Labor Day Leverage Check

Key Takeaways

- On Tuesday, the market experienced cascade of liquidations as nearly $4.0 billion of long positions across the entire crypto market were wiped out. Approximately $1.0 billion of BTC -3.23% long positions and $855 million of ETH -1.89% long positions were liquidated.

- Tuesday’s liquidations were possibly exacerbated by the leverage embedded in the Ethereum market and the wider altcoin universe.

- BTC -3.23% and ETH -1.89% found ample buying support above their 200-day moving averages and continue to show resilience at the time of writing.

- The positive trend in Bitcoin price action continues to be driven by decreasing supply – with demand coming from long-term investors.

- Ethereum is experiencing high levels of supply burn given high network activity from NFTs.

- Bottom Line: The macro and on-chain pictures remain consistent, and therefore we believe these mid-cycle liquidations are good opportunities to consolidate positions.

- El Salvador Adopts Bitcoin: El Salvador makes history as it becomes the first country to make Bitcoin legal tender. While there are plenty of reasons to be skeptical, we think this opens the door for other countries to adopt Bitcoin as legal tender or a reserve asset.

Terrible Tuesday

On Tuesday, we encountered our first real bout of turbulence since the market started moving higher in July. For those new to the crypto world, yesterday might have seemed like a bit of a random, unexpected whirlwind. For those crypto natives among us, it was merely another Tuesday. We will provide a brief overview of what transpired, then discuss why we are (as previously advised) buying into any near-term market tumult.

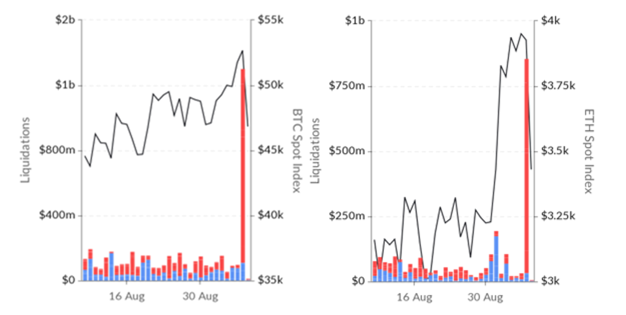

First, let’s start with the carnage. Tuesday morning, we saw a sizeable red candle on our price charts as long positions in Bitcoin and Ethereum of $1 billion and $855 million, respectively, were liquidated. According to data provided by Bybit.com, at the time of writing, the preceding 24 hours were witness to a grand total of $3.7 billion in long liquidations across all cryptoassets.

Interestingly, over half of the BTC -3.23% and ETH -1.89% liquidations transpired on crypto exchanges Bybit and Huobi. Below are charts representing the daily liquidations over the past month for Bitcoin (left) and Ethereum (right), with the red line indicating yesterday’s wipeout of long positions.

Labor Day Leverage

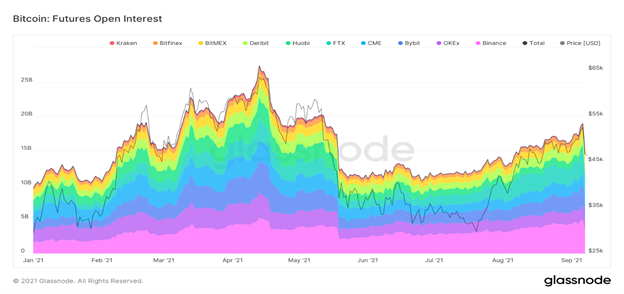

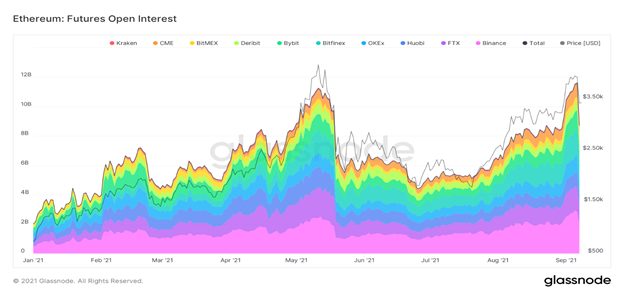

What started the cascade of liquidations? Simply put, traders bit off more leverage than they could chew over the long holiday weekend. Futures open interest for Bitcoin and Ethereum increased by 15% and 14%, respectively, from last Wednesday’s market close through the leverage peak on Monday evening.

Below are charts displaying open interest in Bitcoin and Ethereum across all exchanges. You can see that there is a steep uptick towards the very end of each chart followed by a very sudden drop.

