Digital Assets Weekly: July 29th

Market Analysis

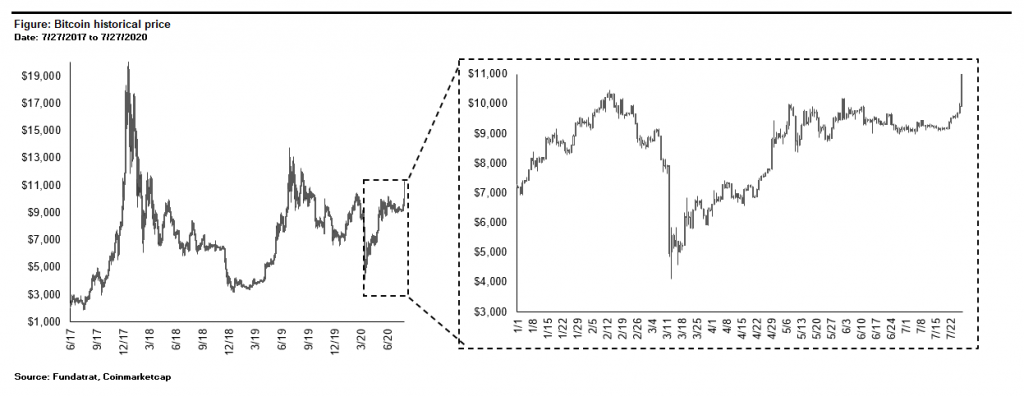

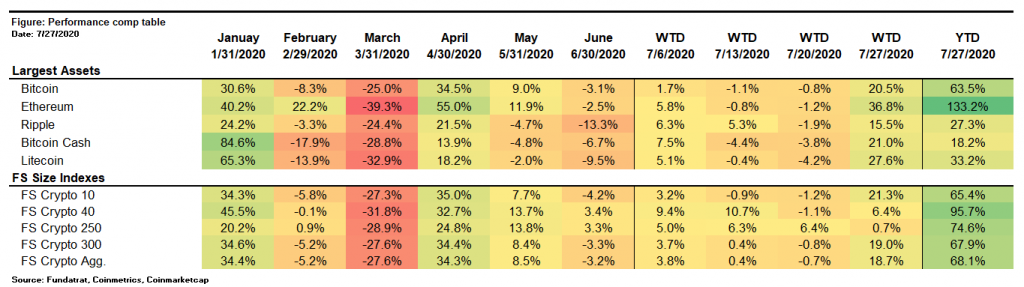

At the beginning of the week, BTC awoke from its slumber and ripped to a new 2020 high of $11,420 on Monday. BTC finished the 7-day period ending 7/27 at $10,990; up 20% week over week.

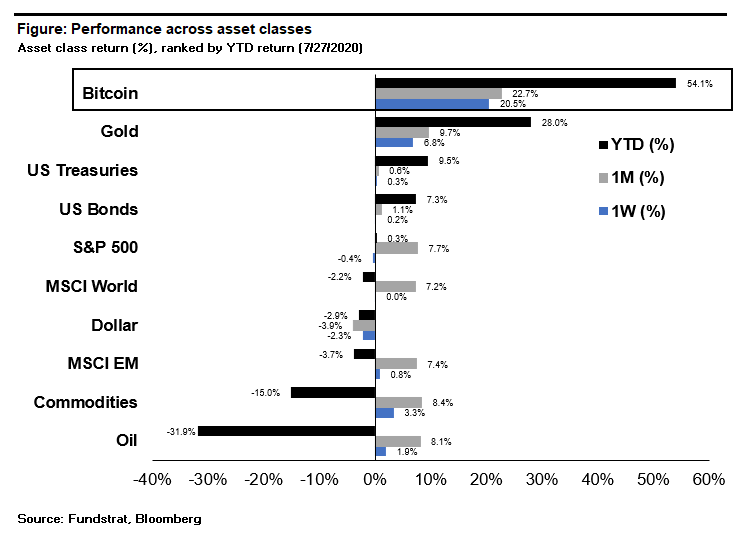

Even though Gold has been enjoying a significant run and breached new all-time highs, Bitcoin is still solidly outperforming Gold and all other major asset classes YTD.

