Digital Assets Weekly: August 18th

For a full copy of this report in PDF format please click HERE

Market Analysis

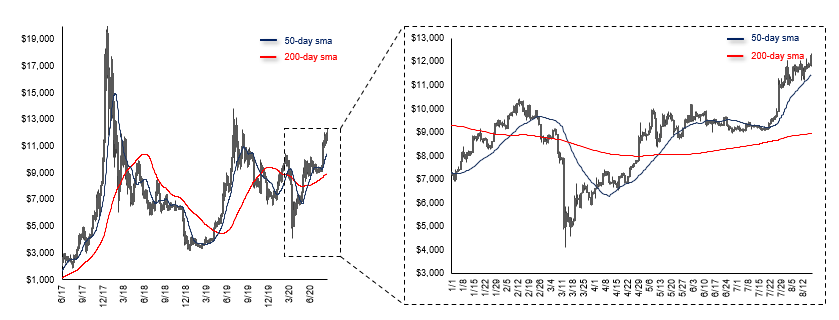

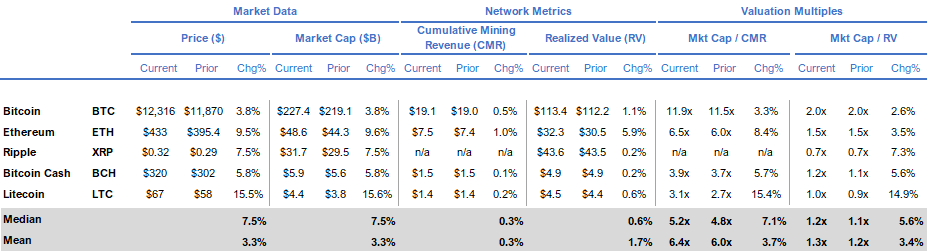

After bumping up against its $12,000 resistance level for the greater part of the week, Bitcoin broke above $12,000 on Monday August 17th and finished the 7D period up 3.8% at $12,316.

Open interest on CME Bitcoin Futures hit an all-time high on Friday ($846M vs last week’s record of $840M) and Bitcoin’s hashrate hit an all-time high over the weekend rising a record 129 TH/s.

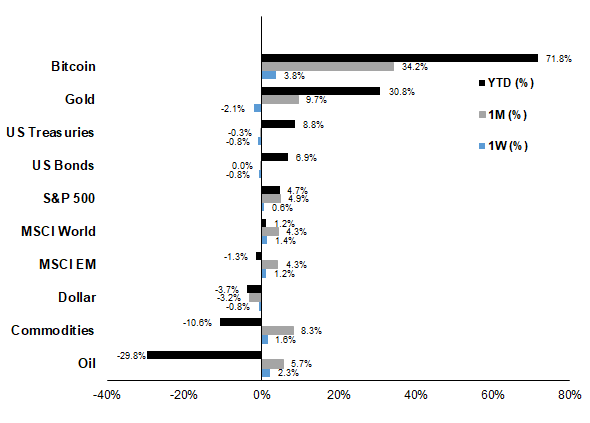

Bitcoin has continued its dominance in terms of its YTD performance compared to other asset classes. Notably, gold continues to perform well alongside Bitcoin as the dollar suffers, pointing to Bitcoin’s growing role as a global store of value.

