Long-term Investors HODL as Potential Catalysts Approach

Key Takeaways

- China FUD causes crypto markets to sell-off for the second week in a row. We take a deeper dive to understand the broader implications (or lack thereof) of the most recent regulatory crackdown announced by Beijing.

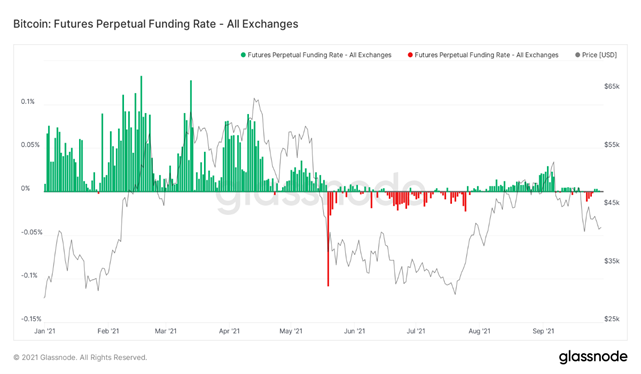

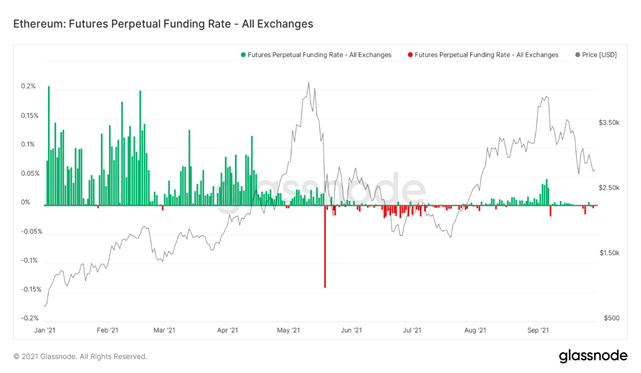

- Leverage and funding rates are trending lower, signaling uncertainty among short-term market participants.

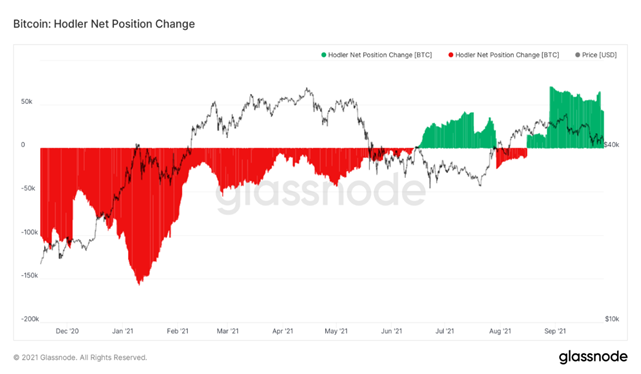

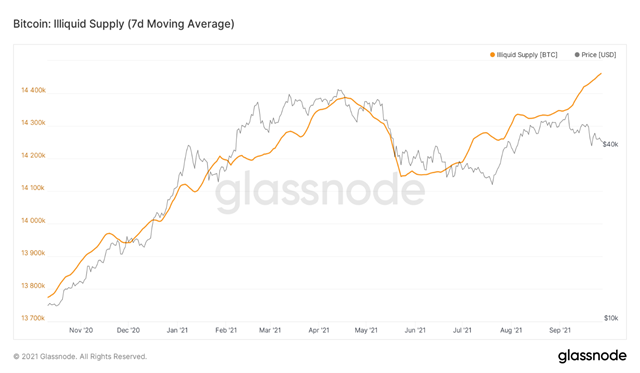

- Despite recent volatility, HODLers continue to accumulate bitcoins, leading to an increasingly illiquid bitcoin supply.

- The Lightning Network allows Bitcoin to gain adoption as a global currency while saving consumers and merchants billions in annual costs.

- Seasonal trends are starting to look favorable for investors as October has been an overwhelmingly positive month for Bitcoin.

- We view the potential approval of a futures-based Bitcoin ETF and increased confidence surrounding a successful transition to ETH 2.0 to be near-term catalysts that clients should have on their radar.

