Crypto Quarterly Portfolio Strategy Q1 2021: Bull market intact as stocks, high yield and capital flows signal further risk-on ahead of landmark Coinbase IPO

In this crypto weekly note, we’re giving a more comprehensive Q1 end update covering prior recommendations and current market views.

- Bitcoin and crypto had a strong March quarter

- Stocks and high yield are signaling risk-on for crypto

- Long GBTC NAV discount is the new BTC premium arb trade

- Bitcoin dominance falling as crypto capital flows push altcoins higher

- Smaller to mid-cap cyclicals offering high-risk high-reward crypto market beta

- Coinbase IPO is landmark moment for the crypto industry – is Wall Street consensus, right?

- We remain bullish on Bitcoin and crypto through balance of the year.

Bitcoin consolidating around ATH while risk-on assets signal continuation of the crypto bull market

Since our last market update note, Bitcoin has rebounded post options expiration on March 26th and prices have been consolidating near ATHs for the last several days.

Source: Tradingview (Date: 4/7/2021)

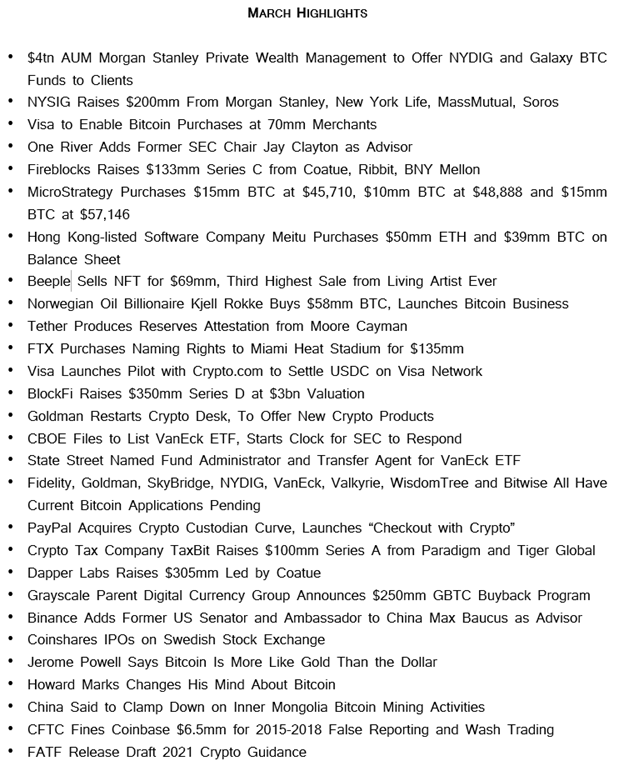

March was a strong month for Bitcoin which was pushed higher by a long list of positive highlights (courtesy of Ikigai Capital):

Source: Ikigai Asset Management

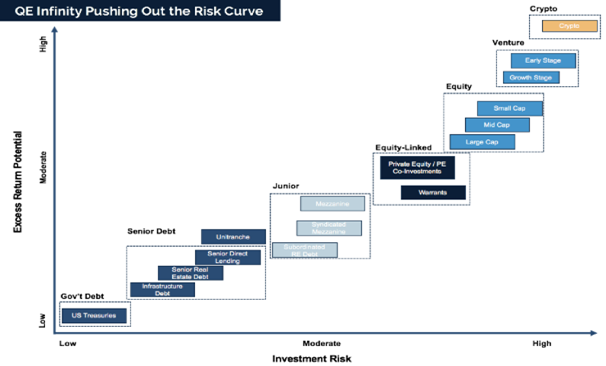

As we have written about before, we view Bitcoin and crypto as a risk-on asset. In our 2021 Crypto Outlook we pointed to how Bitcoin has historically performed best when the stock market and high yield bond (lower yields) returns are strong. We think this relationship between asset investment risk and return is well illustrated by the visualization below (from John Street Capital):

Source: John Street Capital

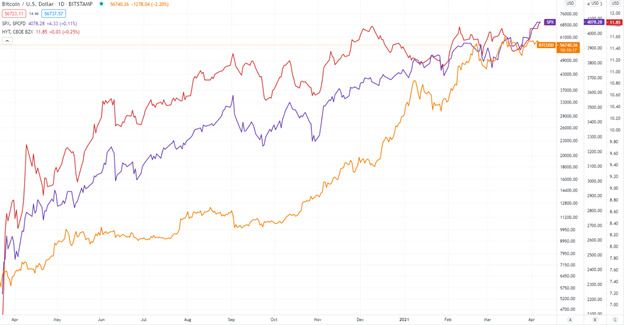

April has historically been a strong month for stock returns and many investors expect 2021 will lead to a similar outcome, while both the S&P 500 and high yields bonds have been off to a strong start (note: BTC in Log in chart below).

