Digital Assets Weekly: July 22nd

Market Analysis

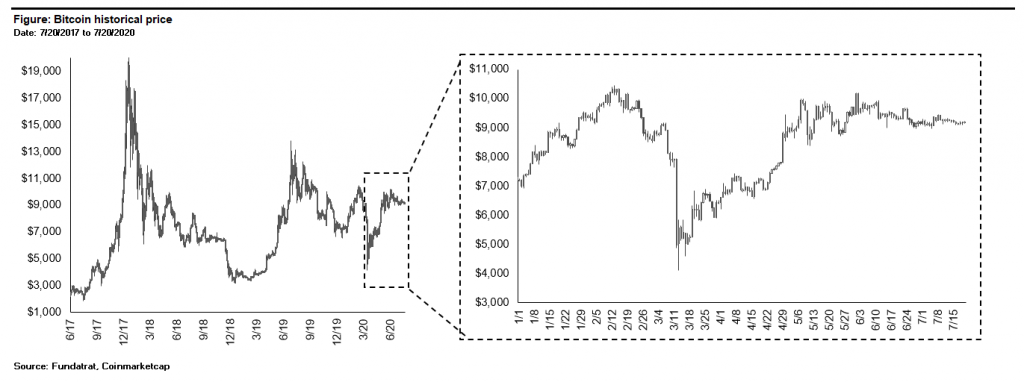

This week, the crypto majors continued their slumber as BTC tightened its trading range between $9,089 and $9,283. The asset finished the 7 days ended 7/20 at $9,164; down 0.8% week over week.

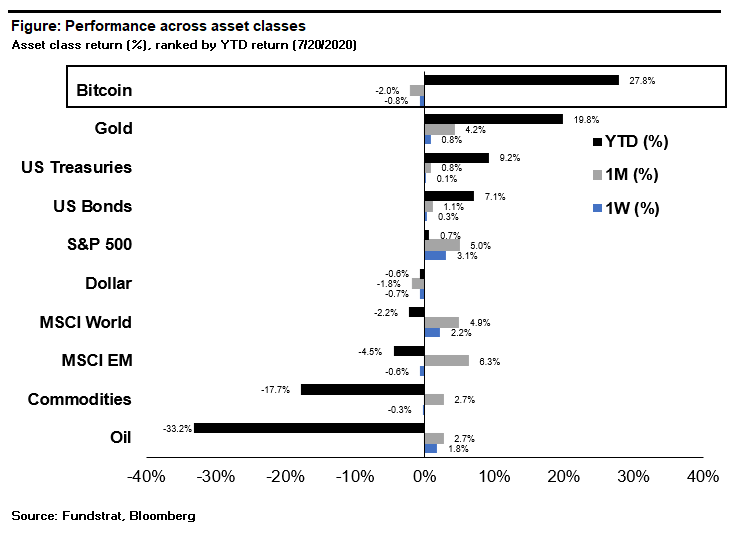

Despite the period of consolidation, Bitcoin remains firmly ahead of gold as the best performing asset class on a YTD basis.

