Bitcoin Rises Above $66k, Base Surpasses $2B TVL

Market Update

August PCE data came in slightly below expectations, with Core MoM PCE reading 0.1% vs. 0.2% expected, reaffirming that inflation is receding steadily. Debates over the size of the Fed’s next rate cut have already begun, with odds for 50bps increasing slightly after the PCE data, rising to 52.1% compared to 49.3% yesterday. Stocks are relatively flat to end the week, with the SPY -0.07% gaining 0.14% and the QQQ 0.13% declining 0.18%. Crypto continues its rally, with BTC 3.94% rising above $66k, supported by strong ETF flows totaling $612 million this week. Yesterday extended Bitcoin’s streak of consecutive days of net inflows to six days. ETH 6.05% is trading above $2,675, although its weekly flows have been less impressive, totaling only $26 million. Binance founder and former CEO Changpeng Zhao has been released from prison after serving about four months. Although he is not permitted to return to the Binance, BNB 4.20% has rallied about 3% following his release and is approaching its all-time high.

Base Surpasses $2 Billion in TVL

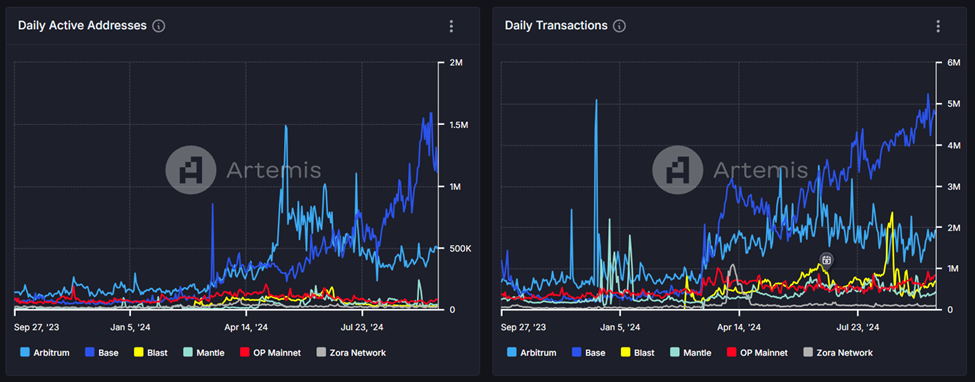

The Base Network, Coinbase’s Ethereum layer-2 network, has accumulated TVL of over $2 billion for the first time in its history, representing about a 370% increase year-to-date. The TVL milestone makes Base the second largest L2 from a TVL perspective, only behind Arbitrum. Although Base trails Arbitrum in TVL, it appears to have a more active ecosystem with more than double the number of daily active addresses and approximately 2.5 times the number of daily transactions. Base’s growth has been impressive and clearly has an advantage in onboarding users as Coinbase continues to add features and marketing to its core exchange product that funnel customers to Base. Base does not currently have a token, but investors can gain broad-based exposure by purchasing shares of COIN 17.12% .

Tornado Cash Founder to Face Trial

Tornado Cash co-founder Roman Storm is set to face trial after U.S. Federal Judge Katherine Polk Failla denied Storm’s motion to dismiss the case. Tornado Cash is a decentralized crypto mixer that can be used to hide the origins and destination of funds. Storm’s charges include conspiracy to commit money laundering, conspiracy to violate the International Economic Emergency Powers Act, and conspiracy to operate an unlicensed money-transmitting business, which collectively carries a maximum sentence of 45 years in prison. Storm’s dismissal motion argued that creating a tool is not inherently a crime and he should not be responsible for the actions of people using the tool, but Failla stated that Storm knowingly facilitated the laundering of over $1 billion and that mixers are no different than traditional money transmitting businesses. Storm’s trial will begin on December 2nd and should last approximately two weeks. Developers will likely watch the trial closely as the verdict could serve as a precedent for all open software going forward.

Technical Strategy

Bitcoin Cash looks to be trying to carve out a bottoming process that could allow it to join the strength seen in many cryptocurrencies this past week. BCH 7.92% managed to successfully break out above the downtrend from this Spring, yet has been in range-bound consolidation as part of a lengthy reverse Head and shoulders pattern that’s been ongoing since August. As charts show, there is a clear delineation of a “low, lower low, and then more recent low” that forms the basis for this pattern. Confirmation requires a breakout above the “neckline” which lies currently at $7.57. Any daily close over 7.57 likely will start an acceleration process in BCH that should help this rally up to challenge July highs just below $12 initially. At present, BCH looks like an excellent risk/reward as this breakout has not yet gotten underway, but yet the area of risk is very well defined near $5.72.

Daily Important MetricsAll metrics as of 2024-09-27 13:50:29 All Funding rates are in bps Crypto Prices

All prices as of 2024-09-27 11:06:22 Exchange Traded Products (ETPs)

News

|