Crypto loses battle in DC but is well-positioned for the war; Recap of weekly price performance; BTC Surpasses 200-Day SMA; Update on EIP-1559; Key data points suggest we are early in this upward trend; The future of gaming lies in crypto

Crypto loses battle in DC but is well-positioned for the war

Last week, we covered the infrastructure bill under deliberation in the Senate due to a crypto provision that was snuck into the bill at the eleventh hour. To recap: the bill had cited a $28.0 billion “pay-for” sourced from tax revenue paid by crypto brokers. This was not a novel concept for the crypto industry, as reputable centralized brokers do, and will continue to, pay the appropriate taxes and meet whichever regulatory requirements Uncle Sam decides to bestow upon them.

The area of concern was related to the broad definition of “broker” used within the bill, which left many in crypto circles to believe that this leaves parties such as wallet developers, miners, and node operators subject to the same tax reporting requirements as centralized brokers. Such requirements would not only be unnecessary (considering said parties are not, in fact, brokers) but would also be entirely impractical as many of the aforementioned entities are individuals or small businesses that do not have the time or resources to file the requisite paperwork to meet said requirements. Consequently, this leaves the door open for possible future regulatory determinations by the SEC and IRS that could render these entities incapable of conducting business in the US.

Source: The Block

Last week competing amendments that offered different levels of specificity surrounding the definition of a broker were brought to the Senate floor. The amendment brought forth by Senators Warner, Portman, and Sinema offered protection exclusively to Proof-of-Work miners while the amendment proposed by Senators Wyden, Toomey, and Lummis offered a much more robust level of protection for non-brokers. The crypto industry favored the latter amendment as the former was viewed as the government choosing winners and losers in a crypto arms race.

Fast forward to Monday afternoon, and the rival groups of Senators were able to reach an agreement on an amendment that narrowed the crypto-related language in the infrastructure bill. The compromise was presented to the Senate by Toomey for unanimous consent, meaning that a single objection would kill the proposal. Senator Richard Selby from Alabama offered approval contingent on his defense spending package being added to the bill. The combined amendment was struck down by Bernie Sanders, thus torpedoing the revised crypto amendment as collateral damage and making it highly likely that the original language will be what ends up in the final bill.

Source: Politico

The Takeaway

Our takeaway this week is consistent with our stance last week. On balance, this is a bullish moment for the industry. This piece of hastily crafted legislation will certainly usher in an era of legal and regulatory battles for crypto, but that is part of “growing up.” In the past couple of weeks, we witnessed a relatively small industry puff its chest and flex its decentralized muscle through community mobilization and lobbying efforts. Led by trade groups such as the Coin Center and The Blockchain Association, the crypto industry stalled an overwhelmingly bipartisan infrastructure package that was seemingly 5+ years in the making and made DC take notice.

We expect investments in legal, compliance, and government relations to increase and for innovation in decentralized platforms to accelerate following this battle on Capitol Hill, as crypto further entrenches itself into the mainstream consciousness.

