Digital Assets Weekly: September 22nd

For a full copy of this report in PDF format please click HERE.

Market Analysis

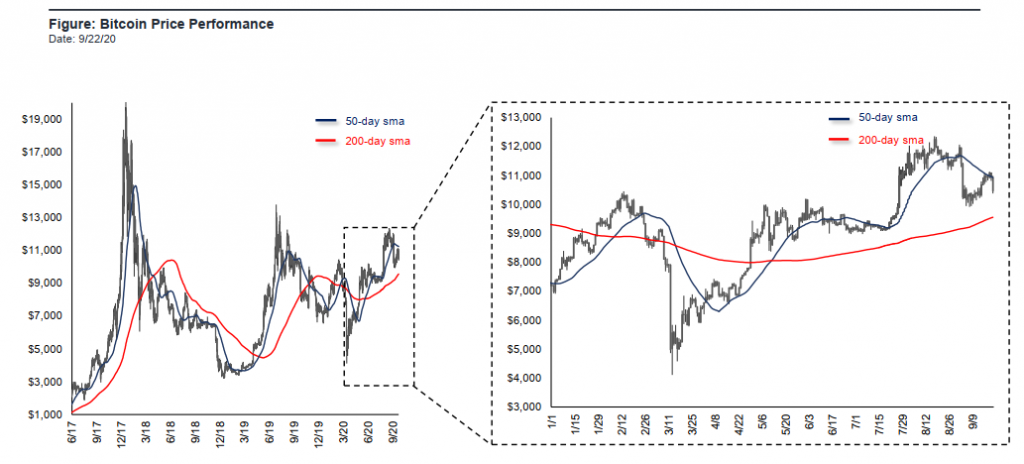

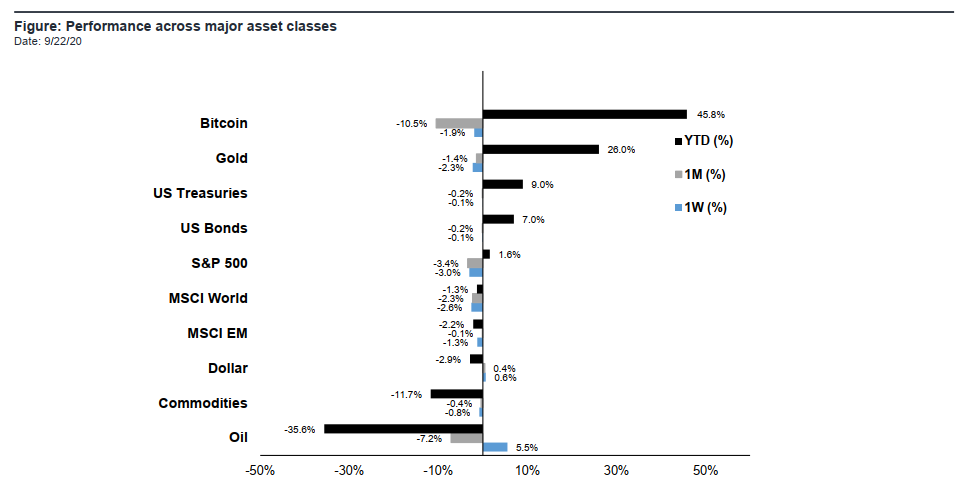

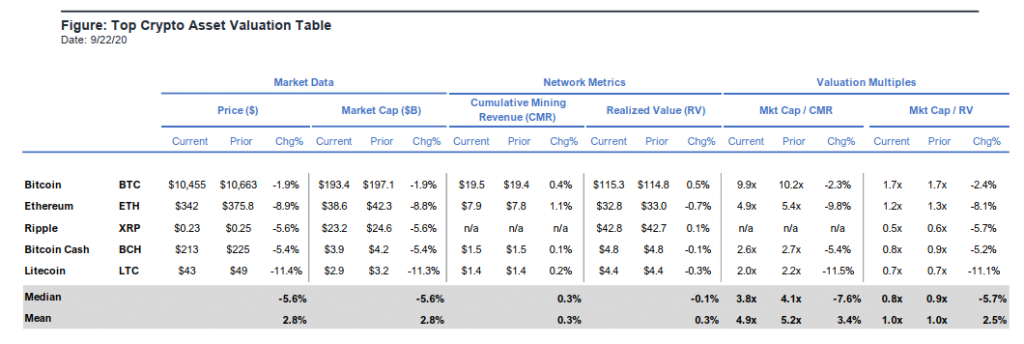

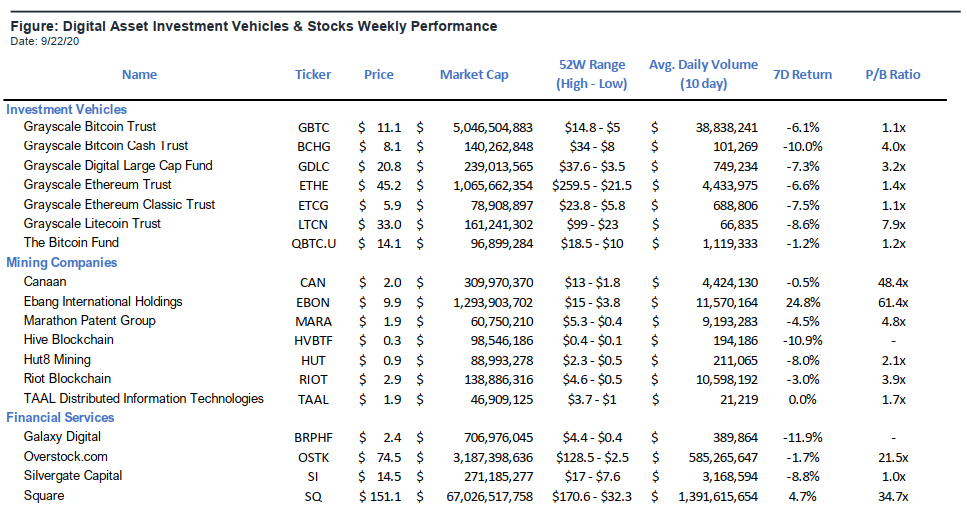

This week, Bitcoin briefly traded above $11,000 before losing ground and ending the week down 1.9% at $10,455. Bitcoin has been exhibiting greater short-term correlation with the broader markets, which could be the primary reason for Bitcoin’s weakness in recent weeks. At time of writing, Bitcoin is currently trading at ~$10,500.

Notably, Bitcoin’s decline corresponds with the decline in the equities market. Despite recent weakness, Bitcoin remains the best performing asset class on a year-to-date basis by a wide margin.

