BitDigest January 15 · Issue #822

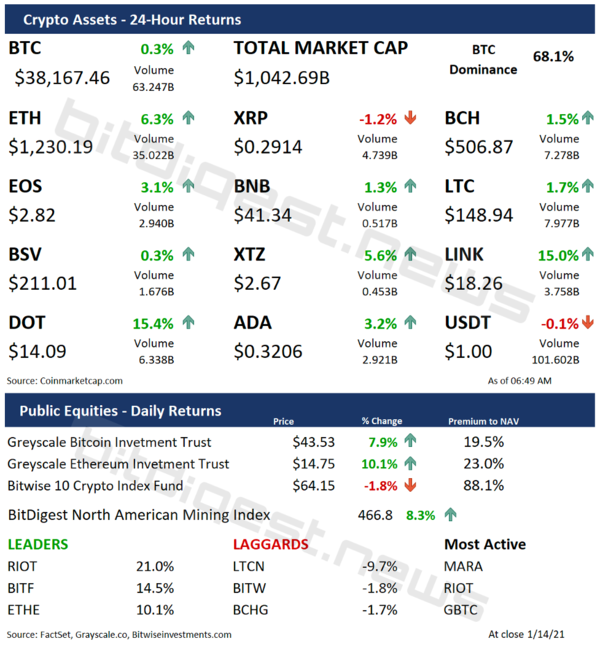

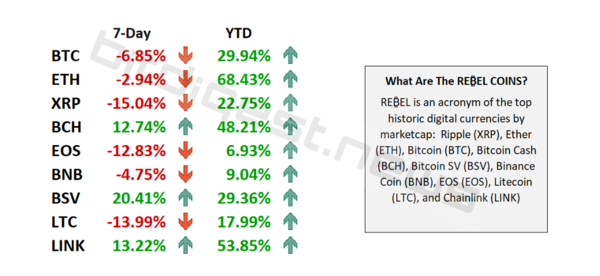

- Crypto prices continue recovery following recent tumbles but still posting strong two-week returns

- FinCEN extends comment period for unhosted wallet proposal

- Powell says stablecoins are a high priority for the Fed

Special Purpose Acquisition Companies

This week’s announcement that International Exchange’s digital currency venture Bakkt will go public by merging with a special purposed acquisition company highlighted the blank-check acquisition structure across the crypto market. This deal makes a lot of sense. Bakkt will raise $532 million in additional capital and gets to go public by negotiating with a single company at a predetermined valuation – in this case $2.1 billion – rather than following the traditional IPO process.

In 2020, 219 blank check companies raised $73 billion leading many to call last year, the year of the SPAC. I have received questions about this so wanted to share a few thoughts:

The first crypto-related SPAC I am aware of was last summers acquisition of Diginex, the parent company of digital currency exchange Equos and crypto custodian Digivault by 8i Enterprises Acquisition Corp at an initial value of $276 million.

Next came Victory Park (VIH) announced merger with Bakkt. The formation of Everything Blockchain was just announced as a new Cayman based SPAC to acquire emerging companies in the blockchain industry.

And then there are also rumors about addition SPACs merging with crypto companies in the future. FUSE has been rumored to merge with BlockFi, and Coinbase has been identified as a merger target by both LFTR and PSTH. I need to stress these are just rumors, but I expect to hear more about blank check company acquisitions in the crypto business going forward.