BitDigest January 7 · Issue #817

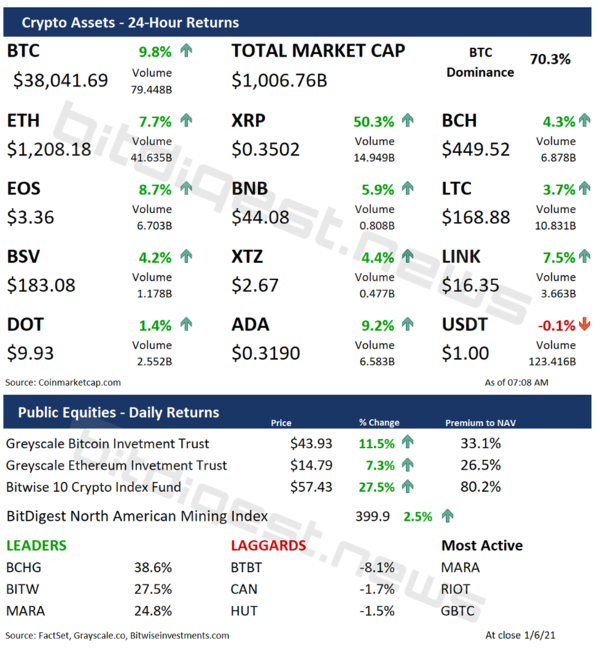

- Crypto market cap breaks $1 trillion as bitcoin hits $38,000

- The OCC has raised sides in a battle to insure that it remains the sole regulatory responsible for issuing and supervising federal fintech charters

- Israel’s Securities Authority believes utility tokens are not assets but rather securities

Weekly Stock Review

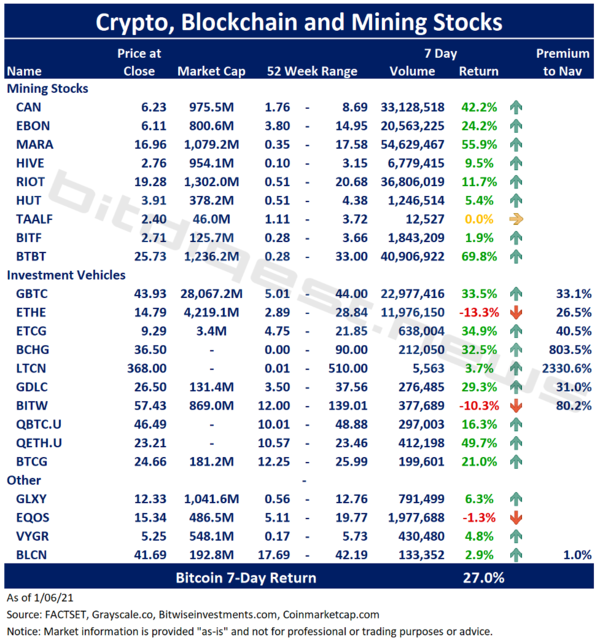

Highlights from the North American listed crypto, blockchain and mining stocks:

- Marathon Patent Group (NASDAQ: MARA) is the top performing stock of the week returning over 55%.The company announced the signing of a non-binding memorandum of understanding to create North America’s first cooperative mining pool. MARA also completed its previously announced $200 million shelf offering ending the 2020 fiscal year with $217 million in cash on its balance sheet.

- Chinese mining equipment manufacturer Canaan has launched a submerged liquid-cooled ASIC rig that is noiseless and increases power efficiency by 78%.

- Ebang International (NASDAQ: EBON) has completed testing of its digital currency exchange and expects to launch the new platform during the first quarter of 2021 in an efforts to expand its operations away from crypto mining.

- HIVE Blockchain (TSX.V:HIVE) announced the purchase of 4,180 MicroBT mining rigs increasing its mining capacity upon delivery by 105% to a total hash rate of 653 Phash/s.

- Canadian crypto miner Bitfarms (TSX.V: BITF) has entered into a private placement agreement to raise gross proceeds of CASD $20 million from the issuance of new shares and warrants.

- I have added Canadian traded digital exchange Voyager Digital (CSE:VYGR.CN) to the weekly tracking list.

- Grayscale’s Ethereum Trust (OTCQX: ETHE) reported a 13.3% loss making it the worst performing asset among the tracked North American equity universe.

- Bitcoin gained 27% this week, outperforming the market which reported a mean return of 18.7% and median of 11.7%

Negative Response to New FinCEN Proposal

Since the December FinCEN proposal requiring exchanges to collect user names and information on transactions over $3,000 in value with unhosted (self-custodied) wallets, there has been an understandable outcry from the crypto and technology community. I have refrained from publishing all of these comments, but yesterday’s Protocol news letter included a good explanation on the subject by Ropes & Gray attorney Marta Belcher:

- Collecting people’s names and addresses tells you everything about the wallet holder, “if you have someone’s wallet address, and you know their identity, you can see all the transactions they’ve ever had using that address.”

- Not only would exchanges would have to collect the information on the wallet holder but on anyone who transacts with those wallets. Belcher references the negative response when it was discovered Cambridge Analytica collect this type of information on Facebook users.

- This proposal targets the cryptocurrency industry by adding special requirements ($3,000 value) to them while the general financial ecosystem only needs to collect information at the $10,000 level.

- This new trove of information would aggregate a lot of sensitive information that could be accessible by hackers (think, SolarWinds).

Market Responds to XRP Charges (continued)

Additional news related to the SEC’s XRP law suit:

- Voyager Digital will suspend trading for XRP on January 18th, but will continue to provide custody and allow clients to make withdrawals.

- South Carolina based digital currency and commodities exchange Uphold has announced it will continue to allow clients to trade XRP “until the SEC’s complaint against Ripple is adjudicated to legally determine that XRP is currently a security, or until trading volume dissipates to a point where” trading can no longer be supported.

C’mon Man

Coinbase’s once again experienced connectivity issues as volume increased on the leading US digital currency exchange yesterday morning.