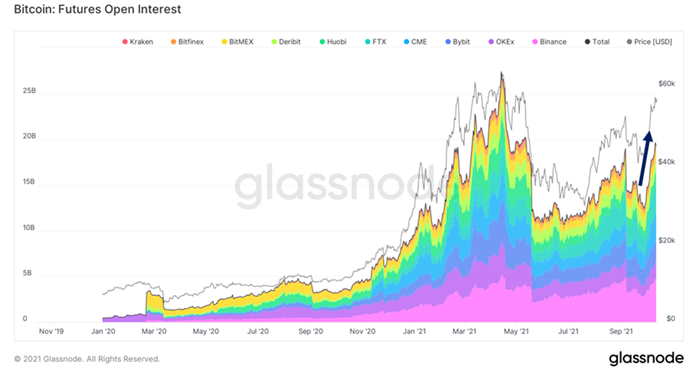

As bitcoin’s price increases, we expect open interest to move higher as well. This is a positive sign that investors are making leveraged bets on continued momentum, and depending on the exchange, can signal increased institutional participation. Since the beginning of this month, futures open interest has launched upwards at a slope mirroring price increase. Of course, if spot demand does not persist, or we experience an unforeseen negative catalyst, any leverage can cause a quick wash out of long positions.

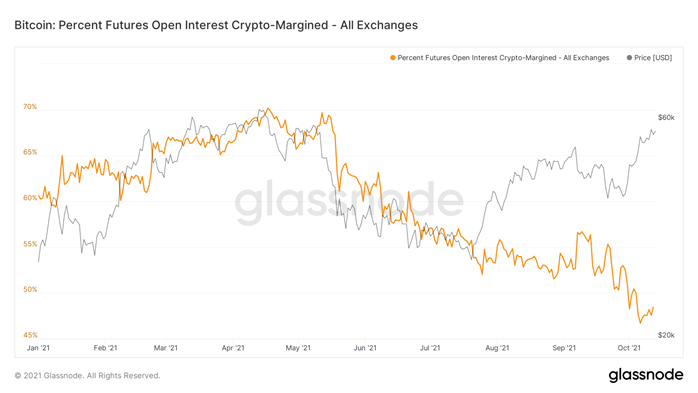

While leverage inherently increases market risk, this is merely a piece of the risk-assessment puzzle. Below is a chart that breaks down the percent of all open interest collateralized by cryptoassets. As evidenced by the chart’s trajectory, we can ascertain that most open interest margin is now denominated in fiat currency, following a consistent downtrend starting with the industry-wide drawdown in May.

While this does not preclude deleveraging events from transpiring, this does increase the level by which prices need to fall to be forced into liquidation as investor collateral will maintain its stable fiat-based value upon any decrease in the price of BTC. This limits the cascading effect that we often see during liquidation events and points to a “healthier” market structure as compared to the last bull run.

Even HODLers need to pay bills

At the time of writing, bitcoin’s price hovers just 8% below the all-time high set back in April. As we approach this milestone, we want to highlight a few metrics that we monitor to pinpoint the best opportunities for profit-taking and discuss why we think there is still room for BTC to run. To be clear, we advocate for a dollar-cost-averaging strategy but understand that most of our clients’ liabilities are still paid in fiat and therefore stand to benefit from liquidating a portion of their assets when the market is overbought.

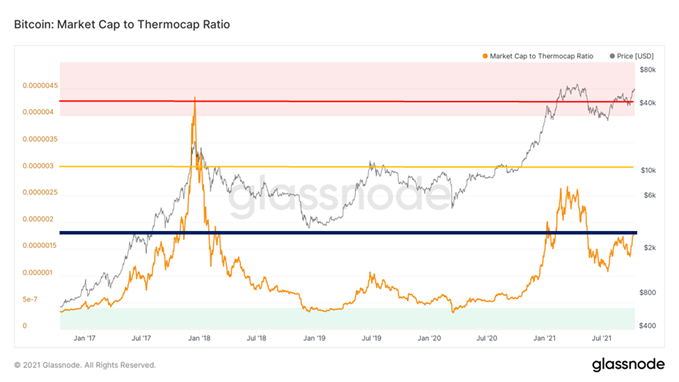

Market cap to Thermocap (MCTC) is a metric that we have highlighted in prior reports and is used to measure the value of the bitcoin network relative to the total cost invested by miners to secure the network. You can think of this metric as a multiple of book value for Bitcoin. As demonstrated by the chart below, this multiple has inched higher since BTC’s trough in July and currently sits at a similar level last seen in April.

