Digital Assets Weekly: June 3rd, 2020

Market Analysis

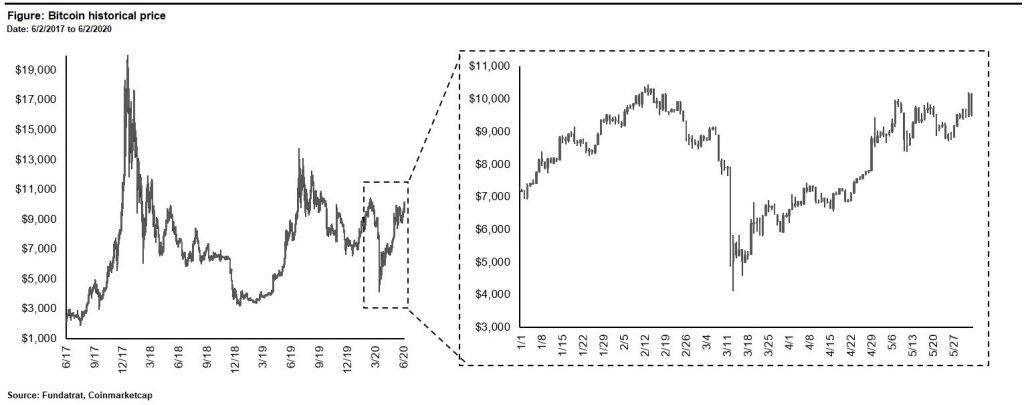

Bitcoin climbed as high as $10,200 on Monday June 1st before retracing to $9,530 by Tuesday’s close and ending the week up 7.2%. According to research from CryptoQuant, this latest dip could be attributable to the 5th largest mining pool, which is unknown, liquidating a large stock of coins on Wednesday as Bitcoin surpassed $10,000.

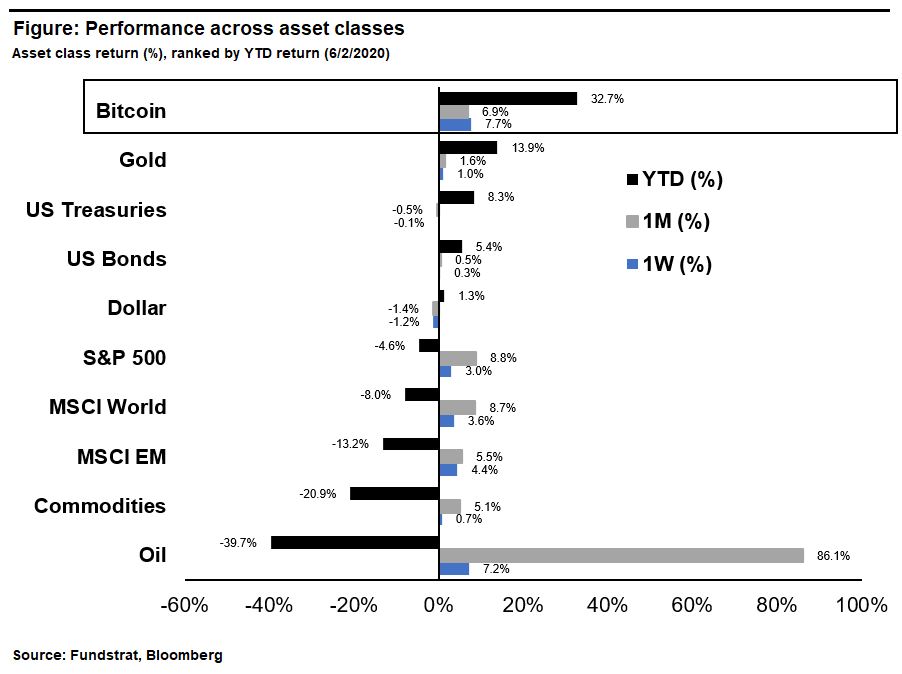

Bitcoin remains firmly ahead of gold as the best performing asset class on a YTD basis.