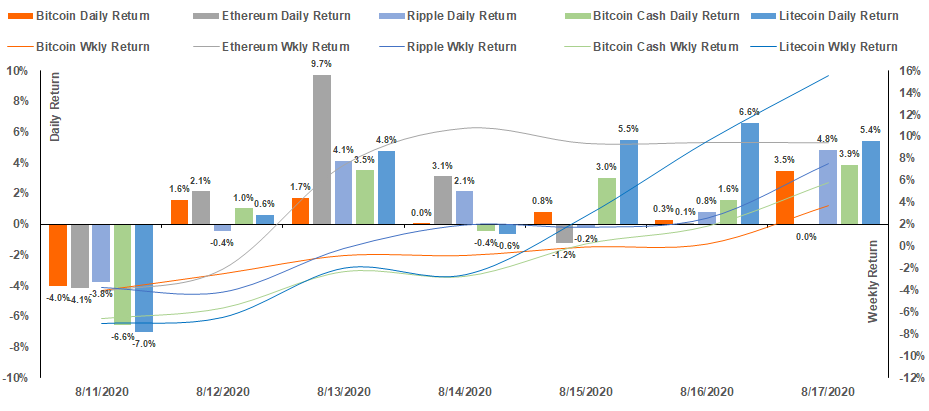

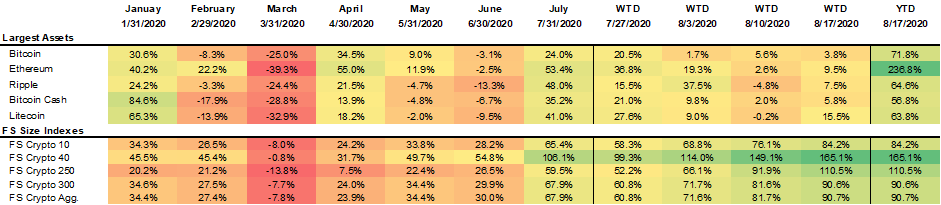

Litecoin, which had lagged all other major crypto assets on YTD basis, led by 6% – 12% this week. Outperformance was primarily driven by bullishness regarding the protocol’s impending privacy upgrade. Referred to as Mimblewimble, the upgrade is expected to help shield the identities of holders of senders while also improving the network’s scalability. It is scheduled for testnet launch in September.

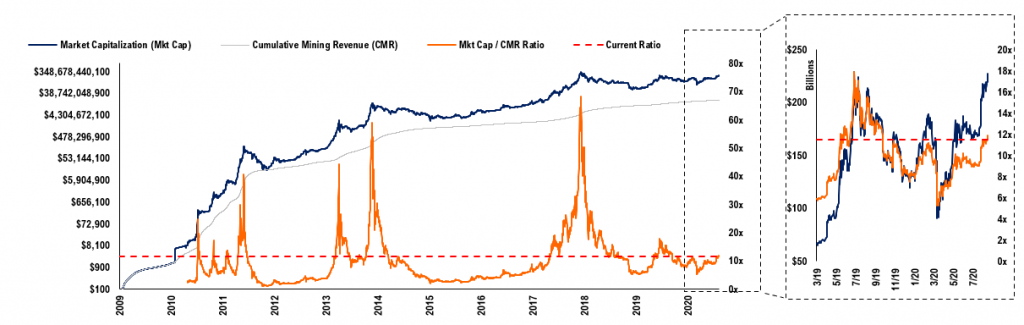

Bitcoin’s Mkt Cap/CMR ratio increased 5.2% week over week from 11.5x to 11.9x. The recent rally has taken the valuation of Bitcoin off the deep value levels seen in March of 2020 at its lows. Bitcoin is now trading at growth at a reasonable price (GARP) levels, consistent with the current expansion stage of the macro market cycle.

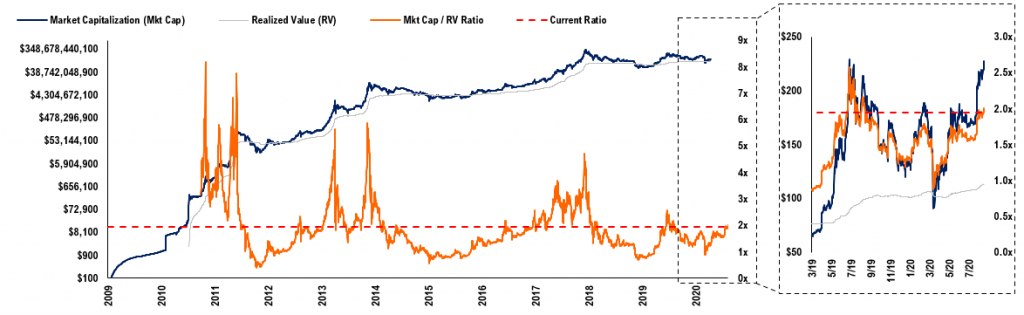

Bitcoin’s Mkt Cap/RV ratio increased was unchanged week over week at 2.0x.

Digital Asset Investment Vehicles & Stocks

Noteworthy this week:

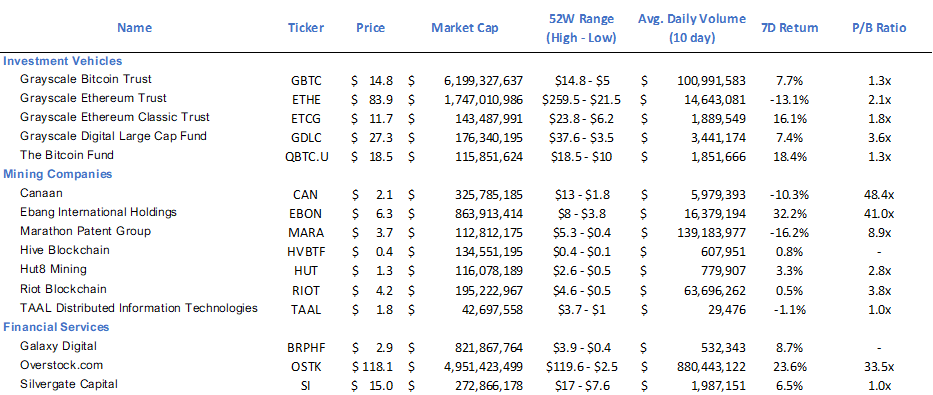

Galaxy Digital Holdings Ltd. (TSX: GLXY): Galaxy reported $38 million in comprehensive income for the second quarter of 2020 relative to $113 million in Q2 2019. The firm said it saw an uptick in trading in its OTC business, reporting $1 billion in volume. “The current quarter gain was largely a result of realized gain on digital assets, i.e. cryptocurrencies which trade continuously in the market,” the firm said.

