Digital Assets Weekly: September 29th

For a full copy of this report in PDF format please click HERE.

Market Analysis

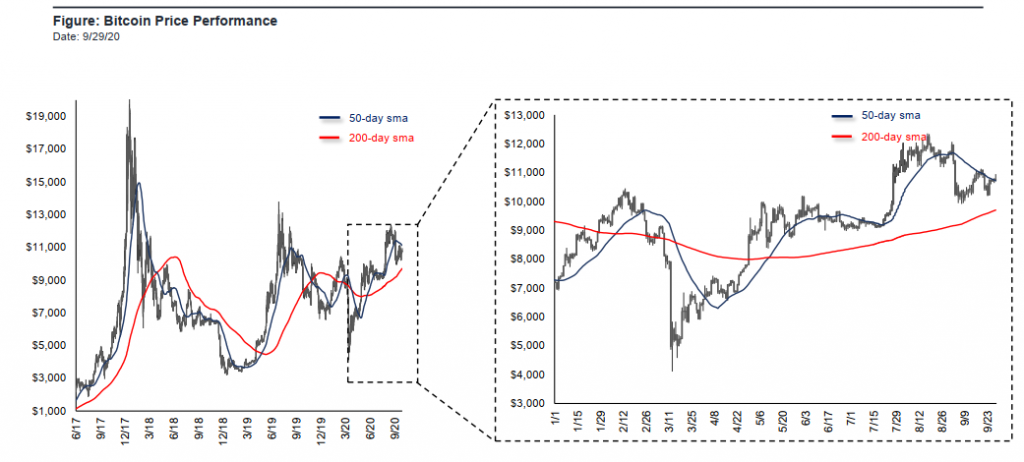

This week, Bitcoin gained some ground but largely still exhibited choppiness as it consolidated above $10,000. As of yesterday, Bitcoin has closed above the key level of $10,000 for 64 consecutive days, which is an all-time high. The previous all-time high was 62 consecutive days back in 2017-2018. At time of writing, Bitcoin is currently trading at ~$10,750.

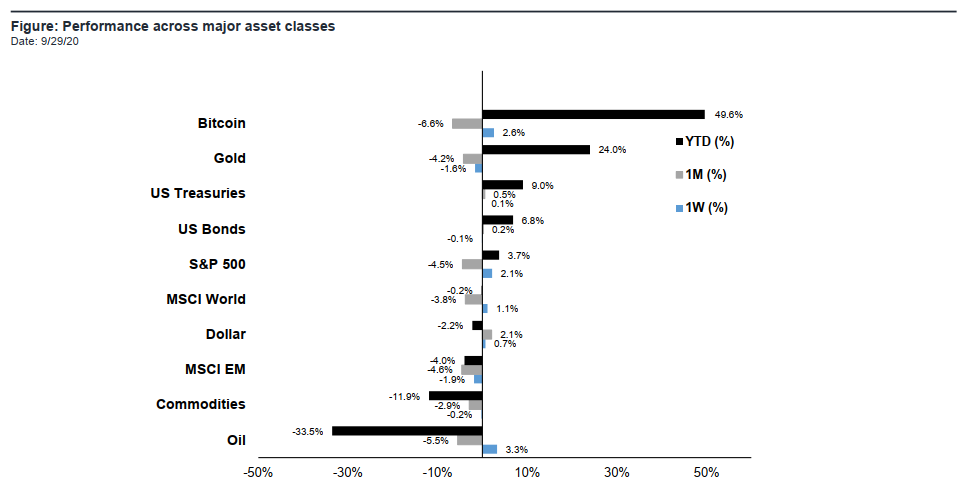

The Dollar has been exhibiting strength which may serve as a headwind for the crypto market. Also, Gold has been underperforming in recent weeks, which may be another contributor to Bitcoin’s recent weakness. Despite these factors, Bitcoin remains the best performing asset class on a year-to-date basis.