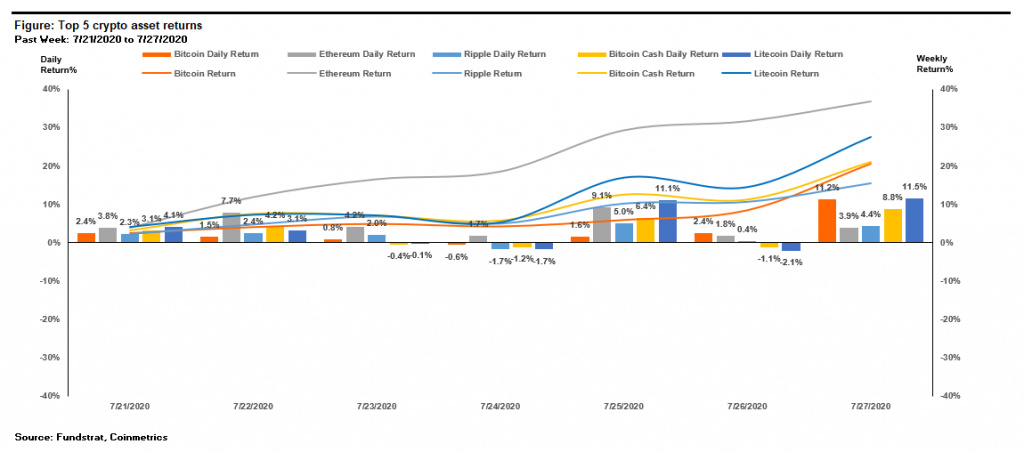

The crypto majors all had significant gains this week, with Ethereum posting the greatest gain of 36%, largely driven by the continuation of positive DeFi momentum.

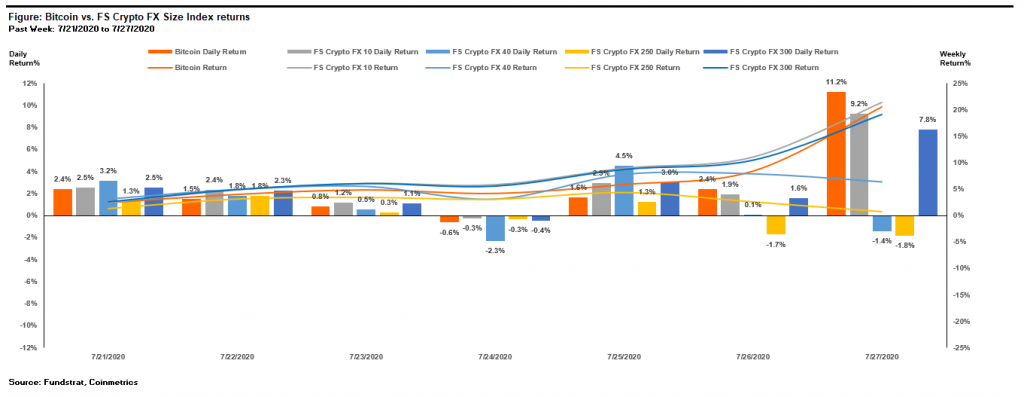

FS Crypto FX 10 had the strongest performance this week with a gain of 21%, slightly outperforming BTC and the micro-caps (FS Crypto FX 300 +19%) and significantly outperforming the mid-caps (FS Crypto FX 40 +6.4%).

The table below shows the returns of the largest assets and the FS Size Indexes over the year.