- Bottom Line: BTC is trading below its 200-day moving average. For those with near-term liquidity needs, it may be suitable to wait until we re-test this level. However, we are steadfast in our view that any near-term selling is an opportunity to buy as we anticipate a risk-on environment through the end of the year to yield a run at all-time highs for both Bitcoin and Ethereum.

With China, it’s déjà vu all over again

For the second week in a row, we find ourselves assessing the damage following an episode of FUD-inspired selling out of China. We addressed the sell-off in our note to clients on Friday, but we will quickly recap below.

Last Friday morning, the PBOC released a statement laying out its intentions for stricter regulation and enforcement measures on crypto, most notably stating that all fiat-to-crypto and crypto-to-crypto transactions are now deemed illegal and that there will be a cross-functional effort among most major Chinese state authorities to curb illicit transactions. We witnessed an immediate sell-off bringing the overall market down 6% and Bitcoin down to nearly $40,000 but both BTC and ETH found ample buying support once market participants properly digested the information.

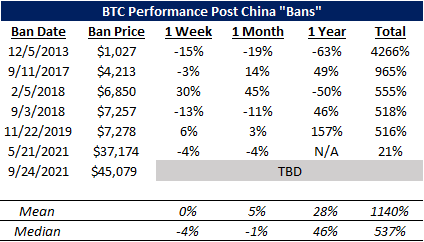

To be clear, this is not the first time such an announcement has come out of China, as the country had enacted similar punitive measures in 2013 and then again in 2017, following the infamous ICO craze. If we broaden our definition of “ban,” then we can actually pinpoint seven dates, including today, in which we witnessed some semblance of a crypto crackdown coming from the CCP. The most recent of which, happened this spring when China cut off centralized crypto exchanges from the banking system in China and forced its miners to completely shut down operations.

Below, we outline price action following each of these dates.

The historical near-term effects are mixed, with the general price impact lessening with each new episode of Chinese FUD – a sign that the market is giving progressively less credence to the messaging out of Beijing. The ultimate lesson here is that Bitcoin is robust enough of an asset to withstand regulatory pressures from one of the world’s largest economies, regardless of how punitive said measures are.

The headline below was published by CNBC in September 2017, the last time China enacted a ban as comprehensive as the one it issued today. Price would fall in the near term as the FUD shook out many new traders in the market, only to rally to all-time highs a mere three months later.

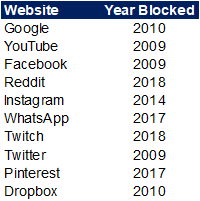

If historical price performance doesn’t assuage your doubts, we urge you to consider the list below which is comprised of some of the prominent Web 2.0 apps currently unavailable to Chinese citizens due to the Great Chinese Firewall. Without getting into the weeds regarding numbers, these tech companies were allowed to flourish on an international stage without the acceptance of the CCP. While we want to caveat this comparison with the fact that none of these apps are designed to serve as a global decentralized store of value, there is sufficient historical evidence that China is unable to impede global innovation based on its domestic policies alone.

