BitDigest October 29 · Issue #773

Oct 29, 2020

Author

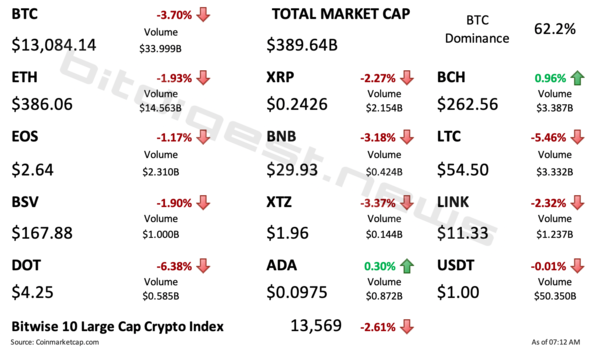

- Crypto prices sell off with traditional market tumble

- The Bank of Canada says it is working with G7 partners on developing its ‘digital loonie’ but does not see compelling need ‘right now’

- Cambodia announces its release of a CBDC

Weekly Stock Review

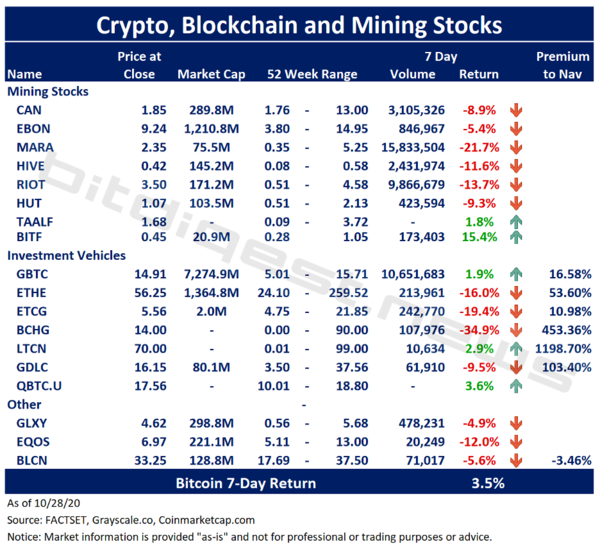

Highlights from the North American listed crypto, blockchain and mining stocks:

- Crypto stocks sold off this week with Bitfarms (TSXV: BITF) posting the top returns at 15.4%. Bitfarms also signed a non-binding memorandum of understanding with a private energy producer to secure exclusive use of up to 200 MW of electricity in South America at an average price of $0.02 cents per kilowatt hour .

- Ebang International (NASDAQ: EBON) established a wholly-owned subsidiary in Australia as part of its growth strategy to build a digital asset financial service platform.

- Marathon Patent Group (NASDAQ: MARA) entered into a contract with Bitmain to purchase an additional 10,000 next generation Antminer S-19 Pro ASIC Miners.

- The premium to NAV for Grayscale’s Litecoin Trust (OTCQX: LTCN) jumped and is at 1198%.

- The Grayscale Bitcoin Trust (OTCQX: GBTC) is trading at a 16.5% premium.

- Grayscale’s Bitcoin Cash Investment Trust (OTCQX: BCHG) posted the worst return at -34.9% over the 7-day period.

- Bitcoin outperformed most stocks this week returning 3.5% compared to a mean return of -8.2% and median of -9.1%.