BitDigest June 1 · Issue #669

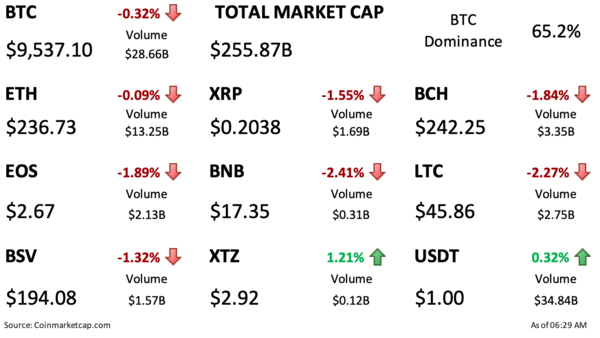

- Crypto prices flat at start of new month; total marketcap holding at $255 billion

- Digital Dollar Project releases whitepaper explaining benefits of US dollar backed stablecoin

- Kingdom Trust looking to tokenize all $13 billion in assets under custody

Galaxy Digital Releases Q1 Update

Galaxy Digital reported a loss of CAD 27.7 million during the quarter ending March 31, 2020. The negative results were driven by $25 million in unrealized losses on crypto holdings. The company’s activities continue to be fueled by crypto investments on its own balance sheet with Q1 holdings ending with approximately 10,000 bitcoin; this figure has increased by 32% in Q2. CEO Mike Novogratz said the company’s trading desk, investment banking and advisory businesses will continue to be the primary focus of his team and should reach break even within 12 months. He added that the next real catalyst for crypto will be the arrival of institutional investors; Novogratz admitted to sounding like a broken record regarding this statement, but feels this time is different.

Crypto’s Influence in Gaming Continuing

So it’s not really news, but I found it interesting that all five of Decrypt’s top stories on their daily update Friday were related to gaming and covered news on Minecraft (Microsoft), Atari, Square Enix, Ubisoft, and battle-royal game Lightnite. This definitely shows the continued cross-over between gaming and crypto.

What I Read (and Watched) This Weekend?

- 100 Acre Ventures reviewed crypto offerings targeting longer term ownership (vs. short term speculation) and suggeted that bitcoin demand is on the rise with net demand likely to turn positive over the next nine months.

- Delphi Digital previewed its upcoming “Institutional Argument for Crypto” report identifying the macroeconomic factors that they believe will drive investors to crypto. Delphi also pre-released an interview with bitcoin author Andreas Antonopoulos. The video will be made available to the public later this week and is highly recommended.