Marathon Patent Group (NASDAQ: MARA): Last Friday, the Company announced that it has entered into a Long-Term Purchase Contract with Bitmain for the purchase of 10,500 next generation Antminer S-19 Pro ASIC Miners. After the installations go operational this week, the Company expects to generate positive net cash flow, based on the current price of Bitcoin and Hashrate difficulty.

Overstock.com (NASDAQ: OSTK): Shares of Overstock.com have skyrocketed Monday, up by 21%, after getting a bullish initiation from Wall Street. Piper Sandler kicked off coverage of the e-commerce company with an overweight rating. Analyst Peter Keith assigned a price target of $140 on Overstock shares, even as the stock has already gained 1,200% year to date. The COVID-19 outbreak has created a surge in demand for e-commerce tech companies, and Overstock has been able to capitalize on this trend by focusing heavily on its home furnishings category.

Riot Blockchain (NASDAQ: RIOT): Riot Blockchain announced a deal to purchase 8K next-gen Bitmain S19 Pro Antminers for $17.7M from BitmainTech. Receipt and deployment are expected to begin in January and continue through April. Despite Bitcoin’s big recent rise, Riot says the size of the purchase allowed the Company to secure a lower cost per miner than what it’s typically paid. Chairman Remo Mancini calls the mega-order a milestone deal moving the Company towards its goal of becoming one of the largest bitcoin miners in North America. Riot, he says, is seen becoming cash flow positive by year-end 2020.

Winners & Losers

Winner

Coinshares: The digital asset financial service firm CoinShares released an in-depth research report this week, titled A Little Bitcoin Goes a Long Way research report, and its been gaining attention from industry insiders. The report discusses Bitcoin’s place as an alternative asset in a modern portfolio and is worth a read.

Uniswap – Last week, Uniswap announced its $11 million Series A fundraising round. The leading decentralized exchange (DEX) protocol, has hit a record high for user growth. According to The Block Research, Uniswap added 57,976 new users in July as compared to 24,963 in June, i.e. growth of 132%. In August thus far, the exchange has added 27,253 unique users.

Uniswap has been adding users at a growing pace since the launch of its new version, Uniswap V2. The new protocol introduced features like ERC-20 pairs, more manipulation-resilient price oracles and flash swaps, among others. Uniswap currently leads the DEX market, with more than 40% market share as of last month.

Loser

Curve Finance (CRV) – DeFi project Curve Finance appears to have been forced to launch its DAO (decentralized autonomous organization) and governance token CRV after an anonymous developer front run and deployed smart contracts without the knowledge of the Curve team.

The anonymous developer with the handle @0xc4ad tweeted Thursday from a newly created account that Curve’s DAO is “ready to rock.” The developer spent 19.9 ETH (~$8,000) in fees to deploy the contracts. Around 80,000 CRV tokens were reportedly pre-mined before the Curve team verified the deployed contracts. Curve was initially “skeptical,” but later found out that the deployment was with “correct code, data and admin keys.“ Some observers have termed the early launch of Curve’s DAO and token as “shady.” The nature of permissionless networks means anyone can deploy codes.

Financing & M&A Activity

Noteworthy this week:

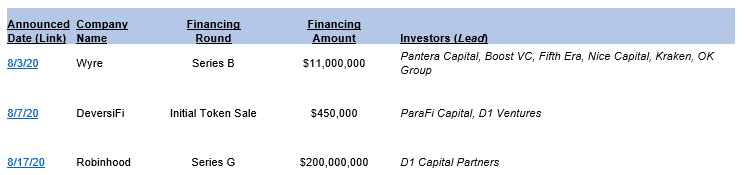

DeversiFi – a decentralized crypto exchange spun out of Bitfinex that leverages StarkWare’s batching technology, raised $450K from D1 Ventures and ParaFi. The funds invested $450K in Tether tokens, in return for the exchange’s NEC governance token.

Robinhood – Brokerage app company Robinhood has raised $200 million in a Series G funding round, adding D1 Capital Partners as a new investor. the new funding elevates its valuation to $11.2 billion. The move comes roughly two months after Robinhood raised $320 million at an $8.6 billion valuation during a round that added TSG Consumer Partners and IVP as new investors.

Recent Research

Tom Lee: Fundstrat’s Tom Lee on why boomers are buying gold while Millennials are trading bitcoin

Leeor Shimron: Global DeFi Summit: The Coming Age of Yield Farming

David Grider: Digital Assets Weekly: August 11th