Crypto Weekly (Oct. 16th, 2019)

Weekly recap…

- Libra Association dropouts are avoiding regulatory spotlight

- The BTC rich are getting richer

- BTC’s 4-hour RSI becoming oversold as BTC tests key 7.7K support

Center Story

1. Libra membership is not for the faint of heart

No one knows for sure what will happen with Libra. But we do know dropouts have returned to “business as usual.”

The Libra Association had their inaugural meeting on Monday, October 14th. There are 21 council members remaining of the original 28, which means there have been seven exits: Booking Holdings, eBay, Mastercard, Mercado Pago, PayPal, Stripe, Visa.

Most of those that have left share a common vertical, payments.

Payments regulations are onerous and as Warren Buffet famously said, “If a cop follows you for 500 miles, you’re going to get a ticket.”

Visa and Mastercard have had their own regulatory and legal headaches pertaining to interchange. The last thing these payments companies want is the US government following them for the next 500 miles because they joined the Libra Council.

And per the WSJ: “Sens. Brown and Brian Schatz (D., Hawaii) warned the CEOs of Visa, Mastercard and Stripe that if they stayed involved, they could “expect a high level of scrutiny from regulators not only on libra-related payment activities, but on all payment activities.”

But for others there are good reasons to stay onboard, despite the underwhelming support the project has received from the public. Fred Wilson, the co-founder of Union Square Ventures (a council member) wrote this week about a few of them:

“…a stable cryptocurrency that is broadly adopted around the world will bring new services to people who don’t have access to the financial system that many of us who read this blog do.

One of the powerful things about being in the venture capital business is that we can support projects that are necessary but unproven, unpopular, and/or misunderstood. Not everyone can do that and so it is even more important that we do.”

Network Monitor

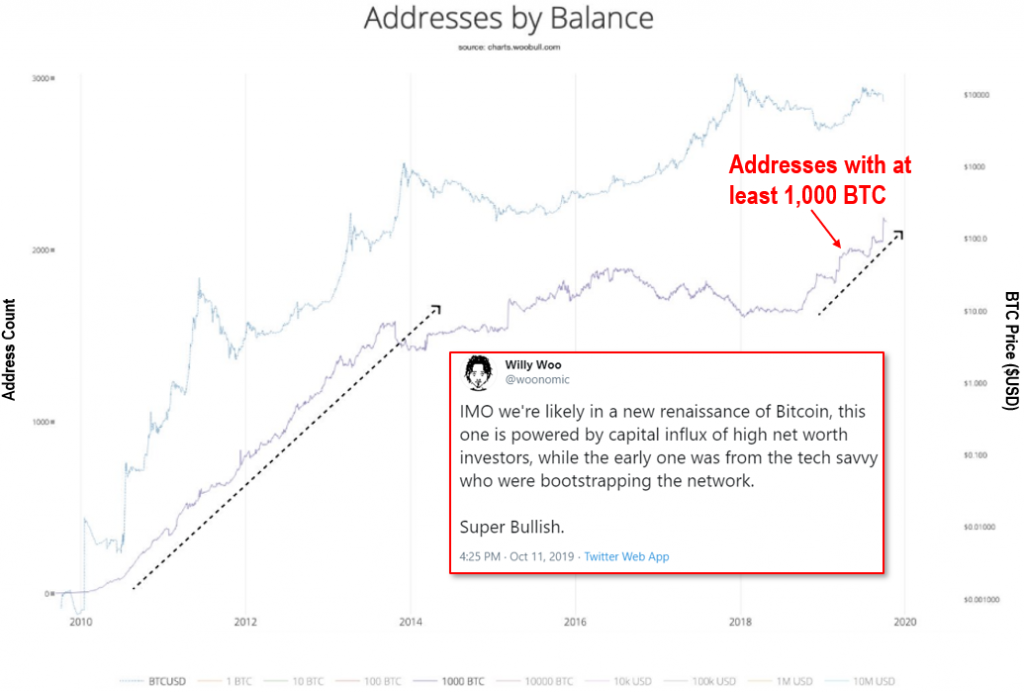

2. The (BTC) rich are getting richer

Willy Woo (@woonomic) found that pre 2015 was the last time the number of addresses with at least 1,000 BTC grew at the current rate.

