Digital Assets Weekly: June 9th, 2020

Market Analysis

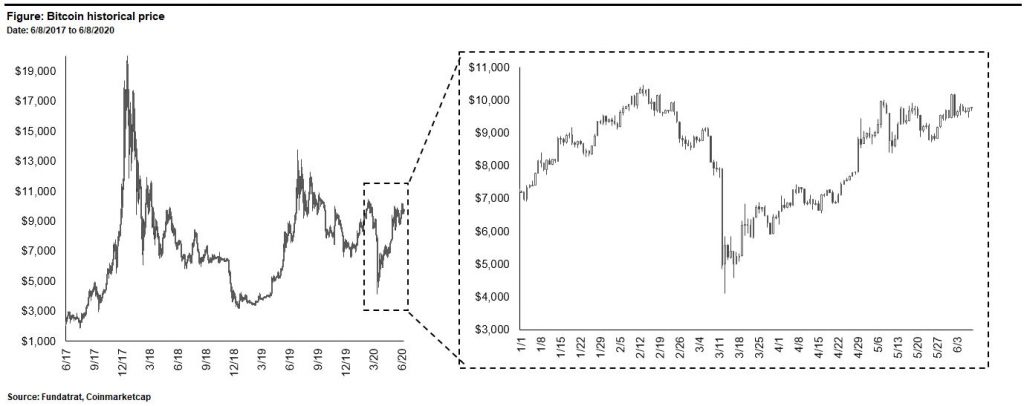

This week, Bitcoin’s price volatility dropped to its lowest level since the Black Thursday crash on March 12th; indicating a sustained lack of definitive direction in the market over the past few weeks.

Following Black Thursday, Bitcoin rallied over 150% leading up to the mining reward halving, but has yet to establish a prolonged break above its key $10K resistance level. As of June 8th, it was trading at $9,771.

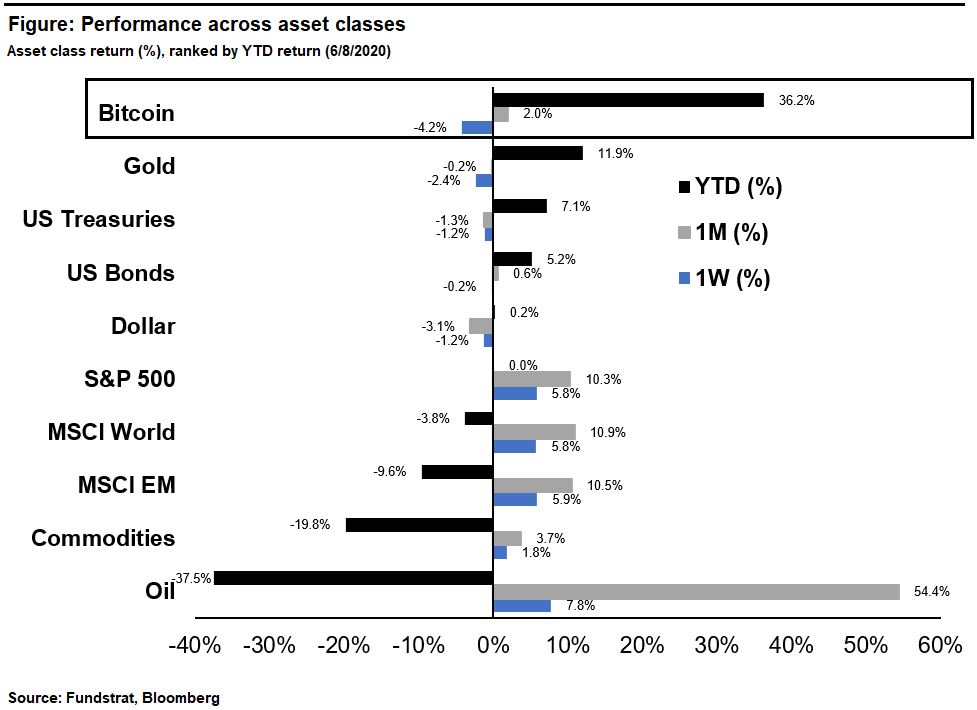

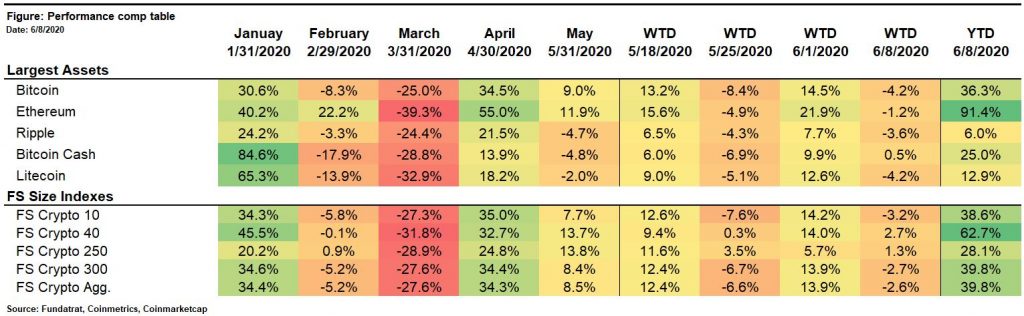

Bitcoin remains firmly ahead of gold as the best performing asset class on a YTD basis with a 36% gain to date. As of June 8th, the S&P 500 was flat on a YTD basis.