Market Showing a Lack of Certainty

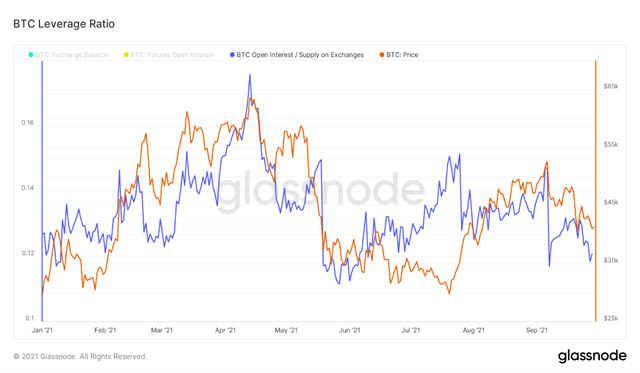

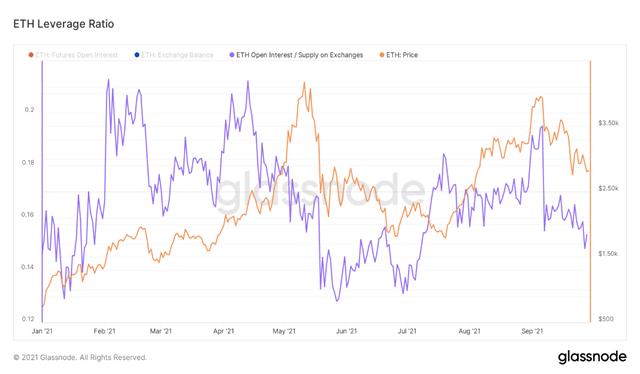

We will now take a brief look at how traders are responding to the recent episodes of volatility. Below are charts laying out the current leverage profile of Bitcoin and Ethereum.

As September winds to a close, the leverage ratios (total futures open interest divided by the supply on centralized exchanges) for Bitcoin and Ethereum hover around 0.12 and 0.15, respectively, well below their monthly highs of 0.15 and 0.195. These are levels that were last maintained in June and July when the crypto market was still reeling from the massive industry drawdown in May. To us, this indicates uncertainty among traders regarding the direction of the next leg up/down.

In a similar vein, funding rates for perpetual futures contracts are muted for both BTC and ETH, further supporting a lack of near-term conviction among traders.

Based on the data above, we can ascertain that short-term market participants on both sides of the trade may be fatigued from recent events, and therefore we expect that there may be continued “chop” until the macro picture clears up, or we experience a significant catalyst.

Below, we look at some on-chain data that continues to paint an underlying bullish picture for Bitcoin.

On-Chain Update (Feat. Lightning Network)

This week we want to spend time discussing the Lightning Network – a Bitcoin scaling solution we think could massively disrupt the legacy global payments infrastructure – but before we do let’s check in on some on-chain supply metrics and Hodler (long-term investor) behavior. Over the past month, we have highlighted the strong accumulation by Hodlers and the corresponding increase in illiquid supply – or bitcoins not likely to be spent. Increasing illiquid supply translates to fewer bitcoins in circulation and less bitcoin liquidity for buyers to tap into.

Hodler accumulation has contributed to an increasingly illiquid bitcoin supply. After decreasing 1.9% or 267,926 BTC from April to May Bitcoin’s illiquid supply has rebounded sharply – up 2.4% or 343,314 BTC since May. Most recently, since the liquidation cascade on 9/7 and rehashed China FUD on 9/24 drove prices lower, illiquid supply has diverged to the upside. A similar bullish divergence can be observed in early July, as well.

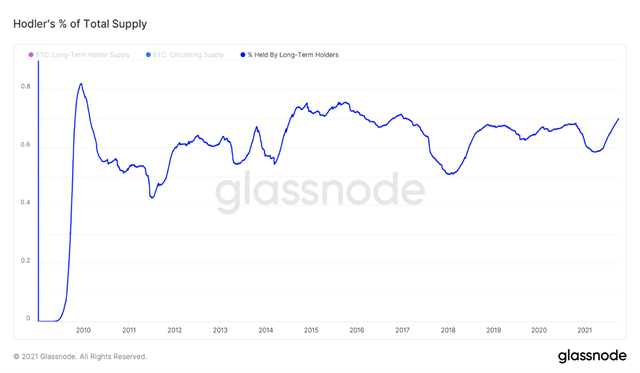

Perhaps the most telling statistic to pop-up on our dashboards this week was the percent of total supply held by long-term holders. As of Wednesday morning, 70.5% of all circulating BTC supply was held by long-term holders, a level that has not been reached since the beginning of the bear market in 2018.

Why the Lightning Network is a Big Deal

The Lightning Network is a layer-2 scaling solution for Bitcoin that addresses two common critiques – high fees and slow transactions. These critiques have been major roadblocks preventing bitcoin’s adoption as a currency as they make it difficult to purchase low-cost goods like coffee quickly and easily. Lightning addresses both – allowing users to transact instantly for fractions of a cent.