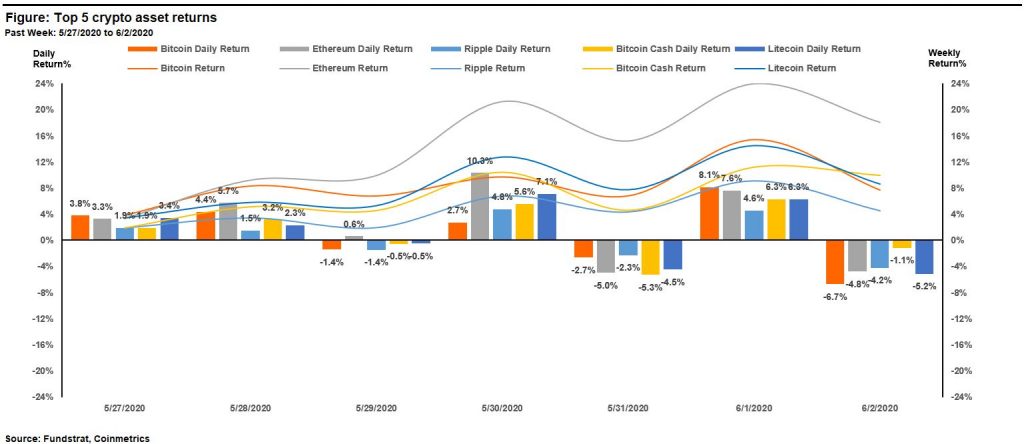

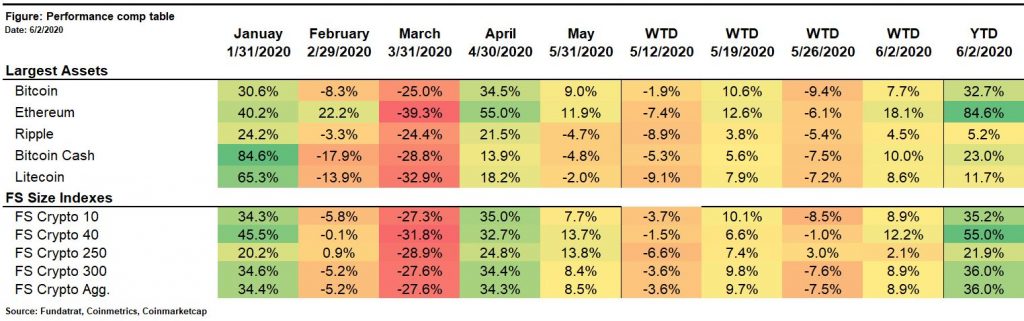

Ethereum led all other major crypto assets over the past week; posting a strong 18.1% return. Ripple lagged all other major coins with a 4.5% return on the week.

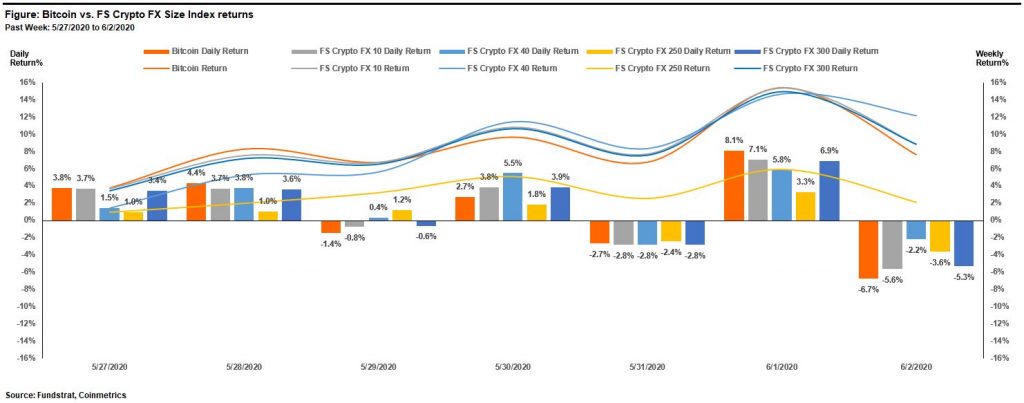

With the exception of the FS Crypto FX 250, all size-based indices outperformed Bitcoin over the past week. FS Crypto FX 40 was the best performing index and was up 12.2%. Major contributors to the outperformance of the FS Crypto FX 40 were Cardano (47%), and Chainlink (14.4%).

