Digital Assets Weekly: Feb 28th, 2020

Summary

Market Strategy:

- Crypto markets had a tough week as global risky assets sold off on coronavirus fears but crypto investors shouldn’t panic.

Winners & Losers:

- Winner: Argon’s Tim Draper investment may hold promise for future crypto legal governance.

- Loser: Ripple’s illegal security lawsuit claims may mean potential upside isn’t justified by regulatory risks.

Weekly Rant:

- Why the announcement “Startup Tokenizes $2.2B in Commercial Real Estate Through Polymath” makes me cringe.

Financing Activity:

- Copper.co raises an $8M Series A round to build out its London based crypto custodian platform.

Recent Research:

- Check out our recent report on the Bitcoin SV (BSV) Genesis protocol upgrade if you missed it.

Market Strategy

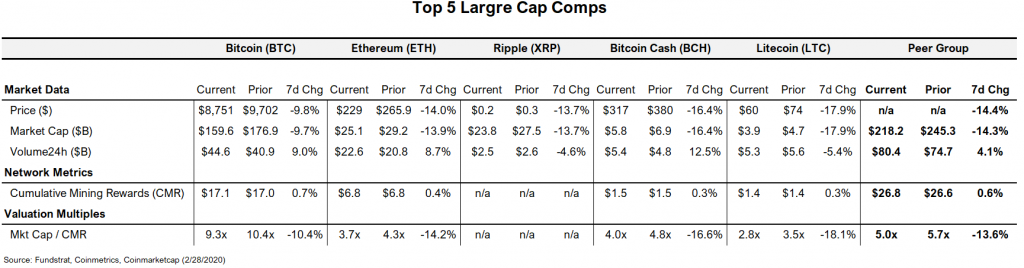

Bitcoin sold off nearly 10% on the week and brought most other crypto assets in to the red along with it. Among the 10 largest crypto assets, the biggest losers were BSV (-25%), XTZ (-20%) and LTC (-18%), while the best relative performers were BTC (-10%), ETH (-12), and EOS (-13%).

The risk off sentiment seen broadly across global markets is the most proximate cause for the move, as fears of the coronavirus spreading and causing an economic slowdown crushed the S&P 500 by 13% on the week.

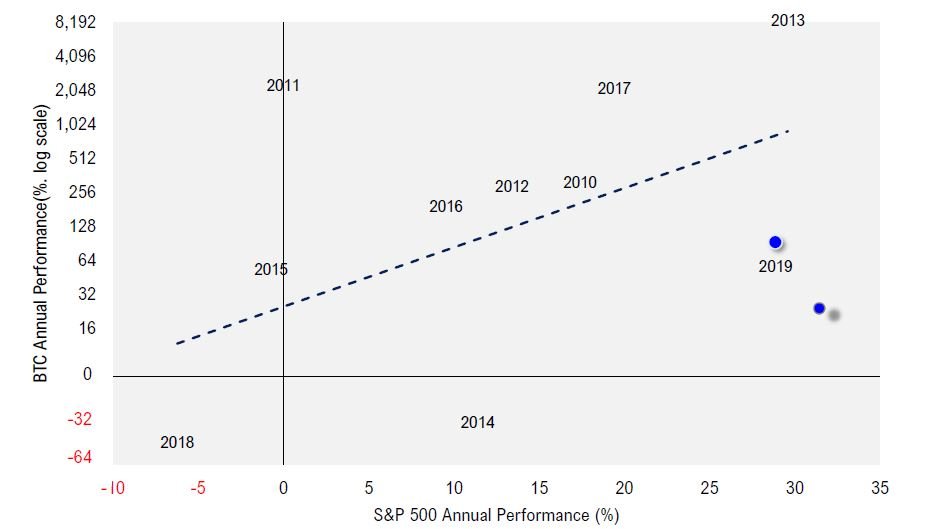

To one degree, this weeks crypto correlation makes sense, because historical data tells us Bitcoin performs best when the S&P 500 is up.

On the other hand, we do not think investors should be overly focused on tying virus driven broader market downside risks to their crypto portfolios at this stage for a few reasons:

- An uptick in correlations over such a short time period is not long enough to define the asset as risk-on vs. risk-off.

- Its notable that Bitcoin, which is a very volatile asset, has relatively outperformed the S&P during this risk off environment, and that may be a sign its capable of acting as a macro hedge like we saw back in January during the U.S. and Iran conflict.

- The rational for the virus effecting stocks is logical (if the move is overblown or not is another question), but crypto prices and their value drivers are not tied to the economy in the same way, and investors should not price the virus risks similarly.

- The likely economic policy responses from central banks globally should be supportive of crypto long term fundamentals.

- Crypto markets are still maturing and their idiosyncratic secular drivers are the most important at this stage.

Instead, long term investors who are under allocated may be wise to use the retracement from recent highs as an opportunity to accumulate a core holding at more attractive levels.