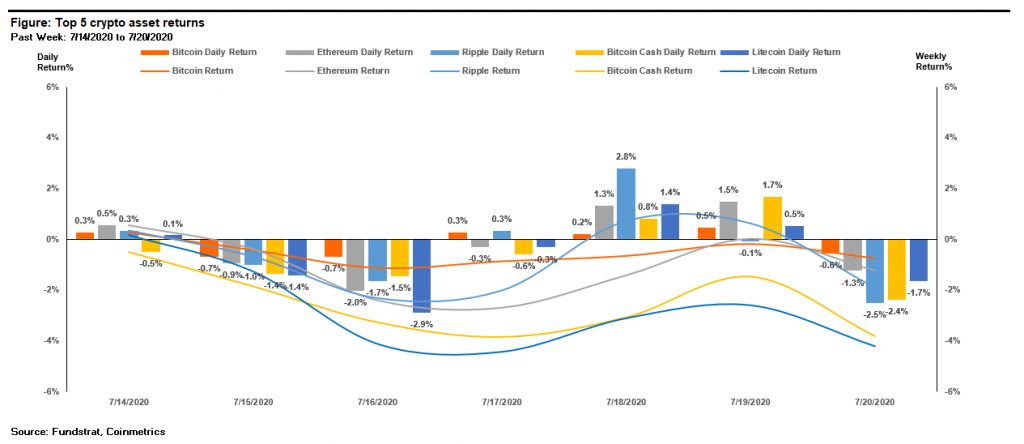

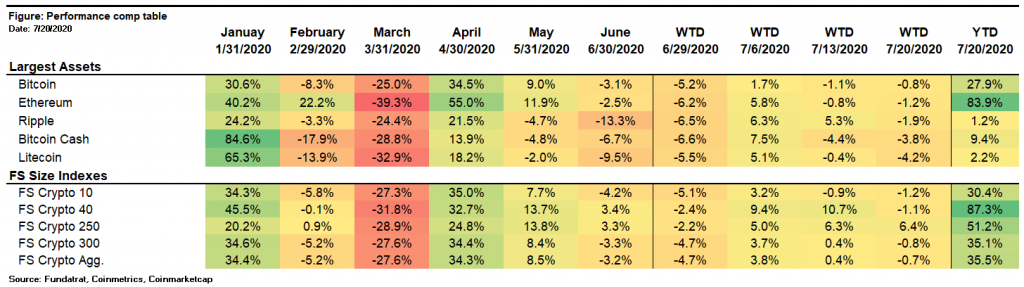

All major crypto assets saw slight dips in price over the week with Litecoin declining the most at -4.2%.

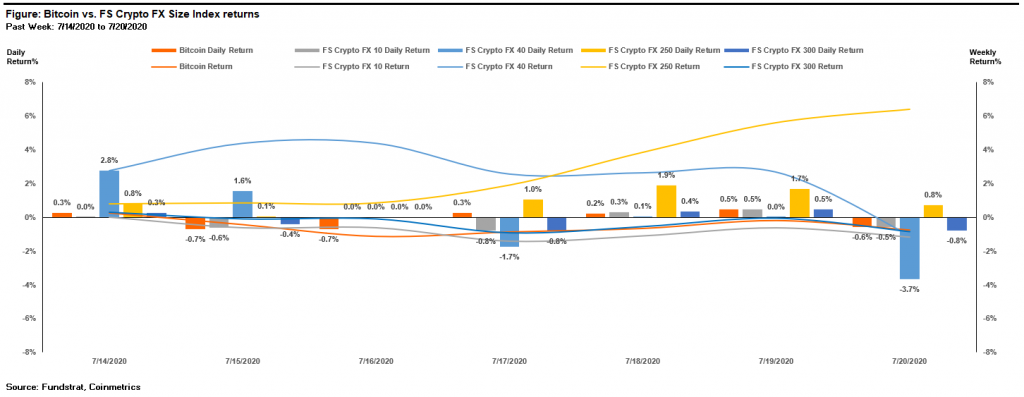

FS Crypto FX 250 had the strongest performance this week with a gain of 6.4%, driven by DeFi projects’ outperformance including Aave (+31%), Ampleforth (+63%), and Kava (+39%). FS Crypto FX 10, 40, and 300 Indexes performed in line with BTC with minor declines of about -1%.

The table below shows the returns of the largest assets and the FS Size Indexes over the year.

Fundamental Valuations

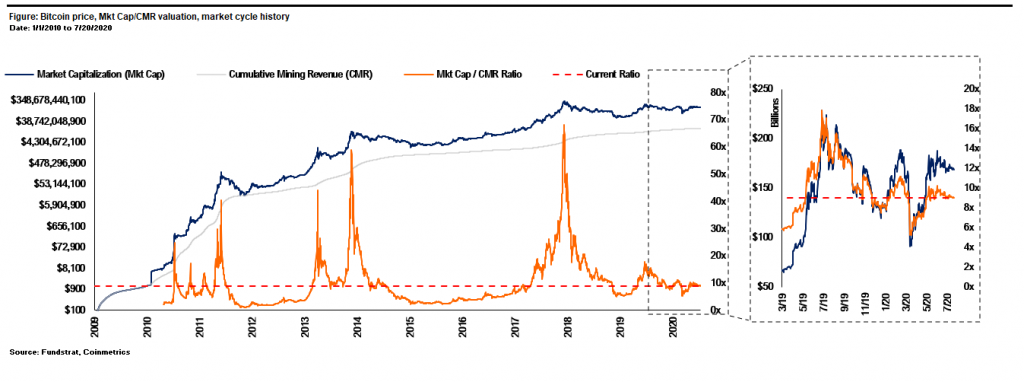

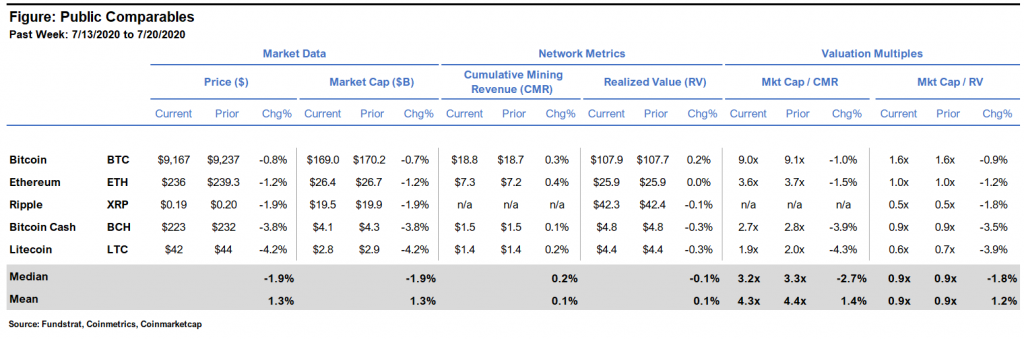

Bitcoin’s P/CMR valuation decreased slightly week over week from 9.1x to 9.0x.