Lightning works by locking up bitcoin on the main (layer-1) Bitcoin chain and then opening a direct channel between two transacting parties on the Lightning Network. The channel is used to send multiple payments until one party has spent all the bitcoin they originally locked up. Once it has been spent, Lightning consolidates all transactions into one and records it on the main chain.

The importance of this innovation shouldn’t be understated. Much in the same way your iPhone or Android’s software receives periodic updates that give it new features (it was originally a phone and then became a media player then a map then a gaming device, etc.) the same thing is happening to Bitcoin and its software. Lightning gives Bitcoin – a sovereign, secure, decentralized, store-of-value, gold-like monetary asset – new features (cheap and fast transactions) that allow it to become a global currency.

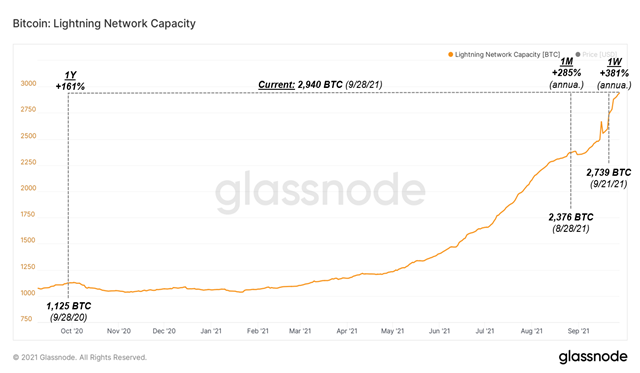

What does this mean for the price of Bitcoin? At a high level, we expect Lightning to drive significant adoption and usage growth of Bitcoin – which has led to higher prices historically. Going a level deeper, increased Lightning usage means an increase in locked bitcoins and a decrease in liquid supply. We can quantify the number of bitcoins locked-up in Lightning through its capacity as shown below. Currently, there are 2,940 bitcoins locked in Lightning and while this is a rather insignificant amount – it is growing exponentially. On a year-over-year basis Lightning capacity is up 161% while more recently annualized growth over the past month and week has been 285% and 381%, respectively.

This metric is backed up by data coming out of El Salvador – which made bitcoin legal tender on September 7th and leverages the Lightning Network for its state-sponsored Bitcoin wallet, Chivo. In a matter of 3 weeks, Chivo has eclipsed 2.25 million active users. For reference, this represents 35% of the country’s 6.54-million-person population. According to Chivo, they’re adding over 200,000 users daily – implying they could reach 100% saturation in 21 days.

At this point, it’s important to ask – what’s driving so many Salvadorans to Bitcoin and the Lightning Network? The answer has to do with two variables most of us in the United States don’t have much experience with:

- Remittance

- Outdated payments infrastructure

El Salvador and its population are highly reliant on remittance payments – citizens earning money abroad and sending it back home to support their families. Remittances account for 24% of El Salvador’s GDP or $6.5 billion annually. This wouldn’t be an issue if the country’s payment infrastructure was on par with the United States where we can easily and cheaply transfer money via apps like Venmo.

However, the payments infrastructure in El Salvador is at best severely outdated and at worst oligopolistic and predatory.

Many Salvadorans rely on Western Union to remit cash to their families – which charges a flat $15 fee for transfers. Someone remitting less than $100 can expect that their families will receive less than $85. Though, Western Union’s fee is not the only cost incurred. Salvadorans need also to pay for transportation to the physical Western Union branch and take time off from work to make the trip. In speaking with Strike CEO Jack Mallers, a Salvadoran mother also noted the need to pay off gangs that patrol areas surrounding the Western Union branches and demand a cut of remittances. In aggregate, these costs can easily reach 50% of the transaction value. We expect Lightning Network usage growth to continue due to its ability to remove virtually all the costs associated with a typical remittance payment.