Fundamental Valuations

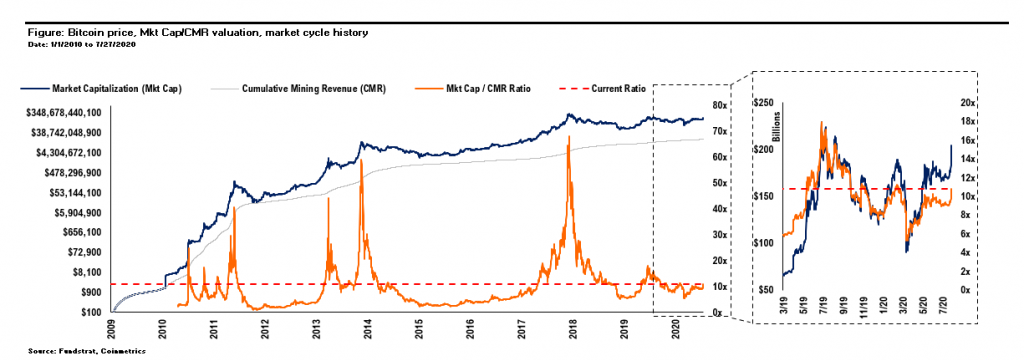

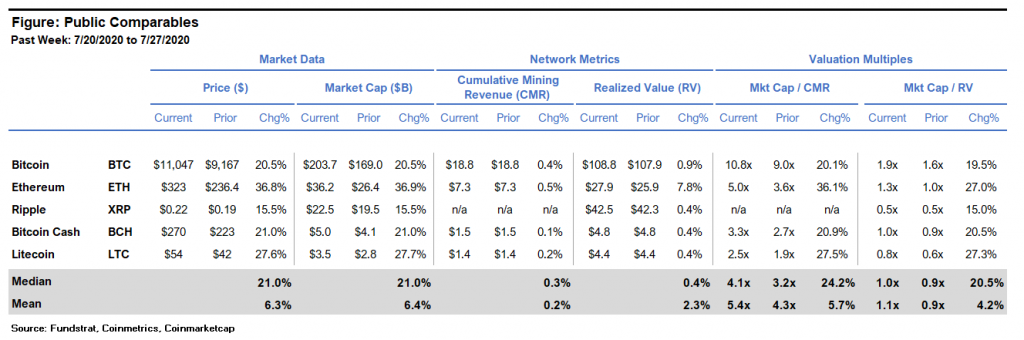

Due to the recent surge, Bitcoin’s P/CMR valuation increased 20.1% from 9.0x to 10.8x.

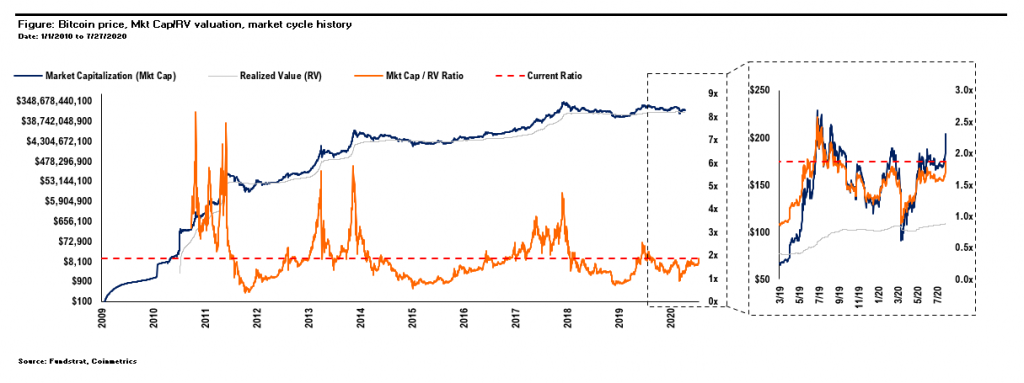

Bitcoin’s market cap to realized value (MV/RV) multiple also increased 19.5% from 1.6x to 1.9x.

The comp table for major crypto asset prices and fundamental valuations is shown below.

