Digital Assets Weekly: March 27th 2020

Portfolio Strategy

It continues to be our view that crypto markets are in the 2nd or 3rd innings of a prolonged recovery following their December 2018 bottom.

The earlier months sell off likely flushed a significant portion of leverage and speculative short term traders out of the ecosystem, as we discussed on our FS Insight Digital Assets call earlier this week. This dynamic bodes well for reducing market downside risks and positions crypto on firmer footing for a healthier recovery. At the same time, while global market prices are improving, the situation remains uncertain and that means crypto liquidity and prices are still fragile.

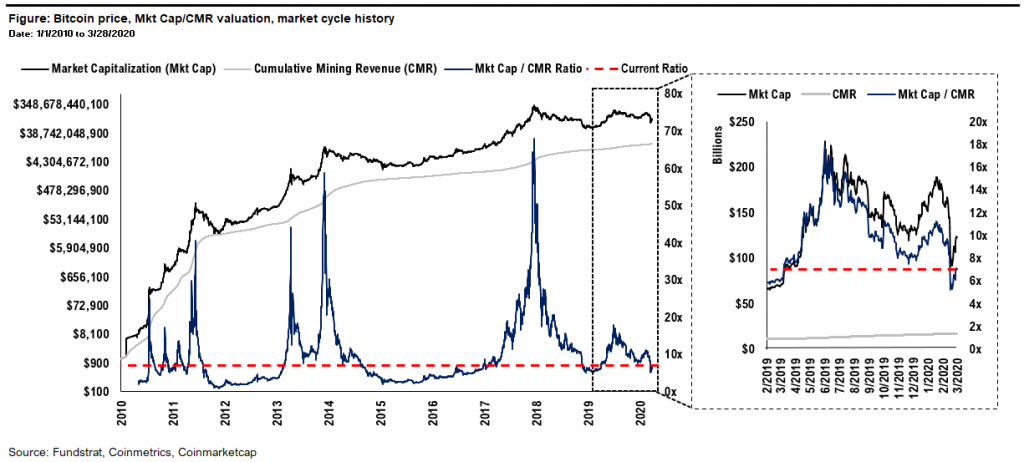

Overall, we have enough confidence to continue recommending investors maintain the increased exposure to crypto assets that we called for on March 13th. Then, valuations had just swiftly shifted down from levels we’d previously advised were reasonable long term but weren’t cheap, to levels we considered more attractive, and we urged investors to buy. Prices have since rebounded a bit, but valuations still look fairly cheap across the board, and while that doesn’t mean they can’t temporarily get cheaper, our view is we’re close, and the 12-month risk/reward looks attractive. If prices retrace to 6x P/CMR multiples or below, we’d advise longer-term investors to continue increasing exposure by accumulating more/less aggressively at cheaper/richer levels.

At the same time, we are still cautious enough to advise investors to gravitate within their crypto exposure towards safer holdings near-to-medium term until there’s greater certainty in the market turn around. We continue to be wary of taking on exposure to small cap names with higher betas that could fall harder and encounter liquidity trouble, as we discussed last week. Additionally, we recommend investors gravitate towards proof of work (PoW) names, which have shown to have more defensive staying power during prolonged downturns, as we discussed in our note a few weeks ago. As outlook visibility improves, investors should be ready to gradually shift towards slightly riskier but still relatively conservative blue-chip alternative coins to capture more of the upmarket cycle beta without taking on too much risk.

Looking past current uncertainty, our 12 months outlook ascribes an 80% chance Bitcoin finishes the year at or above $10k. We see several factors that could drive fundamental improvement alongside multiple expansion, that include 1) structural supply/demand dynamics, 2) central bank and government fiscal response, and 3) macro market influences.