The table below shows the returns of the largest assets and the FS Size Indexes over the year.

Fundamental Valuations

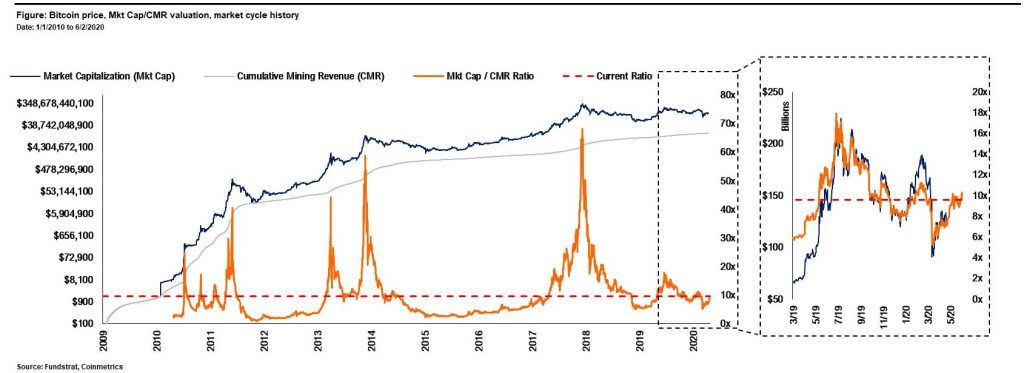

Bitcoin’s P/CMR valuation stood at 9.6x as of 5/27 vs 8.9x as of last week. This value remains slightly below the levels from Mar-19 through present.

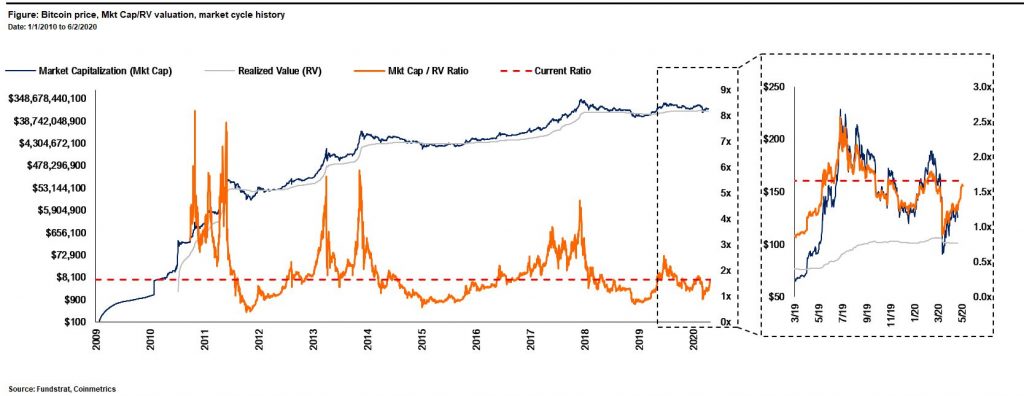

Bitcoin’s market cap to realized value (MV/RV) multiple was 1.7x as of 6/2 vs 1.5x last week.