Source: Tradingview (Date: 7/27/2020 to 4/7/2021)

We think these markets are signaling a risk-on environment for crypto assets as well. One question – why is Bitcoin trading at levels it saw back in late February and mid-March while other risk-on assets are hitting new ATHs? We think it’s a few things:

- Bitcoin unrealized profit taking

- Discounted GBTC weighing on spot

- Capital flows from Bitcoin to altcoins

We think these are all healthy, naturally being worked through by the market, and indicative of a bullish environment for crypto, as we’ll discuss.

Bitcoin has been strong in the face of investor profit taking

We think it’s natural to question if an asset that’s gone up this much is becoming expensive and for investors with unrealized gains to start taking profits.

One metric crypto investors look at is realized value. Similar to our Grider Bitcoin Book Value metric, which uses lifetime mining costs to estimate investors floor costs basis – Realized Value provides a higher bound cost basis estimate by tracking the value of Bitcoin the last time it was moved on-chain, assuming coins were sold at that price.

The Market Cap to Realized Value multiple (orange below) indicates that the relative unrealized profit has been nearing levels last seen leading into the 2017 cycle highs.

Source: Glassnode (Date: 4/7/2021)

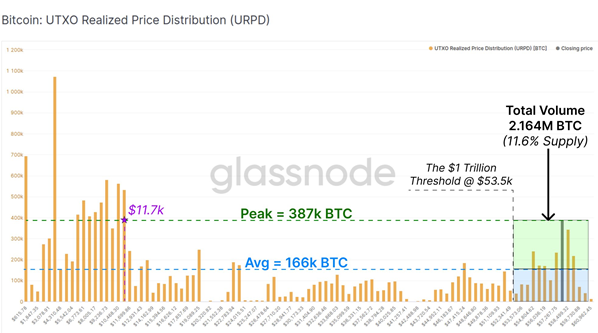

We think some crypto investors who follow these metrics have been locking in returns, weighing on the price. We can see from the coin age distribution that 11.6% of the BTC supply has now been traded at levels over $1T in market cap.

Source: Glassnode (Date: 4/7/2021)

We think the situation we’re in today is illustrative of a strong market. It reminds us of where we were during 2017 with prices holding in the face of liquidating early investors due to strong demand – building a higher average cost basis, lowering the realized value multiple, with the rally continuing through the balance of the year.

Bitcoin rising despite GBTC discount likely absorbing spot market capital flows

As we wrote about on Monday, Grayscale announced that they intended to convert their GBTC trust to an ETF when possible. The gap between NAV remains but we think this should help close it.

Source: FTX (Date: 4/7/2021)

Let’s expand upon what’s going on and what we think it means. A large part of the discount stems from GBTC not allowing BTC redemptions (like ETFs) and charging a 2% mgmt. fee, which is much higher than ETFs (Canadian BTC ETFs charge ~0.4%).

We still don’t know if or when the SEC will approve any Bitcoin ETFs. But there is the general market view that once Gary Gensler assumes his role as SEC Chair (Senate vote April 12th) he will take a more favorable stance on crypto than Jay (he taught the Blockchain and Money class at MIT). Doubt a Bitcoin ETF will be his first priority so maybe we see one approved between late Q3-21 to Q1-22 (but I really don’t know)?

Without knowing the SECs processing timeline, we’d assume GBTC won’t be the first to get approval since others have filed sooner. But once a BTC ETF is approved, it seems likely GBTC isn’t far behind. The trust is already an SEC reporting company, which is a higher standard giving it a 6-month rule 144 lock up window, and that may help.

Grayscale’s announcement is important for the discount because it means the market discount should now only be pricing in an extra 1.6% fee vs. an ETF for 3M to 6M to 1Y maybe after the first ETF is approved… instead of in perpetuity–that’s a big difference.

