Crypto Weekly (Sept. 18th, 2019)

Weekly recap…

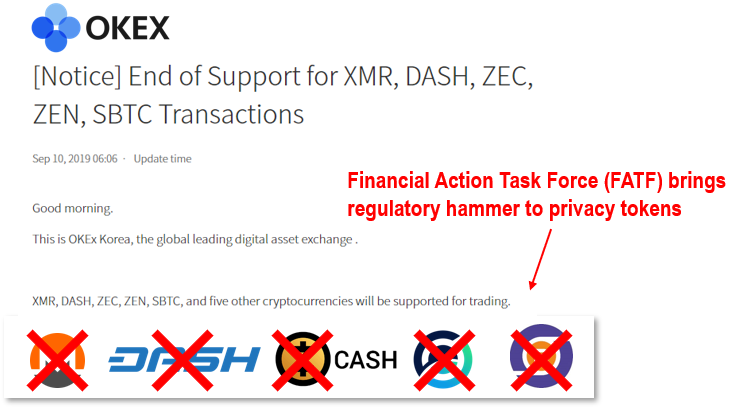

- OKEx Korea delisting all privacy tokens shows regulators tightening grip around crypto

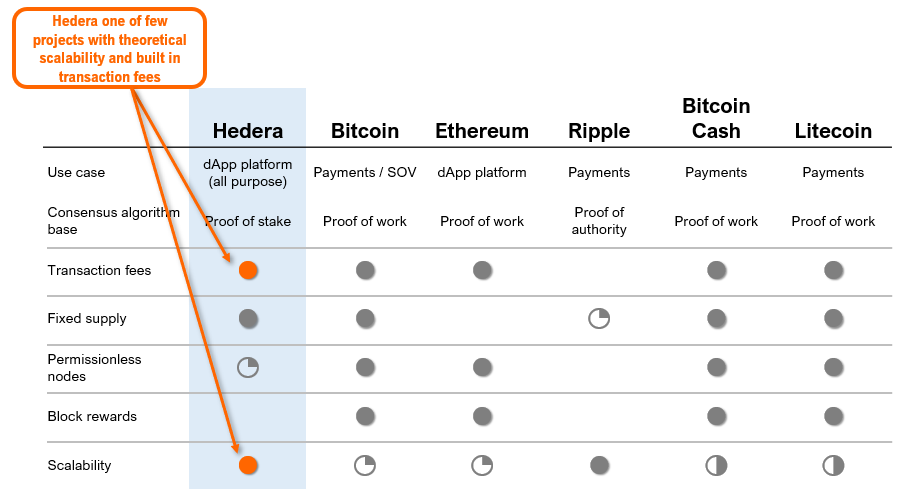

- Hedera mainnet launch on 9/16; project valued at ~$5.3B (total supply)

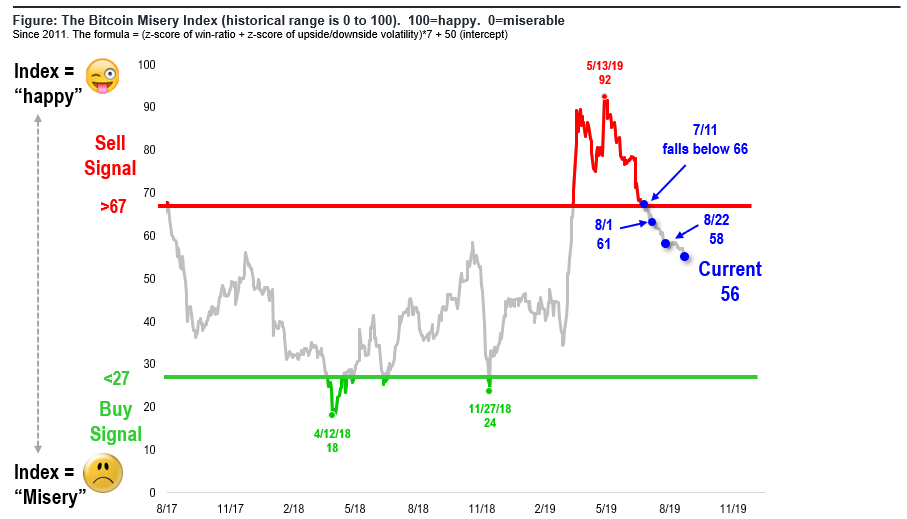

- Watch for Bitcoin Misery Index to fall closer to 50 for better risk/reward profile

Center Story

1. Regulators are slowly wrapping their tentacles around pockets of crypto

OKEx Korea delisting all privacy coins on October 10th due to violation of Financial Action Task Force’s “Travel Rule”

OKEx Korea (not its global unit) is delisting privacy cryptocurrencies from its exchange. This action does nothing to directly impact the operations or development of the project itself, but does show their vulnerability to legislative scrutiny.

