Goldman Launching Tokenized Funds, Microstrategy Announces Stock Split

Crypto Market Update

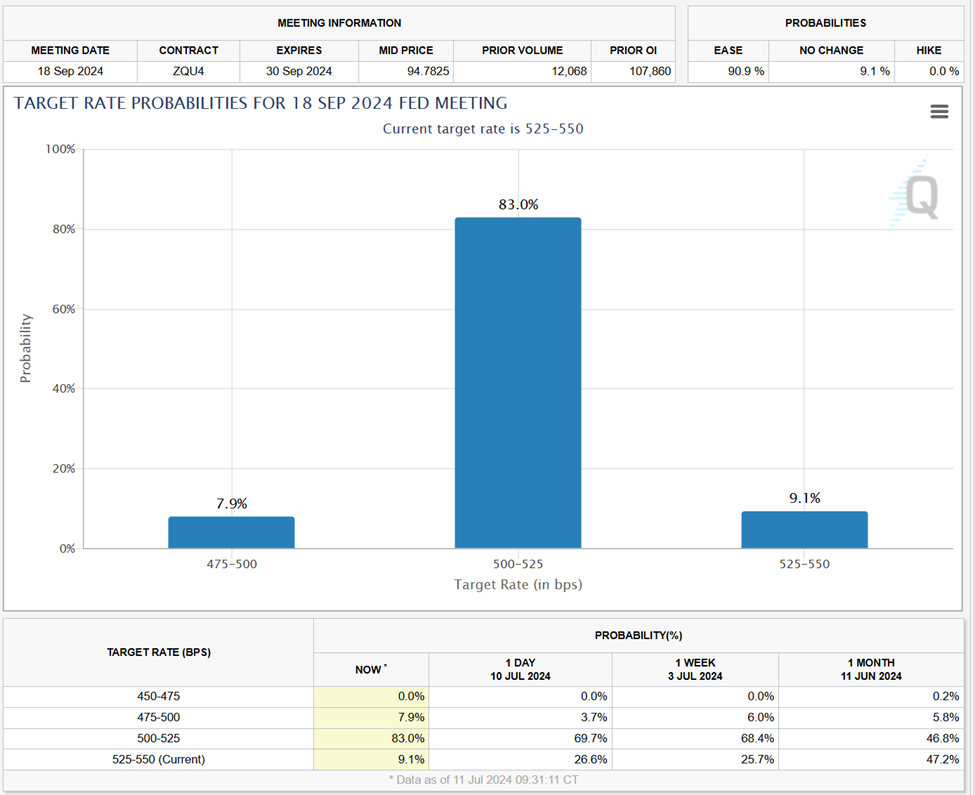

June CPI came in below expectations, with the MoM figure reading -0.1% compared to +0.1% expected, causing a significant drop in rates, with the US10Y dropping to 4.175%. Markets are now pricing an 83% chance of a September rate cut, with higher probabilities for further easing in the subsequent November and December meetings. A large-cap to small-cap rotation appears underway in response to rate expectations, as the IWM -0.78% is surging while the SPY -0.07% and QQQ 0.13% are both negative on the day. ETH 0.92% is outperforming Bitcoin ahead of ETF approval, and a lack of supply overhang plaguing BTC -0.21% . The German Government’s holdings are now below 10,000 BTC (~$570m), although Mt. Gox distributions remain a headwind.

Goldman to Launch Tokenized Funds

Goldman Sachs is extending its push into digital assets with plans to launch three tokenized funds before year-end. Reportedly, two of the funds will target the U.S. “fund complex” and European debt markets, with little details on the third and additional plans to create a tokenized asset marketplace. Goldman has previously worked with European Investment Bank to issue sovereign green bonds for the Hong Kong Monetary Authority, but this represents a larger push into the industry. Goldman has witnessed the success of traditional asset managers like Blackrock and Franklin Templeton with their tokenized products. Blackrock’s tokenized treasury fund BUIDL surpassed $500 million in AUM this week. Goldman’s head of digital assets, Matthew McDermott, stated that Goldman’s approach would target institutions instead of individual investors. He also pointed out a nuance compared to competitors in its belief of building on permissioned blockchains versus decentralized ones due to regulatory hurdles.

Microstrategy 10-for-1 Stock Split

Microstrategy (MSTR 8.83% ) has announced a 10-for-1 stock split of the company’s class A and class B common stock to make shares more accessible for investors and employees. The stock split will be completed by means of a stock dividend to holders as of business close on August 1st, 2024. Each MSTR holder will receive 9 additional shares of stock, which will be distributed after the close of trading on August 7th, with split-adjusted trading to begin on the 8th. MSTR shares are responding positively to the split announcement, rising more than 6% in today’s trading. Microstrategy remains the largest corporate bitcoin holder, with 226,331 BTC, worth approximately $13.1 billion at current prices.

Technical Strategy

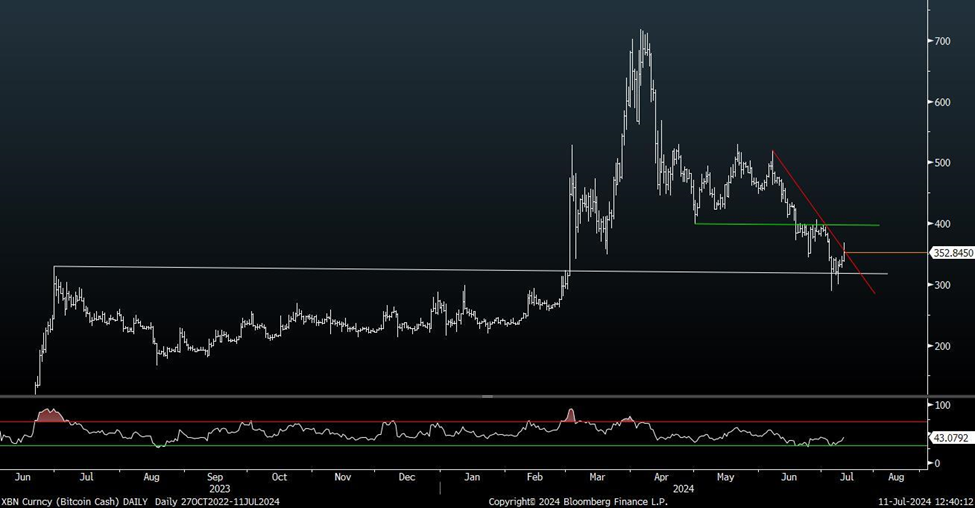

Following a steep 40% correction over the last couple of months, Bitcoin Cash has shown a few signs of stabilizing which might lead to an oversold bounce. As shown, prices fell to test the area right near prior peaks from Summer 2023 which intersected near $329. The decline in BCH 0.55% took the shape of two sharp corrective declines which were nearly equal in price points lost since early April. Today’s bounce has been helpful in moving back to multi-day highs. However, at $352, this hits the current downtrend from early June and is not yet strong enough to claim an upside breakout has been achieved. Moreover, the area at the early May lows at $399 will prove to be the more important area to surpass, and when that happens, then a rally back to near $500 can get underway. At present, any failure to get above $399 might result in a final pullback under $200 into August. However, BCH looks interesting as a risk reward given this recent decline but will need to show more strength to be convincing of a larger low in place.

Daily Important MetricsAll metrics as of 2024-07-11 12:00:25 All Funding rates are in bps Crypto Prices

All prices as of 2024-07-11 11:51:29 Exchange Traded Products (ETPs)

News

|