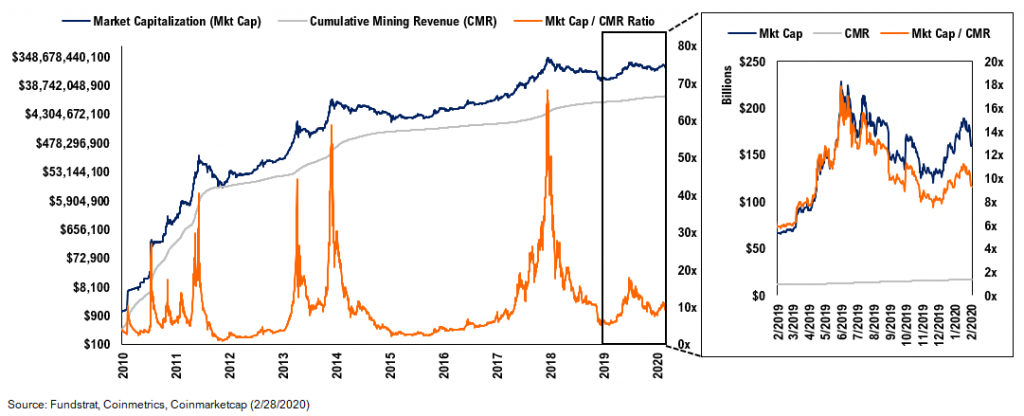

Bitcoin’s Market Cap / Cumulative Mining Rewards ratio has come in from the 11.2x multiple it was trading at earlier this year and is now sitting at 9.2x. The Mkt Cap / CMR ratio is one of our favored fundamental relative valuation metrics (partially because I developed it but mostly because it works). The metric works like traditional Price/Book ratio’s that are used to value financial companies (Bitcoin let’s you “be your own bank” after all). Its methodology can be read here. We will be writing about its application in weeks to come. Notably, current Bitcoin valuations are well below the 70x peak we saw during the 2017 bubble and valuations for other digital assets have followed a similar tend.

Crypto markets are currently in a “Goldilocks Economy” that’s “not too hot and not too cold,” in our view. While current multiples aren’t at absolutely oversold, rock bottom, deep value levels (you get my point), they don’t signal a necessary pull back either, and we do think they’re attractive on a 12-18 month time horizon.

We believe Bitcoin is in the 2nd or 3rd innings of a prolonged market recovery following the bottom we saw back in December 2018 and we still see three main factors pushing Bitcoin’s price higher during 2020:

- The U.S. presidential elections

- Global geopolitical risks, and

- The Bitcoin halving

The convergence of these factors should bode well for certain other crypto assets besides Bitcoin as well, which we’ll discuss in later weeks.

Winners & Losers

Winner: Aragon protocol which received a $1M investment from Tim Draper to build out its digital court system. The innovation of blockchain and crypto extends beyond money. One of its other more promising applications is the ability to enforce executable agreements through smart contract code (hence the saying “code is law”). This holds the potential to revolutionize the way trade disputes are managed, especially between international participants where courts have limited ability to enforce claims over counter-parties. We’re in a globalized world, more dominated than ever by digital trade, that’s becoming increasingly geopolitically fragmented, which is why you can imagine demand might grow if the system could work. The idea of a global self-sovereign internet-based legal system may sound far off, but remember the thought of giving strange merchants your credit card info over the internet was once thought of as crazy as well – now we just call that e-commerce.

Loser: Ripple who has been fighting an ongoing legal battle as to whether its XRP token is an illegal security. Recent court filings indicate that the Ripple Class-Action Lawsuit Can Proceed, Judge Rules. This is not the ideal outcome for Ripple the company. If the final ruling goes against them, there could be negative implications for crypto markets as well (Why Ripple’s XRP lawsuit could wreak havoc on the market). The final outcome wont be known for some time but I’m wondering if investors have already priced in the regulatory risks associated with XRP or if they could eventually weigh on the price?

Weekly Rant

Reports on that a Startup Tokenizes $2.2B in Commercial Real Estate Through Polymath make me cringe. Why? Not because I think tokenization is bad. In fact, I think it will create many back offices efficiencies within capital markets that will save costs – much like use of email’s and pdf’s have done by replacing faxes and filing cabinets.

The part that makes me cringe is what the headline may have done to the Polymath (POLY) token price. POLY traded at a low of $0.19 on the 26th prior to the announcement and jumped over 50% to a high of $0.30 on the 27th (an $8M market cap increase!). Whats wrong? Isn’t this a fundamental improvement that should positively impact the price?

It’s great that businesses are using the Polymath service, but big flashy $2.2B headline numbers can be misleading to retail token investors. Digitizing shares that represent a large asset value doesn’t necessarily tell me anything about the fundamental economic value that will flow back to token holders. That’s the thing I’d also like to hear about.

Financing Activity

Copper.co, the London based crypto custodian, raised an $8M Series A financing round from investors that include Target Global, MMC Ventures and LocalGlobe.

Recent Research

Check out our full recent report on the Bitcoin SV (BSV) Genesis protocol upgrade if you missed it by clicking here or visiting the crypto strategy section of the FS Insight website.