BitDigest May 1 · Issue #649

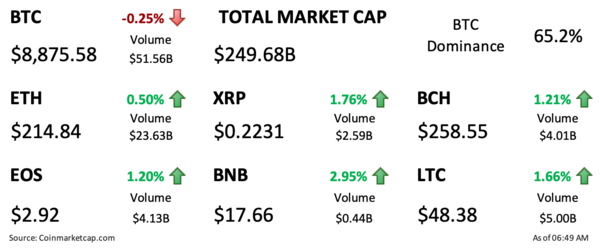

- Bitcoin dominance back above 65% as investors move back in to leading digital asset ahead of halving

- Cayman Island introduces new crypto framework to adhere to FATF recommendations

- Courts bringing end to class action suits against Riot Blockchain and Tezos

The Halving is Coming

May 2020 will be known as the month of the third bitcoin (BTC) halving so get used to hearing about it.

If you don’t know, the halving is when a block reward is reduced by 50% – in this case BTC’s reward will be cut from 12.5 BTC to 6.25 BTC. The halving happens every four years and is currently expected to occur on May 12th when block 630,000 is produced. If you are a real crypto fanatic, there are numerous countdown clocks available on line. Here is one.

Is IOT Being Overlooked?

One of the frequent questions I ask myself is what sector will be next to adopt crypto / blockchain technology. A lot fo effort has been placed in supply chain management and I have written regularly about trading processes and settlement. Yet, I think many of us are overlooking the importance of IOT and the impact that digital currencies and blockchain could have on this market today.

The use of this technology in the IOT (internet of Things) sector or the ability for machines to communicate, transact, and record information in a secure manner has some key advantages that would facilitate its immediate adoption. First, the number of potential users is significantly greater than the number users buying, selling, and trading digital currencies. There are approximately 31 billion IOT devices in existence; think of each device as a consumer / user. Second, the manufacturers (the people behind the machines – we have not recached singularity yet) have been actively talking about developing IOT applications for years and are now seeing the progress that will allow them to fully implement this technology; this is what they have been waiting for. Third, the devices themselves lack the need for traditional education and the necessity to change their behavior patterns. One of the questions we have been recently discussing is how can a digital US dollar be implemented quickly. It could be issued through PayPal / Venmo or Square / Cash in a similar manner as the Chinese are using AliPay, but the idea of then educating everyone to access these platform (the companies report 52 and 24 million users respectively) is very concerning. IOT users are natively digital (they are machines) and will not respond by questioning as to why they have to use the new process.

Now these are just three quick reasons. I am sure there are many more, but I would suggest that the opportunity to develop a digital currency ecosystem across the IOT market is greater than in most other segments. Based on the projects I am seeing today, I think we are missing a great opportunity.

Time to Change It Up (Again)

It’s a new month so I want to try something new. Going forward I will attempt to limit the article summaries to one sentence. It is my response to living in the Twitter generation. My apologies to my grade school teachers but it may occasionally be a ‘run on sentence.’