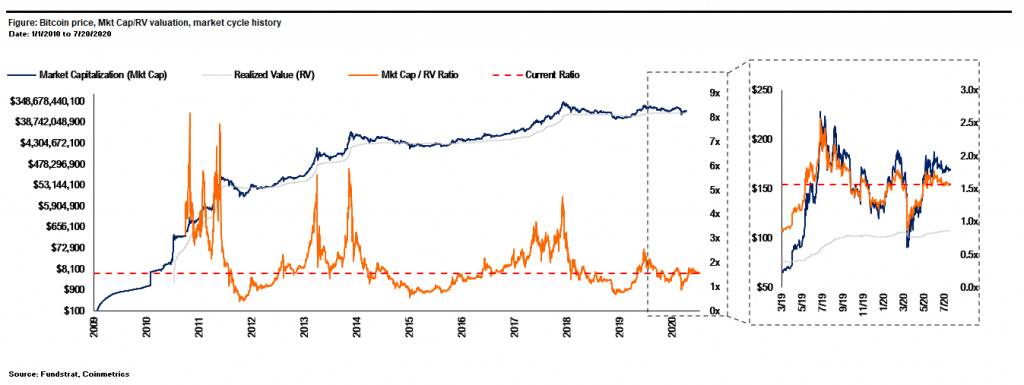

Bitcoin’s market cap to realized value (MV/RV) multiple was unchanged week over week at 1.6x.

The comp table for major crypto asset prices and fundamental valuations is shown below.

Valuation Methodology

The P/CMR ratio is a fundamental valuation method I invented in December 2017 that has historically been a strong predictor of price movements. It functions like a Price/Book (Crypto P/B) ratio by telling investors if a crypto asset is relatively cheap or expensive. It’s calculated by comparing the Market Cap to Cumulative Mining Revenue (Mkt Cap/CMR). The ratio can be calculated on a per coin basis (P/CMR) by adjusting the Mkt Cap and CMR by outstanding supply. Read more.

The MV/RV ratio is another method later developed that takes a similar approach but adjusts the denominator value based on the last time coins were moved. Read more.

The P/CMR and MV/RV metrics gives an approximate measure of unrealized profit, and therefore an investors incentive to sell or hold. The P/CMR ratio gives a measure closer to the absolute floor value of sunk costs for all investors while the MV/RV ratio gives the highest end of the range. Its best to take multiple approaches when valuing any asset. These two have been the best for crypto assets in my experience, and the answer probably lies in the middle.

Blockchain & Crypto Stocks

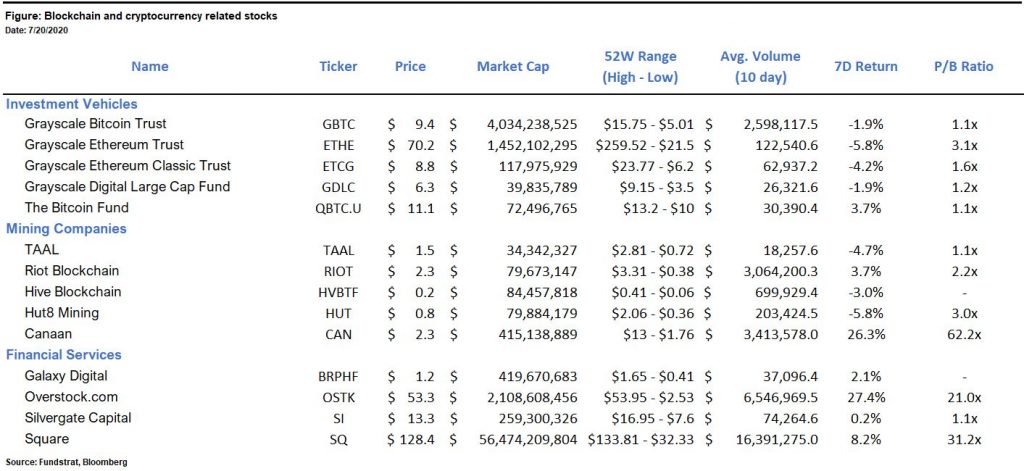

The table above shows publicly traded blockchain and crypto related stocks, which offer a vehicle for investors who are constrained from owning underlying crypto assets themselves.

