BitDigest January 8 · Issue #818

Jan 8, 2021

Author

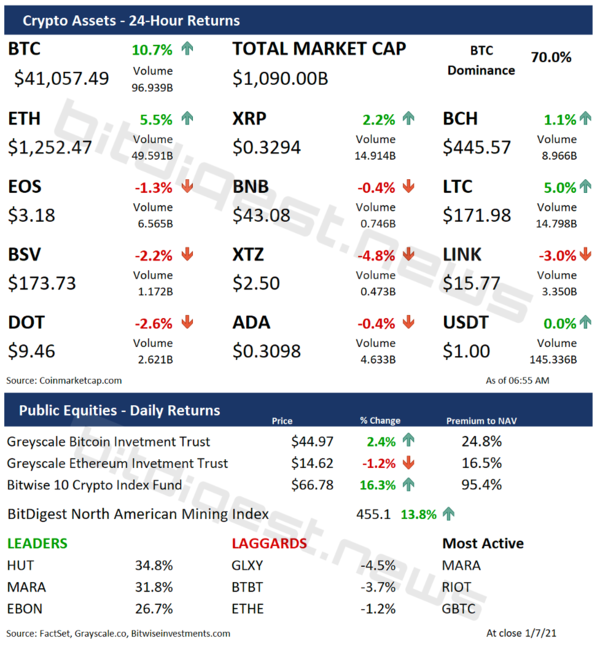

- Bitcoin trades above $41k as ethereum eyes $1,400 ATH levels

- The BoE questions Diem’s lack of publicly stated business model

- South Korea approves 20% crypto tax

Market Responds to XRP Charges (continued)

🐦Ripple CEO Brad Garlinghouse posted answers to 5 currently asked questions in response to the Securities and Exchange Commission’s charges against Ripple:

- Why didn’t Ripple settle with the SEC? They tried

- Did Ripple pay exchanges to list XRP and when will it be relisted? They did not and shares have not been delisted but rather halted.

- When is the company responding to the SEC? There is a lot happening behind the scenes.

- Do investors have faith in Ripple? Yes.

- Did Ripple pay customers to use XRP? First movers were provided with incentives.

Negative Response to New FinCEN Proposal (Continued)

FinCEN has received over 6,840 comments on its proposal require exchanges to collect user names and information on transactions over $3,000 in value with unhosted (self-custodied) wallets