- During the first period from 2010-2014, mining was a high-tech hobbyist activity and non-competitive.

- Now, the growing number of wallets with at least 1,000 BTC likely belong to high-networth buyers.

This is a bullish signal for BTC because it means longer term buyers are actively building positions.

Technicals

3. Bitcoin’s 4-hour RSI becoming oversold as it tests key 7.7K support

Bitcoin’s short-term 4-hour RSI indicator is pressing back into oversold levels suggesting a bounce should develop from near current levels.

- After peaking just above 8.6K resistance, BTC is again retesting trading support at 7.7K with 4-hour RSI returning to oversold levels suggesting a trading bounce from near current levels.

- To signal the beginning of trading turn, BTC will need to rally above its September-October downtrend between its 15-dma at 8247 and 8475.

- BTC continues to face heavy resistance starting at its 200-dma at 8.7k followed by the 9-9.3K coinciding with 50-dma at 9.2kxx

Markets

4. Market Movers (over past 7 days)

Prices as of 10/14/19

Cryptocurrencies

Bitcoin +1.6% to $8374.69

Ethereum +3.2% to $186.96

XRP +7.6% to $0.296523

Bitcoin Cash -2.4% to $228.59

Litecoin -1.4% to $56.98

EOS -0.6% to $3.17

Binance Coin +14.4% to $18.46

Bitcoin SV up +3.3% to $87.21

Stellar +5.7% to $0.064925

TRON +2.3% to $0.016732

Fiat Currencies

Dollar Index (DXY) -0.77% to 98.37

EUR +0.64% to 1.1 USD/EUR

GBP +4.51% to 1.28 USD/GBP

JPY -2.40% to 0.0092 USD/JPY

CNY Onshore +0.89% to 0.1412 USD/CNY

CNH Offshore +1.15% to 0.1412 USD/CNH

CHF -0.61% to 1.0011 USD/CHF

Commodities

Gold -1.7% to $1479.87

WTI Crude +1.6% to $53.45

Brent Crude +1.9% to $59.37

5. Top Tweets

Education

6. Required Reading

The Libra Association – Fred Wilson

Yesterday was an important milestone for the Libra project. We adopted the initial charter for the Libra Association, we elected the initial five board members, and we set in motion a number of important initiatives. “We” are the twenty-one founding members of the Libra Association.

The SEC Really Doesn’t Like ICOs – Matt Levine

The way I like to explain initial coin offerings is that “they’re like if the Wright Brothers sold air miles to finance inventing the airplane.” There are two parts to that explanation.

New Cryptocurrency Fund Finds a Side Door Into Your Brokerage Account – Forbes

The Securities and Exchange Commission just denied the latest application for a Bitcoin exchange-traded fund last week, but a new product is about to be available in brokerage accounts that will give traditional investors even broader access to the cryptocurrency market.

SEC Halts Alleged $1.7 Billion Unregistered Digital Token Offering – SEC

The Securities and Exchange Commission today announced that it has filed an emergency action and obtained temporary restraining order against two offshore entities conducting an alleged unregistered, ongoing digital token offering in the U.S. and overseas that has raised more than $1.7 billion of investor funds.

Bitcoin No Longer Seen as the Driving Force in Crypto Market – Bloomberg

Bitcoin has plunged more than 30% since hitting a year-to-date high. That fact is clear, but explaining why the world’s largest digital currency has lost momentum in the second half of the year is anything but.

Events

7. What’s happening in next week

Wednesday, October 16

World Financial Information Conference

Crypto Invest Conference Los Angeles

Blockchain Health Summit Trade Show

Blockchain Life 2019 Europe

Thursday, October 17

Blockchain Health Summit Trade Show

Blockchain Life 2019 Europe

Friday, October 18

Paris Blockchain Summit

Eurasia Blockchain Summit

Monday, October 21

—

Tuesday, October 22

Blockchain Finance Forum

Wednesday, October 23

4th Annual Blockstack Summit