We also expect merchants to integrate Lightning into their payments systems to save costs. As is the case for individuals, the savings can be massive for merchants, as well. The typical merchant pays credit card companies like Visa anywhere between 1.5-3.0% to process payments from customers. Cutting or removing these fees would significantly improve profitability – especially in low-margin businesses like fast-food restaurants and coffee shops. In fact, McDonald’s, Starbucks, and Pizza Hut have already integrated Lightning at their Salvadoran locations.

We expect more merchants to integrate the Lightning Network over the coming months given its ability to drastically reduce payment processing costs and generate value for shareholders. Furthermore, we expect increased usage of the Lightning Network from both individuals and merchants to positively impact Bitcoin’s price.

Bears start to hibernate in the fall

We are resurfacing the chart below to close the loop on what was a rocky month for crypto. We included this in our weekly on 9/1 and then again last week, following the Evergrande scare.

Seasonal trends can certainly provide useful information on trading behavior at different points in the year, but more importantly, they can provide investors with much-needed perspective on how quickly things can change from one period to the next.

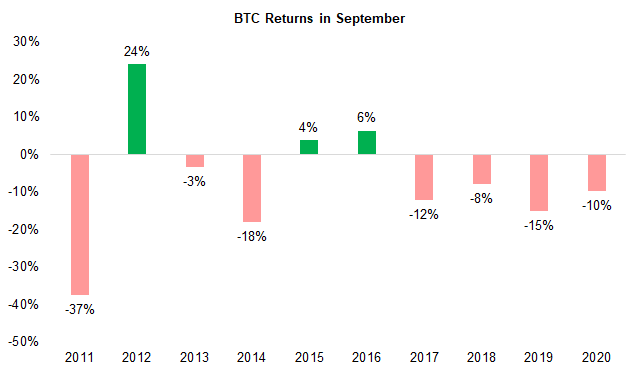

As evidenced by the chart below, since 2011, BTC 0.84% has demonstrated lackluster performance in September. We speculate that this may be due to generally choppy performance during the summer months, leading to profit-taking and a “rinse” of crypto tourists heading into fall and winter.

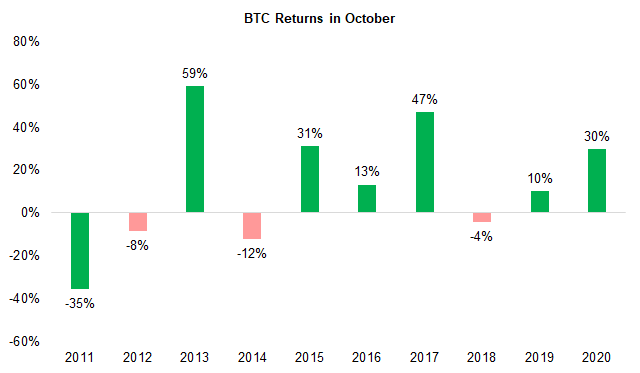

Fortunately, there is another side to this coin found in the chart below, which demonstrates the historical performance of BTC in the month of October. Overall, the blue-chip cryptoasset has fared quite well in October, often following abysmal September performances with meteoric rebounds. We think this is useful data for those investors discouraged by recent volatility.

Potential near-term catalysts

At this point, we have established that (1) short-term traders are uncertain about near-term price movement due to macro concerns, (2) long-term holders continue to stack sats, and (3) monthly trends point to a seasonal environment suitable for rapid price increases.

We still believe that a risk-on macro environment would be enough to propel BTC and ETH to new all-time highs, but obviously, near-term catalysts help the cause.

So, what catalysts should we be considering right now?

Bitcoin

For Bitcoin, the clear near-term catalyst is the possible approval of a Bitcoin-based ETF.

Despite recently levying a slew of criticisms at the crypto industry, SEC Chairman Gary Gensler has been surprisingly open to the potential approval of a futures-based Bitcoin ETF. As recently as today, Gensler reiterated his support for an ETF that would invest in futures contracts instead of the tokens themselves, would trade on the Chicago Mercantile Exchange, and would register under the Investments Company Act of 1940. According to Gensler’s statements this morning, the ‘40 Act “provides significant investor protections,” and for that reason, he looks “forward to staff’s review of such filings.”