Altcoin-led Liquidations

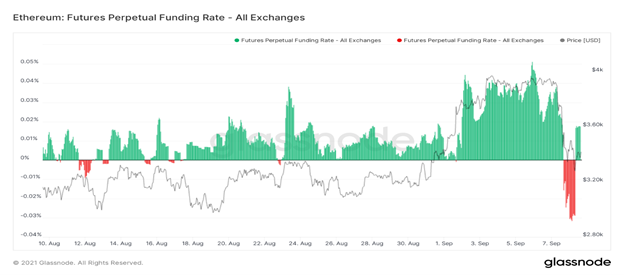

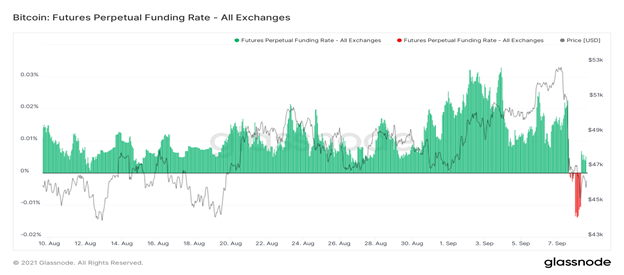

A good barometer of how much leverage is in the system is the futures perpetual funding rate, the rate set by exchanges that one party pays another party to take the other side of a perpetual futures contract. When the rates are positive, longs are paying shorts (and vice versa). When these rates increase rapidly, we consider this a sign of overheating. As demonstrated in the chart below, ETH -1.89% funding rates started to rise on Thursday morning at a rate inconsistent with the preceding month.

Bitcoin’s version of this chart is somewhat less pronounced, as rates have been trending higher for a longer duration.

Based on this fact pattern, we can partially infer that while the selling might have started with Bitcoin, the cascades were possibly exacerbated by the leverage embedded in the Ethereum market and the wider altcoin universe. If you recall, total liquidations for the day were close to $4.0 billion, meaning that there were approximately $2.0 billion of long positions in other more speculative assets that were completely wiped out.

Looking Ahead

While no one wants to see red on their charts, it can be healthy for an asset class to clear out the more speculative crypto tourists and clear the way for more longer-term, thematic investors. We take comfort in the fact that both Bitcoin and Ethereum found ample buying support above their 200-day moving averages and continue to show resilience at the time of writing.

There is also precedent for these types of bull cycle rinses. In the run-up to all-time high prices in April, both Bitcoin and Ethereum longs were subject to liquidations that were greater than those experienced on Tuesday. Bitcoin longs were liquidated for over $2 billion FOUR different times leading up to Bitcoin’s peak in April. Therefore, as long as the macro and on-chain pictures remain consistent, we believe these mid-cycle liquidations are good opportunities to consolidate positions. That said, past performance is not indicative of future results. We will dive into some of the on-chain metrics below to make sure that the underlying fundamentals that we have been tracking are holding steady.

The Bitcoin Supply Crunch Continues

As we’ve been highlighting over the past few weeks, BTC -3.23% has largely been a supply story in the second half of 2021.

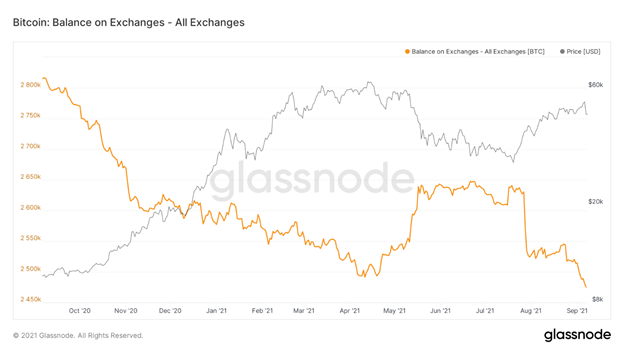

Bitcoin’s march higher, which started on July 20th has been driven by decreasing supply. One data point we have been using to gauge decreasing supply has been the total coins on centralized exchanges. The idea being that fewer coins on exchanges mean less supply to be purchased. Since July 20th we have seen 158k coins worth over $7.4 billion taken off exchanges and onto private wallets. This trend continued yesterday with 5,669 coins removed from exchanges despite Bitcoin’s price falling 15%.