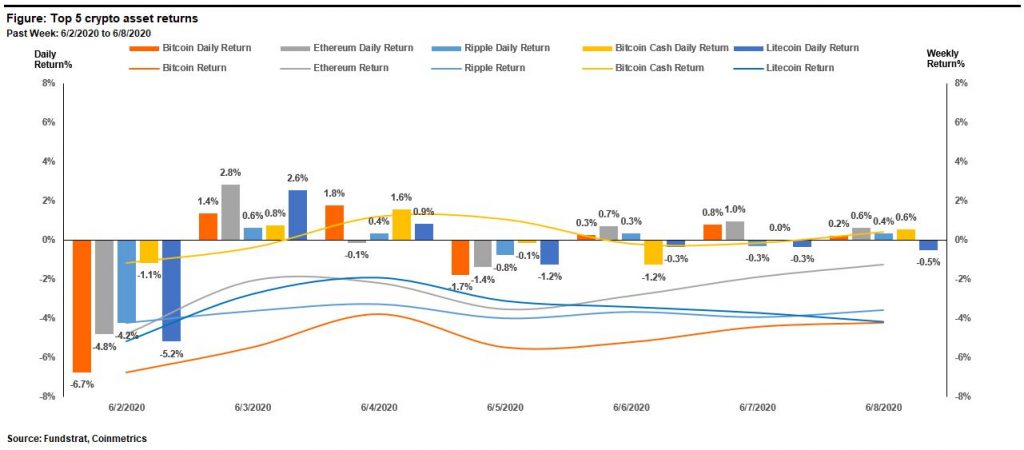

Bitcoin Cash led all other major crypto assets over the past week by 2% – 4%.

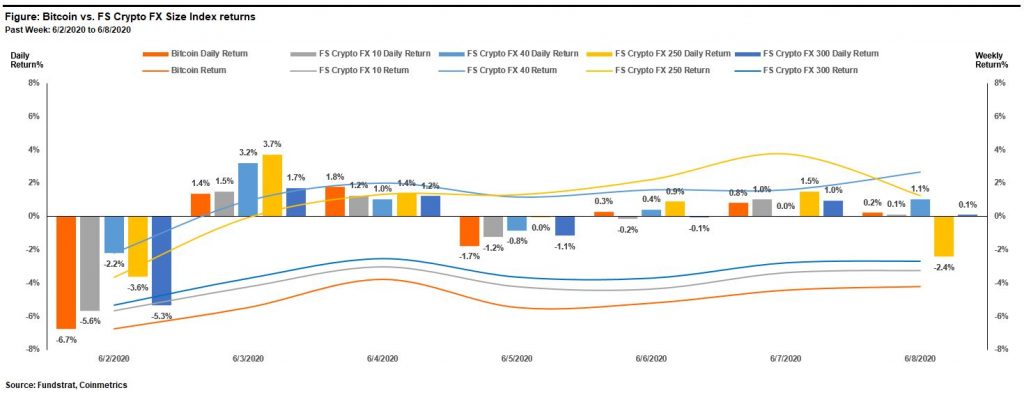

FS Crypto FX 40 was the best performing index last week and was up 2.7%. Major contributors to the outperformance of the FS Crypto FX 40 were Crypto.com Coin (+16%), and Cardano (+6.5%).

The table below shows the returns of the largest assets and the FS Size Indexes over the year.