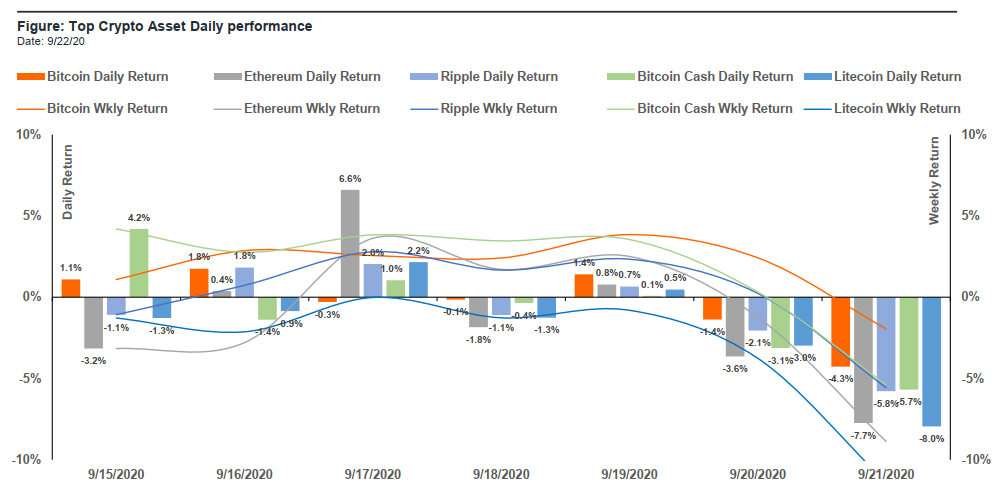

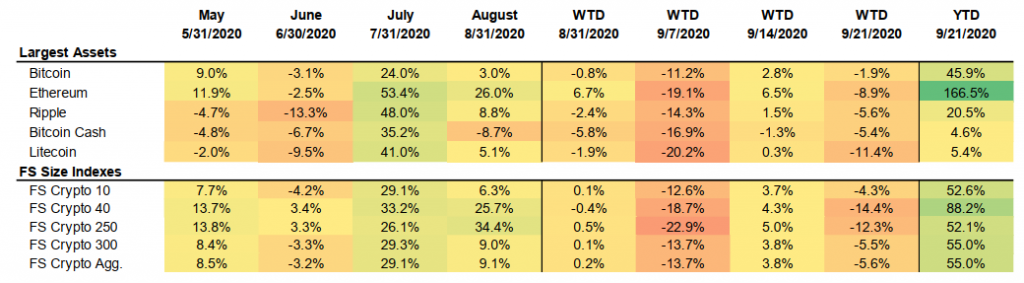

The crypto majors continue to show correlation, and all of them declined this week. Amongst all the major crypto assets, Bitcoin’s decline was the most muted (-1.9%), whereas Litecoin had the largest decline (-11.4%).

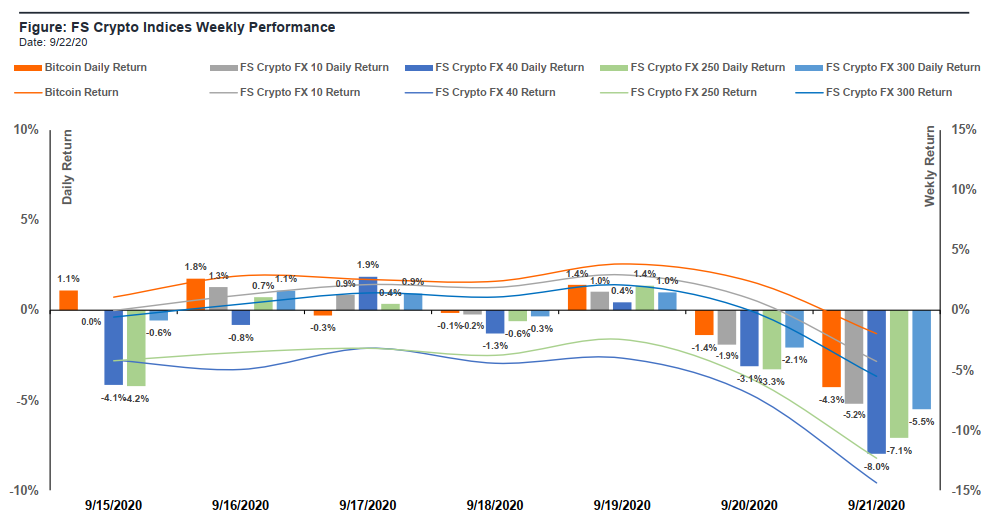

Altcoins are often viewed as a leverage play on Bitcoin, magnifying the direction Bitcoin moves in. Continuing this week, all the FS Crypto FX indexes were negative with the FS 40 performing the worst (-14.4%) and the FS 10 performing the best (-4.3%).

Despite Ethereum’s negative performance this week, it is still up 166% YTD and is firmly the best performing crypto major. All the FS Crypto FX indexes are up more than 50% YTD.