Valuation Methodology

The P/CMR ratio is a fundamental valuation method I invented in December 2017 that has historically been a strong predictor of price movements. It functions like a Price/Book (Crypto P/B) ratio by telling investors if a crypto asset is relatively cheap or expensive. It’s calculated by comparing the Market Cap to Cumulative Mining Revenue (Mkt Cap/CMR). The ratio can be calculated on a per coin basis (P/CMR) by adjusting the Mkt Cap and CMR by outstanding supply. Read more.

The MV/RV ratio is another method later developed that takes a similar approach but adjusts the denominator value based on the last time coins were moved. Read more.

The P/CMR and MV/RV metrics gives an approximate measure of unrealized profit, and therefore an investors incentive to sell or hold. The P/CMR ratio gives a measure closer to the absolute floor value of sunk costs for all investors while the MV/RV ratio gives the highest end of the range. Its best to take multiple approaches when valuing any asset. These two have been the best for crypto assets in my experience, and the answer probably lies in the middle.

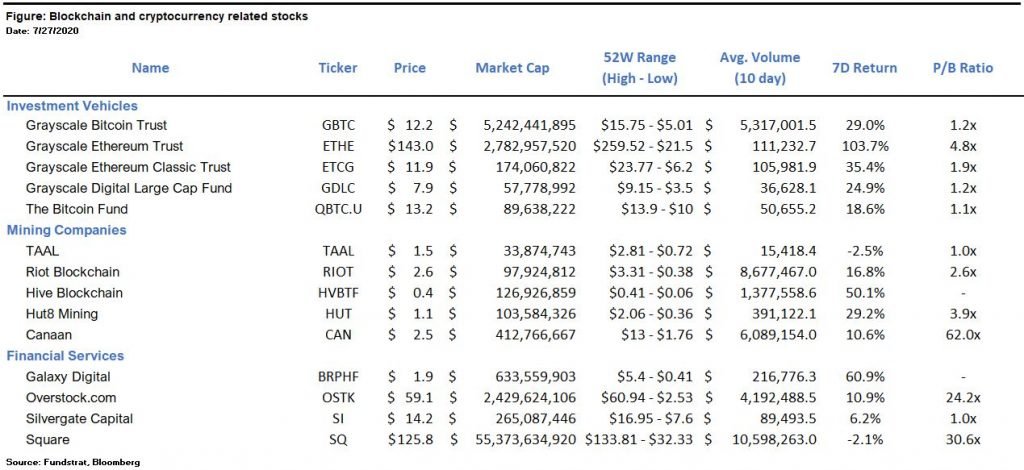

Blockchain & Crypto Stocks

Noteworthy this week:

3iQ (TSX) – Canadian investment fund manager 3iQ Corp. announced Friday that its Ether Fund has filed for an IPO with the securities regulators in all provinces and territories of Canada, except for Quebec. Furthermore, its preliminary IPO prospectus has been green-lighted by a regulator. The Ether Fund intends to raise a minimum of $10.75 million and a maximum of $107.5 million by issuing Class A units at $10.75 and Class F units at $10.53. The Ether Fund reportedly aims to list on the Toronto Stock Exchange (TSX) as does the Bitcoin Fund.

Canaan (NASDAQ: CAN) – The Bitcoin mining hardware manufacturer gained 10.6% as the price of Bitcoin surged.Even though the Bitcoin protocol had a halving event in May which effectively slashed miner revenues in half, Bitcoin price appreciation increases the demand for mining hardware and benefits the manufacturer.

Grayscale Ethereum Trust (OTCQX: GBTC) – after spending most of the previous week in the single digits, the GBTC premium to NAV grew to 26% this week alongside the rise in Bitcoin’s price. GBTC remains the primary way for investors to gain BTC exposure in their retirement and brokerage accounts. However, other firms like Bitwise are seeking to launch similar products to trade OTC, such as the Bitwise 10 Index Fund and the Bitwise Bitcoin Fund, which may serve as an alternative for investors.

