Rates Move Lower, Riot Reports Q2 Earnings

Crypto Market Update

Risk assets are broadly lower today, with the SPY 0.68% and QQQ 0.88% paring some of the rapid gains seen yesterday following the FOMC meeting in which rates were held steady, but dovish comments sparked optimism, leading to markets pricing in three rate cuts by year-end. The US10Y has dropped below 4% for the first time since February. Crypto is showing steeper losses, with BTC 0.26% sharply lower to $62.7k and ETH 0.57% falling to $3,100. Coinbase (COIN 3.07% ) has dropped over 3% ahead of its Q2 earnings release after market close. Trading volumes have been muted over the last few months, but something to watch for could be positive guidance, given multiple political developments in recent weeks.

Riot Q2 Earnings

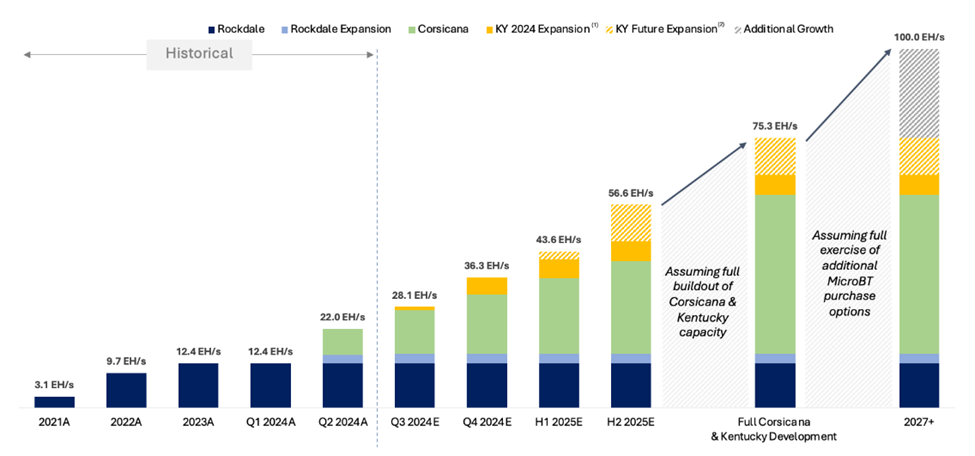

Riot Platforms (RIOT -3.33% ) released Q2 earnings yesterday, reporting a net loss of $84.4 million compared to a $27.4 million loss in Q2 2023. Total revenue dropped to $70 million from $76.7 million YoY, primarily driven by a $9.7 million decrease in engineering revenues but partially offset by a $6 million increase in mining revenue, totaling $55.8 million. In the first quarter post-halving, Riot reported production of 844 Bitcoin, a 52% YoY decrease, at an average cost of production (including power credits) of $25,327. Riot currently holds 9,334 BTC, equal to approximately $585 million. Although production was down, Riot increased its hashrate capacity to 22.0 EH/s as of the end of June and raised its year-end estimate of total hash rate to 36.3 EH/s.

Figure: Riot Hash Rate Projections

Telegram In-App Browser and Mini-App Store

Popular messaging app Telegram has updated its app, releasing an in-app browser, a new mini-app store, and increased functionalities. Users can now switch seamlessly between surfing the internet and messaging without leaving the Telegram app. The Telegram browser also hosts decentralized websites native to the TON network, allowing users to interact with dapps and making web3 available to millions of users. With its new mini-app store, Telegram users can search for new games or services to access and can also add mini-apps to their stories, similar to Instagram or Snapchat. Telegram is making its app a one-stop shop for messaging, web3, social media, and more. TON 2.16% is holding up better than most altcoins amid broad selloffs, declining 0.81%, while the total altcoin market cap is down over 2.7%.

Technical Strategy

Following a decent start to July for Ethereum, the last week of July promptly gave back over half of those gains. Thursday’s selloff under 7/25 lows keeps this near-term decline ongoing for ETH 0.57% and could signal a return to 2900 before this finds support. Daily charts show Thursday’s decline falling to the lowest levels since 7/14, undercutting lows of the last few weeks. Unfortunately, this keeps the downward near-term trend intact, and can allow for a bit more near-term weakness. To have more confidence of ETH bottoming, it’s necessary for the price to get back up above $3400 which would help its larger structure, which has been arguably range-bound since March. At present, I expect another few days of weakness before another attempt at bottoming. However, more will be needed than what was seen earlier this week to make the call for relative outperformance, and at present, short-term trends from mid-July remain negative.

Daily Important MetricsAll metrics as of 2024-08-01 12:39:16 All Funding rates are in bps Crypto Prices

All prices as of 2024-08-01 14:56:56 Exchange Traded Products (ETPs)

News

|