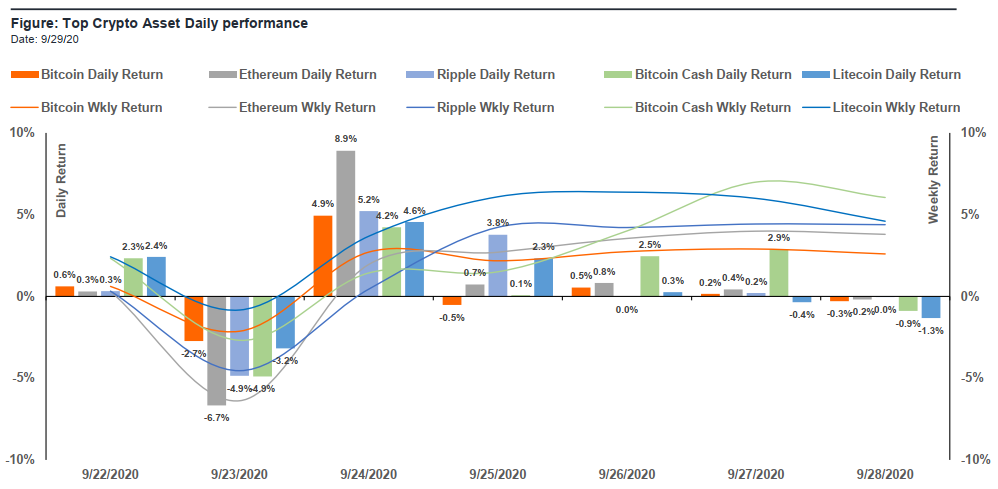

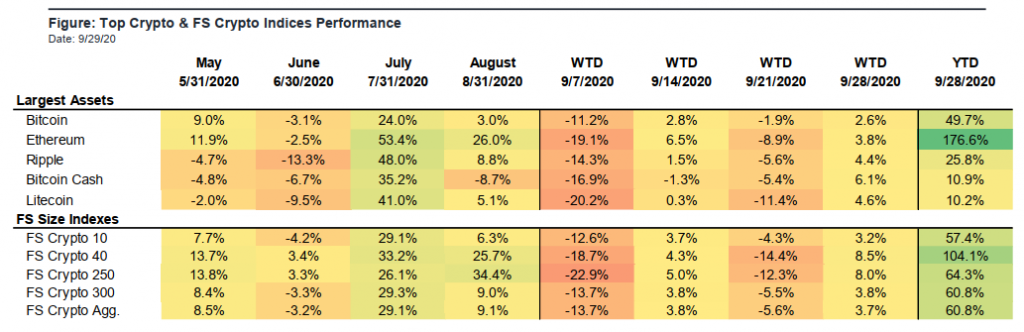

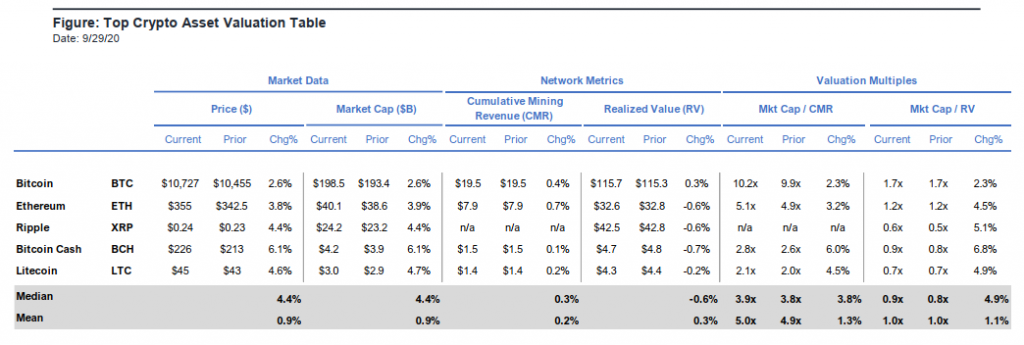

Despite a big down move in the entire market early in the week, all of the crypto majors were in the green this week, with Bitcoin Cash showing the strongest resurgence after recent weakness (+6.1%) and Bitcoin rising the least (+2.6%).