Fundamental Valuations

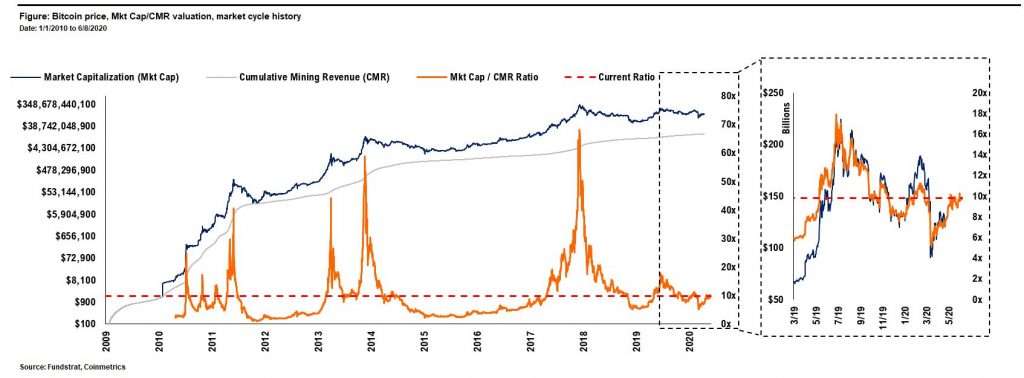

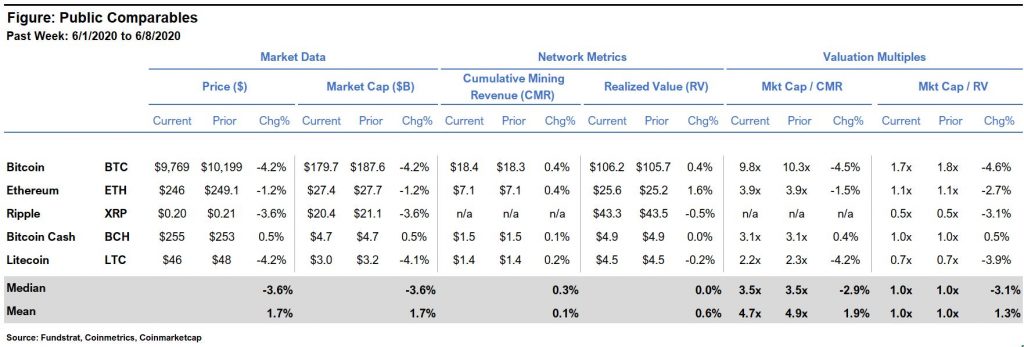

Bitcoin’s P/CMR valuation stood at 9.8x as of 6/8 vs 10.3x as of last week. This value remains slightly below the levels from Mar-19 through present.

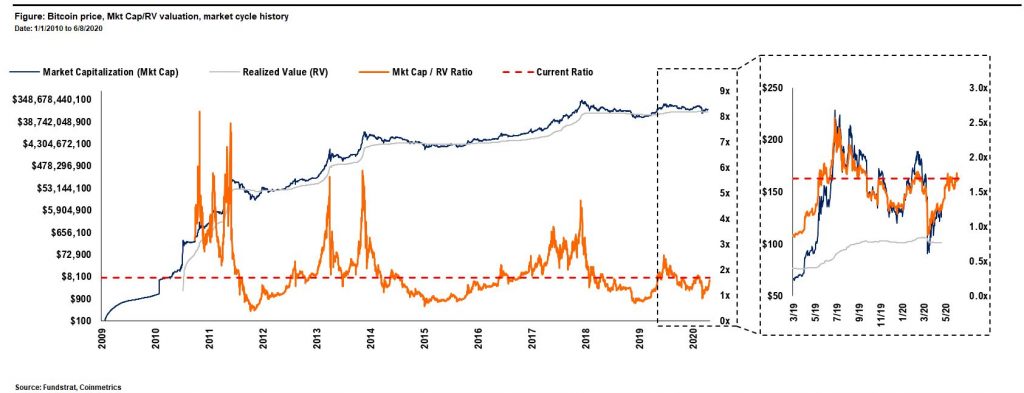

Bitcoin’s market cap to realized value (MV/RV) multiple was 1.7x as of 6/2 vs 1.8x last week.

The comp table for major crypto asset prices and fundamental valuations is shown below.

Valuation Methodology

The P/CMR ratio is a fundamental valuation method I invented in December 2017 that has historically been a strong predictor of price movements. It functions like a Price/Book (Crypto P/B) ratio by telling investors if a crypto asset is relatively cheap or expensive. It’s calculated by comparing the Market Cap to Cumulative Mining Revenue (Mkt Cap/CMR). The ratio can be calculated on a per coin basis (P/CMR) by adjusting the Mkt Cap and CMR by outstanding supply. Read more.

The MV/RV ratio is another method later developed that takes a similar approach but adjusts the denominator value based on the last time coins were moved. Read more.

The P/CMR and MV/RV metrics gives an approximate measure of unrealized profit, and therefore an investors incentive to sell or hold. The P/CMR ratio gives a measure closer to the absolute floor value of sunk costs for all investors while the MV/RV ratio gives the highest end of the range. Its best to take multiple approaches when valuing any asset. These two have been the best for crypto assets in my experience, and the answer probably lies in the middle.