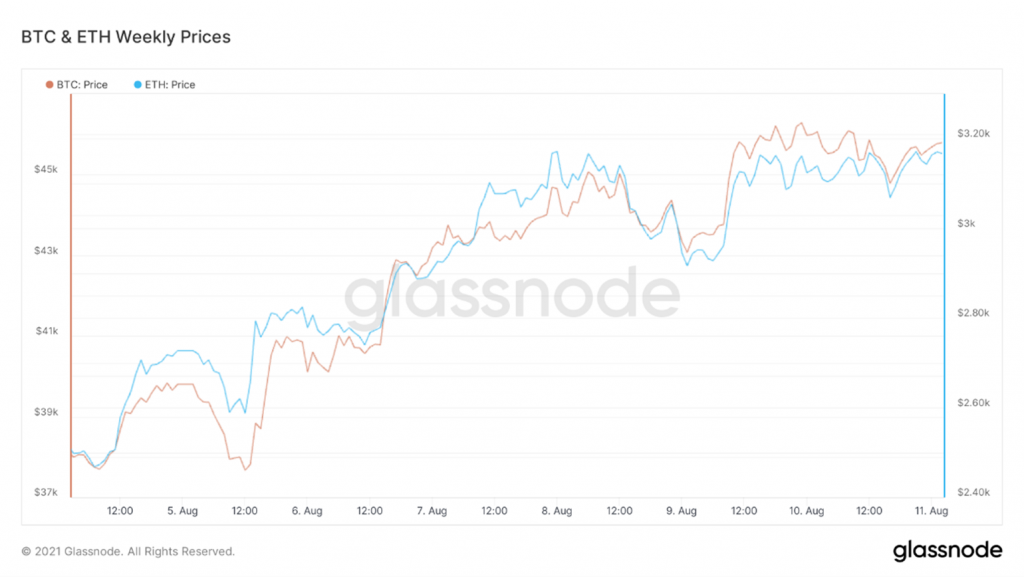

Recap of weekly BTC & ETH price performance

We can see that the crypto market generally agrees that recent regulatory actions are bullish, as evidenced by price action over the previous week. Bitcoin increased from $38,000 to $46,600 and is starting to test the $47,000-mark at the time of writing. Ethereum had a bullish week as well, following its London upgrade and EIP-1559 implementation. ETH started the week around $2,500 and trades around $3,200, at the time of writing, having surpassed the $3,000-mark for the first time since the industry drawdown in May.

Update on EIP-1559

Last week, we mentioned that investors may be overlooking the potential for outperformance in Ethereum unlocked by recent software upgrades. Since the deployment of EIP-1559 one week ago, the Ethereum network has witnessed 800 “deflationary blocks,” meaning that due to the burning of fees paid to transact on the network, the supply of ETH actually decreased as the amount of ETH burned exceeded the amount issued. At the time of writing, nearly 27,400 ETH have been burned since the London upgrade, equating to $87.7 million at current prices. We expect fees moving through the platform to increase concurrent with the recent uptick in market activity and consequently should continue to see further disinflationary and perhaps even deflationary effects on Ethereum’s circulating supply, resulting in positive price performance.

BTC surpasses 200-Day SMA

Early Monday morning, BTC spot price eclipsed the 200-day simple moving average. As highlighted by Tom Lee, this is a key bullish indicator and furthers the thesis that this is not a bear market but rather a “double-pump” bull market. We will continue to observe how well BTC maintains a consistent trading level above the 200-day SMA, but view this as a very positive sign for Bitcoin’s prospects through the remainder of the year.

Below, you can see that spot price exceeding the 200-day SMA is generally a bullish sign for near- and medium-term price performance.

Source: Glassnode

Key data points suggest we are early in this upward trend

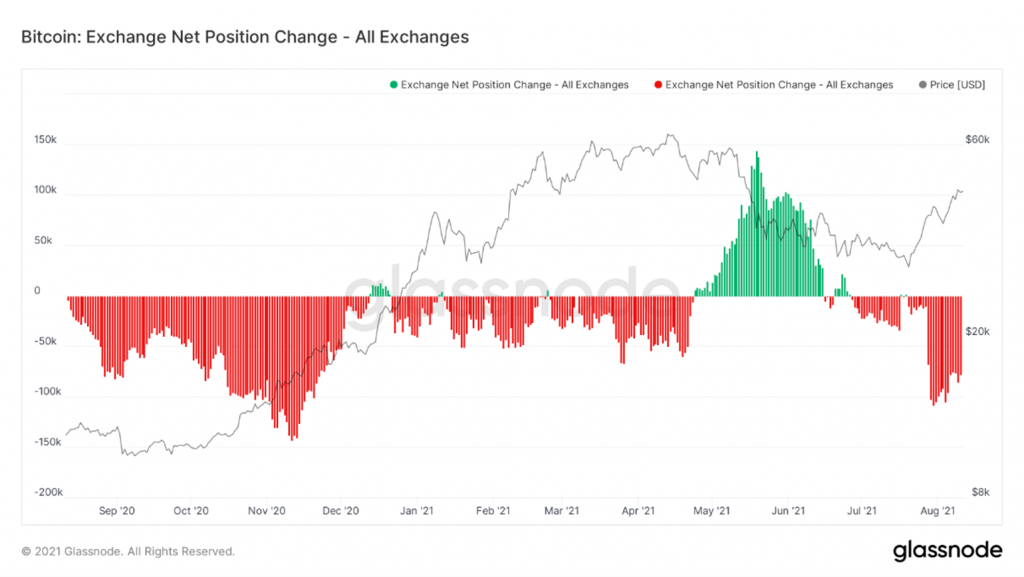

Net flows from exchanges remain in the negative territory

We highlighted in last week’s note that much of the BTC price movement was due to a supply crunch on centralized exchanges, as long-term holders continue to accumulate coins and remove them from exchanges. As bull runs progress into their later stages, we normally start to see coins move back onto exchanges as these “diamond hands” look to shed some BTC and take profits. We note that in the face of the most recent leg-up in BTC price, the net flows from exchanges remain negative, indicating that profitable wallets have yet to cash out from their position. We consider this “supply crunch” to still be in effect and believe it could lead to future significant price step-ups should leverage start to enter the market.