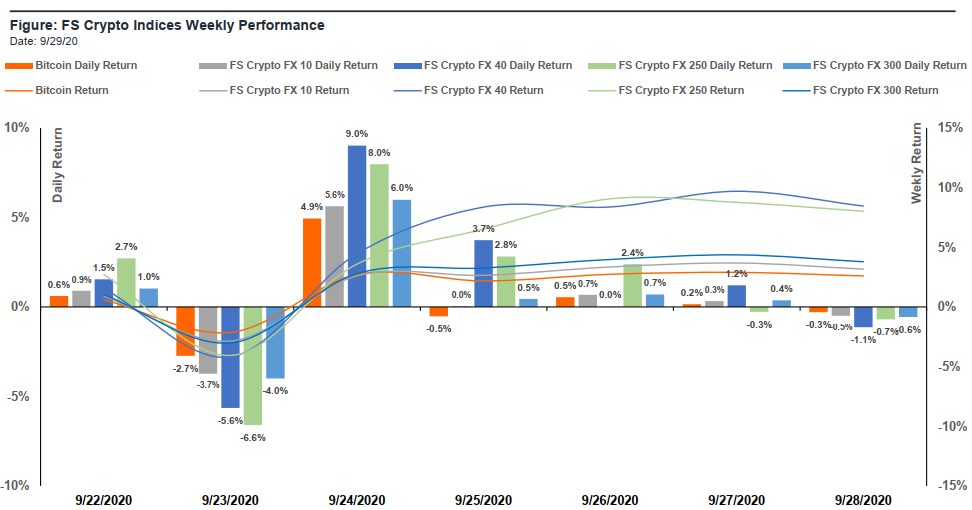

After the previous week’s dismal performance, all the FS Crypto FX indexes finished this week in positive territory with the FS 40 gaining ground after its double-digit loss the prior week (+8.5%). The FS 10 gained the least this week (+3.2%).

Bitcoin Cash was in danger of moving into negative territory on a year-to-date basis, but its strong performance this week moved it back to a double-digit gain YTD. Bitcoin and Ethereum remain the strongest leaders appreciating 50% and 176% YTD, respectively.

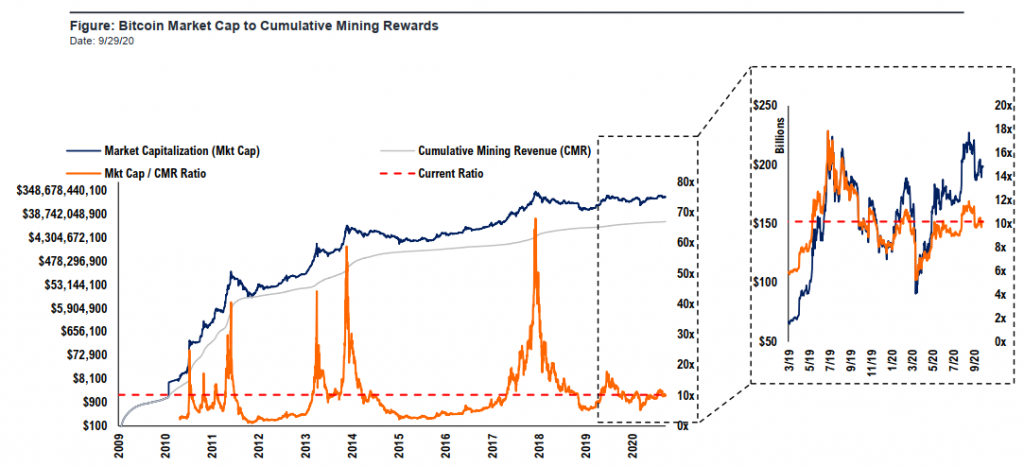

Bitcoin’s Mkt Cap/CMR ratio increased 2.3% week over week from 9.9x to 10.2x.