Blockchain & Crypto Stocks

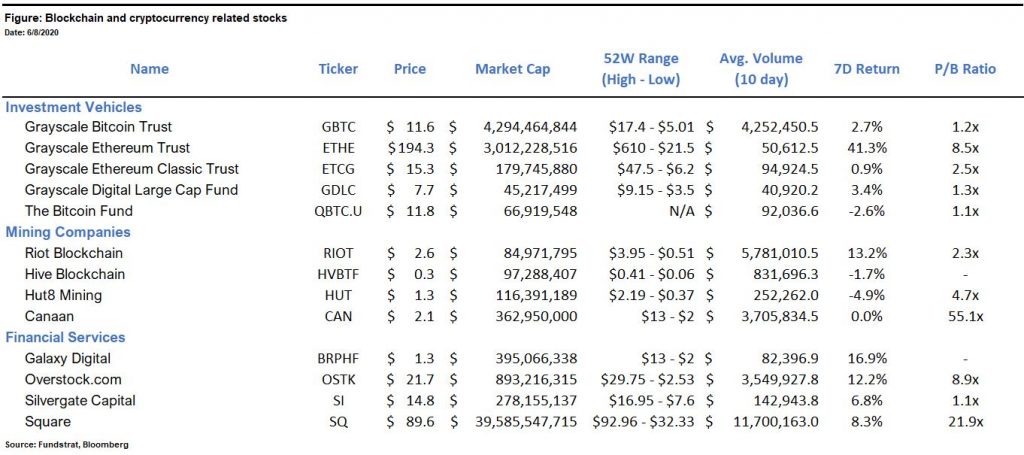

The table shows publicly traded blockchain and crypto related stocks, which offer a vehicle for investors who are constrained from owing underlying crypto assets themselves.

Noteworthy this week:

Grayscale Ethereum Trust (OTCX: ETHE): Shares of ETHE were up 41% on the week as the asset’s premium to NAV widened from 416% as of June 1st to 750% as of June 8th.

Portfolio Strategy

| Bitcoin Outlook | Date |

| Buy Bitcoin ($16,500) | 5/12/2020 |

| Buy Bitcoin ($14,350) | 3/26/2020 |

| Buy Bitcoin ($13,500) | 3/17/2020 |

| Portfolio Allocation | |

| OW “crypto assets” vs. “market portfolio” (1%-2% vs. 0.1%) | 3/26/2020 |

| Market Positioning | |

| OW “blue chip alts” vs. “Bitcoin” | 3/27/2020 |

| OW “large cap” vs. “small cap” crypto assets | 3/26/2020 |

| OW “defensive PoW” vs. “cyclical PoS” crypto assets | 3/26/2020 |

| Asset Selection | |

| UW “Ripple” vs. “market crypto portfolio” | 4/14/2020 |

| OW “Ethereum” vs. “market crypto portfolio” | 4/3/2020 |

| MW Ethereum vs. “market crypto portfolio” | 3/26/2020 |

| Blockchain & Crypto Stocks | |

| Avoid ETHE | 4/3/2020 |

| Source: Fundstrat |

Winners & Losers

Winner: Circle – Bank Frick, the Liechtenstein based bank, now allows clients to trade and custody Circle’s USDC stablecoin. According to a spokesperson from the bank, the addition of USDC is expected to significantly reduce the processing time compared to the classic SWIFT procedure. Circle’s CEO, Jeremy Alliare, said the Company is expecting a surge of regulated banks adding support for USDC in the year ahead.

Loser: Modern Money Team (MMT) – The U.S. Securities and Exchange Commission moved to freeze the assets of cryptocurrency mining and marketing company, MMT. Charges claim that the Company lied to investors and misappropriated up to $12MM of investor funds.

Financing & M&A Activity

Numerai – The San Francisco based crypto hedge fund raised $3M in token sale led by Union Square Ventures with participation from Placeholder, Dragonfly Capital Partners, and CoinFund. The sale comes on top of a $11M token sale the Company conducted in Mar-19

Omniex – The San Francisco based crypto asset brokerage platform raised $14M in a Series A led by SIX group with participation from Jump Capital, Wicklow Capital and Sierra Capital.

Avanti Bank – The Wyoming based digital asset bank raised $5M in a round with participation from University of Wyoming Foundation, Blockchain Capital, Morgan Creek, and Digital Currency Group among others. The Company is in the process of applying for a charter application with the Wyoming Division of Banking.

Kingdom Trust – The Kentucky based crypto custodian acquired Choice Holdings, a self-service retirement platform with digital assets support for an undisclosed sum.

Recent Research

Access Fundstrat’s recent crypto insights if you missed them by clicking below or visiting FS Insight.

- Tom Lee: Tom’s Take on Crypto: The Ten Rules of Bitcoin Investing: Rule No. 4

- Robert Sluymer: Crypto Technical Analysis: BTC whipsaws but select Alts soldier higher following May break-outs

- Ken Xuan: Crypto Quant: Benchmark Crypto Indices Weekly Performance Review

- David Grider: Digital Assets Weekly: June 3rd, 2020