BitDigest March 11 · Issue #858

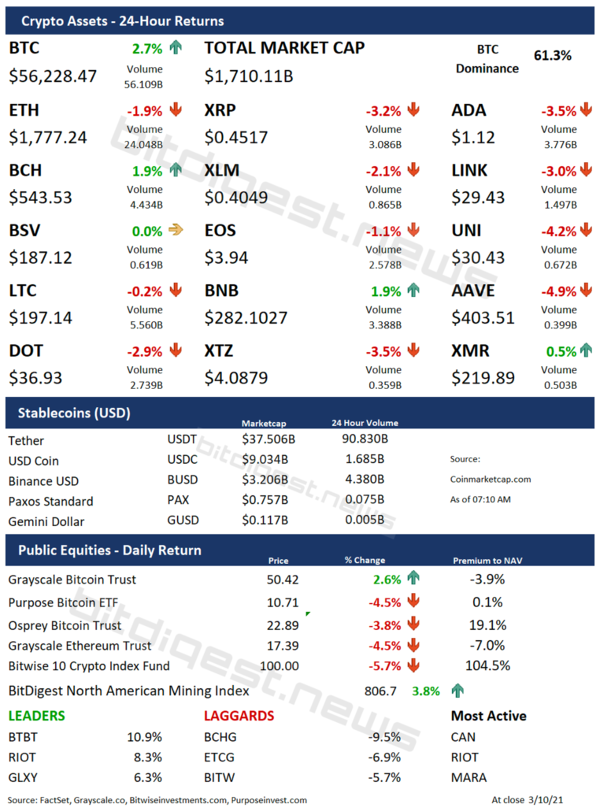

- Bitcoin marketcap back above $1 trillion

- Gensler SEC nomination moves to Senate vote

- Crypto clarity Token Taxonomy Act reintroduced in House

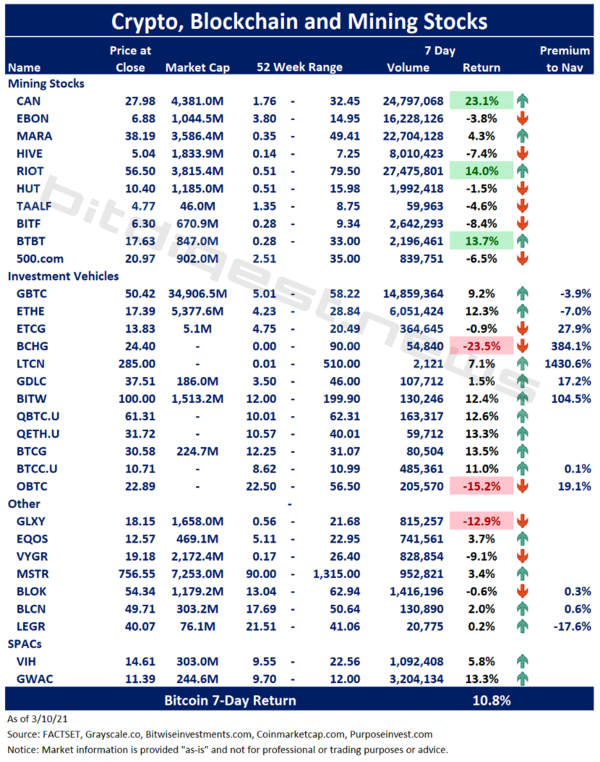

Weekly Stock Update

Several new additions to the weekly chart of North American publicly traded companies. I added the Osprey Bitcoin ETF (OTCMKTS: OBTC), two additional ETFs, – Amplify Transformational Data Sharing ETF (NYSEARCA: BLOK) and First Trust Indxx Innovative Transaction & Process ETF (NASDAQ: LEGR) – and the announced, but non-merged cryptoSPACs: VPC Impact Acquisition Holdings (NASDAQ: VIH) planning to acquire BAKKT and Good Works Acquisition Corp (NASDAQ: GWAC) planning to acquire Bitfury’s US mining subsidiary Cipher Mining

There May Be Overlooked Money Coming to Crypto

🅱️For the past several years the question many of us were asking was when would institutional capital start flowing to crypto. This question has certainly been answered with leading hedge funds, asset managers and now public companies purchasing digital currencies. There have even been reports of pensions and endowments entering the market, but I think there is another cohort of investors that are being overlooked: high-net-worth (HNW) individuals.

The majority of HNW investors still work with the leading banks and although they may have bought bitcoin through Coinbase or Gemini or even participated in the private placement for the Bitcoin Investment Trust, these allocations have been small. More importantly, these purchases have been “an effort,” made outside of their typical banking partners. The investors were not able to call their coverage teams, like they are accustomed to, and ask to but some BTC or GBTC; today, you are still unable to purchase either of these assets at JP Morgan, Goldman Sachs and UBS.

I believe that once these financial institutions open up crypto investment opportunities to their clients, the HNW investor will begin to allocate more funds to the crypto asset class. If we just look at the cohort with over $10 million in liquid assets, we have approximately 1.4 million Americans. If we assume each of these investors allocates 1% of their $10 million – only $100,000 – to digital currencies, we will add $140 billion to cryptocurrencies, an equivalent of 8% of the current total market cap.

So while we wait for new capital to enter the crypto market, do not forget about the HNW investor. When the banks open up crypto investment opportunities, it is coming, there will a flow of new, overlooked money entering the market.