BitDigest February 23 · Issue #847

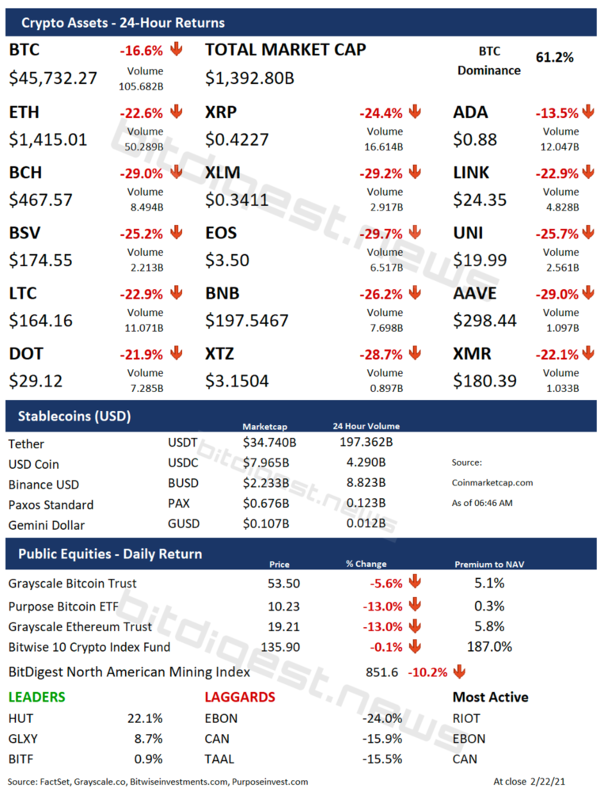

- Crypto market cap falls 16% in overnight sell off

- South Korea reportedly ready to ban trading of privacy coins

- China and UAE join Thailand and Hong Kong’s CBDC study

I have added the Purpose Bitcoin ETF (TSX: BTCC.U), the first and largest bitcoin ETF (so far) to the daily market recap. Of interest to many is the premium to NAV of BTCC.U compared to the premium to NAV for the Grayscale Bitcoin Trust (NASDAQ: GBTC).

Crypto Fear & Greed Index

It may surprise you that the Fear & Greed Index for bitcoin and other large cryptocurrencies is basically unchanged on the week posting a one-point decline to 94, but it should be noted that the index is updated daily and was last adjusted before the current crypto market sell off saw a significant effect. Based on historic movement, I expect the index to drop below 50 later today.