Soft CPI Fuels Risk Assets Surge, Ripple Chooses Axelar as Sidechain Bridge Partner

Crypto Market Update

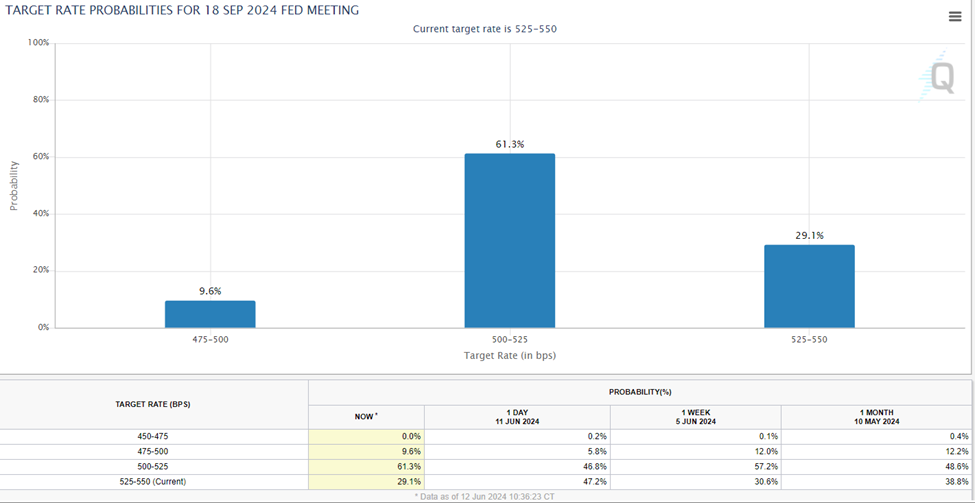

May CPI data was soft across the board, with headline inflation coming in at 0.0% MoM vs. 0.1% expected and MoM core inflation at 0.2% vs. 0.3% expected. The data has fueled a significant decline in rates and the dollar, erasing the gains following Friday’s NFP data. Markets have begun pricing a higher likelihood of a September rate cut, with futures implying a 61.3% chance of a cut compared to a 46.8% chance yesterday. Risk assets are surging in light of the soft inflation data, with the SPY 0.68% and QQQ 1.04% both gaining over 1% to new all-time highs. Crypto is following suit, with BTC 3.15% trading slightly below $70k and ETH 20.78% hovering near $3,600. Market participants are still awaiting the Fed’s interest rate decision, combined with a renewed dot plot and Chair Powell’s comments. Many expect the dot plot to imply two rate cuts for 2024, but if the median projection implies three, it could provide a further tailwind to risk assets.

Ripple Leverages Axelar as EVM Sidechain Bridge

Ripple, the development company behind XRP 6.74% , announced its EVM-compatible sidechain called XRPL EVM Sidechain. XRPL EVM Sidechain is built using evmOS, a modular tech stack built by Evmos. EVM compatibility will allow developers to easily port Ethereum applications to the sidechain, unlocking new opportunities for growth within the XRP ecosystem. Axelar (AXL 3.02% ) will be the exclusive bridge between XRPL and XRPL EVM Sidechain so users can bridge their XRP into eXRP, which will serve as the native gas token on the sidechain. Axelar can also facilitate bridging between the XRP ecosystem and 55 other blockchains, vastly improving the interoperability of XRP. Ripple applauded Axelar as a stellar interoperability solution that simplifies the user experience without compromising security. With the Axelar partnership, Ripple is putting the development of XLS-38, a proposal to develop an in-house cross-chain bridge, on the back burner as they monitor whether it’s worth the time, effort, and cost.

MetaMask Unveils Pooled Staking Service

MetaMask has introduced a new pooled staking service where Ether holders can stake any amount of ETH with Consensys’ validators. Previously, MetaMask users would need 32 ETH to delegate to Consensys validators. Now, MetaMask Pooled Staking allows smaller owners to earn a share of staking rewards and secure the network with any amount. More than 99% of ETH holders have less than 32 ETH, so MetaMask hopes the feature will increase participation in Ethereum staking. MetaMask Pooled Staking is built on top of Consensys’ 33,000 hosted Ethereum validators in a multi-cloud, multi-region, and multi-client infrastructure. It also leverages Stakewise’s modular architecture to power its smart contracts. MetaMask users can unstake at any time but are subject to the Ethereum exit validator queue. Additionally, the pooled staking service will not be accessible to U.S. and U.K. customers due to regulatory uncertainty. Consensys hopes to offer the feature to all jurisdictions in the future.

Technical Strategy

Today’s sharp reversal to multi-day highs in Avalanche likely could mark a meaningful low following the last few weeks of consolidation. AVAX 9.75% experienced a false breakout into the end of May, and since has backtracked to a level of support which has proven important on multiple occasions over the last few months. The area near $30.45 stands out as having significance for AVAX, and is considered a “line in the sand” for longs after several retests. Gains back to test trendline resistance at $35.50 is important in the weeks to come, and the ability to exceed that could allow for a push higher to challenge and exceed May peaks at $41.78. Until then, AVAX requires a bit more strength to have confidence that a continued rally can occur. Any violation of $30.45 in the weeks and/or months to come would prove problematic to the bullish thesis, and likely drive a decline to challenge and break early January 2024 lows at $27.21.

Daily Important MetricsAll metrics as of 2024-06-12 12:00:25 All Funding rates are in bps Crypto Prices

All prices as of 2024-06-12 11:51:17 Exchange Traded Products (ETPs)

News

|