Noteworthy this week:

Square (NYSE: SQ) – Square continued its rally last week as its price target was raised to $140 from $125 by KeyBanc analyst Josh Beck (overweight). He cited debit/credit card data indicating there was growing acceleration throughout the 2Q, with Cash App growing 130% in June, above April/May levels.

Overstock (NASDAQ: OSTK) – Overstock had a tremendous week appreciating 27% as global quarantines trapped consumers at home and caused the web-based commerce giant to gain user traffic. Citi projects by 2022 e-commerce will increase 43% and brick-and-mortar retail will fall 4%, largely induced by the pandemic. Furthermore, Overstock’s crypto exchange tZERO has seen its strongest month ever recently transacting over 423,000 digital securities in May 2020, 4x that transacted in May 2019.

Silvergate Capital Corporation (NYSE:SI) – Silvergate will release its second quarter earnings before the market open on Monday July 27th, 2020. The analyst consensus estimate is EPS of $0.19 and revenue of $19.8M, which would be slightly down from its reported Q1 EPS of $0.20 on revenue of $20.4 million. Silvergate beat its last quarter analyst estimates by $0.05 and $3.5M for EPS and revenue respectively.

Grayscale Ethereum Trust (OTCQX: GBTC) – The GBTC premium to NAV spent most of the week in the single digits; however, it jumped up to 13% today. The GBTC premium to NAV can be viewed as a proxy gauging institutional interest in Bitcoin.

Riot Blockchain, Inc. (NASDAQ: RIOT) – The mining company has received 1,000 S19 Pro miners, the first of three orders cumulatively totaling 3,040 S19 and S19 Pro Antminers from Bitmain at their Massena, New York facility. Once all miners are deployed, Riot estimates the aggregate hashing power capacity of its fleet of 7,040 next generation miners (4,000 S17 Pro, 2,000 S19 Pro and 1,040 S19 miners) will be approximately 566 PH/s, representing a 129% increase over the Company’s current hash rate capacity.

Winners & Losers

Winner: Aave (LEND) – As the DeFi space heats up, Aave has been one of the main beneficiaries posting a gain of 31% this week. The lending protocol has a reported marketcap of $400M and total value locked (TVL) of $481M in crypto assets locked in the protocol.

Loser: Twitter – Twitter suffered from a catastrophic social engineering attack on an employee admin panel. The attacker gained control of the platform’s user handles and was able to successfully penetrate about 130 high-profile accounts such as Joe Biden, Elon Musk, and Kim Kardashian. The attacker used the platform to post a Bitcoin scam giveaway and was able to steal approximately $120,000 worth of Bitcoins. The hack urged the Company to rethink its security and may place a spotlight on decentralized alternatives.

Financing & M&A Activity

Aave – The Ethereum-based DeFi lending protocol raised $3M from Framework Ventures and Three Arrows Capital through the sale of its LEND token sale. The funds purchased ~30M LEND at $0.10 apiece, which together are now worth ~$7M. Separately, ParaFi Capital also holds ~$4.5M worth of LEND, which they accumulated through market purchase and a token sale with the Aave team.

Avalanche Foundation Limited – The foundation behind the New York Based Avalanche DeFi platform raised $42M through the sale of its native token, AVAX, in a public financing round that concluded on July 22. Proceeds from the sale will be used for the sustained growth and development of the Avalanche network. This raise comes on top of a $12M private token sale that the Company conducted in June. Tokens will be distributed upon launch of the Avalanche mainnet which is anticipated by end of August.

Celsius Network – The crypto interest and lending platform with $6.2B in loans and $630M in assets raised $10M from Tether, the stablecoin company, at a $120M pre-money valuation, bringing the post-money valuation to $150M.

Swipe – A provider of Visa crypto debit cards, was acquired by Binance. Swipe has offices in the UK and Estonia and has a presence across 31 countries within the EEA. Financial terms were not disclosed.

Recent Research & Upcoming Events

Access Fundstrat’s recent crypto insights if you missed them by clicking below or visiting FS Insight.

- Leeor Shimron: Leeor will be moderating a panel on DeFi Yield Farming at the Global DeFi Summit free online event on August 6th

- David Grider: Digital Assets Weekly: July 15th

- Tom Lee: Tom’s Take on Crypto: The Ten Rules of Bitcoin Investing: Rule No. 5

- Robert Sluymer: Crypto Technical Analysis: Crypto sells off with risk assets but is holding above first key support