Eric Balchunas, Senior ETF Analyst & Funds Product Specialist at Bloomberg has gone on “record” (Twitter) voicing his opinion as it relates to an imminent approval of a futures-based Bitcoin ETF.

In his tweet below, he places a 75% probability on the passage of said product by the end of the year, with the ProShares Bitcoin Strategy ETF as the likely candidate to lead the pack.

We note that he also led this Tweet with a statement pertaining to a perceived lack of interest in a futures-based Bitcoin ETF. This statement was based on his consideration of the lackluster demand seen by ProShare’s futures-based BTC mutual fund that launched just over a month ago and manages a mere $15 million as of this morning.

While we think it is a stretch to use a mutual fund as a proxy for demand in an ETF, we think the larger point here is that it probably doesn’t matter how much capital flows into these futures-based ETFs so long as the spot market for BTC gets a boost from improved sentiment.

Just a few days ago, Jake Chervinsky, General Counsel at Compound Finance and DeFi Chair for the Blockchain Association also voiced his optimism via Twitter, as it seems that his resources are sending him similarly bullish signals.

This evidence is anecdotal, and therefore, we caution our clients on taking this one to the bank, especially given Gensler’s attitude towards crypto since taking office. However, we do think that the recent fact pattern surrounding a Bitcoin ETF is positive and, internally, we feel good about the potential for a futures-based Bitcoin ETF approval by December.

Ethereum

Shifting our focus toward Ethereum, we expect a continued push towards the transition to proof-of-stake (“ETH 2.0”) through Q4 of this year to be a potential catalyst for the ETH price.

From a timeline perspective, the parallel “Beacon Chain” opened for staking nearly a year ago, while the formal update request for the ETH 2.0 upgrade was accepted this past July. Since then, we have witnessed a few incremental updates, the most notable of which was EIP-1559, which we have discussed several times in our letters to clients.

As we get closer to the final transition, we expect there to be positive sentiments surrounding this milestone which may cause increased speculative buying. This alone would be constructive for the ETH price, but it is also important to consider the mechanics of staking. Presently, ETH locked in a staking contract may only be withdrawn once the merge has been finalized. Therefore, there are likely many ETH investors waiting to deposit their ETH into a staking contract until there is more clarity surrounding the transition (illiquidity in crypto can be a dangerous thing).

Below is a chart showing the amount of ETH staked since the Beacon Chain opened last fall.

Based on industry dialogue we feel that a move to ETH 2.0 could be finalized as early as Q1 2022. We would expect chatter surrounding the upgrade to increase leading up to any official transition, causing sentiment to improve, and consequently, additional ETH to be staked on the Beacon Chain. We would expect that a combination of increased speculative buying and decreased liquidity due to ETH locked in staking contracts could result in performance that the market is failing to price in.

Bottom Line

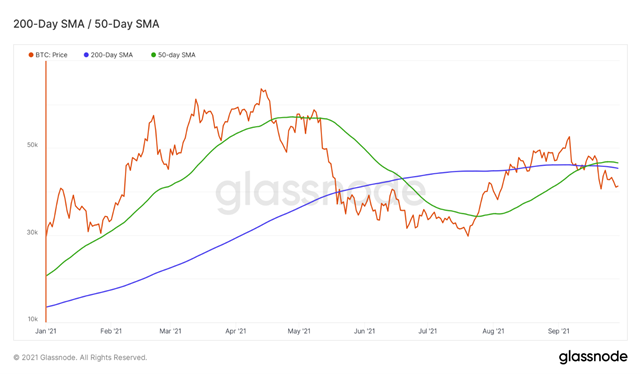

From a technical perspective, BTC is now trading somewhat consistently below its 200-day moving average. As mentioned in prior notes, a key guideline of ours is to buy BTC when it trades above this level.

We still generally support this rule as a sound approach to Bitcoin, and for those with near-term liquidity needs, it may be suitable to wait until we re-test this level. However, we are steadfast in our view that any near-term selling is an opportunity to increase one’s position as we still anticipate a risk-on environment through the end of the year to yield a run at all-time highs for both Bitcoin and Ethereum.