Markets Derisk Ahead of Jackson Hole, Franklin Templeton Expands MMF to Avalanche

Market Update

U.S. equities are declining as investors derisk ahead of tomorrow’s speech from Fed Chair Powell at the Jackson Hole Economic Symposium, expected at 10 AM EST. The SPY 0.68% has declined to $555, and the QQQ 0.88% to just below $475. Crypto rallied yesterday afternoon after it was reported that, if elected, Kamala Harris will support policies that ensure technologies like digital assets can continue to grow. BTC -0.07% rallied to $61.8k, and ETH 0.22% gained to $2,660, but both have pared those gains, trading at $60.5k and $2,610, respectively. Avalanche is displaying strength today following two positive headlines, with Grayscale launching an Avalanche Investment Trust and Franklin Templeton expanding access to its MMF fund on Avalanche (more below). AVAX -2.57% has gained over 6%, surpassing the $25 mark.

Franklin Templeton Expands On-Chain MMF to Avalanche

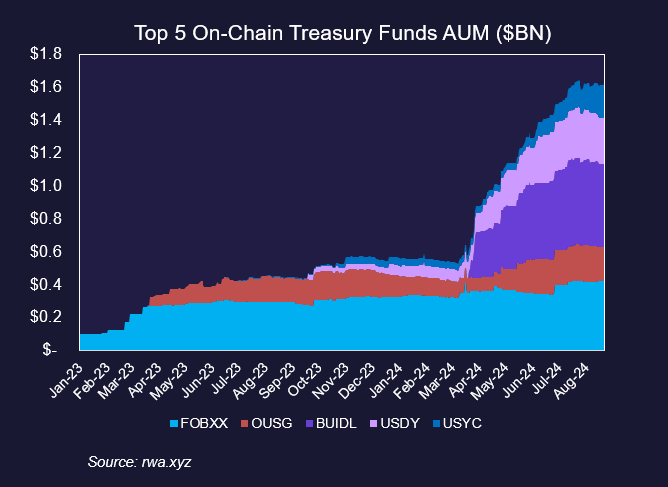

Asset manager Franklin Templeton is expanding access to its On-Chain U.S. Government Money Fund (FOBXX) to the Avalanche Network (AVAX -2.57% ). Avalanche is the fourth blockchain supporting the MMF, joining Arbitrum, Polygon, and Stellar. FOBXX launched in 2021 and was the first U.S. registered mutual fund to leverage a public blockchain to issue tokenized shares. The fund has grown to over $420 million in AUM and invests 99.5% of funds into U.S. government securities, cash, and repurchase agreements, with the objective of offering investors a high level of current income. The tokenized treasury market has rapidly expanded to $1.92 billion as blockchains have unlocked efficiencies for asset managers and increased accessibility for investors. Currently, FOBXX is the second largest tokenized fund, only behind Blackrock’s BUIDL fund, which has approximately $500 million in AUM.

Near Completes Nightshade 2.0 Upgrade

Near Protocol, a layer-1 blockchain network, has completed its “Nightshade 2.0” upgrade on mainnet, introducing stateless validation and scalability improvements to the network. Near operates with a sharding architecture where network data gets broken up into multiple “shards,” with each being validated in parallel. Nightshade 2.0 introduces stateless validation, where validators no longer need to maintain local records of all shards and can instead retrieve all necessary data directly from the network, improving single-shard performance and adding capacity for additional shards. Near currently operates with six shards and hopes to have ten by the end of the year. The upgrade will also reduce costs and hardware requirements for validators, lowering the barrier to entry for new validators to join the Near ecosystem. NEAR -6.47% has gained approximately 1.10% following the news of the successful upgrade.

Technical Strategy

LDO’s push to the highest levels since 8/9 gives some minor evidence of a bottoming out following a difficult stretch in recent months. Following its recent stabilization at support levels which lined up with 2022 lows, and also marked a 61.8% alternative retracement target, LDO -4.41% began some neutral consolidation over the past couple weeks. While it would take a rally back over $1.80 to exceed the ongoing downtrend from January peaks, the near-term technicals have improved given its uptick in strength this week. Rallies up to $1.29 look likely, then a push to $1.52 thereafter. The act of getting back above $1.52 will be important technically, as this approximates both May and July 2024 lows. Thus, if/when LDO can exceed this level, it would give much greater confidence of an intermediate-term bottom.

Daily Important MetricsAll metrics as of 2024-08-22 13:55:09 All Funding rates are in bps Crypto Prices

All prices as of 2024-08-22 13:35:28 Exchange Traded Products (ETPs)

News

|