Hut-8 Reveals New West Texas Site, Worldcoin Announces Layer-2 Network

Crypto Market Update

Equities are gaining alongside rates today as Fed Chair Powell provides testimony to Congress. He reiterated that recent progress on inflation has been welcomed, but more is needed before reducing the restrictiveness of monetary policy. He also acknowledged that risks are beginning to become two-sided, citing recent cooling in the labor market. The SPY 0.69% and QQQ 0.66% have both gained approximately 0.21% as they hover near all-time highs. Crypto assets are building on yesterday’s gains, with BTC -1.92% trading at $57.3k, supported by close to $300 million in ETF inflows yesterday. ETH -2.53% is showing slight outperformance, rising to $3,060 following multiple ETF issuers submitting revised S-1 statements yesterday afternoon, which should likely be the final round of revisions before approvals, with trading potentially starting next week.

Hut 8 Agreement for 205-Megawatt Texas Site

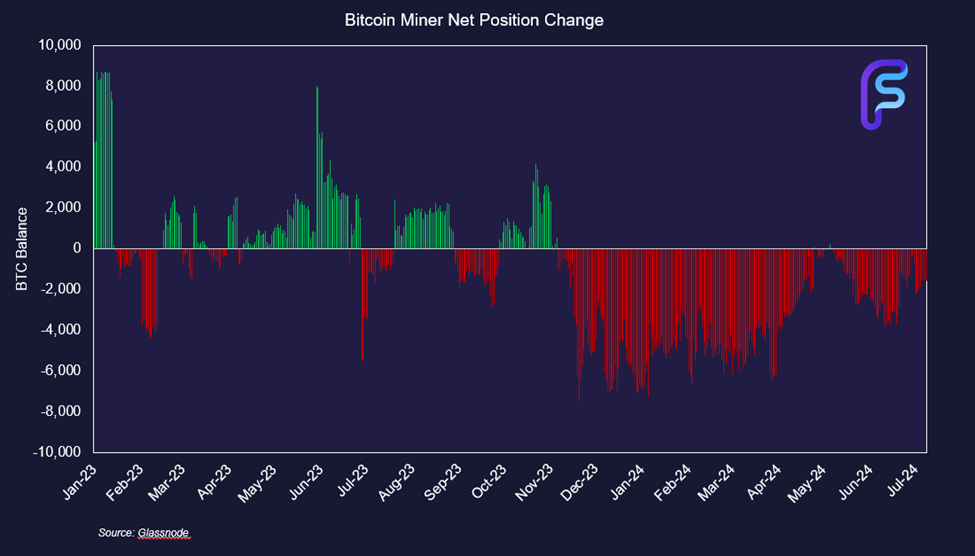

Bitcoin miner Hut 8 has reached a power purchase agreement for 205 megawatts at a site in West Texas. Hut 8 previously announced a development pipeline of 1,100 megawatts of exclusive energy capacity, with this being the first disclosed project. The site is next to a wind farm and connected to the ERCOT grid, giving Hut 8 some of the cheapest wholesale energy in North America. The site’s engineering, procurement, and construction efforts are ongoing, and once the purchase is finalized, Hut 8 should have close to 1.3 gigawatts of capacity across owned and managed services. The new power should help Hut 8 execute high-performance computing (HPC) use cases along with Bitcoin mining operations. Miners continue to explore use cases beyond pure Bitcoin mining as a way to diversify revenue streams and reduce the effects of Bitcoin cyclicality. Miners have been reducing bitcoin positions to account for the April halving, but going forward, HPC revenues may provide a solution to improve operational efficiency. HUT has gained approximately 84% since the start of June as investors are optimistic about revenue diversification and potential.

Worldcoin Foundation Unveils World Chain

The Worldcoin Foundation, the development company behind Worldcoin (WLD), has released a developer preview of its new layer-2 network, World Chain. The preview allows developers to start exploring, building, and testing applications on World Chain ahead of its mainnet launch later this summer. World Chain will leverage the OP Stack and join the “superchain” of Optimism L2s. Worldcoin user transactions have grown to over 50% of OP Mainnet’s total activity since July 2023, and the introduction of World Chain will solve scalability issues when activity surges. World Chain will supposedly be able to process approximately twice as many transactions as OP Mainnet before the fee market is impacted. Developers can now begin setting up their deployments before migrating over 10 million World App users to World Chain.

Technical Strategy

Similar to ETH -2.53% comments yesterday, Chainlink also has pulled back to a “Make-or-Break” area of technical support which has marked lows along a neckline established last November, 2023. This managed to bottom near an exact 50% absolute retracement of its March peaks and makes LINK -3.03% a more appealing risk/reward given its well defined risk levels at $11. Movement back over $14 would help this surpass a minor downtrend from late May, arguing for a likely bounce up to initial resistance near $17. This approximates a 50% retracement of LINK’s high to low range since March as well as intersecting a downtrend from March peaks. Over $17 would add some conviction to the idea of a larger rally getting underway. Conversely, patience is required under $11 which would postpone its advance, allowing for movement down to $8.50-$9. Overall, the next few weeks should decide which scenario should be correct, but LINK looks more appealing at these levels given stabilization near important support.

Daily Important MetricsAll metrics as of 2024-07-09 12:00:23 All Funding rates are in bps Crypto Prices

All prices as of 2024-07-09 11:50:11 Exchange Traded Products (ETPs)

News

|