Consider the difference in costs between the following two scenarios of assumptions:

- 10Y of higher fees: $50 NAV * 1.6% Fee Diff * 10Y = $8 / $50 = 16%

- 6M convert ETF: $50 NAV * 1.6% Fee Diff * 0.5Y = $0.40 / $50 = 1%

These are undiscounted- then present value at whatever rate you like, but you get the point.

Theoretically, the discount should shrink immediately from this. But in practicality, we think the discount gap may close over time, likely by Q3 2021 once the bulk of locked up supply gets absorbed by the market, but maybe sooner if the announcement instils confidence in GBTC investors to hold. There are even activist funds now pushing for further action from GBTC which could help it resolve quicker.

Source: PR Newswire

This may sound crazy, but we think it wouldn’t be impossible for it to flip to a premium again if an ETF is slower than expected and retail gets Bitcoin FOMO.

We think investors seeking long BTC exposure with a 6 month to 1 year time horizon would be better putting new capital to work buying GBTC over spot BTC to capture a narrowing of the discount gap – the opposite of the premium trade happening before.

We think this has been reducing spot demand to a degree and think once the discount gets worked out it will be bullish for BTC spot price.

Crypto market cap has been rising as altcoins absorb capital flows from Bitcoin while dominance falls

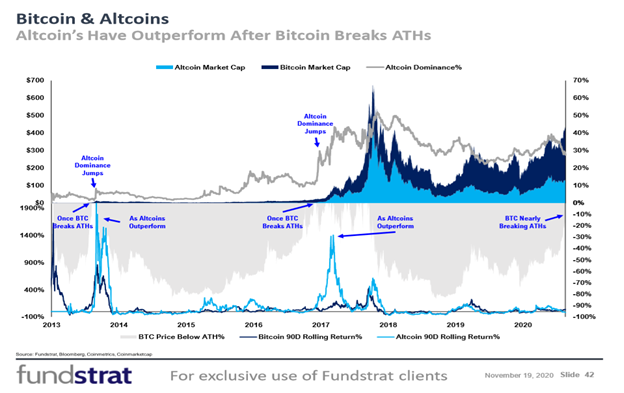

In our November 2020 post-election outlook call, we shared the following chart showing how altcoins have outperformed after BTC breaks prior ATHs:

Source: FSInsight (Date: 11/19/2020)

And we’ve seen this playing out again this cycle since BTC broke its ATH in late December 2020.

The Domination Finance Bitcoin Dominance Index (BTCDOM) is a DeFi (Decentralized Finance) product that offers investable exposure to this trade. We can see below that BTC DOM has been falling since the start of the year but still would still have to fall to 22 dominance (-40% lower) before reaching prior cycle lows of 32:

Source: Denomination Finance (Date: 4/7/2021)

We don’t think it will be straight down, but on balance over the cycle, we do think alts will outperform strictly due to capital flow dynamics – a view still in line with our earlier 2021 Crypto Outlook forecast for the total crypto market cap size vs. Bitcoin.

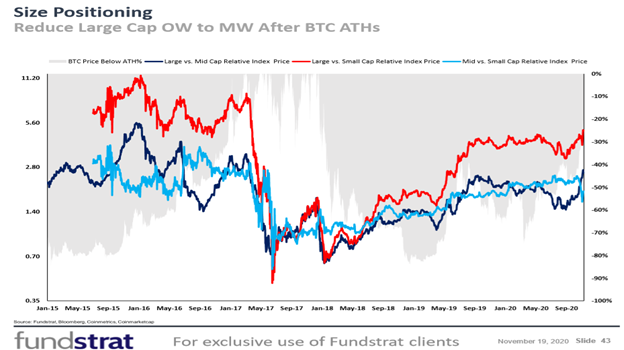

Smaller cap cyclicals have been outperforming since Bitcoin broke prior ATH

We still think smaller cap cyclicals will outperform on balance across the cycle as crypto markets move higher. The slide below from our November 2020 post-election outlook call shows how this has happened during past cycles after BTC breaks prior ATHs.

Source: FSInsight (Date: 11/19/2021)

The above chart shows the relative performance of our FSInsight size-based crypto indices to illustrate the longer-term historical pattern. Although slightly different data, we’re showing the FTX indices below because they’re investable proxies for Large (Alt), Mid (Mid) and Small (SHIT: yes, that’s right stands for Shitcoins or small cap highly speculative crypto assets) –description of the FTX Index Assets for those interested.