Silvergate Capital Corporation (NYSE:SI) – Posting its 2Q results, net income for the quarter was $5.5M, compared to net income of $4.4M for 1Q 2020, and net income of $5.2M for 2Q 2019. Digital currency customers grew to 881 at June 30, 2020 compared to 850 at March 31, 2020, and 655 at June 30, 2019. The Silvergate Exchange Network (“SEN”) handled 40,286 transactions in 2Q 2020, an increase of 28% compared to 31,405 transactions in the 1Q 2020, and 12,254 transactions in the 2Q 2019. The SEN handled $22.4B of USD transfers in 2Q, an increase of 29% compared to $17.4B in 1Q 2020, and $8.6B in 2Q 2019. The positive results caused the stock to increase 6.2% on the week.

Square (NYSE: SQ) – Barclays Equity Research raised its price target on Square 26% from $115 to $145. When discussing the stock’s recent performance, Barclays cited “the main driver has likely been Cash App, whose revenues have been roughly doubling year over year consistently for several quarters.” Square will report its 2Q earnings on August 5 after the market close.

Winners & Losers

Winner: Yearn.finance (YFI) – As DeFi yield farming kicked into high gear, this lending protocol and liquidity mining aggregator launched its governance token YFI. Prior to the introduction of the token, the protocol had around $8M in assets under management which quickly grew to over $400M after the token was introduced. Interestingly, the token had a “fair launch” in which 30,000 tokens were distributed equally to users of the platform and liquidity providers, rather than having any form of token sale or premine. At its peak, the token reached $3,907, representing an increase of 11,000% over the last week.

Loser: Prime Factor Capital – The first cryptocurrency hedge fund in the U.K. to win approval from the country’s government is closing its doors. Founded by former BlackRock execs and granted approval from the U.K. Financial Conduct Authority last summer, the Fund is shuttering “due to insufficient demand from institutional investors,” according its CEO, Nic Niedermowwe. According to a Crypto Fund Research report, at least 68 crypto hedge funds closed last year internationally, almost double the number, 35, in 2018.

Financing & M&A Activity

Bitcoin Suisse – a Zug-based financial services provider for the digital asset industry raised a $48M Series A round for 16.4% of total equity, including the issuance of 10% of new shares, pushing its valuation to CHF 302.5M (~$327M). Funds will be used to expand core capital and credit business, provide additional liquidity for brokerage business and proprietary trading, and provide capital for and setup of Liechtenstein bank.

Spencer Dinwiddie – the Brooklyn Nets point guard, raised $1.35M by selling tokenized shares backed by his NBA contract. Dinwiddie’s issuer SD26 LLC sold 9 of the 90 available tokenized contract shares, priced at $150,000, to 8 investors. The amount raised was 10% of the target raise of $13.5M. He first proposed tokenizing his 3-year contract in Sep 2019, but faced pushback from the NBA.

Teller – the blockchain project is building an algorithmic credit risk protocol for decentralized finance and was incubated by A16Z’s crypto startup school. It raised a $1M Seed led by Framework Ventures with participation from ParaFi Capital and Maven11 Capital. The protocol aggregates data from legacy credit scoring systems, like Equifax, into decentralized lending markets.

VALR – the South African cryptocurrency exchange raised 57M rands (~$3.45M) in a Series A round led by 100x Ventures, the investment arm of 100x Group, with participation from 4Di Capital, Bittrex, and former CEO of FirstRand’s First National Bank. Funds will be used to expand into new markets across South Africa, launch new products and services such as derivatives trading and lending, and strengthen its team of technology, compliance, and client service functions.

Recent Research & Upcoming Events

Access Fundstrat’s recent crypto insights if you missed them by clicking below or visiting FSInsight.

- Leeor Shimron: Leeor will be moderating a panel on DeFi Yield Farming at the Global DeFi Summit free online event on August 6th

- FS Digital Asset Strategy Team: Business Use Cases of the Bitcoin SV Blockchain

- David Grider: Digital Assets Weekly: July 22nd