Privacy focused cryptocurrencies and those which could be serious competitors to fiat currencies will likely see a lot more red tape coming their way. Libra, for example, received a cold welcome on the Hill in D.C., and European lawmakers have not been kinde (German and France openly oppose its existence).

What else to know (source: The Block)…

“In June, the FATF, the global money-laundering watchdog, issued its final crypto guidelines, retaining “travel rule,” which requires exchanges to collect and transfer customer information during transactions. The information includes originator’s name, account number and location information, as well as beneficiary’s name and account number.

OKEx Korea said privacy-oriented coins do not allow collecting such information, hence the end of the support for the five coins.”

Network Monitor

2. Hedera valued at $5B (fully diluted) post mainnet launch

Hedera was trading on 9/17 at ~$0.106, valuing the network at ~$169 million (circulating supply) or ~$5.3 billion (total supply).

What is Hedera? Hedera Hashgraph (HH) is a Distributed Ledger Technology (DLT) platform for decentralized applications (dApps), primarily for enterprise usage. Notably, its use of “directed acyclic graph” technology (DAG) for recording data improves scalability.

Hedera Hashgraph (HH) launched its Mainnet beta, or “Open Access” on September 16th. This means three things primarily: (1) 3rd party developers can start building decentralized applications (dApps) on the network without direct onboarding from Hedera; (2) there are five confirmed exchanges that will begin trading HBAR on their platforms; (3) OA marks the start of the 15-year HBAR distribution schedule.

Fourteen confirmed organizations will support HBAR trading at or around OA. The exchanges are: AlgoZ, BitOoda, Bering Waters, Bittrex, Carbon, Galaxy Digital, Galois, GSR, Liquid, OkCoin, OKEx, OSL, Upbit, xFutures.

Fundamentals

3. BTC performs when macro trend is clear

Our view is that Bitcoin generally does not perform well when risk markets have no established trends. Since July, the macro uncertainty created by rising trade tensions caused equity markets to be range-bound. Similarly, Bitcoin has stalled.

- In years where S&P 500 has seen gains >15%, Bitcoin averages 1,800% annual gains.

- When S&P 500 flattish/up <15%, BTC ~300%

- Wen S&P 500 is down, BTC averages declines of 9%.

- When there is a clear trend in risky markets, Bitcoin shines. Granted, there are only 10 years of price history. But as the chart on Slide 4 shows, the relationship is striking.

Watch the Bitcoin Misery Index to drift towards 50. Since falling below 66 on 7/11/19, it was 61 on 8/1 and as of latest reading 56. So the BMI is making steady progress towards 50, which is the level where Bitcoin could have better risk/reward. Remember, it is a contrarian indicator, at the extremes.

BMI closer to 50 = better risk/reward profile

Technicals

4. BTC is at yet another key inflection point – Get ready for Q4

BTC is once again at another important technical inflection point after falling under 11K resistance to retest the upper end of its 9-10K support band.

BTC appears to be swinging from short-term overbought to oversold levels every week based on 4-hour charts. For example, we’ve previously noted the 4-hour RSI momentum was overbought as BTC tested 11K resistance and was due for a pullbacks.

We continue to highlight the similarities between BTC’s 2016 price behavior to 2019. In fact, a similar technical argument can be made for traditional macro markets notably the S&P 500 index, which — as we have highlighted previously — is also poised for a Q4 acceleration following a multi-quarter consolidation.

- After falling under 11K resistance, BTC is one again in a short-term corrective trend, challenging first trading support near its 15-dma near 10K.

- A move above 11K resistance will be needed to signal a bullish trend reversal.

