Digital Assets Weekly: September 15th

For a full copy of this report in PDF format please click HERE

Market Analysis

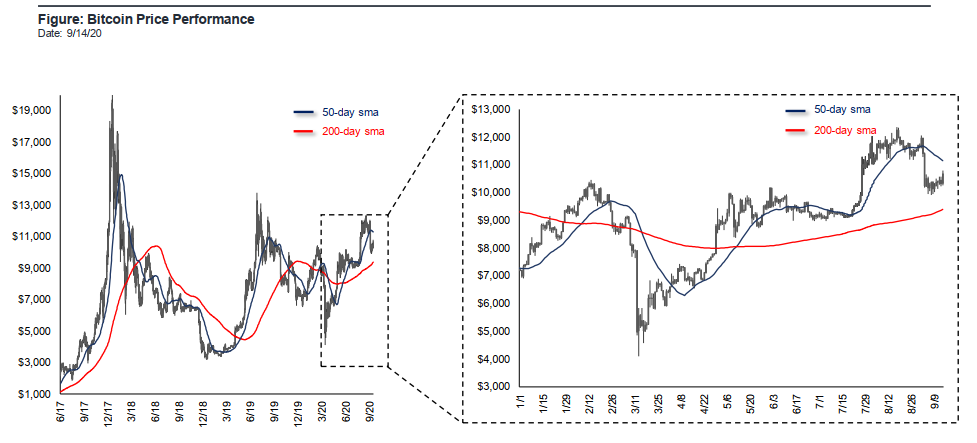

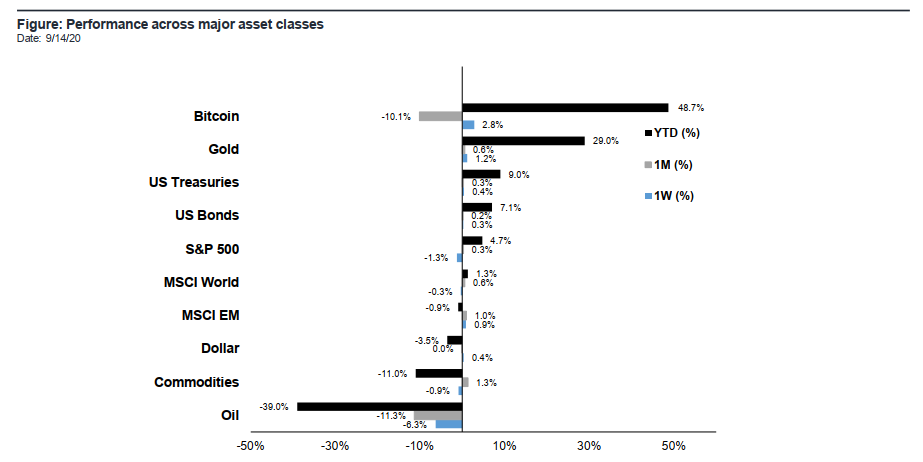

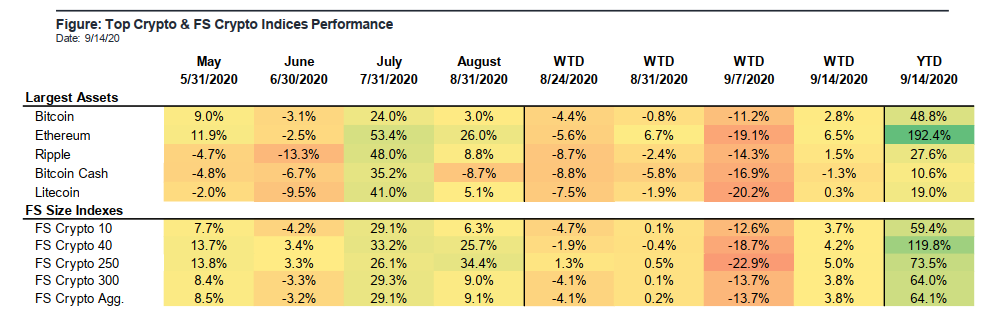

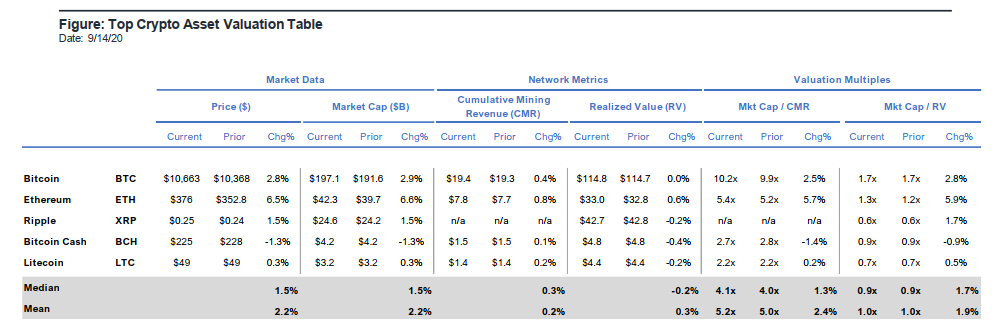

Following last week’s downside volatility, Bitcoin stabilized and regained some ground finishing the week ending 9/14 up 2.8% at $10,663. Bitcoin currently sits around ~$10,850 and seems poised to retest $11,000.