Source: Glassnode

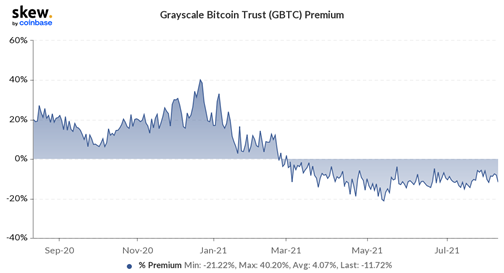

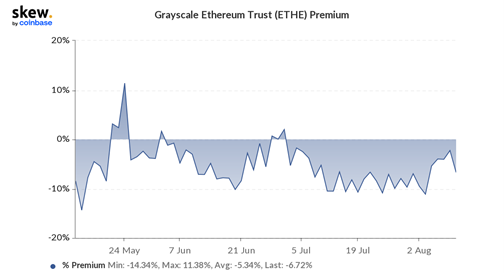

Grayscale discounts remain negative

The discounts for GBTC and ETHE, the Bitcoin and Ethereum trusts offered by Grayscale, continue to trade at discounts to NAV. At the time of writing the discounts to NAV for GBTC and ETHE were -11.72% and -6.72%, respectively. We would expect these discounts to compress with a bull run, as demand for these publicly traded funds increases, and ultimately reach NAV. We think that these discounts are a sign that recent price increases have been largely driven by retail, as the Grayscale funds are often ways for institutional market participants to gain exposure to the asset class.

Below is a chart that features the GBTC premium/discount over the past 12 months.

Source: Skew

Below is a chart that features the ETHE premium/discount over the past 3 months.

Source: Skew

We will be keeping an eye on these discounts as a move towards positive territory may indicate an acceleration of demand for both BTC and ETH from institutions and traditional market participants. In the meantime, we would also like to point out that if you prescribe to the thesis that there will be a rally into the end of this year, this is a good opportunity to scoop up some GBTC and ETHE on a bet that they will converge on NAV and provide an additional 6%-11% spread on your investment.

The future of gaming lies in crypto

In the following section, we introduce an interesting vertical within crypto and discuss why the combination of crypto and gaming is something that investors should be keeping an eye on in the years to come. We want to note that none of the below comments are investment recommendations.

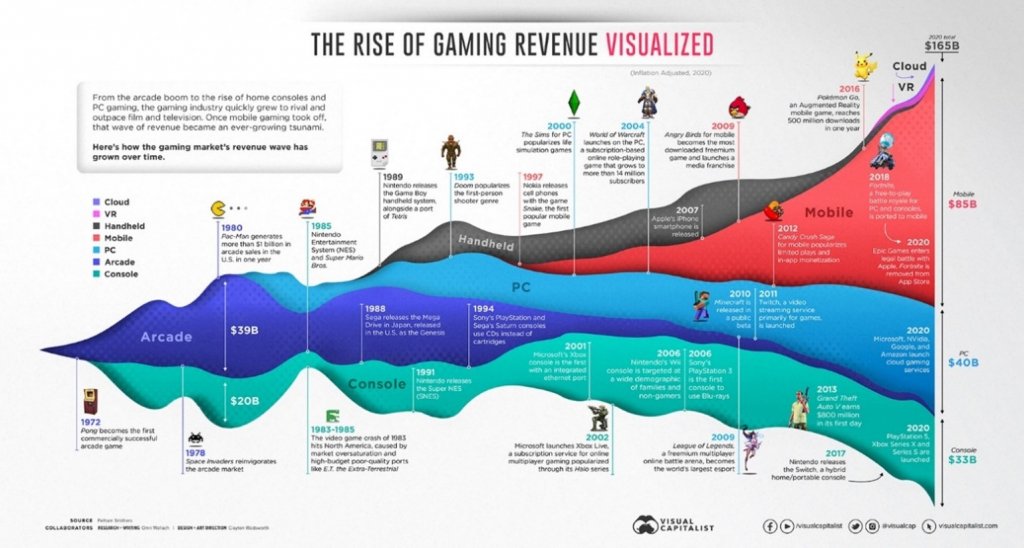

Player-owned digital gaming economies will continue to gain mass adoption

From traditional gaming consoles to virtual-reality games to mobile games – it’s impossible to deny the gaming boom that has taken place in the last decade. In 2020, the global gaming industry’s revenues hit $165 billion, with over 2.6 billion gamers worldwide. Global gaming tournaments, or eSport tournaments, now draw players and spectators in crowds, often with multinational brands sponsoring the tournaments.