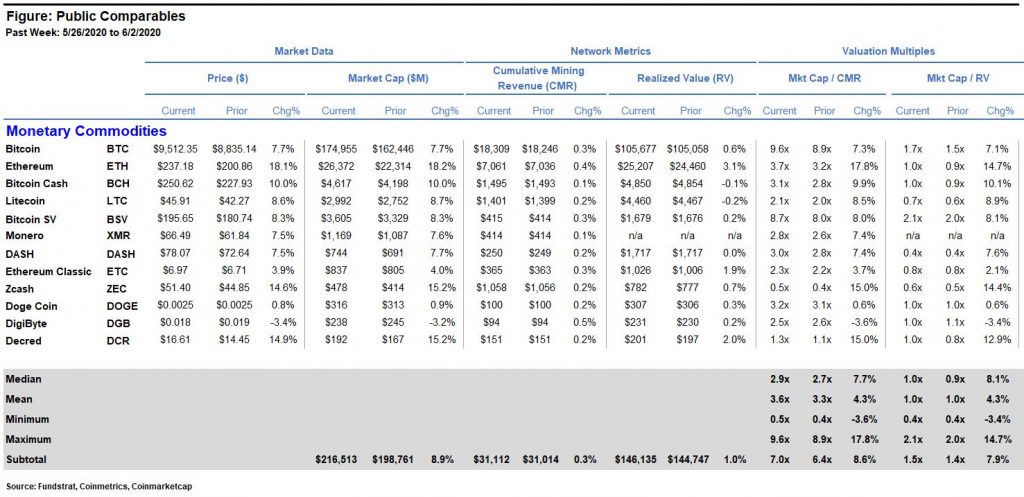

The comp table for monetary commodity (PoW) crypto asset prices and fundamental valuations is shown below.

Valuation Methodology

The P/CMR ratio is a fundamental valuation method I invented in December 2017 that has historically been a strong predictor of price movements. It functions like a Price/Book (Crypto P/B) ratio by telling investors if a crypto asset is relatively cheap or expensive. It’s calculated by comparing the Market Cap to Cumulative Mining Revenue (Mkt Cap/CMR). The ratio can be calculated on a per coin basis (P/CMR) by adjusting the Mkt Cap and CMR by outstanding supply. Read more.

The MV/RV ratio is another method later developed that takes a similar approach but adjusts the denominator value based on the last time coins were moved. Read more.

The P/CMR and MV/RV metrics gives an approximate measure of unrealized profit, and therefore an investors incentive to sell or hold. The P/CMR ratio gives a measure closer to the absolute floor value of sunk costs for all investors while the MV/RV ratio gives the highest end of the range. Its best to take multiple approaches when valuing any asset. These two have been the best for crypto assets in my experience, and the answer probably lies in the middle.

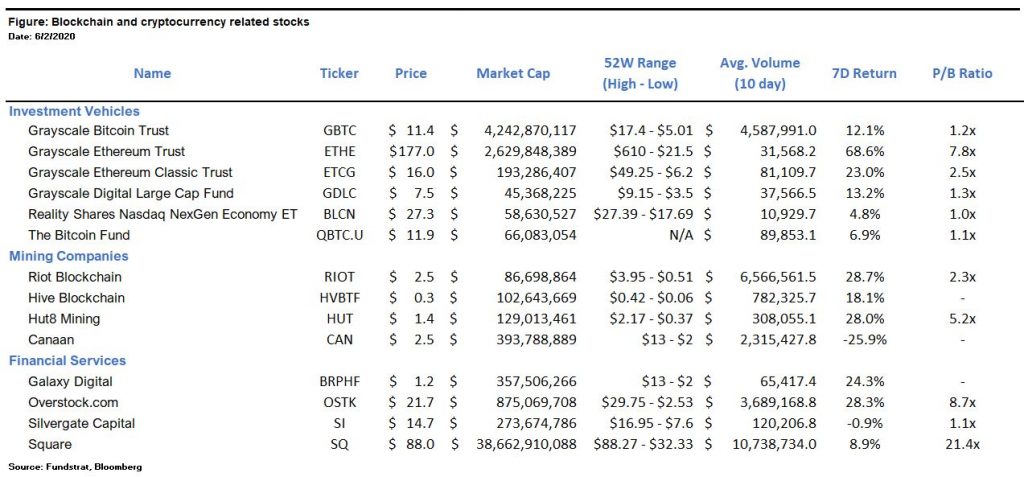

Blockchain & Crypto Stocks

The table shows publicly traded blockchain and crypto related stocks, which offer a vehicle for investors who are constrained from owing underlying crypto assets themselves.

Noteworthy this week:

Grayscale Ethereum Trust – While ETH performance was strong over the past 7 days (+18%), shares of Grayscale’s Ethereum Trust (ETHE) were up 68.6% on the week as demand drove expansion of the security’s premium. As of June 2nd, shares were trading at a ~680% premium to their underlying net asset value compared to ~450% last week.

Galaxy Digital – Galaxy Digital reported a loss of CAD 27.7 million during the quarter ending March 31, 2020. The negative results were driven by $25 million in unrealized losses on crypto holdings. The company’s activities continue to be fueled by crypto investments on its own balance sheet with Q1 holdings ending with approximately 10,000 bitcoin; this figure has increased by 32% in Q2.