- It’s too early to conclude BTC has bottomed yet BUT 4-hour RSI (bottom panel) is again showing evidence of bottoming near oversold levels and positively diverging with higher lows in place.

- Use pending pullbacks to accumulate in anticipation of Q4 acceleration into YE

Markets

5. Market Movers (over past 7 days)

Cryptocurrencies

Bitcoin -0.6% to $10276.79

Ethereum +8.8% to $197.11

XRP +0.5% to $0.260952

EOS +5.2% to $4.08

Litecoin up +3.4% to $72.57

Bitcoin Cash up +0.7% to $307.53

Binance Coin down -8.5% to $20.4

Stellar down -2.0% to $0.058621

TRON down -0.3% to $0.01569

Dash up +6.4% to $92.73

Fiat Currencies

Dollar Index (DXY) -0.11% to 98.22

EUR +0.27% to 1.11 USD/EUR

GBP +1.21%% to 1.25 USD/GBP

JPY -0.55% to 0.0092 USD/JPY

CNY Onshore +0.29% to 0.141 USD/CNY

CNH Offshore +0.28% to 0.1411 USD/CNH

CHF -0.10% to 1.007 USD/CHF

Commodities

Gold +1.0% to $1501.37

WTI Crude +3.0% to $59.1

Brent Crude +2.8% to $64.14

6. Top Tweets

| This future is coming at us fast…when Libra was first suggested I thought it was a game changer and the genie was out of the bottle. Carney’s speech cemented that view, now the ECB are jumping on it. The future financial system is being formed. Very nascent still. https://t.co/rTv7t49Z8z— Raoul Pal (@RaoulGMI) September 17, 2019 |

| Warren Buffett owns almost 10% of Wells Fargo. Wells Fargo is creating a dollar-backed digital currency. So now Warren Buffett basically loves Bitcoin, right?— Pomp (@APompliano) September 17, 2019 |

| Hedera’s mainnet (beta) has officially reached open access! Watch a replay of the event. Hear from Hedera Co-Founder’s @leemonbaird and @ManceHarmon, members of Hedera’s governing council, and #dapps in production on the Hedera mainnet. https://t.co/DWzqo3mISk #hellofuture pic.twitter.com/XiVjs5PEIX— Hedera Hashgraph (@hashgraph) September 17, 2019 |

Education

7. Required Reading

Harbor Tokenizes $100 Million in Real Estate Funds on ETH – Securities.io

One of the leading tokenization platforms, Harbor announced this week that they successfully tokenized $100 million in real estate funds. The firm tokenized four major funds with the goal to increase liquidity for investors. The move showcases growing interest by investors towards more liquid alternative investments…

Blockstack PBC Raises $23M in Token Offerings – Blockstack Labs

We are pleased to announce that the sale period for Blockstack’s SEC-qualified token offering ended yesterday, and we announced our Asia strategic round earlier. We want to thank the thousands of you that have participated. For the first time, retail investors in the United States were able to participate in a token offering qualified by the SEC…

Introducing Chronicle — A Permanode Solution – IOTA

Chronicle is the IOTA Foundation’s official permanode solution. It makes it easy for node owners to store all IOTA transactions in a fast, secure, scalable, and distributed database. Chronicle is used to store the unbounded data flow of the Tangle and make it queryable. In other words, a permanode enables indefinite storage of the Tangle’s entire history and makes that data easily accessible at scale…

Mark Zuckerberg Struggles to Keep Libra Alive – Lionel Laurent

Mark Zuckerberg’s cryptocurrency project, Libra, has become the regulatory equivalent of a pinata: Everyone is lining up to hit it with a stick. France’s finance minister Bruno Le Maire calls it an assault on sovereignty and a risk to financial stability, an attack backed up by his German counterpart Olaf Scholz who dubbed it a “parallel currency.” You can see their point…

Events

8. What’s happening in next week

Wednesday, September 18

—

Thursday, September 19

StorJ Open Core Summit

Bitcoin / Altcoins & Cryptocurrency Enthusiast Night – September Crypto Networking Night

Friday, September 20

FinWise Macao

Monday, September 23

CryptoBlockCon London

Tuesday, September 24

—

Wednesday, September 25

Blockchain Live 2019