We think that based on Bitcoin’s price history relative to miner spend, this multiple can still experience significant expansion before raising any red flags. The yellow line below indicates the MCTC multiple that the network achieved before the sentiment-driven sell-off in April. Reaching this line would cause us to start considering some adjacent metrics that might point to a frothy market. However, we think it is reasonable to expect this multiple to test the red line drawn below, which indicates the MCTC multiple reached during the bull run in 2017.

A key reason that we think this multiple could approach the red line is because of the underlying “cost basis” on the Bitcoin network, discussed below.

The following metric is a repeat from last week and features Bitcoin’s Market Value to Realized Value (MVRV) ratio. Realized value, or “realized cap”, measures the value of the network based on the price at which each coin was last transacted. This metric can be more simply viewed as the network’s cost basis. MVRV is the Bitcoin market cap over the total realized cap of BTC. Naturally, as MVRV increases, coins in profit are more likely to sell given their extended levels of profit. The chart below clearly indicates that despite the ongoing run towards a new all-time high, the current MVRV ratio is much lower as compared to the ratio experienced during the winter months, when we were running hot.

Based on this MVRV data, we are confident that there is additional room for the BTC price to run before facing any significant selling pressure similar to the dynamic experienced in April and May.

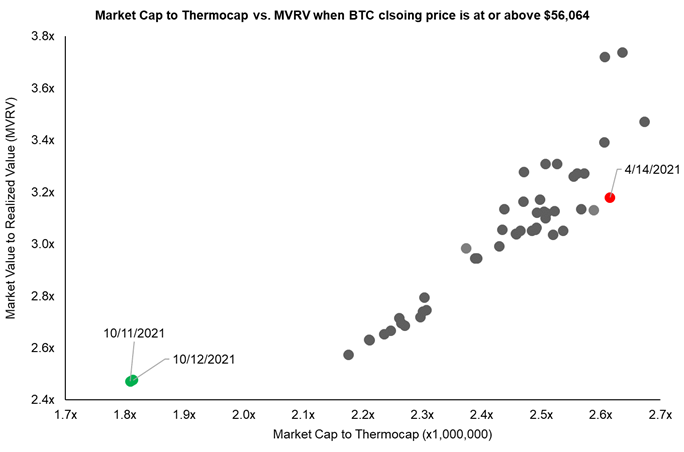

After diving into MCTC and MVRV, we think the chart below provides a concise visual representation of where we are from a valuation perspective and speaks to the overall “health” of the current market structure as compared to the bull run in the winter and spring of this year. We plotted the MVRV against MCTC for every day that Bitcoin closed the trading day at or above the current market price (we used yesterday’s closing price as the benchmark value).

The green dots represent BTC on Monday and Tuesday, both days on which prices were at, or above, the benchmark price. The red dot is the market top back in April. The green dots are clearly outliers here, demonstrating to us that the current bullish price action is much healthier from a fundamental valuation perspective than it was in February, March, and April of 2021.

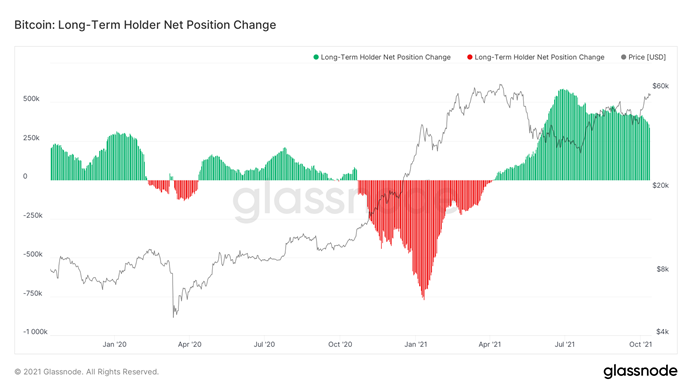

In addition to keeping tabs on multiple expansion/contraction, we also find it important to monitor on-chain data to observe when the “smart money” decides to start selling. If you follow our weekly notes, you should be familiar with the fact that we place significant weight on the behavior of long-term holders as an increase in their holdings (1) create a more illiquid supply and (2) indicate the anticipation of a bull market as these holders generally buy into weakness and sell into strength.

The chart below displays the total supply held by long-term holders. As previously alluded to, these holders accumulate BTC during times of bearish sentiment and unload their holdings during times of euphoria. Based on Glassnode data, it appears as though these investors continue to be net buyers of BTC as their holdings continue to increase.