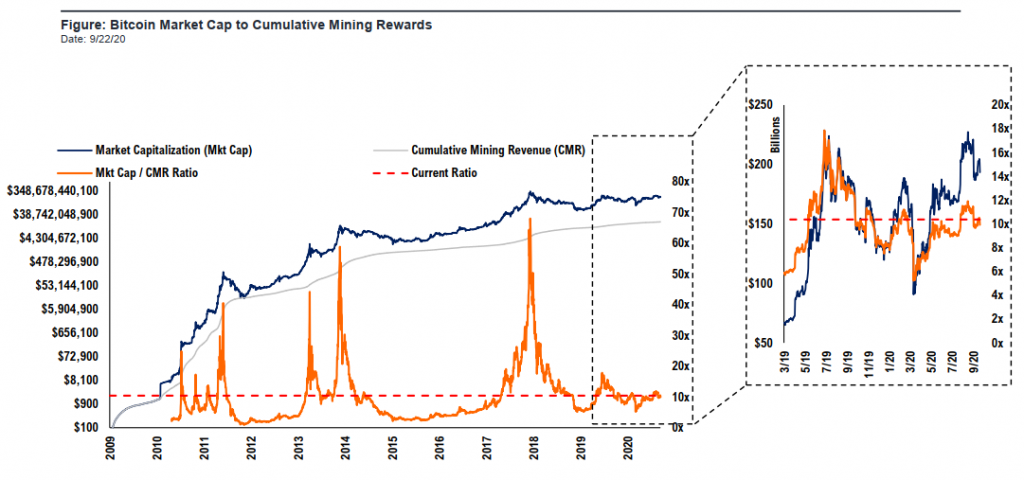

Bitcoin’s Mkt Cap/CMR ratio decreased 2.3% week over week from 10.2x to 9.9x.

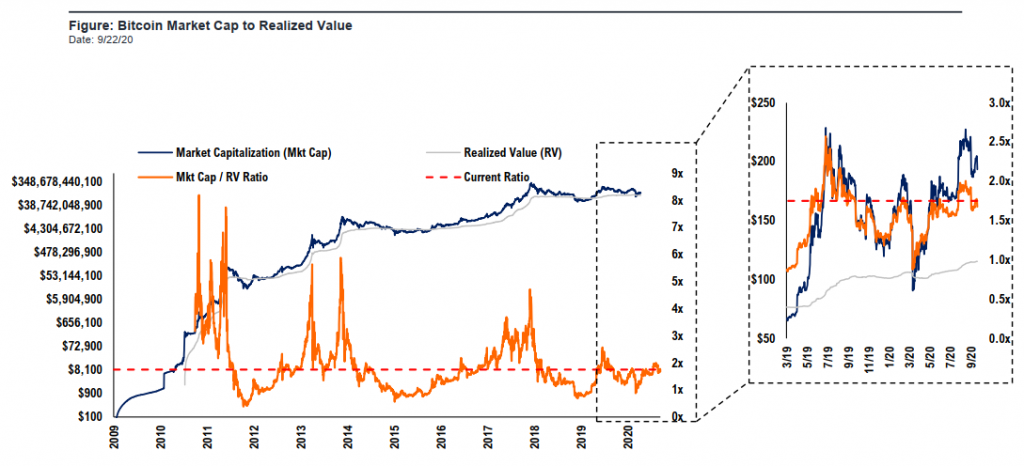

Bitcoin’s Mkt Cap/RV ratio decreased 2.4% week over week and currently sits at 1.7x.

Noteworthy this week:

Marathon Patent Group (NASDAQ: MARA): Marathon Patent Group Inc. pulled its offer to acquire Fastblock Mining in an all-stock deal because the two companies could not extend the term of a power agreement. Marathon said it found out that an agreement for Fastblock to provide power at a subsidized rate was going to end in three years and the agreement could not be extended with the power provider to a term that would make the deal economically feasible for Marathon. Marathon said it has a term sheet with another power company and will announce those terms when due diligence is done.

Overstock (NASDAQ: OSTK): Overstock.com’s security token crypto exchange, tZERO, on Wednesday reported a record trading volume of more than 2.3 million digital securities in August, 21 times higher from the year-ago period. It said it transacted nearly $22 million of securities for the month, up from $7.6 million in July. Year-to-date through August, tZERO’s traded shares jumped by over 300% from last year, it reported. tZERO said its Crypto app’s users increased by more than 11% in August.

