Crypto Weekly: 2/24/2021

Market Recap: New ATHs & Continued Volatility

Bitcoin rallied to a high of $58,367 on Sunday before commencing a 23% sell off down to $44,888 yesterday morning and bouncing to its current price of $48,770. In our view, the recent move is nothing more than a nice healthy correction and we think recent events have de-risked the market. We continue to believe the fourth crypto bull market remains intact and our Bitcoin price target remains $100k.

Source: Tradingview

One reason we believe the recent sell off puts the market on sounder footing is the impact it has had on leveraged. We had generally been moving higher for the last month and momentum traders have been riding that wave with margin long positions. The sell-off on Sunday and Monday liquidated $3.6B and $2.3B of long futures positions, respectively. Putting these numbers in perspective, the total Bitcoin futures open interest across all exchanges dropped 16% from $19B to $16B over the last few days according to Skew. We think this offers a nice reset that could set us up for the next moving higher.

Source: ByBit

Looking back to the prior bull market in 2017, we see that the best times to add crypto exposure were following similar sell offs. During the six ~30%+ sell offs we tallied, the average return after was ~160%. If Bitcoin made such a move from its low on Sunday, that would take the price to a little over $70,000.

Source: Tradingview

NY Attorney General Tether Settlement Removes Crypto’s Biggest Systemic Risk

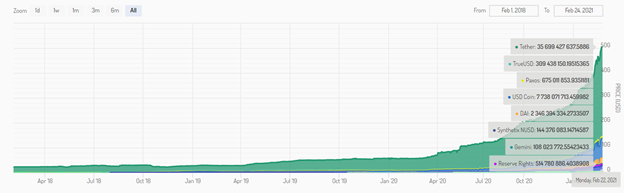

Stablecoins, crypto assets designed to have their price pegged to a dollar, have become an iatrical part of crypto market trading infrastructure. Their total market cap now stands at $50B (3% of the $1.5T total crypto market cap) with Tether (USDT) being by far the largest at a market cap of $35B (70% stable coin market cap).

Source: Messari Stablecoin Index

Tether (USDT) has perhaps been one of the crypto industries biggest possible systemic risks for years. USDT, which is supposed to be collateralized 1 for 1 by dollar reserves held with the issuer, has come under fire repeatedly from critics claiming the tokens aren’t fully backed. Given the size and importance of USDT within the crypto industry, if the assets were proven worthless, it would likely cause a wave of systemic exchange failures crashing crypto prices.

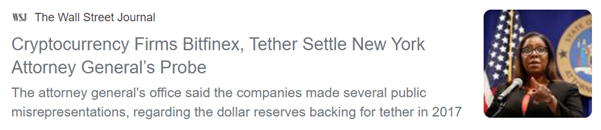

Yesterday, the New York Attorney General (NYAG) announced that it had settled an investigation into Tether and its affiliate exchange Bitfinex.

Source: WSJ

Most news reports we saw focused on the companies past missteps, the $18.5M fine, and the ban against the company doing business in NY.

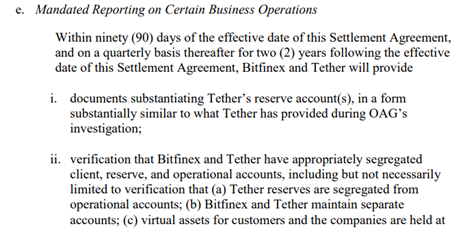

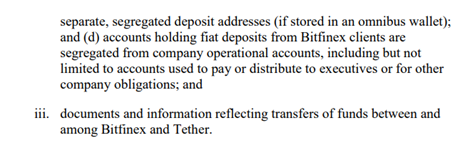

But we think this misses the real headline markets should be grabbing on to – Tether currently has sufficient reserves to back its $35B market cap and the company will be submitting ongoing proof of reserves to the NYAG.

We believe this represents a massive de-risking event for the crypto industry which should bode well for institutional capital flows moving forward.