Investment Themes

- OW crypto assets vs. market portfolio

- OW large cap vs. small cap crypto assets

- OW defensive PoW vs. cyclical PoS crypto assets

- OW blue chip alts vs. Bitcoin as recovery confirms

Market Analysis

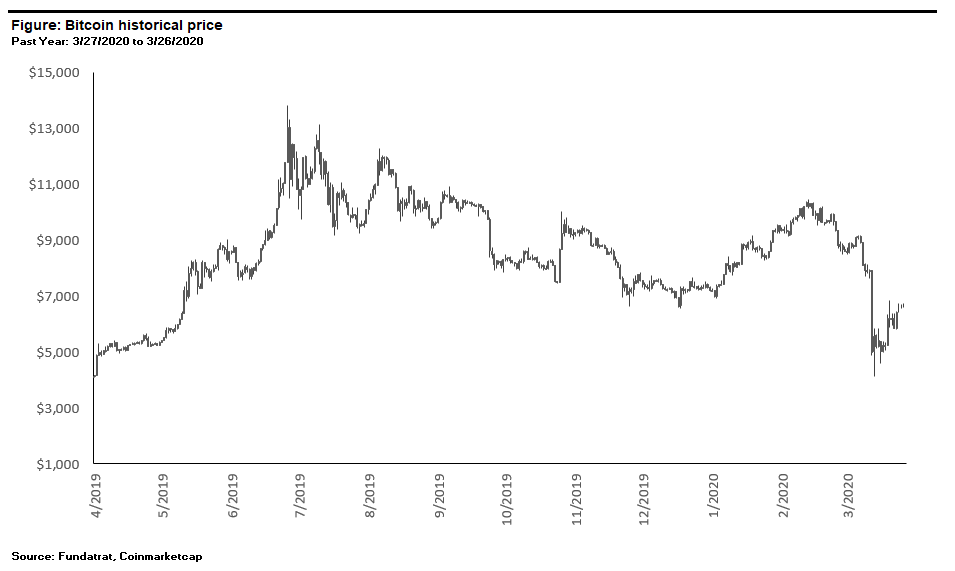

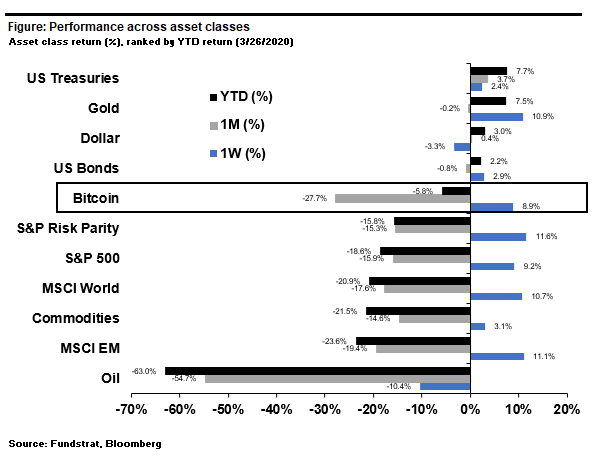

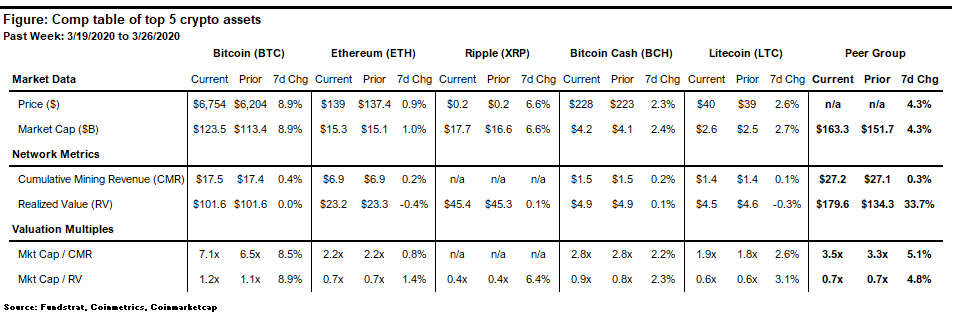

The price of Bitcoin continued to recover from the earlier months sell off and finished the week heading into Friday up 8.9%.

The positive weekly performance was in line with the general improvements we’ve seen in global asset prices as market fears over COVID-19 have modestly eased. Bitcoin remains the 5th best performing asset YTD behind US bonds.

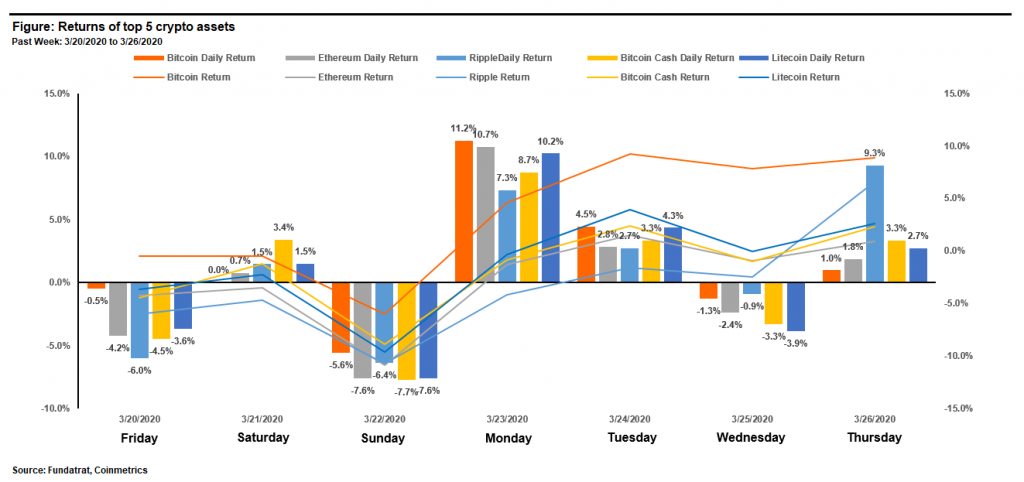

Large cap crypto assets largely moved in line over the course of the week with Bitcoin finishing as the best performer among the top 5.

