BitDigest May 8 · Issue #654

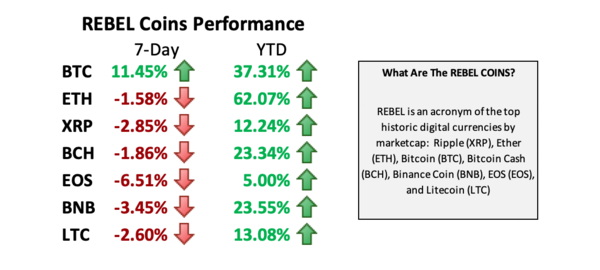

- Bitcoin breaking away from pack but finding resistance at $10,000

- Paul Tudor Jones is buying bitcoin as hedge

- Zoom is silencing critics by adding crypto encryption to video-chatting network

Countdown to the Halving

Interest in bitcoin continues to grow ahead of the halving with the number of new and active bitcoin addresses increasing to levels not seen since the 2017 bull market.

The amount of blocks mined over the past 24 hours is 149, an increase over the average 10 minute schedule of 144 per day. At this rate, timing of the schedule halving has moved ahead a few hours Monday night (New York time).

Power of the OG

The number one question many of us have been asked this week is what will happen to bitcoin after the halving. I have given this a lot of thought and while I am not willing to give a specific forecast on where bitcoin will end next week or even next month, thinking about this has driven me to believe that the group with the greatest influence over the price of bitcoin is not the miners or exchanges, but the OGs and hodlers.

Recent reports say that the number of hodlers is increasing with approximately 61% of BTC is wallets having not moved in a year and over 42% having no activity over the past two years. In dollar terms the value of the long-term hodlers is over $100 billion and $70 billion respectively. I have been asking around and no one I speak with is looking to sell.

Over 87% of all bitcoin has already been circulated and the number of new issuances is about to be cut in half. Don’t overlook it will take 120 more years for the remaining 2.6 million coins to be mined. Starting next week only 900 ($8.5 billion at current prices) new BTC will mined per day. The supply will be cut and buyers will have decreasing options.

Bitcoin will still remain a liquid market, but the OGs and long-time hodlers will have substantially more power than I believe this group is getting credit for. If they start to sell, an unprecedented supply of BTC will enter the market, naturally causing pricing to fall. But if they continue to hold , buyers will have to pay up. Let’s hope it’s the later.

Its Also About the Blockchain

I spend a lot of time talking about digital currencies and the evolution of sovereign stablecoins, but I can’t overlook the importance of the underlying blockchain technology. As an investor, most of our portfolio companies are actually targeting different sectors and building solutions using this technology.

Ken Seiff’s Blockchange Ventures shared their view on the primary trends impacting the crypto ecosystem. I think their list is a very thoughtfully presented overview of the market, and in reading it, it also reminded me of the great progress that has been achieved:

1. Enterprise adoption is growing rapidly

2. Blockchain has reach governments worldwide

3. Regulatory clarity has been accelerating

4. Institutional infrastructure is emerging

5. Blockchain application are emerging outside of cryptocurrency

6. Instability drives bitcoin adoption, usage, and trading

Telegram Founder Turning on US

I recently wrote a post questioning whether Telegram founder Pavel Durov may have caved under pressure from the Russian government supporting oligarchs who invested in his token offering. Durov released a post yesterday titled “7 Reasons Not To Move To The [Silicon] Valley” in which he calls the US a police state and criticizes Silicon Valley as a plan to live and do business. Unlike prior posts, this was only released in Russian, adding to my conspiracy theory that he may have been encouraged to write this by his new partners.