PYUSD Expands to Solana, Gemini Earn Customers Receive First Distributions

Market Update

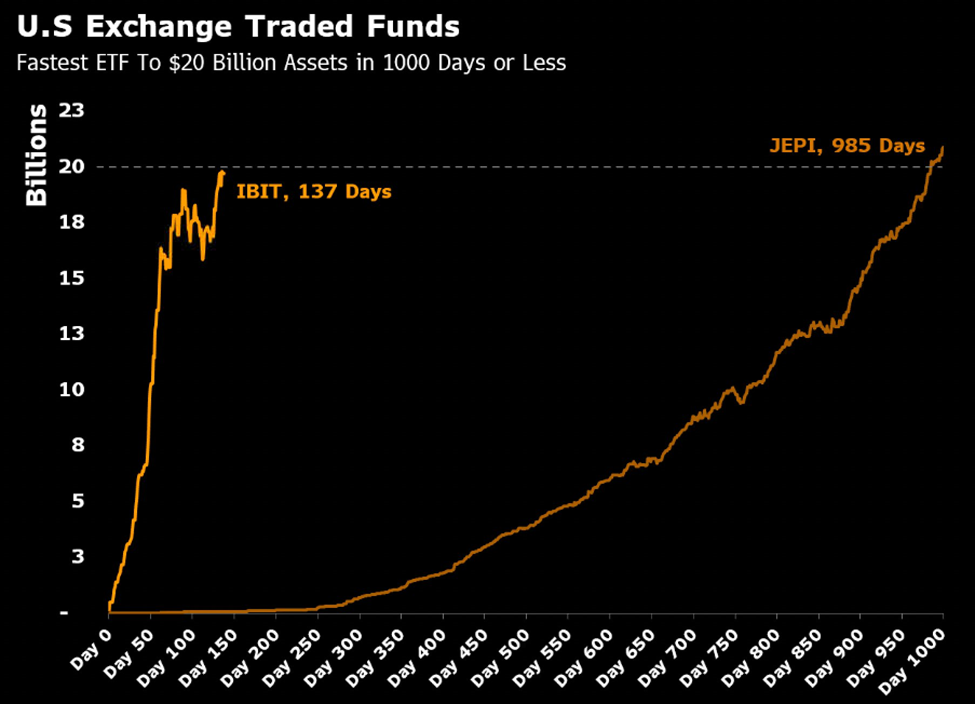

U.S. Treasury yields and the DXY N/A% continue pushing upwards, putting downward pressure on risk assets. The SPY 0.68% has declined 0.53%, breaking below $530, and the QQQ 0.88% has decreased 0.42% to $458. Crypto assets are showing more pronounced losses, with BTC -3.41% (-1.42%) trading in the low $67,000s and ETH -4.88% (-2.29%) hovering near $3,750. Blackrock’s IBIT 0.74% saw inflows of $102.5 million yesterday, bringing its total AUM to just under $20 billion. For comparison, the fastest ETF to reach that level of AUM was JEPI, which took 985 days, whereas IBIT has the chance to break that record today (138 days), displaying the overwhelming success of the Bitcoin ETFs and a potential foreshadowing of what’s to come upon Ethereum ETF launches.

PYUSD Expands to Solana

PayPal launched its stablecoin, PYUSD, in August 2023, and in the nine months since its launch, PYUSD has grown to a roughly $400 million market cap, a small portion of the $160 billion of total stablecoins. PayPal and Venmo collectively have over 100 million users, and getting those users to adopt digital asset technology remains one of PayPal’s primary goals. In an effort to reach their goal, PYUSD is now available on Solana. Through Solana’s token extensions, PYUSD will be able to expand functionality with confidential transfers, transfer hooks, and memo fields – all of which mirror traditional payment features. Paypal believes the enhanced features, in combination with Solana’s cost-effectiveness and high throughput, could be the key to unlocking the next wave of PYUSD adoption.

Gemini Earn Users Receive 97% of Assets In-Kind

Gemini has announced that initial distributions to Gemini Earn customers have begun. 232,000 users had lent their crypto assets to the Gemini Earn program in 2022 but were unable to withdraw funds due to Genesis’ insolvency. At the time when Gemini halted withdrawals, customer assets were worth approximately $940 million. Distributions are being made “in-kind,” meaning they will be in the form of tokens and not converted into fiat terms. As crypto assets have appreciated significantly in value over the past eighteen months, those assets are now worth over $2.18 billion, representing a 232% recovery of assets. The $2.18 billion represents approximately 97% of total customer assets, with the remaining 3% to be distributed over the next twelve months.

Technical Strategy

TRU has pushed to the highest levels in more than two years on Wednesday, exceeding March 2024 peaks of $0.1963 on above-average volume. While stretched on a short-term basis, the broader ability for May to possibly end at new multi-month highs is a bullish technical development heading into the month of June. Upside should be likely to $0.37 with 50% retracement zone resistance found at $0.478 on gains into mid-to-late June. Support lies a $0.17 and should provide buying opportunities on any minor pullbacks in the days ahead. Overall, TRU’s push to new yearly highs is a real technical positive, and should result in gains in the weeks to come.

Daily Important MetricsAll metrics as of 2024-05-29 17:57:48 All Funding rates are in bps Crypto Prices

All prices as of 2024-05-29 13:51:55 Exchange Traded Products (ETPs)

News

|