Bitcoin’s valuation continued to rise and now sits just above 7x P/CMR. It has rebound sharply after briefly touching a 4.9x P/CMR during the recent sell off we had that triggered a cascade of structural debt/margin deleveraging waves across the industry. For reference, the P/CMR ratio is a valuation method that I invented in December of 2017. It compares the market cap of a crypto asset to its cumulative mining revenue (Mkt Cap/CMR) and can also be adjusted and shown on a per coin basis (P/CMR).

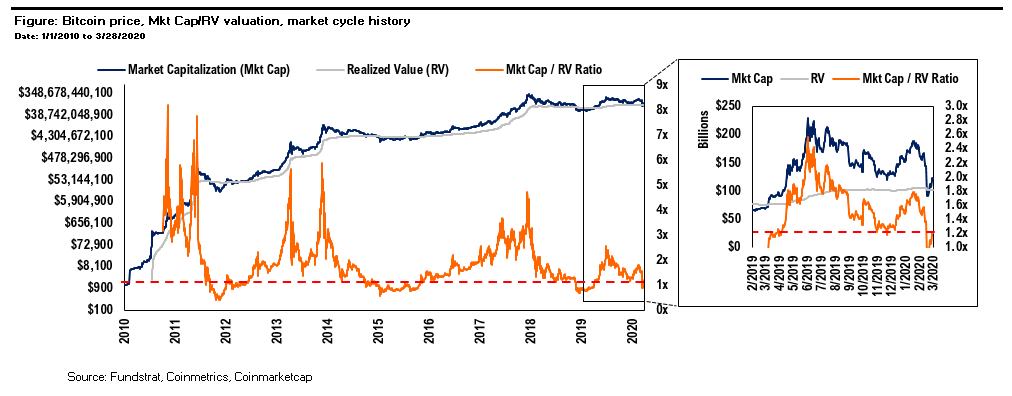

Bitcoin’s market cap to realized value (MV/RV) multiple sits at the lower end of its range as well after likewise rebounding off its lows during the recent sell off. For reference, the MV/RM ratio is another method that was later developed that takes a similar approach but adjusts the denominator value based on the last time coins were moved.

The usefulness of both methods are similar in that they each give an approximate measure of unrealized profit, and therefore an investors incentive to sell. The P/CMR ratio gives you a measure closer to the absolute floor value of sunk costs for all investor’s while the MV/RV ratio gives you the highest end of the range. As with all asset valuations, the answer usually lies somewhere in the middle, and its best to look at prices through multiple lenses – I’ve found these two to be the best over the years.

Valuations expanded modestly faster than prices on the week but remain reasonably cheap across the board compared to historical levels. Bitcoin continues to trade at a premium to its peers, which we believe is justified giving its market dominance and competitive advantages.

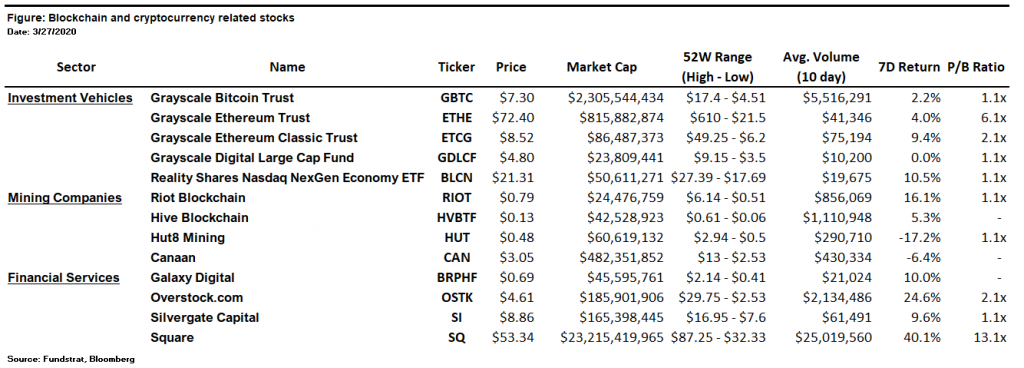

The table above shows the major publicly traded blockchain and crypto related stocks. These assets offer a vehicle for investors who are looking to gain exposure to the asset class but are constrained from owning actual crypto assets themselves. Our advice to investors:

- Avoid ETHE within the investment vehicles sector due to its 600%+ Price/NAV premium (P/B Ratio) which may greatly contract.