Canaan reported Q1 financial results on Friday 5/22. Despite strong revenue increases to the tune of 45% YoY, the Company had to cut is hardware prices by an estimated 50% in an effort to sell more mining equipment; reflecting a broader slowdown of buying interest into hardware amidst the halving event and greater COVID-19 uncertainties. Unsurprisingly, Canaan is not issuing a business outlook for Q2 ’20 given limited visibility.

Portfolio Strategy

Investment Recommendations

| Bitcoin Outlook | Date |

| Buy Bitcoin ($16,500) | 5/12/2020 |

| Buy Bitcoin ($14,350) | 3/26/2020 |

| Buy Bitcoin ($13,500) | 3/17/2020 |

| Portfolio Allocation | |

| OW “crypto assets” vs. “market portfolio” (1%-2% vs. 0.1%) | 3/26/2020 |

| Market Positioning | |

| OW “blue chip alts” vs. “Bitcoin” | 3/27/2020 |

| OW “large cap” vs. “small cap” crypto assets | 3/26/2020 |

| OW “defensive PoW” vs. “cyclical PoS” crypto assets | 3/26/2020 |

| Asset Selection | |

| UW “Ripple” vs. “market crypto portfolio” | 4/14/2020 |

| OW “Ethereum” vs. “market crypto portfolio” | 4/3/2020 |

| MW Ethereum vs. “market crypto portfolio” | 3/26/2020 |

| Blockchain & Crypto Stocks | |

| Avoid ETHE | 4/3/2020 |

Winners & Losers

Winner: Tether – According to data from Etherscan, value transacted through Tether stablecoins issued on Ethereum reached a new all-time high last Monday 5/25: 208,107 transactions were made, transferring $1.2 billion, within a span of 24 hours.

Loser: Goldman Sachs – During a conference call on Wednesday 5/27, the investment bank presented a case arguing that bitcoin and other cryptocurrencies are not viable investments for their clients. The presentation was dissatisfying for most in the crypto community to say the least. We continue to recommend that investors allocate 1% – 2% of their portfolio to bitcoin and crypto-assets.

Financing & M&A Activity

Coinbase – The San Francisco based crypto exchange has acquired Tagomi, an aspiring crypto prime broker, for an estimated $75M – $100M. The deal represents one of Coinbase’s biggest acquisitions to date and will help fill out the exchange’s institutional business, which covers professional trading and custody. The transaction is pending regulatory approval and is expected to close at the end of 2020.

Genesis Capital – The New York based trading firm, announced on Thursday it has acquired London-based custodian Volt for an undisclosed sum. The acquisition comes just as the Genesis announced the launch of Genesis Prime, its prime brokerage service focused on proving a single point of access for custody, trading, borrowing, and lending digital currencies.

LayerX – The Tokyo based blockchain company raised $28MM in a financing round led by VC firms JAFCO, ANRI and YG Capital. The funds are slated to be deployed to support build out of new business development efforts such as consulting projects and joint venture partnerships with financial institutions.

Ginkan – The Japan based restaurant discovery company raised $2.6M in a Series A led by MTG Ventures. The platform awards restaurant reviewers with cryptocurrency rewards. Other investors in the round include Aucfan DD Holdings Venture Capital, Mitsubishi UFJ Capital, and SLD Entertainment.

CoinDCX – TheIndia based crypto exchange raised $2.5 million in a financing round with participation from Coinbase Ventures and Polychain Capital. CoinDCX plans to set up a center of excellence to promote crypto adoption in India and launch new products for retail investors including lending. The investment comes just two months after the Company’s $3M Series A which was also led by Polychain Capital.

Recent Research

Access Fundstrat’s recent crypto insights if you missed them by clicking below or visiting FS Insight.

- Tom Lee: Tom’s Take on Crypto: The Ten Rules of Bitcoin Investing: Rule No. 4

- Robert Sluymer: Crypto Technical Analysis: BTC consolidating at resistance but ADA breaks out, ETH likely to follow

- Ken Xuan: Crypto Quant: Benchmark Crypto Indices Weekly Performance Review

- David Grider: Why Goldman Sachs Is Wrong About Bitcoin | Coinbase Angel Investor and Fundstrat Analyst Explain