Below is perhaps a better visual representaion of recent “smart money” behovior. This reflects the net position change of long-term holders over rolling 30-day periods. Once we start to see signs that long-term holders are net sellers, this could be a be a clue hinting that the market is overbought, however, for now it is business as usual.

World Domination

We can also take a bird’s eye view at the entire crypto industry and use capital rotations to help us determine where the market is heading. Below we discuss this exercise further.

Bitcoin dominance is the relationship between Bitcoin’s market cap and the total crypto market cap expressed as a percent (Bitcoin market cap / total crypto market cap). It is a helpful metric for gauging the relative allocation of capital to Bitcoin vs “alts” (digital assets other than BTC). Before one of the first alts, Ethereum, rose to prominence in 2017 this metric lacked practical utility as Bitcoin dominated >95% of the total crypto market. However, since then Bitcoin dominance has been range-bound between 35-75%. Fluctuations within this range and in Bitcoin dominance more broadly indicate capital rotating back and forth between Bitcoin and alts. Furthermore, rotations out of Bitcoin and into alts, like the one observed from April to May of this year, suggest a more “risk-on” sentiment within crypto markets. Alternatively, rotations out of alts and into Bitcoin, like the one observed from May to September 2018, suggest a reduction in risk-taking by crypto-native investors.

To clarify terminology, we are currently applying the “risk-on/risk-off” nomenclature within the context of crypto markets. We would still define a move from traditional equities to Bitcoin as a “risk-on” move.

This relationship can most clearly be observed when comparing Bitcoin Dominance to the ETH/BTC pair (ether priced in bitcoin, purple line). In this example, we’re using ether as a proxy for alts. You can see that the two are generally inversely correlated where strong alt performance relative to BTC is associated with decreasing Bitcoin dominance.

Taking this relationship a step further, we can use dominance to better understand various periods of risk-taking among crypto-native market participants. In the previous Bitcoin halving cycle, we observed two distinct rotations into more speculative alts, marked by decisive breakdowns in Bitcoin dominance – the first starting in March 2017 and the second starting in December 2017, leading up to the market top in January 2018. In the first rotation, Bitcoin dominance fell 28% (from 95% to 69%), while in the second, it fell nearly 50% (71% to 36%) – a 62% decrease in total from the beginning of the first rotation to the end of the second rotation.

Additionally, in the last cycle, Bitcoin peaked before Ethereum – indicating the second rotation was the final push into altcoins before the market topped and began its long decline three weeks later. The rotation into alts from April to May of this year was also accompanied by Bitcoin’s price peaking before Ethereum’s. Similarly, this period saw Ethereum rally ~100% from $2,056 to $4,193 while Bitcoin simultaneously peaked at $65,000 and floated down to below $50,000.

The key takeaways here are that (1) decisive rotations into riskier alts have generally preceded short-term and long-term Bitcoin tops and (2) investors have been able to leverage Bitcoin dominance to manage allocations – overweighting alts at the top end of the range (red) while overweighting BTC at the low end of the range (green). This has worked historically. However, throughout this bull market, some analysts have wondered if we are on the verge of the “flippening” – a point at which ETH surpasses BTC in market cap. This would most certainly put us at the low end of the Bitcoin dominance range, and the support level provided would be in danger of breaking.

While we don’t like to rely too heavily on past cycles to form future expectations, we can learn from historical investor behavior. As mentioned above, the last cycle experienced two risk-on periods where capital shifted from BTC to altcoins. In between these periods of heighted risk-taking we can observe a cooling period when the focus shifts back to BTC. During that cooling period Bitcoin outperformed Ethereum. Additionally, Bitcoin Dominance made lower lows as its RSI made higher highs. Fast forward, to the present, post the April – May rotation into alts, we observe all the same trends – lower lows for Bitcoin dominance, Higher Lows for RSI, and BTC outperformance.

Conclusion

We continue to lean into our thesis that Bitcoin should make a run at all-time highs at some point in Q4 and ultimately reach our $100,000 price target by year-end. Therefore, we are buying into any near-term weakness caused by deleveraging events or negative catalysts. While this report mainly discussed Bitcoin, we also want to reiterate our bullish stance on Ethereum as we remain comfortable in the perceived tailwinds that the leading smart contract platform is set to benefit from and expect rotations into ETH to follow any sizeable run-up in a Bitcoin-dominated market.