- Cautious of investing in the mining sector until there’s greater certainty on how the recovery will play out. Miners are leveraged to crypto prices and may enter financial distress if markets experience prolonged depressed levels. These risks could be negatively amplified by the Bitcoin halvening reducing industry revenue and the potential for competitors to enter the market with more efficient mining equipment taking additional market share.

Winners & Losers

Winner: Bitmain the largest mining equipment hardware producer is the winner this week as its Bitmain S19 Antminers Sell Out but Won’t Ship Until May 11.

Loser: Low cap illiquid more speculative coins are the losers this week as Bitfinex delists 87 different market pairs due to low trading volume. We’ve warned investors to avoid these types of coins in last weeks note and suspect that the trend will continue.

Financing Activity

Coinmetrics – The Boston based crypto-asset data and infrastructure provider raised $6M in a Series A financing led by Highland Capital Partners with participation from FMR, LLC, Castle Island Ventures, Communitas Capital, Collaborative Fund, Avon Ventures, Raptor Group, Coinbase Ventures, and Digital Currency Group. Read more

Billon Group – UK based distributed ledger technology (DLT) for national currency and business documents raised $6m in Series A financing led by Billon CEO Wojtek Kostrzewa. Read more

Recent Research

Access Fundstrat’s recent crypto insights if you missed them by clicking below or visiting FS Insight.

- FS Insight Digital Assets: FS Insights Digital Asset Launch Call

- Ken Xuan: Crypto Quant: Benchmark Crypto Indices Weekly Performance Review

- David Grider: CoinTelegraph Interview

Disclosures

This research is for the clients of FS Insight only. For additional information, please contact your sales representative or FS Insight at https://fsinsight.com.Conflicts of Interest

This research contains the views, opinions and recommendations of FS Insight. At the time of publication of this report, FS Insight does not know of, or have reason to know of any material conflicts of interest.General Disclosures

FS Insight is an independent research company and is not a registered investment advisor and is not acting as a broker dealer under any federal or state securities laws.

FS Insight is a member of IRC Securities’ Research Prime Services Platform. IRC Securities is a FINRA registered broker-dealer that is focused on supporting the independent research industry. Certain personnel of FS Insight (i.e. Research Analysts) are registered representatives of IRC Securities, a FINRA member firm registered as a broker-dealer with the Securities and Exchange Commission and certain state securities regulators. As registered representatives and independent contractors of IRC Securities, such personnel may receive commissions paid to or shared with IRC Securities for transactions placed by FS Insight clients directly with IRC Securities or with securities firms that may share commissions with IRC Securities in accordance with applicable SEC and FINRA requirements. IRC Securities does not distribute the research of FS Insight, which is available to select institutional clients that have engaged FS Insight.

As registered representatives of IRC Securities our analysts must follow IRC Securities’ Written Supervisory Procedures. Notable compliance policies include (1) prohibition of insider trading or the facilitation thereof, (2) maintaining client confidentiality, (3) archival of electronic communications, and (4) appropriate use of electronic communications, amongst other compliance related policies.

FS Insight does not have the same conflicts that traditional sell-side research organizations have because FS Insight (1) does not conduct any investment banking activities, (2) does not manage any investment funds, and (3) our clients are only institutional investors.

This research is for the clients of FS Insight only. Additional information is available upon request. Information has been obtained from sources believed to be reliable, but FS Insight does not warrant its completeness or accuracy except with respect to any disclosures relative to FS Insight and the analyst’s involvement (if any) with any of the subject companies of the research. All pricing is as of the market close for the securities discussed, unless otherwise stated. Opinions and estimates constitute our judgment as of the date of this material and are subject to change without notice. Past performance is not indicative of future results. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The opinions and recommendations herein do not take into account individual client circumstances, risk tolerance, objectives, or needs and are not intended as recommendations of particular securities, financial instruments or strategies. The recipient of this report must make its own independent decision regarding any securities or financial instruments mentioned herein. Except in circumstances where FS Insight expressly agrees otherwise in writing, FS Insight is not acting as a municipal advisor and the opinions or views contained herein are not intended to be, and do not constitute, advice, including within the meaning of Section 15B of the Securities Exchange Act of 1934. All research reports are disseminated and available to all clients simultaneously through electronic publication to our internal client website, fsinsight.com. Not all research content is redistributed to our clients or made available to third-party aggregators or the media. Please contact your sales representative if you would like to receive any of our research publications.

Copyright © 2020 FS Insight LLC. All rights reserved. No part of this material may be reprinted, sold or redistributed without the prior written consent of FS Insight LLC.