Crypto Weekly: 2/4/2021

THIS MESSAGE IS BEING SENT SOLELY TO CLIENTS OF FSINSIGHT

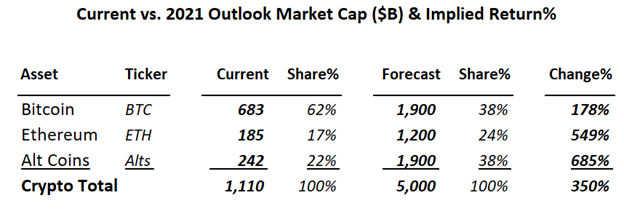

Last Thursday, we held our FSInsight 2021 crypto outlook call and made three bold predictions:

- We raised our price target on Bitcoin from $40k to $100k.

- We reiterated our $10.5k Ethereum price target released on 1/20/2021.

- We forecasted the total crypto market cap to rise to $5T.

Outlook Implied Crypto Market Expectations

While prices have risen a bit since our call last week, the below table illustrates the outlook implied expectations for the market cap of Bitcoin, Ethereum and altcoins more generally.

Bitcoin Rallied This Week

We remain bullish on Bitcoin and think it must continue to rise during 2021 for our other forecast to prove correct given its size and heavy influence over the entire crypto market. After the quick run we saw in the first week of the year, we think the retracement and choppy movement from Bitcoin has allowed capital to flow to other assets within the crypto ecosystem. Bitcoin has started to rally again and we think as long as prices hold generally in this range or above, it will benefit crypto assets broadly.

Ethereum Hitting New Highs

We continue to see Ethereum as the best risk reward play in the crypto ecosystem. Our price target is $10.5k. This year it has continued its trend of outperforming Bitcoin and we think more upside remains.

Healthy Altcoin Rally

As bitcoin started to consolidate, we thought it could be beneficial for alts (Follow me on twitter: @David_Grid). Our outlook implies altcoins could see greater gains (note: higher potential returns = greater risk!!).

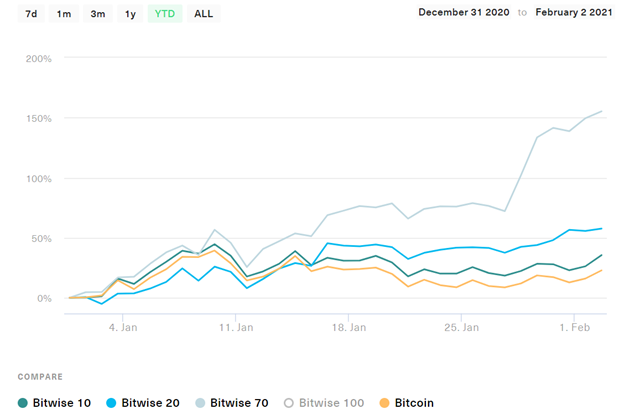

Thus far this year we can see from the Bitwise size indices that smaller cap alts have been outperforming Bitcoin which led the rally as it headed toward all time highs. We think if a healthy alt rally can continue for at least a week or two, it will set the stage for a move higher in Bitcoin.

Strong DeFi Performance Expected During 2021

One of the altcoin sectors that we think will perform strongly during 2021 is Decentralized Finance (DeFi). The Tokensets Defi Pulse index has outperformed Bitcoin YTD. While we expect there to be waves of rotations, on balance we think over the course of the year, this altcoin sector is a very good place to have exposure.