Square Inc. (NYSE :SQ): Square is set to establish a cryptocurrency patent alliance to enable open access to patents covering foundational technologies in the cryptocurrency sector. This is seen to be necessary for the crypto community to grow, freely innovate, and build new and better products. The Cryptocurrency Open Patent Alliance, or COPA, seeks to democratize patents for everyone, empowering even small companies with tools and leverage to defend themselves. There is an invitation for all in the crypto community to join the alliance to address patent lockup concerns.

TAAL (CSE: TAAL): TAAL announced it purchased all of the issued and outstanding shares of WhatsOnChain Limited (“WhatsOnChain”) enhancing TAAL’s technology portfolio and accelerating TAAL’s strategy as a leading provider of enterprise blockchain infrastructure services. TAAL purchased WhatsOnChain for $2MM GBP, which was paid through the issuance of 1,739,882 TAAL common shares (the “Consideration Shares”), with a share value of $1.97. WhatsOnChain owns proprietary Bitcoin SV blockchain explorer technology developed by its founders who created the first-ever BSV block explorer to provide data in an easy and user-friendly manner.

Winners & Losers

Winner

Kraken – This week, Kraken Financial became the first crypto company to receive a banking charter under Wyoming’s Special Purpose Depository Institution statute. The new structure was purpose-built for cryptocurrency companies and will allow the crypto exchange to offer certain banking functions to clients and effectively serve as the exchange operator’s primary banking relationship. Up until this point, Kraken has relied on third-party providers for wire transfers and other services that enable it to engage with the broader financial system.

Loser

UniLogin – UniLogin, which provides a user onboarding solution for Ethereum apps, is shutting down due to high gas fees. “UniLogin is out of gas,” co-founder Alex Van de Sande said in a blog post on Friday. “Not necessarily out of money, but the current Ethereum gas market, the rise of DeFi [decentralized finance], have changed the game significantly enough that we don’t see a way forward with the project.“

Van de Sande said UniLogin is particularly sensitive to gas prices because before onboarding any users, the project was deploying a new multi-sig wallet on users’ behalf, registering an ENS [Ethereum Name Service] name, and sometimes using its relayer to add a Dai transaction. He went on to say that some days the whole process of onboarding a new user was costing over $130, equivalent to a cost of a hardware wallet.

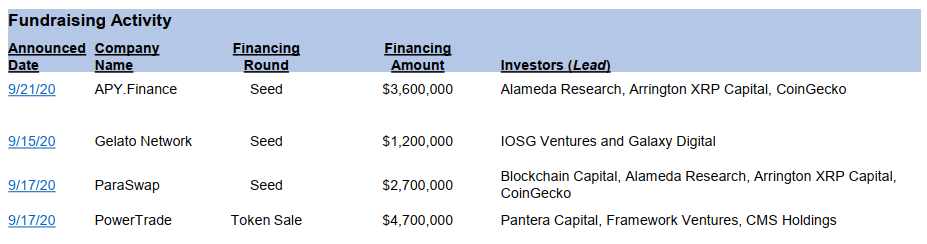

Financing and M&A Activity

Noteworthy this week:

APY.Finance – APY.Finance, which is building a decentralized finance (DeFi) aggregator for yield farming, has raised $3.6 million in new funding. APY claims to be building the “Wealthfront for yield farming,” or a roboadvisor that helps optimize token lending for risk-adjusted gains. With the fresh capital in place, APY plans to speed up its platform development and launch it in mid-October.

PowerTrade – PowerTrade raised $4.7 million via token sales in a round led by Pantera Capital and joined by Framework Ventures, CMS Holdings and QCP Capital among others. PowerTrade said in a press release it will offer low minimum deposits allowing traders access to crypto options for as little as $1. The platform, which will launch to non-U.S. traders first, will focus on user experience and education, while helping traders understand and manage risk, it said.

Recent Reports & Events

• Leeor Shimron: Investing in the DeFi Landscape Panel Discussion at the LA Blockchain Summit on October 6th

• David Grider: Digital Assets Weekly: September 15th

• FS Digital Strategy Team: Bitwise: Leading Crypto Index Funds & New Alpha Opportunity