BitDigest September 2 · Issue #734

- Bitcoin can’t break $12,000 as market turning focus to ether and DEFI protocols

- The OCC is ready to release a national charter for payment companies

- Bermuda is piloting a stable coin that will act as a stimulus / assistance token

A Framework to Consider DeFi

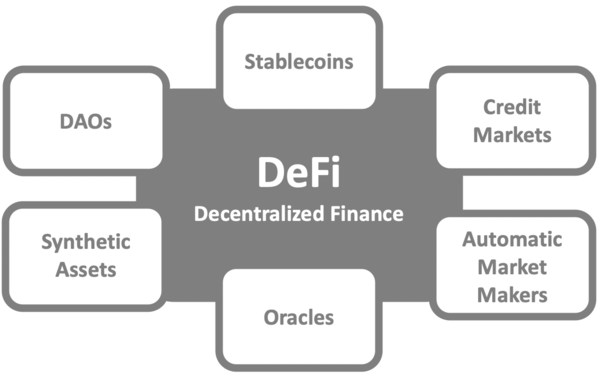

2020 is definitely crypto’s year of DeFi, but many people I speak with are not investing in DeFi and more importantly do not really understand it and all of its application. On the most basic level, DeFi is financial applications operating automatically, without the need for human intervention, on a decentralized blockchain.On Monday, Messari shared a poll from a twitter post asking investors in Yearn (YFI) if they actually understand what Yearn is. 38% of the respondents said “No” while only 26% said “Yes.” (I could not figure out how the other 36% voted but I guess that fits the confusion surrounding DeFi). Blocktower Capital, a leading crypto investment firm, shared their view of DeFi with me last week and I found it to be a clear and understandable framework consisting of 6 different categories that comprise crypto’s hottest investment class. Here is an abridged version of their classification.

Each explanation below will be followed by an example of an Ethereum based protocol(s) and a Cosmos based protocol(s).

- Stablecoins – a digital asset designed to offer price stability and backed by a reserve asset (Maker, Tether, USDC | Terra)

- Credit Markets – digital asset loans that use smart contracts and the acceptance of collateral to authorize and secure the loan approval (Compound, Aave | Anchor)

- Automatic Market Makers – smart contracts that create a liquidity pool of tokens automatically traded by an algorithm rather than a traditional custodial order book (Uniswap, Curve, Bancor | THORChain)

- Oracles – Smart contracts connecting on-chain applications with off-chain data and information (Chainlink | Band Protocol)

- Synthetic Assets – a blockchain based financial derivative whose asset value is based on the value of an underlying off-chain asset (Synthetix | Kava)

- DAOs – decentralized autonomous organizations that function through the use of smart contracts rather than traditional hierarchical management (Aragon, DAOStack | Aragon)

The Headlines

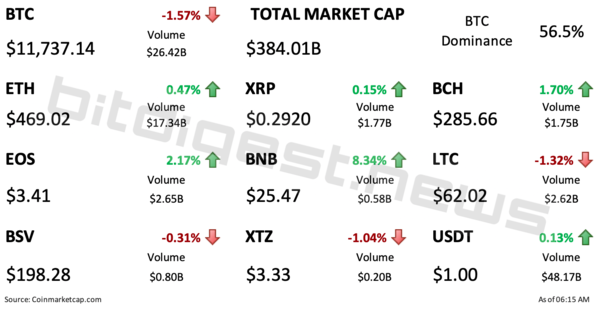

Market Data

Exchange, Custody and Product News

Articles Read 1/2

Enjoyed the read? Subscribe now for unlimited access!

Get invaluable analysis of the market and stocks. Cancel at any time.

Already have an account? Sign In 410e3a-1a33f7-940c1b-4c3fe6-07e433

Already have an account? Sign In 410e3a-1a33f7-940c1b-4c3fe6-07e433