BitDigest May 7 · Issue #653

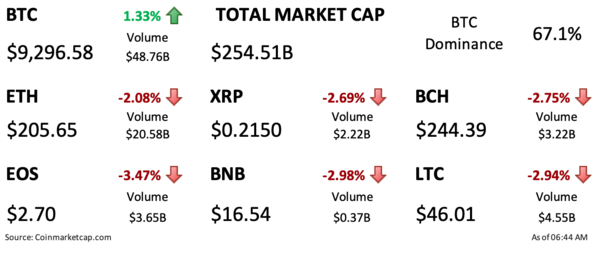

- The crypto market is focusing on bitcoin (BTC) as its total market dominance breaks to 67.1%.

- The Ukraine wants its nuclear power plants to consider mining cryptocurrencies

- The State of California is redefining a “security” to exclude a digital asset

Halving Countdown

Bitcoin has less than 700 blocks to go before its halving. As I am writing this morning (6:42AM) , BTC is at height (block number) 629,331, however BTC’s average blocktime is currently running over 10 minutes which has pushed the scheduled halving back an hour.Coindesk is reporting that the total node count has fallen to a 3 year low and has been steadily declining since peaking at 200,000 nodes in January 2018. One factor may have to do with the size of the bitcoin blockchain. In late 2017, the total size was 149 gigabytes, today the size is over 250 gigabytes.Ahead of next week, open interest in CME bitcoin futures has surpassed February’s previous all-time-high of $338 million and gained 18% to reach a new level of $400 million

Weekly Stock Review

Following last week’s market strength, public crypto companies traded across the board this week. It appears the market is looking to GBTC ahead of the halving – the price is up 12% on the week.

Why I Am Not Leaving Crypto Today or Tomorrow

I just reread a Medium post titled “3 Reasons Why I Am Leaving Crypto Now.” In the essay, the author highlights three reasons supporting his decision to leave the cryptocurrency market: the fact that crypto companies are not yet profitable, crypto is a small market with the same people repeating the same stories over and over, and the opportunity to adopt digital currencies is dependent on developing nations.

While I agree with the notion that crypto can be like an “echo chamber” with the same people speaking and repeating similar message (this is never more apparent than during New York’s blockchain week), I think the author missed out on the real innovation behind digital currencies and his statement can be viewed an example of many people who can be accused of taking the digital gold thesis to a an extreme.

Crypto markets in 2016 and 17 may have had similarities with the California Gold Rush of the 1850’s but the innovation behind bitcoin was not meant to generate new wealth for participants. Looking back at Satoshi’s whitepaper, nowhere did he / she mention the intrinsic value of bitcoin or make a prediction that bitcoin would reach X dollars by Y. Instead, Satoshi wrote about a new peer-to-peer electronic cash system using a public transaction ledger and a decentralized validation system.

The author is 100% correct that the long-term survival of crypto companies is dependent on a profitable business model, but this should not dissuade anyone from remaining or entering into this business. This concept is also not unique to crypto. The U.S. Bureau of Labor Statistics says that only 25% of new businesses survive to 15 years or more. There is an inherent risk in joining or investing in a start-up or early stage business but this is what has developed our economy over the past century. America has the greatest economy in the world and technology has been one of the true champions supporting our nation.

I also do not agree with the statement that the adoption of digital currencies is dependent on developing nations. In fact, I think the escalation of sovereign digital currencies as exemplified by China signifies the evolution of this technology will be driven by developed nations. The leading industrial nations were behind crypto’s first 10 years and although a prevailing story has been the use of digital currencies by the unbanked and people in nations with devaluing currencies, the crypto market will continue to be led by the G20 countries. As I mentioned above, we are driving its technical development.

So I would like to tell the author that I think he is wrong and sincerely hope he did not follow on his words to leave the crypto ecosystem. Crypto is a great business with many creative and talented people. We – and I say this standing on the shoulders of many of our founders – are actively developing the next form of value and supporting applications that will bring us decades into the future. No one said this would be easy, but the rewards will be well deserved.