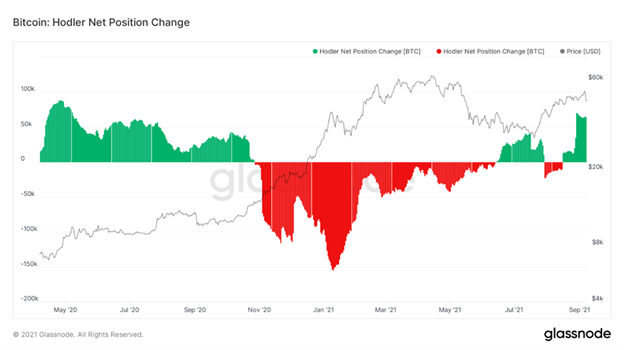

We can also better understand supply by analyzing the behavior of long-term bitcoin holders or “Hodlers”. These are investors who hold coins for longer durations – only selling into speculative price run-ups and adding to their stash otherwise. In analyzing Hodler Net Position Change we can see that this cohort has been adding to their positions, especially over the past week. Taken together with the exchange outflows highlighted above this further indicates that less bitcoin supply is available to purchase.

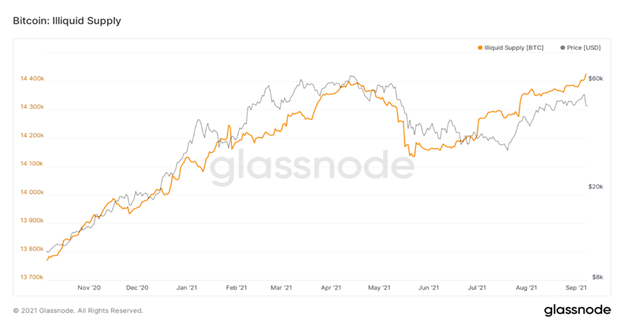

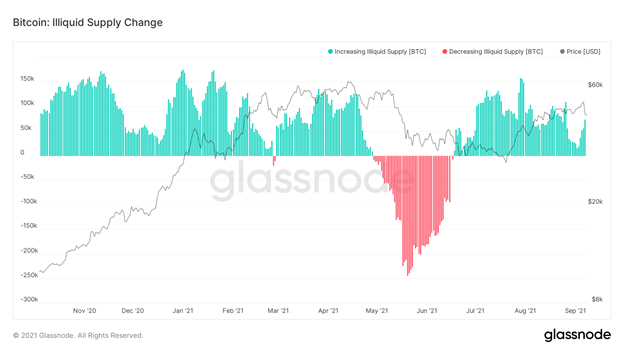

To further quantify the available supply of bitcoin we also analyze the total supply held by illiquid entities – or entities with very low bitcoin outflows but significant inflows. Entities with an outflow-to-inflow ratio less than 0.25 are considered illiquid. The total supply held by these entities is then classified as the Total Illiquid Supply. In analyzing this metric, we can see the continued uptrend. Importantly, despite the sell-off yesterday illiquid entities added to their illiquid supply.

This trend is even clearer in the below chart showing the Net Change of Illiquid Supply.

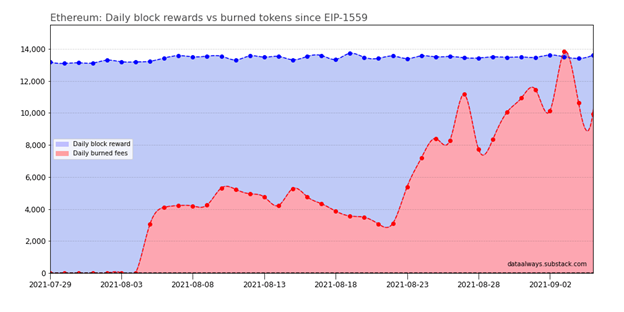

ETH -1.89% ’s recent price action has much to do with supply, as well. In recent reports, we covered EIP1559 – an update to the Ethereum network that impacts supply through the burning of transaction fees. Pre-update these fees were paid to miners while now they are removed from the circulating supply of ether. Specifically, we noted the potentially deflationary effects of the update in our August 4th newsletter.

“Since the base fee must be paid in ETH the burn puts disinflationary pressure on ETH’s circulating supply. Theoretically, during times of high network activity, the amount of ETH burned could exceed new ETH issuance from block rewards (2 ETH every block) making the network net deflationary.”

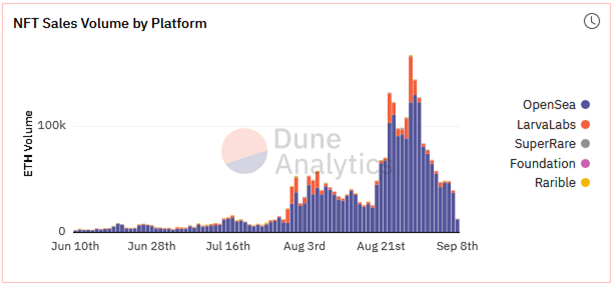

Given high network activity from NFT trading and minting, last week we saw Ethereum’s first deflationary day. On September 3rd, more ether was burned than was created via block rewards.

