Core Scientific Diversifies into AI Computing, Watford FC Selling Tokenized Equity

Market Update

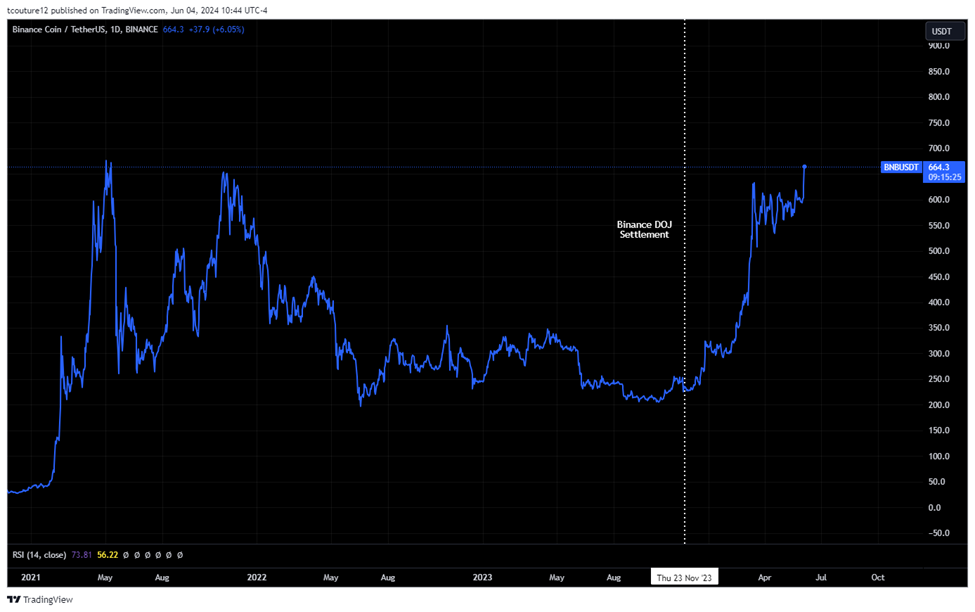

U.S. Treasury yields continue to roll over following this morning’s JOLTS report showing 8.059 million job openings versus 8.35 million expected. Yields are lower across the curve, with the US10Y decreasing 1.12% to 4.34%. Equities are declining today, with the SPY -0.07% and QQQ 0.13% both trading approximately 0.40% lower, while the IWM -0.09% is showing relative underperformance despite a decrease in rates. In contrast, crypto assets are responding positively to the decline in rates, with BTC 1.95% trading above $70,000 and ETH 1.06% above $3,800. BNB 2.97% is a top performer today, rising almost 6% and approaching its 2021 all-time high of $692. Binance’s settlement with the DOJ has been a turning point for BNB’s price performance, rising approximately 180% since the news became public.

Core Scientific Diversifies into AI Computing

Core Scientific has inked a deal with cloud infrastructure company CoreWeave to provide approximately 200 MW to host CoreWeave’s high-performance computing services. The deal includes a series of 12-year contracts, which will have Core Scientific repurpose multiple of its Bitcoin mining sites to host CoreWeave’s Nvidia GPUs. The site modifications should start in the second half of 2024 and be operational in the first half of 2025. CoreWeave will contribute about $300 million in capital investments with the option to increase hosting capacity. The deal is expected to generate approximately $290 million in annual revenue over the course of the contracts, providing Core Scientific with dollar-denominated revenue, which could help them navigate the cyclicality of the mining industry and raises the question of whether other mining companies will begin exploring different revenue streams to supplement their business models. CORZ has surged over 33% to $6.50 in response to the partnership, surpassing the value of an all-cash offer of $5.75 per share that CoreWeave also made for Core Scientific.

Watford FC Selling Tokenized Equity

Watford Football Club, a European soccer team that plays in the EFL Championship League and previously the Premier League, is selling 10% equity in the team via tokenized equity. The sale will be conducted digitally via Seedrs, the European arm of the investment platform Republic. Investors can choose to receive equity tokens, which will come with additional benefits and exclusive offers, similar to traditional fan tokens. Watford FC is valued at 175 million GBP and is looking to raise 17.5 million GBP at a share price of 12.44 GBP. The capital will be designated towards initiatives to improve the team’s performance, such as recruitment, training, and coaching. The minimum investment is four shares if investing through Seedrs and eight shares if going through Republic. Watford is planning to enable trading of its equity token and represents one of the first clubs to open ownership up to fans via tokenized equity.

Technical Strategy

Monero’s gains have started to accelerate in the last couple weeks, and despite rising over 40% in the prior six of the past seven weeks, XMR -2.32% still looks to have some work to do before any type of larger intermediate-term technical improvement occurs. Key resistance lies near $176 which has held a pattern of former peaks since mid-2022. This looks to be an important area for XMR and could be tested in the weeks ahead. The ability to clear $180 would allow for a much larger intermediate-term rally to take hold, with a zone of upside resistance found from $245-$260. Overall, the short-term trend remains bullish at this time as part of a neutral intermediate-term trend which has been improving in recent weeks. Dips, if/when they occur, should find solid support near $148 before pushing back higher.

Daily Important MetricsAll metrics as of 2024-06-04 12:00:31 All Funding rates are in bps Crypto Prices

All prices as of 2024-06-04 11:49:45 Exchange Traded Products (ETPs)

News

|