Bitcoin is still down double digits this month (-10%) alongside oil and commodities. Historically, September has been Bitcoin’s worst performing month.

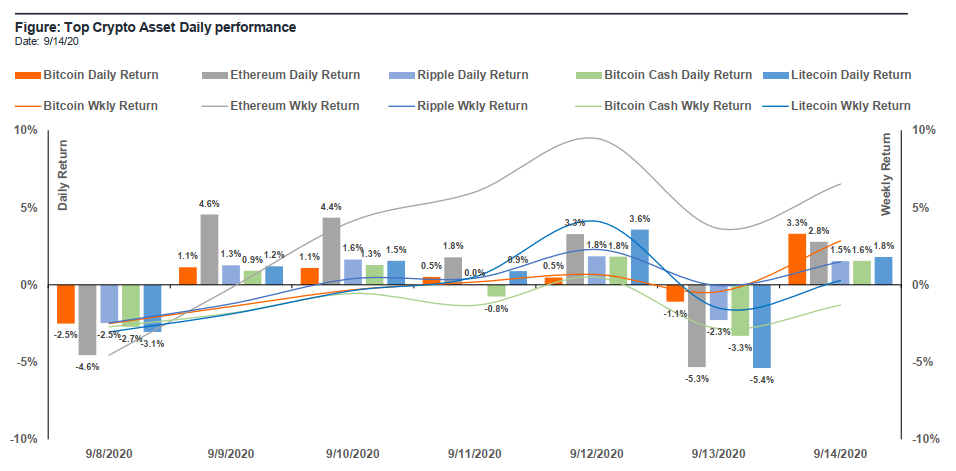

Amongst all the major crypto assets, Ethereum was the best performing asset this week (+6.5%) and Bitcoin Cash was the worst (-1.3%).

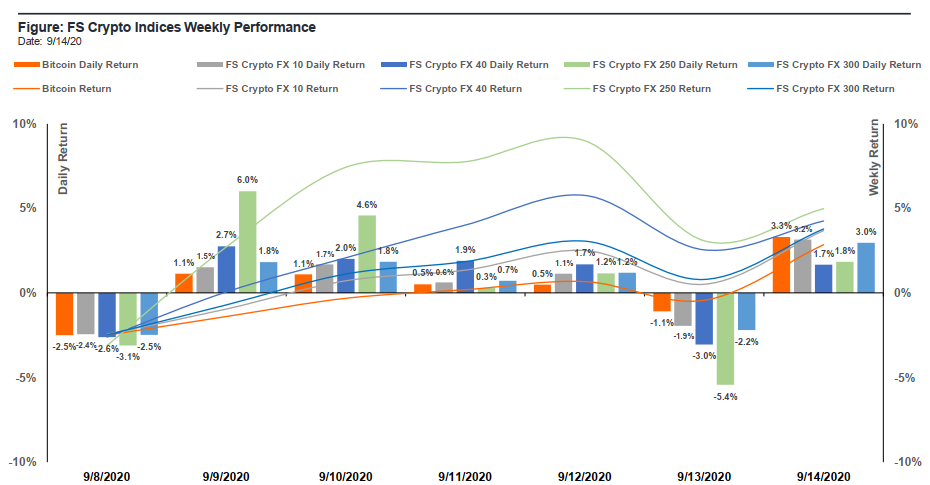

Reversing from the week prior, the FS Crypto FX 250 was the best performing index this week (+5%) and Bitcoin was the worst (+2.8%) as the entire crypto market showed signs of recovery after the big selloff.

All major crypto assets and the FS Size Indexes remain firmly in the green on a YTD basis. Bitcoin Cash is the worst performing asset which was the only asset that declined this week and posted a gain of only 10% YTD. Ethereum remains firmly ahead with a gain of 192% YTD.