Comparing returns for BTC, ETH, Alt, Mid and SHIT prior to Bitcoin breaking ATHs, we can see that ETH outperformed followed by BTC:

Source: FTX (Date: 8/16/2019 to 12/13/2020)

Since Bitcoin breaking ATHs, we have seen the smaller cap rotation taking place with the smaller more cyclical alt indices leading the returns of BTC and ETH. Note, we still remain bullish on Ethereum and think it presents one of the strongest risk rewards in crypto – we view fundamentals as strongest among crypto peers (lower risk) but at its large size, it won’t have the same capital flow reflexivity (lower reward) as smaller alt coins (higher risk).

Source: FTX (Date: 12/13/2019 to 4/7/2021)

We want to caution investors, there’s a lot of risk with these assets, many have run fast over the last several months, and there will be rotations. We may already be seeing one starting towards larger caps with the move higher Ripple and Steller the other day.

We don’t know the future and certainly can’t time it exactly, but if we had to guess, we think this small, mid-cap and alt risk-on rotation has a little more room to go if Bitcoin can consolidate here. But we have more faith that over the course of the next 6 months, if Bitcoin is higher (and this is our view), crypto size beta will outperform.

Coinbase direct listing offers a catalyst for increased Wall Street crypto exposure

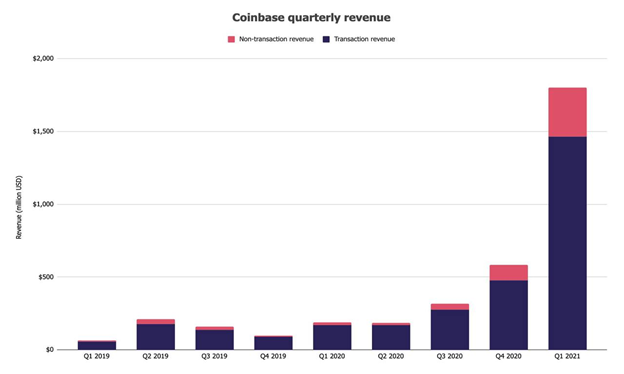

Coinbase, the largest U.S. crypto exchange, is expected to go public via a direct listing on April 14th. We think the Coinbase offering will be a key moment for bringing a new class of investors into the crypto industry – traditional Wall Street tech and fintech funds.

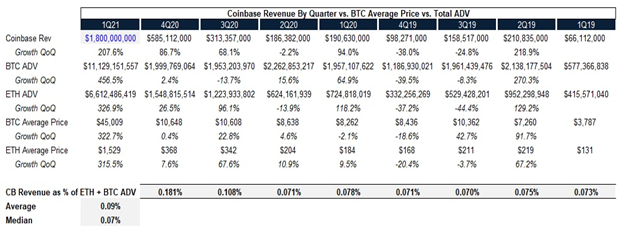

The company reported impressive quarterly earnings yesterday ahead of the debut that saw an explosive 200% jump in QoQ revenue to $1.8B:

Source: The Block

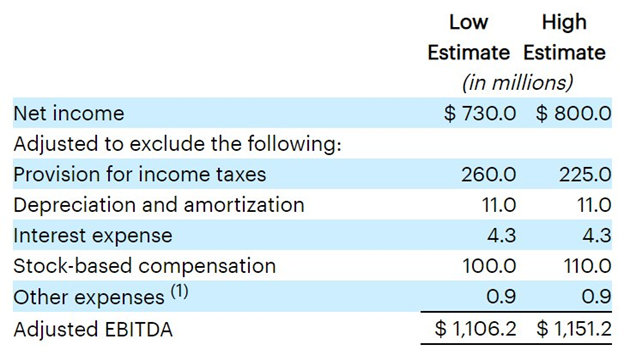

The company also generated heathy ~$1.1B of EBITDA (~60% margins) and a net income range of $730M to $800M (~40% to ~45% margins).