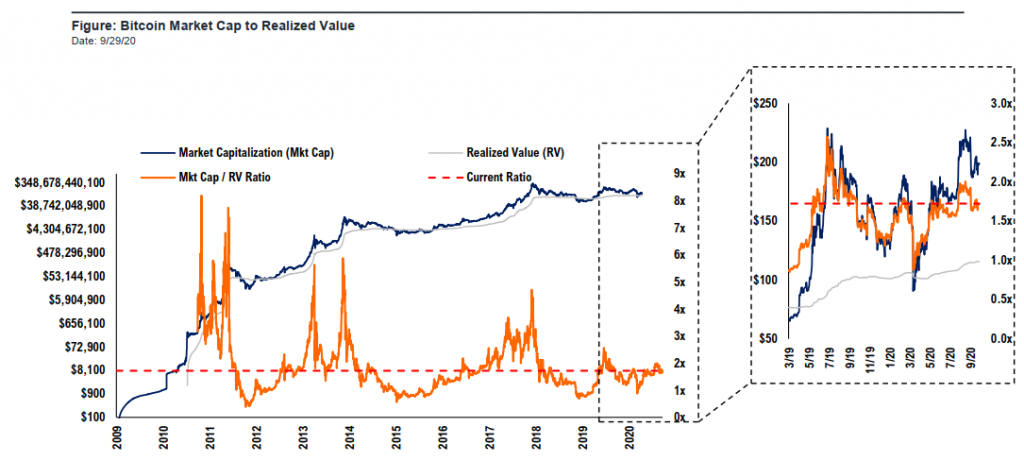

Bitcoin’s Mkt Cap/RV ratio decreased 2.4% week over week and currently sits at 1.7x.

Noteworthy this week:

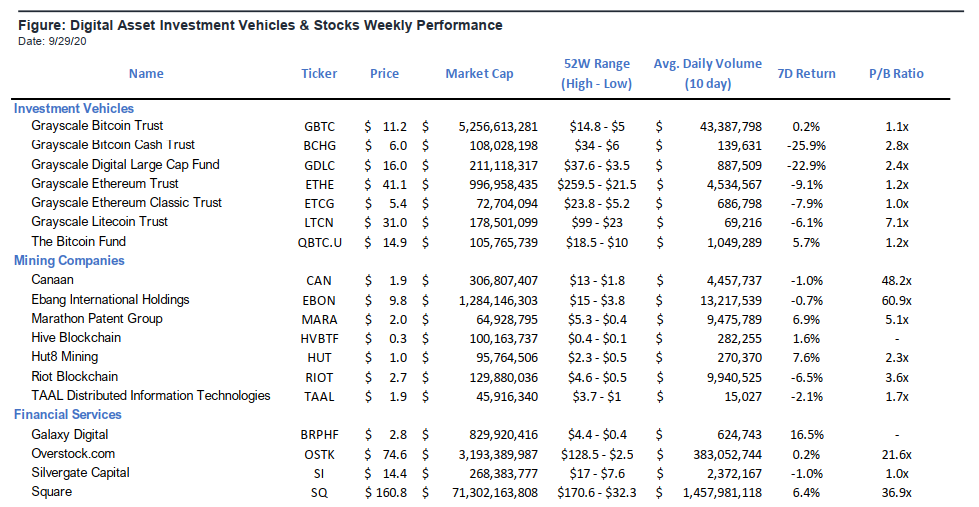

Ebang International Holdings (NASDAQ: EBON): Ebang, a leading ASIC chip design company and leading manufacturer of high-performance Bitcoin mining machines, announced it has established a wholly-owned subsidiary in Canada to improve its industrial chain layout and upgrade its digital asset financial service platform. The Company’s new subsidiary in Canada received a Money Service Business License from the Financial Transactions and Reports Analysis Centre of Canada, which will allow the Company to engage in foreign exchange trading, digital currency transferring and dealing in virtual currencies in Canada.

Grayscale Investment Trusts: All of Grayscale’s listed products’ premiums to NAV fell this week. The ETHE premium to NAV fell to a new all-time low of 19% (45% last week). The ETHE decline is notable as it listed at a premium of >1,000% and has an average historical premium of ~250%. The GBTC and ETCG premiums fell to 7% and 2% respectively (13% and 15% the weeks prior). Grayscale’s newly listed products BCHG and LTCN still have sizable premiums but also dropped to 144% and 602% (303% and 664% the weeks prior).

