Crypto Weekly: 3/25/2021

Bitcoin has rebounded to new highs and pulled back again since our last market update on Bitcoin two weeks ago. We may sound like a broken record, but we remain bullish on Bitcoin and crypto and see further upside during the balance of the year.

A few reasons we see for the recent pull back:

-Traders repositioning ahead of $6B largest ever Bitcoin options expiration tomorrow

-Traditional institutions new to crypto may be selling to locking in quarter end returns

-Retail tax selling pressure to cover big gains from 2020 with April 15 around the corner

-GBTC NAV premium arbitrage traders selling BTC and buying GBTC shares

A few reasons we’re remaining bullish:

-The retracement offers a healthy de-risking for the market

-Macro balances favorable across equities, rates, inflation, dollar

-Institutional capital still entering crypto space (Morgan Stanley, etc.)

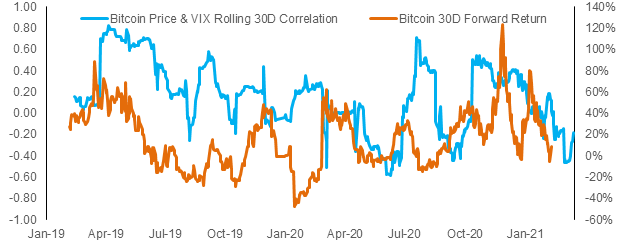

-Returns after prior Bitcoin options expiration dates have tended to be positive

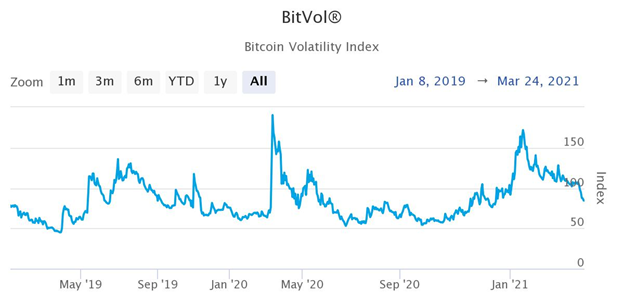

-Market calm based on Bitcoin VIX falling with room to fall further

Source: Tradingview (Date: 3/25/2021)

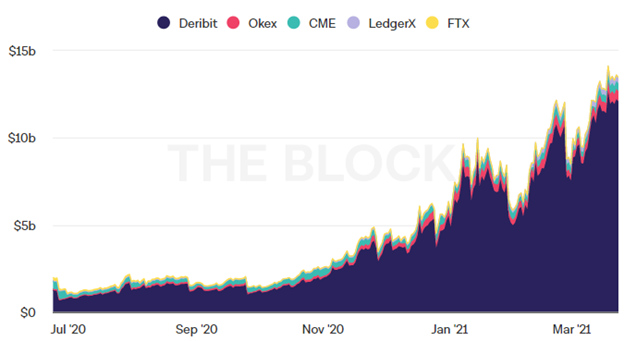

Bitcoin options are becoming a bigger and bigger part of the crypto market, with the aggregate open interest now pushing close to $15B.

Source: The Block (Date: 3/23/2021)

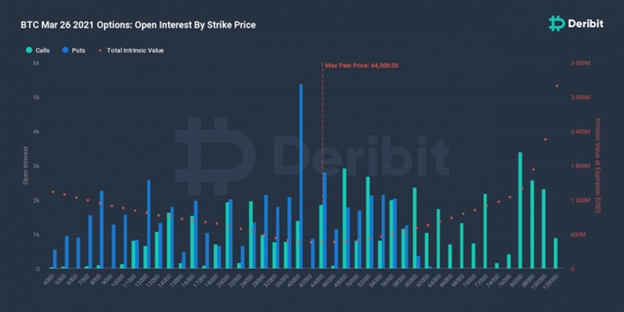

Of that, there’s a record amount $6B of Bitcoin options set to expire Friday. We think the market may be selling off into the event.

Source: Deribit (Date: 3/24/2021)

The chart below shows the prior options expiration periods with the line color marked as either green or red based on the direction of the next 10% move–historically favoring to the upside.

Source: Tradingview (Date: 3/21/2021)

The Bitcoin Volatility Index (VIX) indicates the market has been calm into this latest slight pull back.

Source: T3I Bitcoin Volatility Index (Date: 3/24/2021)

The stock market VIX is somewhat purely thought of as a “fear index” and we think the same is true for the Bitcoin VIX but we recognize the crypto market has a slightly unique balance of fear & greed:

-Fear of losing money (FEAR)

-Fear of missing out (FOMO)

Source: T3I, Coinmetrics (Date: 3/24/2021)

We do still view very sharp upticks are a signal of peak FEAR after a rapid sell off, like we saw in March 2020 and January 2021, with the index falling after being a bullish signal the market is moving higher. Smaller spikes or more gradual moves higher may signal bullish FOMO after quick or continued price moves higher.

Source: T3I, Coinmetrics (Date: 3/24/2021)

Future is uncertain but we think markets could see a rebalance to the long side after expiration. We think this period could be similar to the May-June 2020 period where the VIX continued to fall from March panic highs. We think prices could be choppy but to the upside with the bull market continuing though the balance of the year.