BitDigest October 13 · Issue #761

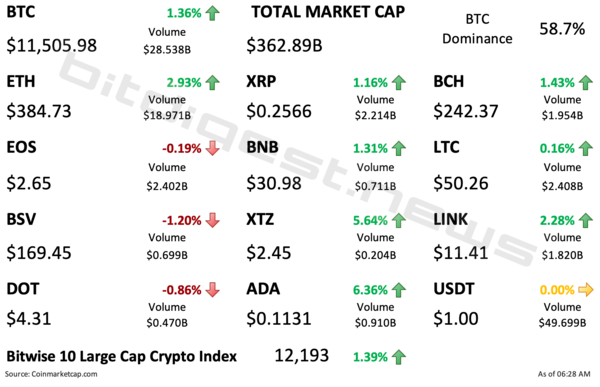

- Bitcoin breaks back and gaining support above $11,000

- G7 leaders plan to denounce efforts by Libra without greater regulation

- The Bank of Japan plans to begin testing CBDC by early 2021

Crypto Fear and Greed Index

The Fear & Greed Index for bitcoin and other large cryptocurrencies has moved up, gaining 9 points this week, brining the index out of its ‘neutral’ level back into a ‘greed’ position. The index is at its highest level since the early September drop.

Where was China in BIS Announcement?

China’s South China Morning Post reported on the announcement of last week’s BIS working group on central bank digital currencies (of which China is a member) by questioning the Bank of China’s conspicuous absence from this discussion. “The People’s Bank of China (PBOC) was conspicuously absent from the international group, despite China being a world leader in testing its own digital sovereign currency,” the report said.