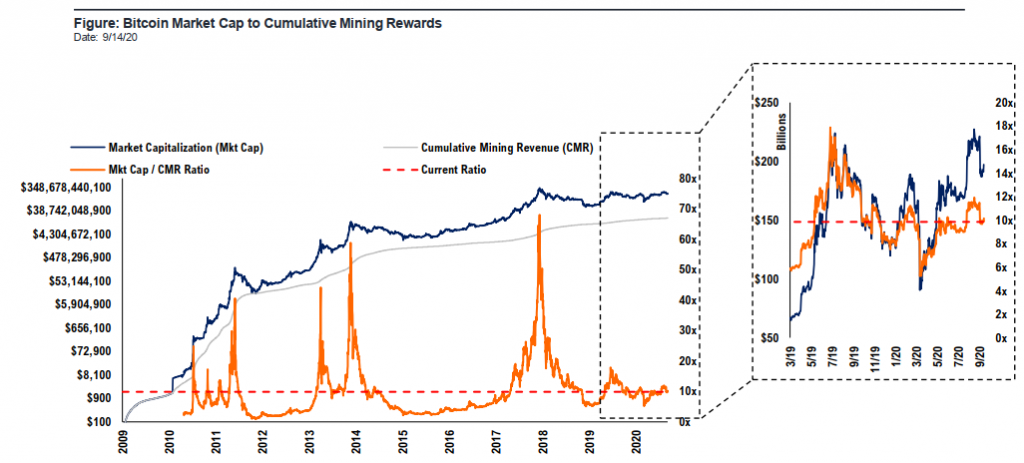

Bitcoin’s Mkt Cap/CMR ratio increased 2.5% week over week from 9.9x to 10.2x.

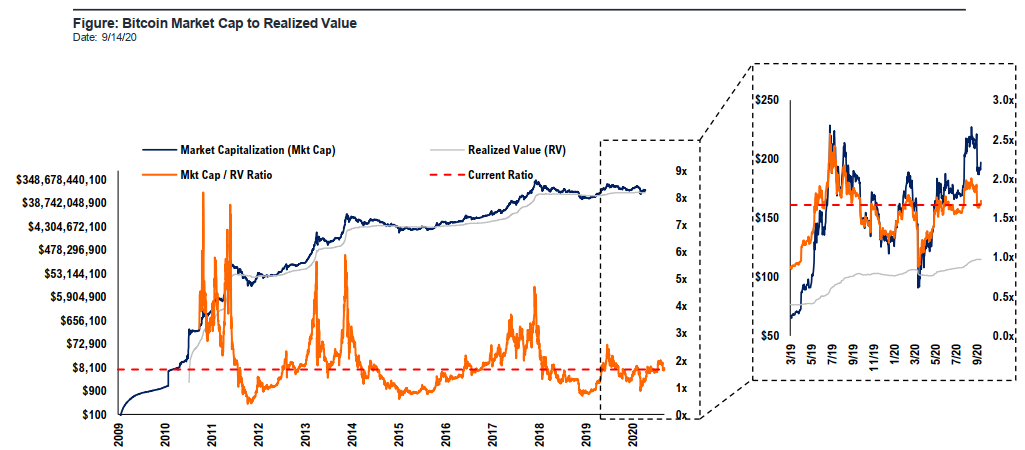

Bitcoin’s Mkt Cap/RV ratio increased 2.8% week over week and currently sits at 1.7x.

Noteworthy this week:

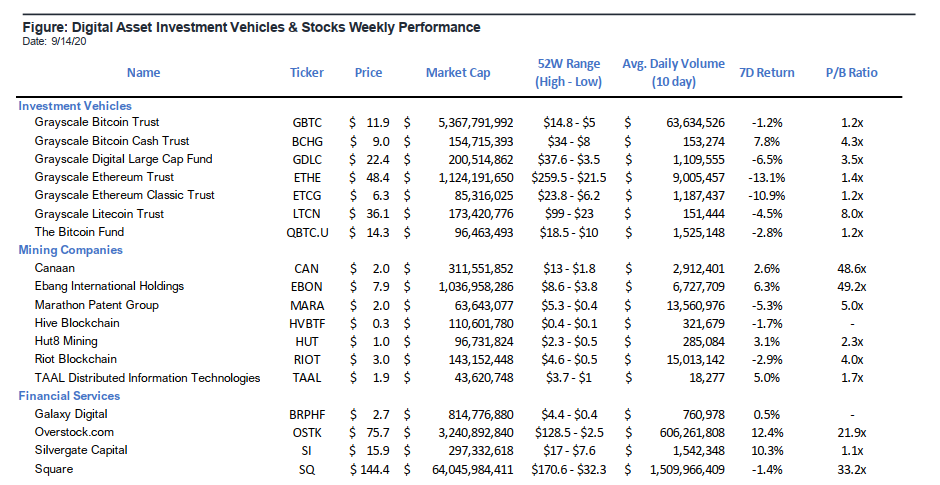

Grayscale Investment Trusts: Despite its resurgence last week, the ETHE premium to NAV trended lower finishing at 41% (55% last week). The ETHE decline is notable as it listed at a premium of >1,000% and has an average historical premium of ~260%. Grayscale’s newly listed products BCHG and LTCN continued to trade with high premiums finishing the week with premiums of 327% and 700%, respectively.