Having observed gaming’s explosive growth, tech companies have begun acquiring gaming platforms with the hopes of taking market share from the incumbent publishers and hardware makers. Incumbents such as Microsoft and Sony have focused their efforts on launching cloud-based subscription services while continuing to design new consoles. Meanwhile, Amazon and Google are launching their cloud-based offerings that integrate across multiple hardware platforms including VR. Additionally, with the continued success of mobile gaming best exemplified by Pokémon Go – which has reached more than $1 billion in annual revenue – and Grand Theft Auto V’s record-breaking haul of $1 billion in just three days, companies are targeting as much of the market as they can.

Source: Google Analytics

Worlds built on the blockchain

But new entrants and industry incumbents alike face a new frontier in gaming – the Metaverse. Leveraging blockchain, the Metaverse is an open virtual economy characterized by ownership rights and social interactions not apparent in the legacy “Web 2.0” internet. Under the Metaverse are several themes (Marketplaces, Sports, Governance, NFTs, Virtual Worlds, Gaming, etc.) that frequently overlap creating new applications and use cases. The metaverse opens literal worlds of possibilities for gaming that we’re excited to highlight.

Video games such as Roblox, Fortnite, REVV, Alien Worlds, and Axie Infinity are games in which players can build their own worlds and have attributes that resemble a metaverse. To access the metaverse and participate in the digital environment, one must own a non-fungible token (NFT) or crypto.

True digital ownership

Many of the most popular games today are free to play but offer “in-game purchases” of items like skins, avatars, maps, and weapons that gamers can buy inside the game. However, in the traditional sense, in-game purchases may be more accurately defined as gaining “in-game access” since developers restrict the ability to resell or trade in-game items. This limitation is completely removed in crypto gaming, offering true digital ownership. The cleanest example of true digital ownership may exist within Decentraland (MANA) – a metaverse project where players can purchase land, build, and socialize with friends. Land in Decentraland can be purchased, developed, and resold in open markets not dissimilar to the physical world. In the past week, there has been about half a million dollars’ worth of secondary market land sales in Decentraland in Decentraland. At its peak, MANA hit a high of $1.60 implying a total market cap of $2.47 billion.

Play-to-earn

Crypto gaming and its ability to foster true digital ownership has also unlocked the viability of new gaming models like Play-to-Earn where players can earn in-game items for progressing or completing challenges. These items can then be traded or sold for other cryptoassets and fiat currencies, making them viable “side-hustles” or even full-time jobs in some parts of the world. For example, Axie Infinity players have been able to earn on average $1,200 per month from playing the game which has gained significant adoption in the Philippines and Venezuela. Generally, we expect crypto games that are both fun to play and provide players economic benefit to have higher player engagement and retention over traditional video games.

Axie Infinity

Through its play-to-earn model, Axie Infinity has quickly become one of the most popular crypto games with over 350,000 daily active users. Even more impressive, there has been a staggering $900 million worth of value transferred between players across all in-game items over the past 30 days. The price of Axie’s native token, AXS, has benefited significantly – up 832% over the past 3 months now with a total market cap of $3.88 billion.

The game itself isn’t overly complicated. Players can create value through two mechanisms: Battle and Breeding. In the former, players can team up to battle other Axie squads or battle solo against other individual players. Players receive SLP tokens as a reward for winning. Currently, each SLP is worth about 20 cents. The second way players can earn is through breeding which involves creating new “Axies” and selling them to other users via the in-game marketplace.

Takeaway

The numbers speak for themselves: the metaverse is an emerging vertical within the crypto space that has attracted millions of loyal market participants. We view this sub-sector within crypto as ripe for growth as games become more engaging and these digital worlds become more defined. As of now, we do not recommend any metaverse tokens for investors, but we certainly encourage our clients to engage with the platforms and learn more about these digital societies as they continue to gain traction.