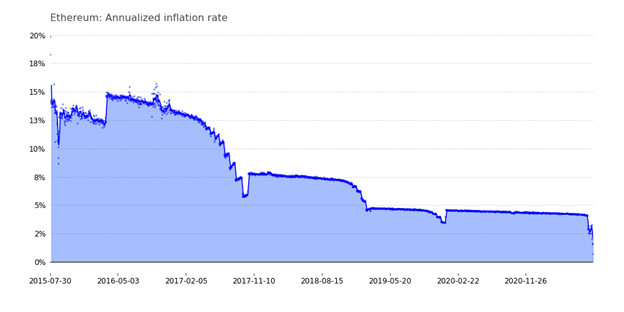

With the burn taken into consideration, Ethereum’s annualized inflation rate is now approaching zero.

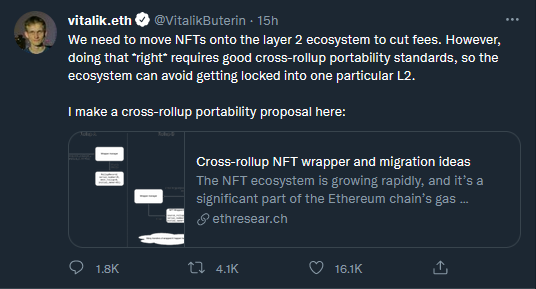

We view this trend as a positive price catalyst for ETH -1.89% – especially in the short-term given high network activity. If NFTs on Ethereum mainnet continue to rise in popularity and utility, we should expect continued high levels of supply burn further boosting price. However, Vitalik and the Ethereum Foundation recently acknowledged the NFT craze as an issue – advocating for the transition of NFTs to more efficient layer 2 ecosystems.

Bitcoin Day

In early June 2021, El Salvador’s legislative body voted by a supermajority of 62 votes to 22, to pass a new law decreeing Bitcoin legal tender. Yesterday, September 7, 2021, fear and excitement washed over El Salvador as it became the first country to accept Bitcoin as a legal tender. Salvadorans awoke to a partially “Bitcoinized” economy as businesses are now obliged to accept the digital coin as payment.

The controversial president of El Salvador, Nayib Bukele, has promised to adopt BTC -3.23% to cut fees for Salvadorans sending remittances, helping the nearly 70% unbanked Salvadoran population gain access to financial services and attract foreign investments. To inaugurate the historic moment, Bukele has bought 550 Bitcoin worth roughly $25 million with public funds dedicated to building out Bitcoin infrastructure.

Millions of Salvadoran citizens are expected to download the government’s new digital wallet app “Chivo”. The government of El Salvador will give away $30 in Bitcoin to every citizen. In support of El Salvador’s historic day, Bitcoin fans around the world have been buying $30 worth of BTC to show support. Bitso, the Mexican crypto Fintech platform will be servicing the “Chivo” wallet. Bitso will be working with Silvergate, the U.S. federally regulated and California state-chartered bank facilitating transactions in U.S. dollars.

Citizens in El Salvador are divided over Bitcoin legal tender law. Hundreds of protesters took to the street to show their dislike for what they believe could create more financial chaos for the country than the benefits it could provide. Businesses are worried that the risky exchange rate volatility can wipe out their savings, revenues and could lead them into bankruptcy.

Infrastructure will be one of the main challenges to mass adoption. Currently, more than 200 new ATMs are being installed across the country to enable fiat to be converted into BTC. More ATMs will be required to support the growing demand.

Not everyone is a fan of El Salvador’s move to make BTC a legal tender. The World Bank and International Monetary Fund, which is contemplating extending a $1 billion loan to the country, have repeatedly voiced strong opinions that adopting BTC could leave El Salvador open to illicit financial activities and money laundering. These institutions fear that the volatility of Bitcoin could wreak the economy.

We are cautiously optimistic about this endeavor for El Salvador. We think that adding Bitcoin to sovereign balance sheets is a profitable idea and is a road that all countries will eventually head down. However, we are skeptical about the ability to use Bitcoin as a means of payment, especially in the network’s current stage of development. Additionally, we are by no means experts on Latin American politics, but the Salvadoran government has a very poor record on human rights, something that generally conflicts with the core of Bitcoin’s proponents and could pose a potential risk to its people in the future. Ultimately, we think this will be a net positive for the tiny Central American country as simply giving unbanked people the tools to build personal wealth and affordably remit international payments may lead to increased opportunities, and consequently, economic prosperity. Further, this opens the door for other dollarized countries or countries that have been subject to rapid inflation to adopt Bitcoin as either legal tender or preferably a reserve asset, something that we anticipate happening over the next 1-3 years.