Mt. Gox Repayments to Begin in July, Riot Withdraws its Bitfarms Bid

Crypto Market Update

Equities are mixed this morning, with the SPY -0.22% gaining 0.30% and the QQQ 0.16% decreasing 0.31%, weighed down by a 5% drop in NVDA. The DXY N/A% has dropped 0.32%, although it has not boosted crypto assets. BTC 0.04% has fallen more than 3%, briefly dropping under $61k after news of Mt. Gox repayments beginning in July (more below). ETH 0.75% has followed suit, declining to $3,300 despite the likelihood that spot ETFs begin trading next week. Altcoins are holding up despite the decrease in majors, with TOTAL3 only declining 1.16%. Some top-performing alts include LDO 1.44% , WIF -0.15% , and INJ -1.07% , which have gained 5.84%, 5.30%, and 4.64%, respectively. As mentioned in last week’s Core Strategy note, Lido presents a favorable risk to reward, with the ETH ETF potentially providing a tailwind in the near term.

Mt. Gox Repayments to Begin in July

In a letter to creditors, Mt. Gox Rehabilitation Trustee Nobuaki Kobayashi said that preparations for distributions of Bitcoin and Bitcoin Cash have been made, and payments can commence from the beginning of July. Mt. Gox was exploited in 2014 for 850,000 Bitcoin, and creditors have patiently been waiting for their repayments. Mt. Gox has 142,000 BTC (~$8.6 billion) and 143,000 BCH (~$51 million) to distribute by October 2024. Kobayashi iterated that Mt. Gox has taken sufficient time to ensure safe and reliable repayments to creditors, including technical remedies for safe payments and compliance considerations across different countries. The repayments will be made to crypto exchanges in the order that they completed the required steps. Although Bitcoin has sold off following the news, in our view, it is likely that many creditors have already hedged their positions or are long-term believers in Bitcoin and the immediate market impact of distributions will be less severe than many anticipate.

Riot Withdraws Bitfarms Bid and Proposes New Board Members

Riot Platforms has announced its requisition of a Special Meeting of Bitfarms’ shareholders to reconstitute the board of directors. The meeting will give Bitfarms shareholders the opportunity to vote on the removal of Bitfarms’ interim CEO Nicolas Bonta and Director Andres Finkielsztain, and Riot has nominated three potential candidates as their replacements. Riot believes Bonta and Finkielsztain bear direct responsibility for poor corporate governance and the inability of the company to realize Bitfarms’ full potential. Over the course of a year, Riot has tried to constructively engage with Bitfarms regarding a potential transaction between the companies, and Riot claims that good faith negotiations are impossible without change to the Bitfarms Board. Riot attempted a hostile takeover bid, accumulating a 14.9% stake in Bitfarms, and also proposed purchasing all Bitfarms common shares for $2.30 / share. Riot has withdrawn its acquisition proposal but remains committed to pursuing a transaction to create the largest publicly listed Bitcoin miner. Riot concluded that it stands ready to engage and deal with a new Bitfarms board to pursue a mutually beneficial transaction.

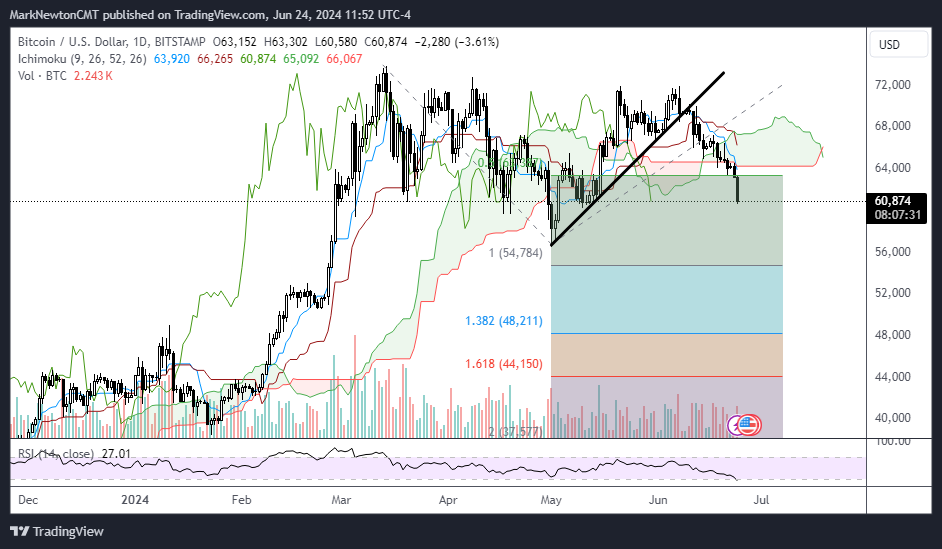

Technical Strategy

Bitcoin’s decline is now extending for its third week, and many are starting to take notice given the large retracement back below 61.8% Fibonacci retracement levels of the prior advance from early May. Momentum remains downward sloping and is just nearing daily oversold levels using RSI. However, DeMark based exhaustion counts remain premature, and volatility has picked up over the last 24 hours. Overall, two scenarios seem feasible, technically speaking. First, this BTC 0.04% selloff finds support at/near early May lows at $56.5k, which helps to form a giant three-month Triangle pattern which results in a push back to new highs. Second, $56.5k is undercut which would result in weakness in an Elliott-wave style ABC pattern down to $44-$48k, which is based off of projections from the initial selling which started in March. Given that the Bitcoin cycle composite seems to suggest weakness until July expiration, one cannot rule out a move to the mid-$40’s in my view. However, it should be right to consider buying weakness down near May lows initially as the first real area of downside support. On the lack of this holding, then one should hold off on immediately looking to buy dips until some evidence of stabilization arises in the mid-$40’s.

Daily Important MetricsAll metrics as of 2024-06-24 12:00:29 All Funding rates are in bps Crypto Prices

All prices as of 2024-06-24 12:22:51 Exchange Traded Products (ETPs)

News

|