Source: Company Filings

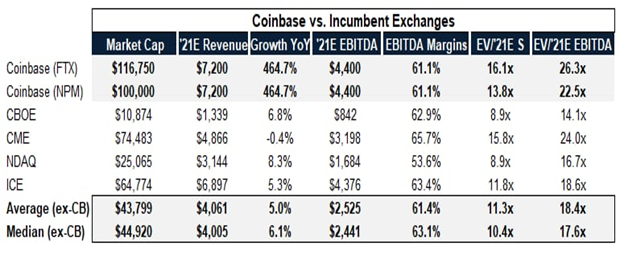

As the company acknowledged on the call, this has a lot to do with the growth of the overall crypto market over the last several months. But nevertheless, Coinbase is on pace to be priced roughly in line with traditional legacy exchanges on an EV to revenue and EBITDA basis – but while growing YoY at ~100x the speed:

Source: John Street Capital

Coinbase (COIN symbol once public) futures (CBSE) are already trading at $482 on the FTX offshore exchange, which we can see compared against the BTC perpetual below:

Source: FTX (Date: 4/7/2021)

Although we only have a few months of data and few hundred thousand of average daily volume, we think this market tells us some noteworthy things:

- CBSE and BTC were trading with a ~90% 7D correlation until the last few days – we think this says the market started expecting better earnings before the announcement

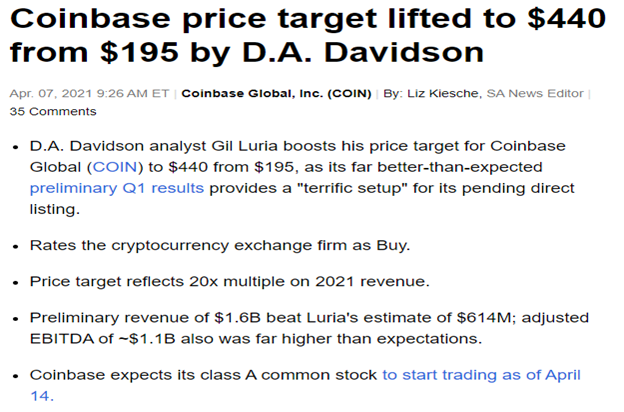

- CBSE price rose roughly 5% yesterday and Wall Street analysts lifted their price target from $195 to $440 – we think this says the market liked what they got

- CBSE price only rose roughly 5% yesterday and now sits at $480 – we think this say that even though Coinbase had what many would consider a blow-out quarter, it was roughly in line with “Crypto Street” consensus but 2.5x Wall Street expectations

Source: Seeking Alpha

We think this mostly stems from Wall Street systematically underestimating the crypto market trajectory. We can see from the table below that Coinbase revenue has been relatively similar as a percentage of combined BTC and ETH average daily volume.

Source: John Street Capital

Although, we don’t officially cover Coinbase or have a recommendation on the stock, we think the crypto macro matters most for the stock and will offer are a few thoughts:

- Consensus estimates look to be forecasting more conservative revenue expectations during the next three quarters of 2021– we think there will be a soft quarter somewhere along the way, but our macro crypto market forecasts call for further upside during the year, which we think would flow through to Coinbase numbers, if correct.

- Coinbase started focused on Bitcoin trading but has been actively moving towards more listing alt coin assets and offering incremental services like custody– we think if alt coins continue to outperform during the balance of the cycle it could see trading fees increase and if crypto prices continue to rise fees for asset under custody likely rise too.

- Crypto is a cyclical industry and it’s to be seen if Wall Street investors are willing to pay up for high growth tech valuations or will discount multiples given industry earnings volatility risk – my experience covering media stocks earlier in my career was investors tended to focus on closer boom quarters in election years more than the off-cycle advertising troughs, which may be the same here (i.e., lean towards paying for growth).

- Competitors like FTX, which recently bought the naming rights to the Miami Heat Arena, are moving more aggressively into the US crypto exchange market – we think Coinbase has a strong market lead that won’t be easy to erode but won’t last forever.

- Tech innovations like DeFi are reshaping many segments of the crypto industry which include Coinbase’s core business – we think Coinbase is on the cutting-edge of DeFi tech innovation either investing in, supporting or using the emerging protocols and while DeFi has grown very fast in taking crypto-to-crypto market share, they can’t substitute the fiat gateway offering that centralized exchanges like Coinbase offer.

Bottom line: We remain bullish on crypto over the balance of the year. We think the macro risk on environment is supportive of higher prices. Liquidity continues flowing into the crypto economy. More cyclical sectors are benefiting most from the current cycle stage. Coinbase direct listing is a catalyst for getting a new class of investors looking at and putting money to work in crypto.