Silvergate Capital Corp. (NYSE: SI): Silvergate Capital Corp. Class A rose 6%, more than any full-day gain since July 10 as its sector advanced. Trading volume was double the average for this time of day. Analysts have 2 buy, 1 hold, and no sell recommendations on the stock. The consensus rating is 4.3, on a 1-5 scale with 1 meaning strong sell and 5 meaning strong buy. The price target of $18 represents a 15.49% increase from the last price. Analysts boosted their targets 0.7% in the past three months.

Square Inc. (NYSE :SQ): Square released a new report that highlights how the onset of COVID-19 has affected global commerce and payments behavior. This is the third installment of Square’s Making Change series, which examines whether we’re headed towards a cashless society. In February 2020, just 5.4% of Square sellers across the US were cashless. By April 2020, amidst the height of shelter-in-place mandates, that number jumped up to 23.2%. By August 2020, as the world slowly began to reopen, the number of Square sellers with a cashless business model was showing signs of stabilizing at 13.4%. That said, there has still been a remarkable increase in cashless adoption rates compared to pre-pandemic.

TAAL (CSE: TAAL): TAAL, a vertically integrated blockchain infrastructure and service provider announced the opening of its new office in Zug, Switzerland, along with key hires in c-suite and senior management roles. TAAL is onboarding a number of key new hires with the goal of expanding the Company’s operations, including a Chief Technology Officer, Chief Compliance Officer, VP of Product Development, Head of Business Development, Chief Scientist and VP of Digital Strategy. Chief Executive Officer Jerry Chan and Chief Financial Officer Satoshi Kitahama will be relocating to the Swiss office in 2021.

Winners & Losers

Winner

Yearn Finance (YFI) – Despite the market wide selloff the past two weeks, YFI surged to a new all time high of ~$40,000 per token, largely in anticipation of its Coinbase Pro listing Tuesday. During the selloff, YFI tested its $20,000 support level before bouncing back to reach new highs. YFI is a DeFi protocol aggregator with a token cap of 30,000. The YFI token confers governance rights and a portion of on-chain cashflows from the yield generated through the protocol.

Loser

bZX – The Fulcrum DeFi protocol developed by bZX, which had recently relaunched after a series of hacks in February forced the team to regroup, was hacked once again to the tune of about $8 million. According to the incident disclosure by bZX, the culprit was one line of code placed at the wrong location in the contract for its “iTokens,” the token representing a user’s share in the pool of supplied assets — essentially a tokenized deposit balance.

A fix was quickly deployed to prevent further occurrences. The bZX team reported that the hacker returned the

money on Monday, saying, “The attacker was tracked and identified due to their on-chain activity, he came

forward shortly after this and returned the funds stolen.”

Financing & M&A Activity

Noteworthy this week:

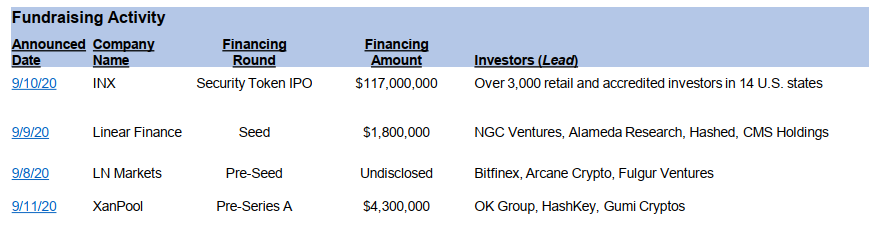

INX – Crypto exchange INX, which recently launched its security token initial public offering (IPO), has crossed the minimum $7.5 million threshold imposed by the U.S. Securities and Exchange Commission (SEC). The regulator wanted INX to raise the first $7.5 million of its up to $117 million IPO in dollars and not crypto. Now that the minimum requirement has been met, INX will start accepting bitcoin, ether, and USDC stablecoin, beginning September 14.

LN Markets – LN Markets, a crypto derivatives exchange built on top of Bitcoin’s Lightning Network, has raised an undisclosed sum of money in a pre-seed round. Developed by bitcoin startup ITO, LN Markets currently has trade limits set at 0.01 bitcoin per trader. The exchange said its users have so far executed more than 25,000 trades, worth over $10 million in volume.

Recent Reports & Events

Access Fundstrat’s recent crypto insights if you missed them by clicking below or visiting FS Insight:

• David Grider: Digital Assets Weekly: September 9th

• FS Digital Strategy Team: Bitwise: Leading Crypto Index Funds & New Alpha Opportunity

• Leeor Shimron: The Coming Age of Yield Farming