BitDigest May 29 · Issue #668

- Bitcoin picks up in post Goldman call panic

- The Bank of Russia is looking to put mortgages on a blockchain

- France is looking for feedback on the impact of new technologies on payments

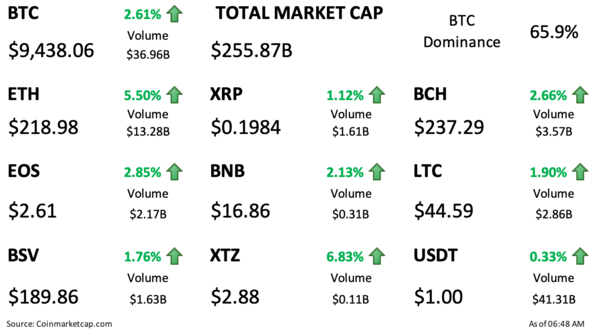

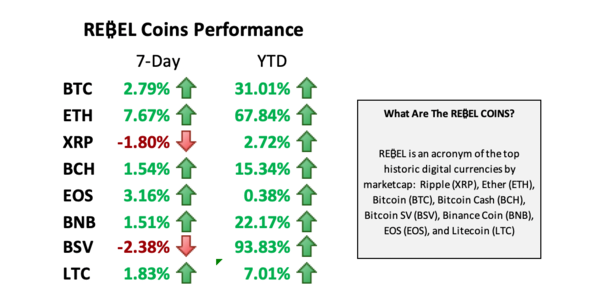

I decided to add three coins to my daily tracking list to properly account for the top 10 cryptocurrencies by marketcap. This list currently accounts for 88.5% of the total market cap of the 2,000 + different digital currencies listed on Coinmarketcap.com

Is Grayscale Increasing Activity a Threat to Bitcoin?

I have been thinking a lot about Grayscale and whether their continued buying of bitcoin is a threat to the crypto economy. Yesterday I reported that Grayscale is buying bitcoin at a rate of 1.5x the supply of new daily minted bitcoin and last night I learned that Grayscale added close to 2,000 new bitcoin to their AUM yesterday.

While these numbers are incredibly high, I think we need to look at Grayscale’s activities in context of daily trading volume. According to Coinmarketcap.com, bitcoin’s daily volume is typically over $30 billion. While I report these figure, I also look at Messari’s ‘real volume’ which reports the 24 hour volume on exchanges identified by Bitwise “as well-functioning markets.” The daily level I look for here is $5 billion. If volume trades outside this figure a mental flag goes up.

The amount of new daily minted bitcoin is 900 BTC or approximately $8.5 million so even at the 2x level this would be a considerable amount of new purchases, but in the context of daily volume, it is not a figure to be concerned by.

Update on Canaan

I have been looking into the recent sell-off of Chinese mining equipment supplier Canaan (NASDAQ: CAN) and it appears that the company’s initial share lock-up period following its November IPO has ended. Furthermore, the company just announced plans to issue an addition $12 million in shares as part of its employee incentive program. Since May 13th, CAN shares have declined 51%.

Weekend Reading (and Viewing)

- Last month digital asset manager CoinShares released a series on the Future of Capital Markets. Five different sessions address how new applications in digital currency markets could apply to traditional capital markets. The sessions include: Automating Execution and Trading Workflows, Cross Margining through a Distributed Clearing House, Decentralized Settlement Protocols, Insights from the Trading Desk, and a panel discussing the Future of Capital Markets.

- Tokeny Solutions has released “Tokenized Securities” the ultimate handbook on how to issue compliant securities on a blockchain through a securities token offering (STO).