Overstock (NASDAQ: OSTK): The U.S. District Court in Utah on Monday dismissed a securities class-action lawsuit against Overstock.com Inc. filed by investor Mangrove Partners Master Fund Ltd. in September 2019, ruling in favor of Overstock and other defendants. The plaintiffs, led by Mangrove Partners on behalf of people who bought Overstock stock between May 9, 2019,and Nov. 12, 2019, alleged that the defendants falsely made financial projections for 2019 and schemed to issue a digital dividend that purportedly caused a rapid increase in stock price. The court, in its order to dismiss the suit, said Mr. Byrne’s statements regarding future financial performance were protected by safe-harbor provisions. “There isn’t any evidence that the company concealed information related to the dividend that was material to investors,” the order said.

Square Inc. (NYSE :SQ): Jed Kelly of Oppenheimer upgraded Square’s stock from Perform to Outperform, while establishing the price target of $185 (trading at ~$167 at time of writing). COVID-19 has resulted in a “massive shift in digital commerce requiring merchants to rapidly adopt omni-channel solutions,” Kelly wrote in the note. He added that Square’s business model has “two sided networks of sellers and consumers,” which positions the company’s platform as a “structural winner during the recovery.”

Winners & Losers

Winner

Bitwise – Revealed in regulatory form filed with the SEC last week, crypto asset management firm Bitwise has raised about $9 million for its bitcoin fund over the last one year. Bitwise also offers an Ethereum fund and a crypto index fund. The index fund raised about $66.5 million (lifetime) as of June this year according to their latest SEC filing. Click here to see Fundstrat’s recent research report on Bitwise.

Loser

KuCoin – The Asian exchange KuCoin suffered the third-largest hack in history after losing an estimated $279 million. The total amount stolen from exchanges has exceeded $1.79 billion with this hack. In the last three days, the hacker has already sold $6.5 million of the stolen assets on Uniswap.

Over 200 cryptocurrency assets trade on KuCoin with a combined daily average volume of around $100 million, ranking it as one of the busiest trading exchanges, according to the cryptocurrency data site CoinGecko. The price of KuCoin’s exchange token KCS fell by 14% to $0.86 within an hour on Saturday as news of the security breach spread on social media. KuCoin is investigating the hack with international law enforcement and stolen customer money will be “covered completely” by an insurance fund.

Financing and M&A Activity

Noteworthy this week:

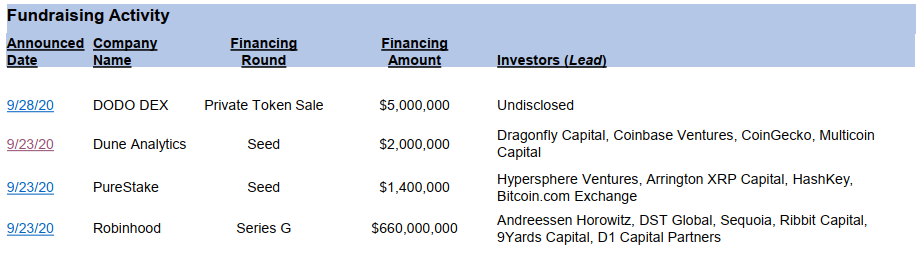

Dune Analytics – Dune Analytics, the community-driven analytics platform that provides data tools for the Ethereum network, has raised $2 million in a seed funding round. Dune came out of stealth mode last fall after having been backed by Binance’s startup incubator. The end result is an open-walled analytics platform that provides free services, with premium offerings as a value-add to customers that want a more customized experience, such as private queries and data exports.

Robinhood – Brokerage app Robinhood has raised an additional $460 million for a now-closed Series G funding round, adding to the $200 million it announced last month. Robinhood now touts an $11.7 billion postmoney valuation. The company’s valuations were just $8.6 billion in July and $11.2 billion in August, The Block previously reported. Robinhood now has over 13 million users, with the median age of users around 30. The app lets users buy and sell stocks without paying a commission but offers educational material to help users better understand investing.

Reports & Events

• Tom Lee and David Grider: Tom and David will be speaking at the upcoming CoinGeek conference this

Thursday October 1st.

• Leeor Shimron: Investing in the DeFi Landscape Panel Discussion at the LA Blockchain Summit on October 6th

• David Grider: Digital Assets Weekly: September 22nd

• FS Digital Strategy Team: Bitwise: Leading Crypto Index Funds & New Alpha Opportunity